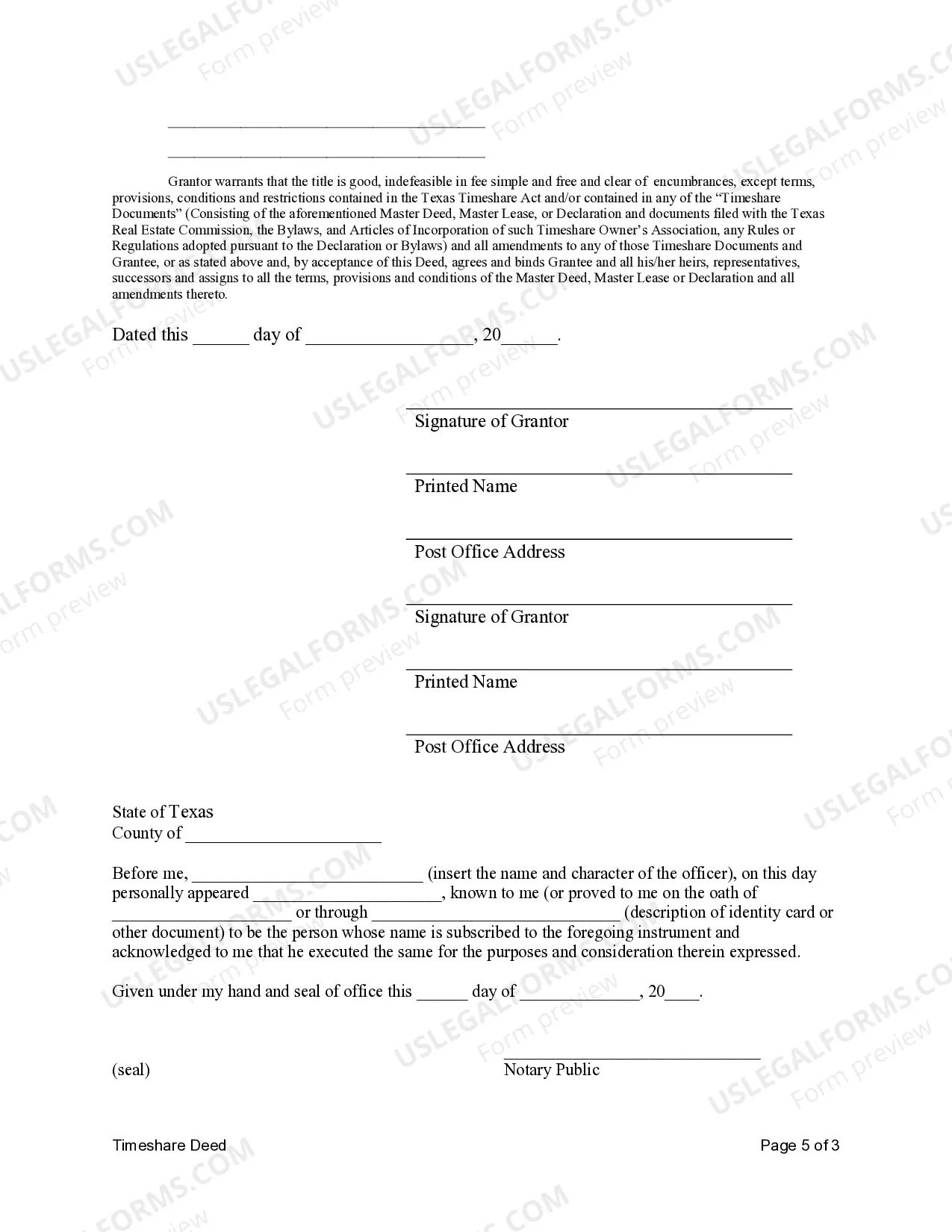

This form is a Warranty Timeshare Deed where the grantor is an individual and the grantee is an individual.

Texas Warranty Timeshare Deed for Individuals to Individuals

Description

How to fill out Texas Warranty Timeshare Deed For Individuals To Individuals?

Among numerous free and paid templates that you’re able to find on the web, you can't be certain about their accuracy. For example, who created them or if they’re competent enough to take care of the thing you need them to. Always keep relaxed and utilize US Legal Forms! Locate Texas Warranty Timeshare Deed for Individuals to Individuals samples made by skilled attorneys and prevent the expensive and time-consuming procedure of looking for an lawyer and after that having to pay them to write a papers for you that you can easily find yourself.

If you have a subscription, log in to your account and find the Download button next to the file you are searching for. You'll also be able to access your earlier saved examples in the My Forms menu.

If you are utilizing our service the first time, follow the instructions listed below to get your Texas Warranty Timeshare Deed for Individuals to Individuals quickly:

- Make sure that the document you see applies in your state.

- Review the file by reading the information for using the Preview function.

- Click Buy Now to start the ordering process or look for another sample utilizing the Search field in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted file format.

