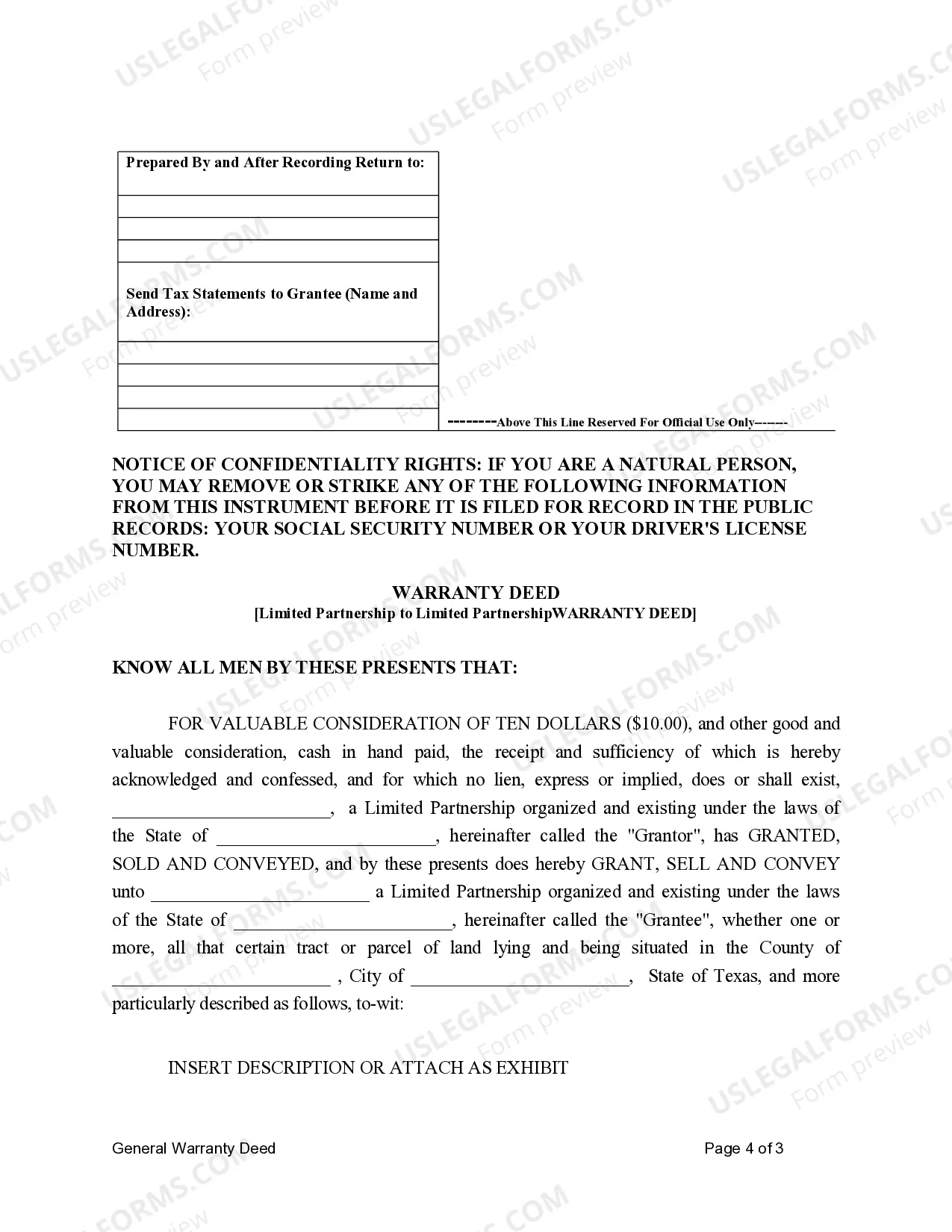

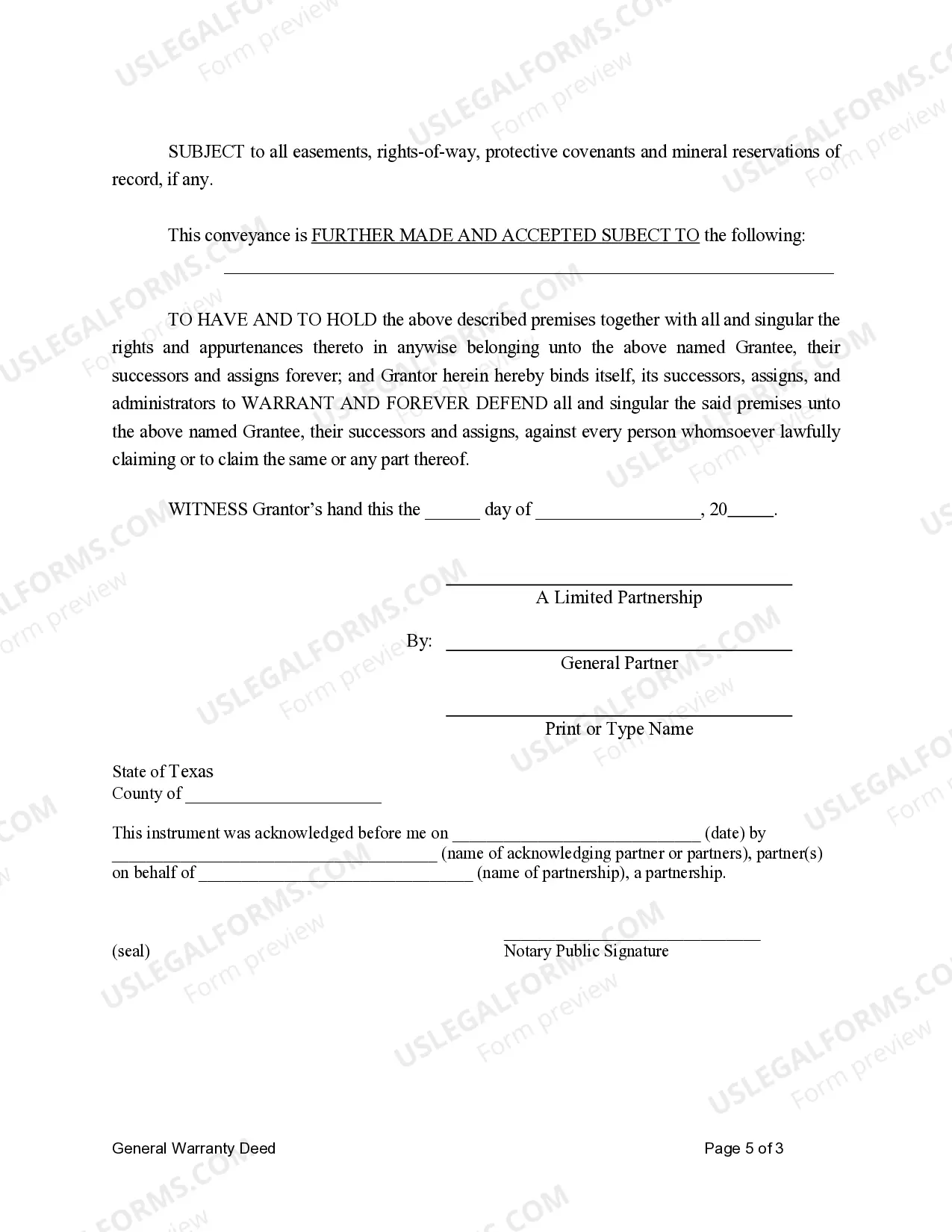

This form is a Warranty Deed where the grantor is a limited partnership and the grantee is a limited partnership.

Texas Warranty Deed for Limited Partnership to Limited Partnership

Description

How to fill out Texas Warranty Deed For Limited Partnership To Limited Partnership?

Among numerous paid and free examples which you find online, you can't be certain about their reliability. For example, who made them or if they are competent enough to take care of what you need these people to. Always keep relaxed and make use of US Legal Forms! Locate Texas Warranty Deed for Limited Partnership to Limited Partnership templates made by skilled attorneys and get away from the expensive and time-consuming procedure of looking for an lawyer and after that having to pay them to write a document for you that you can easily find yourself.

If you already have a subscription, log in to your account and find the Download button near the form you’re searching for. You'll also be able to access all your earlier acquired samples in the My Forms menu.

If you are making use of our service the first time, follow the instructions listed below to get your Texas Warranty Deed for Limited Partnership to Limited Partnership fast:

- Make certain that the file you see is valid in the state where you live.

- Review the file by reading the description for using the Preview function.

- Click Buy Now to begin the ordering process or find another template using the Search field found in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the needed format.

Once you have signed up and bought your subscription, you can use your Texas Warranty Deed for Limited Partnership to Limited Partnership as often as you need or for as long as it continues to be active in your state. Revise it in your favored editor, fill it out, sign it, and create a hard copy of it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

An LLC business structure provides personal asset protection to all of its members. Individual members do not bear the burden of business debts. In contrast to an LLC, an LP only offers personal liability protection to certain partners. Full personal liability rests with general partners.

