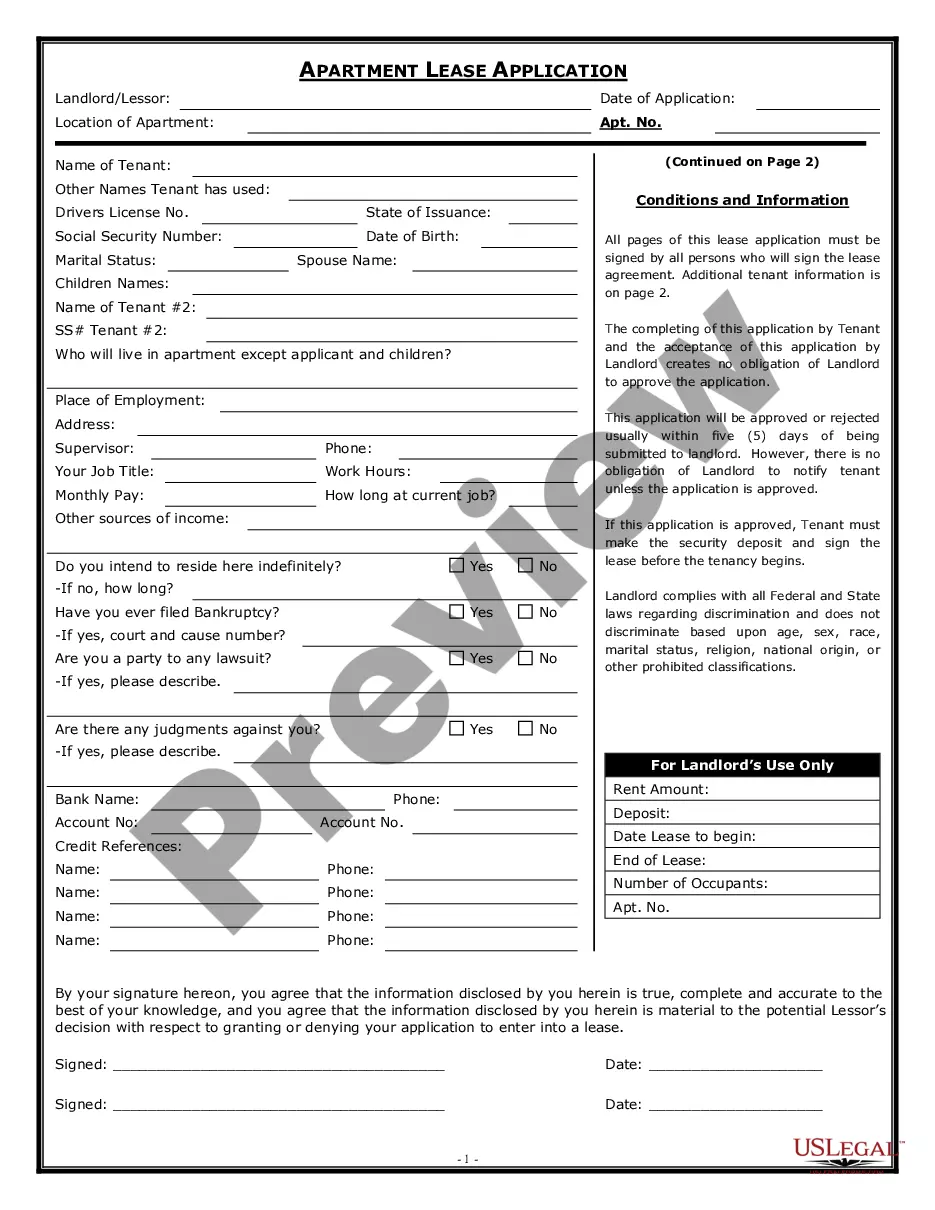

This form is a Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith-Jury Trial Demand. Adapt to your specific circumstances. Don't reinvent the wheel, save time and money.

Texas Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand

Description

How to fill out Complaint For Wrongful Termination Of Insurance Under ERISA And For Bad Faith - Jury Trial Demand?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a vast selection of legal document templates you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Texas Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand in moments.

If you have a membership, Log In and download Texas Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand from your US Legal Forms library. The Download button will appear on every form you view. You can access all previously saved forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Make edits. Fill, modify, print, and sign the saved Texas Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand. Every template you added to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Texas Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements and specifications.

- If you want to use US Legal Forms for the first time, here are basic steps to help you get started.

- Ensure you have selected the correct form for your city/state.

- Click the Review button to check the form's details.

- Read the description to confirm that you have chosen the right form.

- If the form doesn’t meet your needs, utilize the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select the payment plan you prefer and provide your information to register for an account.

Form popularity

FAQ

Under ERISA, punitive damages are generally not available for claims related to the Texas Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand. Instead, ERISA primarily allows for the recovery of actual damages, which can include lost benefits. However, if your case involves bad faith or misconduct by the insurer, you may explore additional avenues for compensation. Utilizing a platform like USLegalForms can help you navigate these complex legal waters effectively.

In Texas, several entities can hold insurance companies accountable, including the Texas Department of Insurance and the courts. If you believe your insurer has acted in bad faith, you can file a complaint with the state department, which oversees insurance practices. Additionally, pursuing a Texas Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand allows you to seek justice through the legal system. Utilizing resources from uslegalforms can streamline this process and enhance your chances of success.

A bad faith claim against an insurance company in Texas occurs when an insurer fails to act in good faith towards its policyholders. This can include denying a valid claim without a reasonable basis, failing to investigate a claim properly, or delaying payment unnecessarily. If you believe you have faced such treatment, you may pursue a Texas Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand. This type of claim can help hold insurers accountable for their actions.

Briefly, section 510 of ERISA provides that it shall be unlawful for any person to discharge, fine, suspend, expel, discipline, or discriminate against a participant or beneficiary of an employee benefit plan for the purpose of interfering with the attainment of any right to which such participant may become entitled ...

Six years after (A) the date of the last action which constituted a part of the breach or violation, or (B) in the case of an omission the latest date on which the fiduciary could have cured the breach or violation, or.

Another important distinction between § 510 and Title VII is that, unlike Title VII, ERISA preempts otherwise applicable state law.

There are no jury trials under ERISA. For instance, a lawsuit alleging the wrongful denial of benefits will be adjudicated based on dispositive motions submitted by both parties. The court will review the ?administrative record? and determine whether the claim fiduciary's decision to deny benefits was reasonable.

Generally, ERISA preempts state law breach of contract claims. However, there are exceptions. For example, a physician sued an employer for breach of contract for the employer's failure to contribute to his retirement benefit plan. The employer claimed that ERISA preempted the claim.

What About ERISA Violations, Fines, and Sanctions? While ERISA does not allow punitive damages, it does provide a way to punish plan administrators that misbehave. When you file a complaint against a plan administrator, the Employee Benefits Security Administration (EBSA) is responsible for investigating your claim.

ERISA's ?preemption clause? makes void all state laws to the extent that they ?relate to? employer-sponsored health plans. Who interprets and enforces ERISA? The U.S. Department of Labor is responsible for administering and enforcing the ERISA law and setting policy for the conduct of employee benefit plans.