Texas Notice of Underpayment of Income Benefits

Description

How to fill out Texas Notice Of Underpayment Of Income Benefits?

If you’re searching for a way to appropriately complete the Texas Notice of Underpayment of Income Benefits without hiring a legal representative, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reputable library of formal templates for every private and business scenario. Every piece of paperwork you find on our web service is drafted in accordance with nationwide and state laws, so you can be certain that your documents are in order.

Adhere to these straightforward instructions on how to get the ready-to-use Texas Notice of Underpayment of Income Benefits:

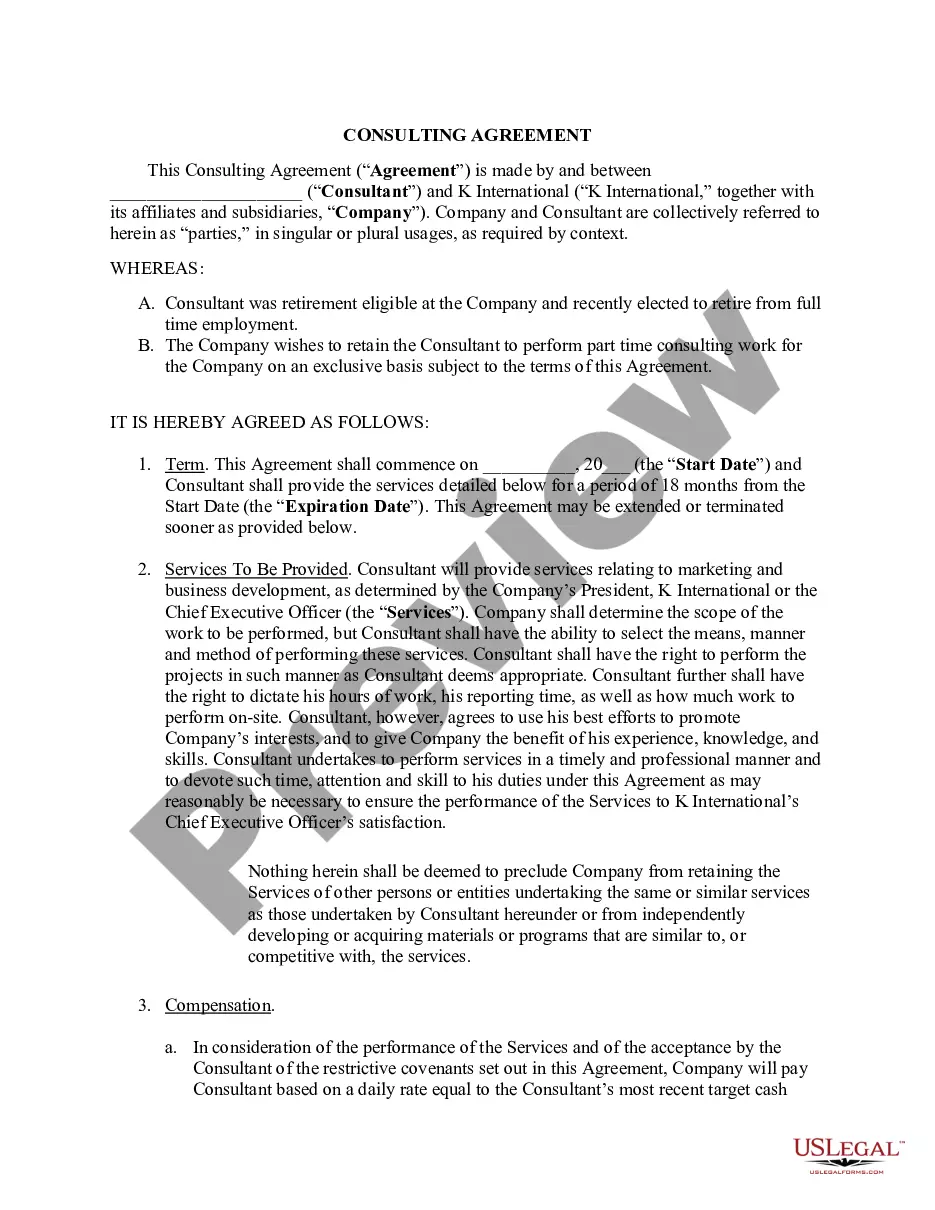

- Make sure the document you see on the page complies with your legal situation and state laws by checking its text description or looking through the Preview mode.

- Type in the document title in the Search tab on the top of the page and select your state from the dropdown to find an alternative template if there are any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Register for the service and choose the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be available to download right after.

- Decide in what format you want to get your Texas Notice of Underpayment of Income Benefits and download it by clicking the appropriate button.

- Import your template to an online editor to fill out and sign it quickly or print it out to prepare your paper copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you purchased - you can find any of your downloaded templates in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

Amount of Temporary Income Benefits TIBs equal 70 percent of the difference between your average weekly wage and the wages you are able to earn after your work-related injury.

This benefit equals 70% of the worker's average weekly wage prior to injury. These benefits do not depend on ability to work and could continue even after the injured worker returns to the job. Doctors assign an impairment rating to the injured worker based on the percentage of permanent physical damage.

While most other states allow lump sum settlements, Texas does not. The only benefits that may be paid in a lump sum are impairment income benefits. If you have been back to work for at least three months and earn at least 80% of your average weekly wage, you can commute your impairment income benefits.

Because workers' compensation involves no ?settlement? as such, it is largely unaffected by whether you have surgery or not. As long as the surgery is medically necessary, it's usually covered by the state's workers' compensation scheme.

There are no ?settlements? in a Texas Workers' Compensation case, and you can never ?sell? your lifetime medical benefit for any kind of ?settlement? or ?payment?.

You are able to earn the average amount of money your employer said you got each week from your job before you were hurt (average weekly wage), or. you reach the end of your TIBs benefits period, which is 104 weeks after your eighth day of work-related disability.