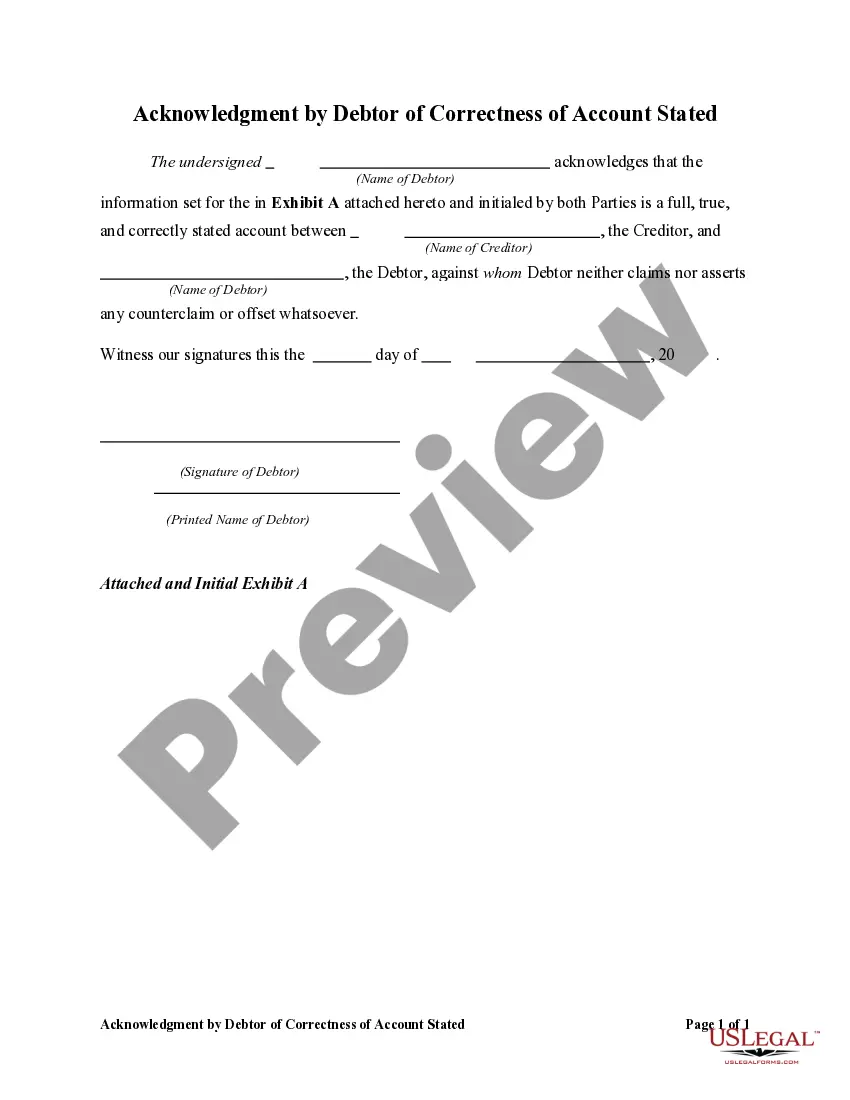

Texas Acknowledgment by Debtor of Correctness of Account Stated

Description

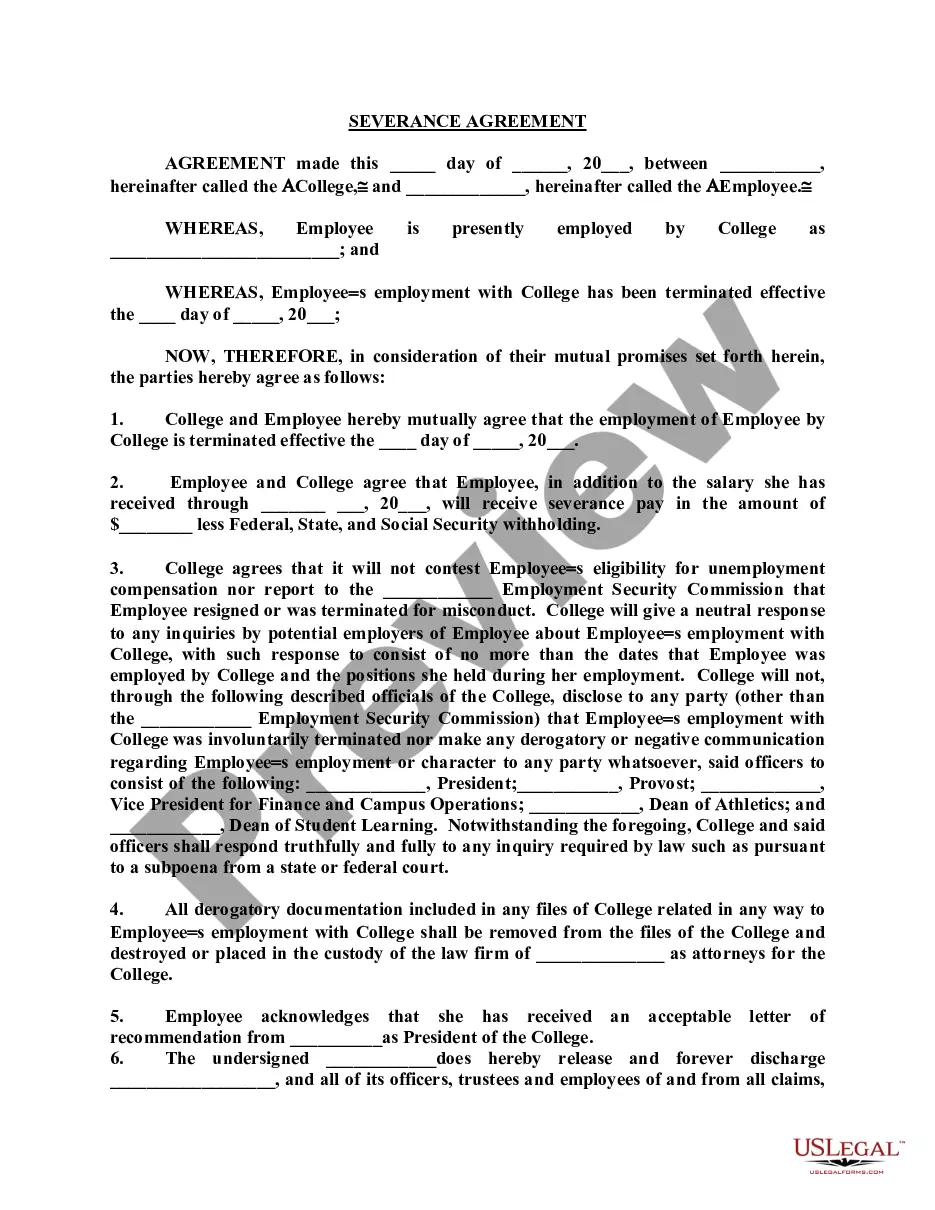

How to fill out Acknowledgment By Debtor Of Correctness Of Account Stated?

US Legal Forms - one of the most extensive collections of official forms in the United States - provides a vast selection of legal document templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can obtain the latest versions of forms such as the Texas Acknowledgment by Debtor of Correctness of Account Stated in just moments.

If you have a subscription, Log In and download the Texas Acknowledgment by Debtor of Correctness of Account Stated from your US Legal Forms library. The Download button will be visible on each form you view. You have access to all previously downloaded forms within the My documents section of your account.

Proceed with the transaction. Use your credit card or PayPal account to complete the transaction.

Choose the format and download the form to your device. Edit. Fill out, modify, and print and sign the downloaded Texas Acknowledgment by Debtor of Correctness of Account Stated. Each template you add to your account has no expiration date and is yours indefinitely. So, if you wish to download or print another version, simply visit the My documents section and click on the form you need. Gain access to the Texas Acknowledgment by Debtor of Correctness of Account Stated with US Legal Forms, the largest collection of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal requirements.

- Ensure you have chosen the appropriate form for your region/area.

- Click the Preview button to review the form's details.

- Examine the form description to confirm that you have selected the right form.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to locate one that does.

- If you are satisfied with the form, confirm your choice by clicking on the Purchase now button.

- Next, select the payment plan you prefer and provide your information to register for an account.

Form popularity

FAQ

An acknowledgment of a debt or liability by a debtor in writing or a partial payment of the outstanding dues, during the subsisting period of limitation, extends the period of limitation. There are several cases pending before the Supreme Court in which these issues have cone up for consideration.