Name Your LLP. The name of a Texas LLP must contain the phrase Limited Liability Partnership or an abbreviation of that phrase. File a Registration. No Registered Agent. Prepare a Partnership Agreement. Get an EIN. Register With the Comptroller of Public Accounts. Obtain Business Licenses. File Annual Renewals.

Regarding liability, an LLC is always better than a general partnership. You and your partners can form an LLC and limit your personal liability. However, there will be additional costs in setting up and registering an LLC.

The most important difference between the LLC and LP relates to the personal liability of the participants.A limited partner typically does not have personal liability for partnership obligations, but is not permitted to participate in the day-to-day management of the limited partnership.

To form a limited partnership, the partners must enter into a partnership agreement and file a certificate of formation with the secretary of state. In a limited partnership, there will be one or more general partners and one or more limited partners.

They both offer "pass-through" taxation, which means that the owners report business income or losses on their individual tax returns; the partnership or LLC itself does not pay taxes. And both are eligible for the 20% pass-through deduction established by the Tax Cuts and Jobs Act.

A limited partnership (hereinafter LP) is governed by title 4, chapters 151 and 153 of the Texas Business Organizations Code (BOC).A limited partnership is a partnership with limited partners that do not have the obligations or duties of general partners solely by reason of being limited partners.

Call the State. Call the State Business Information Line at 512-463-5555 and tell them: Hello, I am forming an LLC and I'd like to check to see if my name is available. Send an Email. The Texas Secretary of State replies to emails very fast. Search the State's Online Database.

Similar to the LLC, the LLP is a hybrid of both the corporation and partnership, to give the greatest advantages for taxation and liability protection. The LLP is not a separate entity for income tax purposes and profits and losses are passed through to the partners.