As soon as you’ve signed up and paid for your subscription, you can utilize your Texas Warranty Timeshare Deed for Individuals to Individuals as often as you need or for as long as it continues to be valid where you live. Change it in your favorite online or offline editor, fill it out, sign it, and create a hard copy of it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

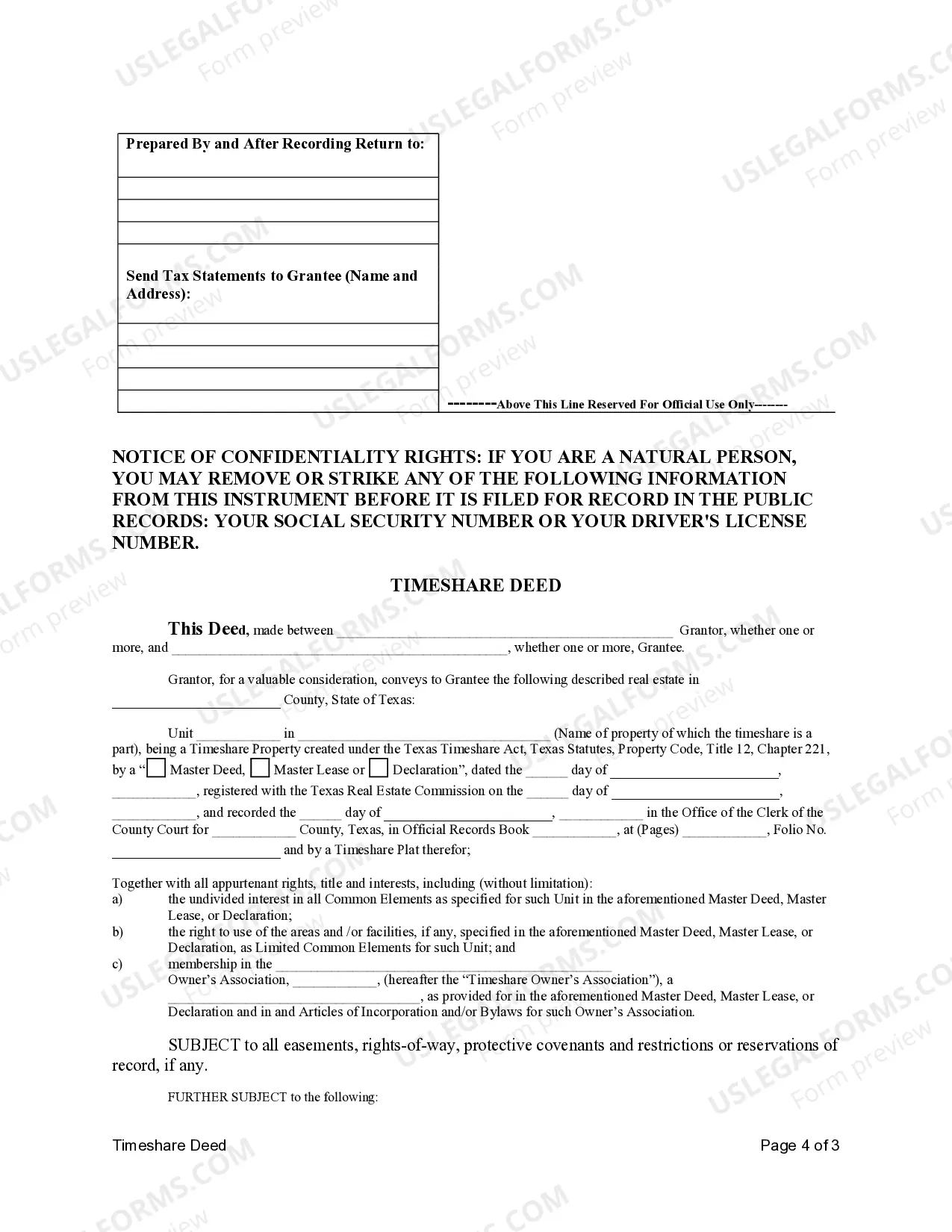

Find the most recent deed to the property. It is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor). Create a new deed. Sign and notarize the deed. File the documents in the county land records.

Gift the house When you give anyone other than your spouse property valued at more than $14,000 ($28,000 per couple) in any one year, you have to file a gift tax return. But you can gift a total of $5.49 million (in 2017) over your lifetime without incurring a gift tax.

You can arrange to legally transfer the deed to your house to your children before you die. To do so, you sign a deed transfer and record it with the county recorder's office.

The deed must be presented to and accepted by the grantee, and it should be filed of record in the county clerk's office to put the public on notice of the transfer. Failure to file the deed can subject the property to future claims by other parties. Most commonly, a grantor provides a general warranty deed.

Both a warranty deed and deed of trust are used to transfer the title of a property from one person to another. However, the difference between these two contracts is who is protected. As you now know, a deed of trust protects the beneficiary (lender). A warranty deed, on the other hand, protects the property owner.

As a property owner and grantor, you can obtain a warranty deed for the transfer of real estate through a local realtor's office, or with an online search for a template. To make the form legally binding, you must sign it in front of a notary public.

To be valid, gift deeds in Texas further require the document set forth (1) the intent of the grantor, (2) the delivery of the property to the grantee, and (3) the gift to be accepted by the grantee. The one claiming the gift bears the burden to establish each of the elements.

Think about IHT implications potentially exempt transfer Be aware of the rules on gifts with reservation of benefit You will no longer be the legal owner of the property. Risk from outside parties. Don't forget capital gains tax.

Special Warranty Deed TX A Special Warranty Deed is a document that transfers title with both express and implied warranties. However, unlike in a General Warranty Deed, the Grantor only warrants the title from the time the Grantor has owned the property.