Acknowledging a debt means making a payment or in some cases, confirming the debt in writing. When a debt is acknowledged, the limitation period restarts.

If you continue to ignore communicating with the debt collector, they will likely file a collections lawsuit against you in court. If you are served with a lawsuit and ignore this court filing, the debt collection company will then be able to get a default judgment against you.

Don't admit to it If debt collectors contact you trying to get you to pay up, be mindful of your language. Ask about the original creditor, the date or time period of when the old debt took place and any other identifiable information. But try not to admit that it's yours.

Debt collectors are legally required to send you a debt validation letter, which outlines what the debt is, how much you owe and other information. If you're still uncertain about the debt you're being asked to pay, you can send the debt collector a debt verification letter requesting more information.

3 Things You Should NEVER Say To A Debt CollectorNever Give Them Your Personal Information. A call from a debt collection agency will include a series of questions.Never Admit That The Debt Is Yours. Even if the debt is yours, don't admit that to the debt collector.Never Provide Bank Account Information.

In it the debtor acknowledges that he or she owes a particular sum of money to the creditor and undertakes to repay what is owing. An AOD requires no more than this in order for it to be legally valid and binding on the signatory.

An acknowledgement of debt (AOD) serves as great opportunity between the debtor and the creditor. It is a written agreement between a debtor and a creditor in terms of which the debtor agrees that he is unequivocally liable to the creditor for a sum of money.

An Acknowledgment of Debt is a contract which both a debtor and creditor sign acknowledging that a debtor is indebted to the creditor and for how much as well as setting out the payment terms of paying off the debt owed.

The statute of limitations on debt in Texas is four years. This section of the law, introduced in 2019, states that a payment on the debt (or any other activity) does not restart the clock on the statute of limitations.