Texas Accounts Receivable — Contract to Sale refers to a financial transaction process commonly used in business transactions within the state of Texas. This particular method involves the sale of accounts receivable, which are amounts owed to a business by its customers or clients, to another entity known as the buyer or factor. The buyer then assumes the responsibility of collecting payment from the customers on the outstanding invoices. Keywords: Texas, accounts receivable, contract to sale, financial transaction, business transactions, sale, amounts owed, customers, clients, entity, buyer, factor, collecting payment, invoices. Types of Texas Accounts Receivable — Contract to Sale may include: 1. Recourse Factoring: In this type, the original business retains the obligation to buy back the accounts receivable if the buyer cannot collect payment from the customers as initially agreed upon. 2. Non-Recourse Factoring: Unlike recourse factoring, the original business is not liable to repurchase the accounts receivable from the buyer if the customers fail to make payment. The buyer assumes the risk of non-payment. 3. Selective Factoring: Selective factoring allows the business to choose specific accounts receivable to sell rather than selling all outstanding invoices. This provides flexibility and control over the financing process. 4. Spot Factoring: Spot factoring refers to the sale of a single invoice instead of a batch of accounts receivable. It is an option when a business needs immediate cash flow for a particular invoice, while still offering the possibility of collecting payment from the customer at a later date. 5. Invoice Discounting: In this arrangement, the accounts receivable are used as collateral for a loan, allowing the business to access immediate funds. The company can continue to collect payment directly from customers, with the lender receiving interest and fees on the outstanding balance. The Texas Accounts Receivable — Contract to Sale process provides businesses with an opportunity to improve their cash flow by converting outstanding invoices into immediate funds. By selling these accounts receivable to a buyer or factor, businesses can focus on their operations rather than spending time and resources on managing collections. Proper understanding of the various types of Texas Accounts Receivable — Contract to Sale allows businesses to choose the most suitable method to meet their financial needs.

Texas Accounts Receivable - Contract to Sale

Description

How to fill out Texas Accounts Receivable - Contract To Sale?

Finding the right lawful file web template can be a battle. Obviously, there are plenty of layouts available on the Internet, but how would you find the lawful kind you require? Utilize the US Legal Forms web site. The services gives 1000s of layouts, like the Texas Accounts Receivable - Contract to Sale, which can be used for company and private needs. All the varieties are examined by experts and fulfill federal and state needs.

Should you be previously authorized, log in to your bank account and click on the Down load button to have the Texas Accounts Receivable - Contract to Sale. Make use of your bank account to look throughout the lawful varieties you may have acquired formerly. Go to the My Forms tab of your own bank account and obtain one more duplicate of the file you require.

Should you be a whole new customer of US Legal Forms, here are easy directions so that you can follow:

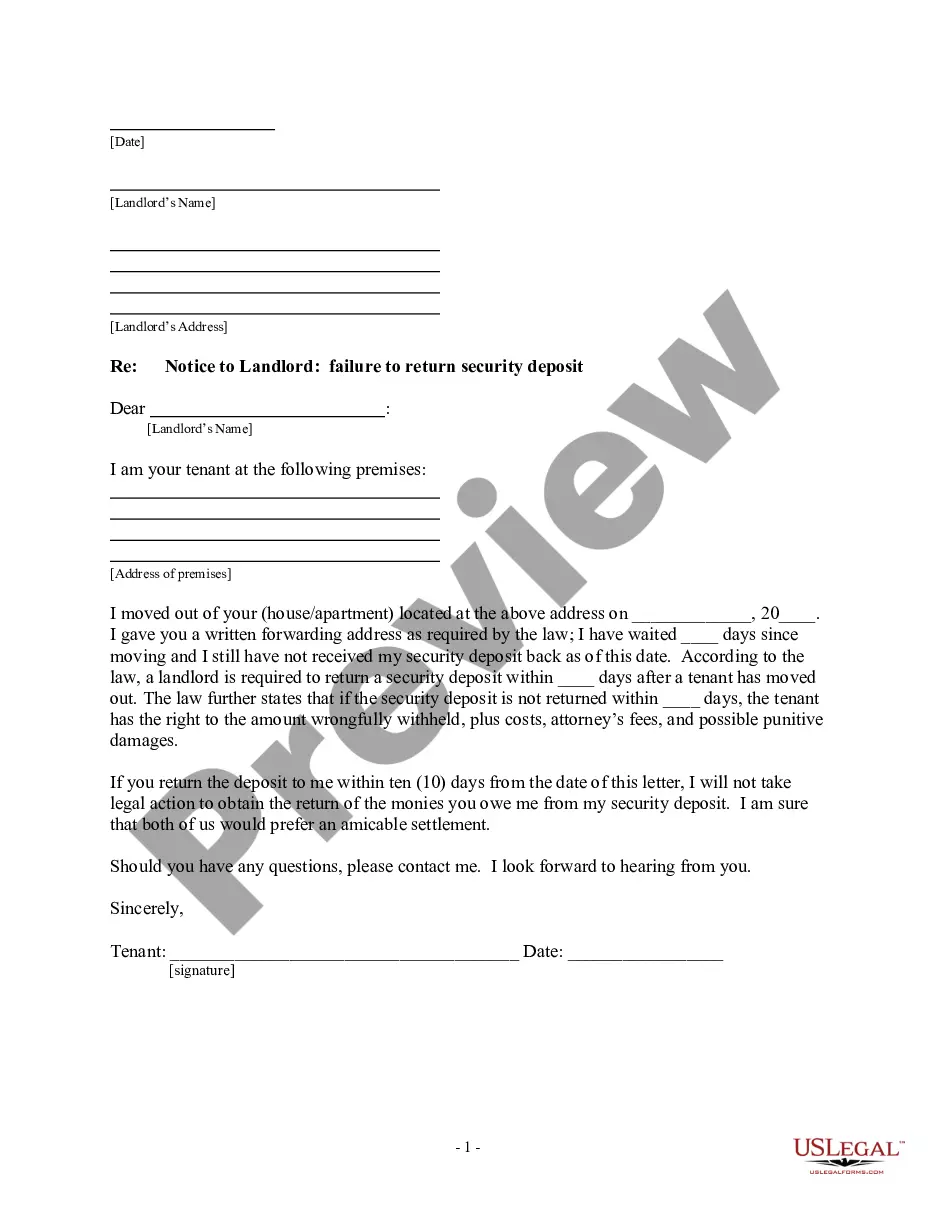

- Initial, make sure you have selected the proper kind for the area/state. It is possible to check out the shape using the Review button and study the shape description to ensure it will be the best for you.

- In case the kind does not fulfill your preferences, utilize the Seach discipline to obtain the proper kind.

- When you are certain the shape is acceptable, select the Buy now button to have the kind.

- Choose the rates prepare you desire and type in the needed information. Design your bank account and pay for an order with your PayPal bank account or credit card.

- Select the submit format and obtain the lawful file web template to your product.

- Full, edit and print out and signal the acquired Texas Accounts Receivable - Contract to Sale.

US Legal Forms will be the most significant collection of lawful varieties that you can find various file layouts. Utilize the company to obtain skillfully-created documents that follow status needs.