Texas Consulting Agreement - with Former Shareholder

Description

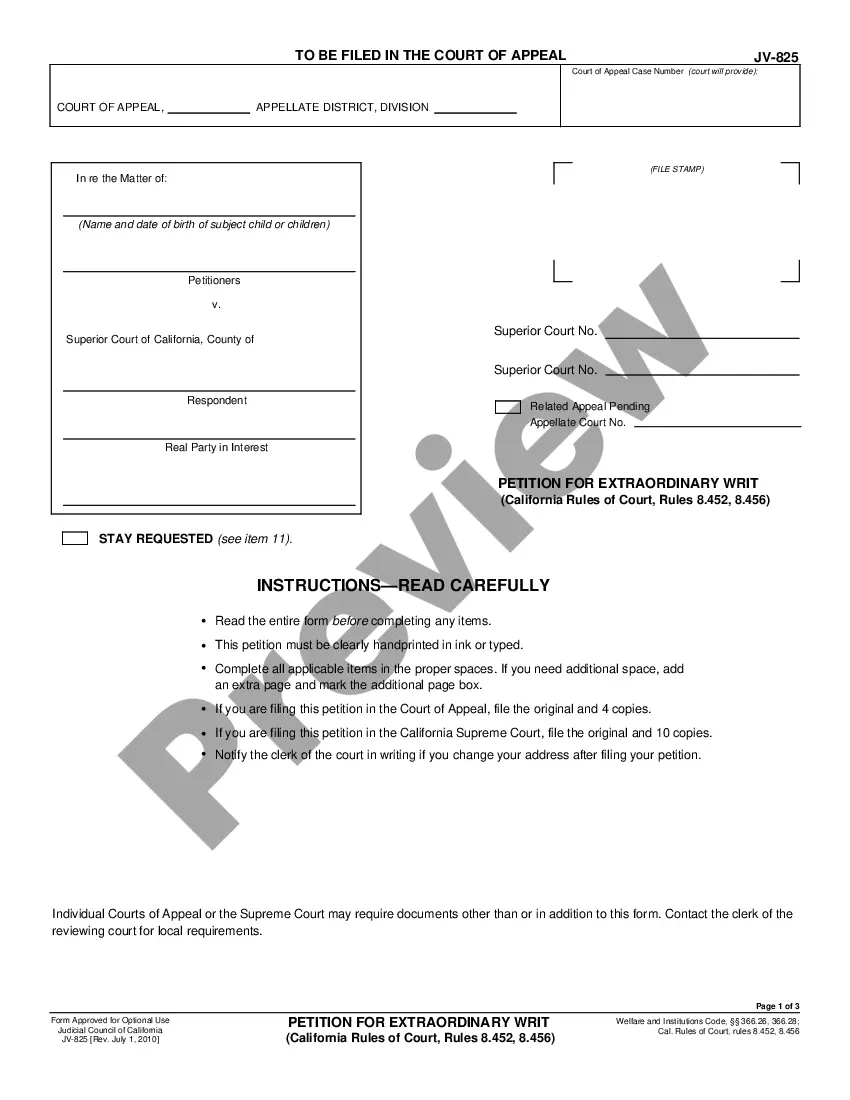

How to fill out Consulting Agreement - With Former Shareholder?

You might spend hours online attempting to locate the proper legal document format that meets the state and federal requirements you need.

US Legal Forms provides a vast array of legal templates that are examined by professionals.

It is easy to access or print the Texas Consulting Agreement - with Former Shareholder from the services.

To find another version of the form, use the Lookup section to find the format that meets your needs and requirements.

- If you already have a US Legal Forms account, you can Log In and click on the Acquire option.

- Then, you can complete, modify, print, or sign the Texas Consulting Agreement - with Former Shareholder.

- Every legal document format you obtain is yours indefinitely.

- To acquire another copy of the purchased form, go to the My documents tab and click on the relevant option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document format for the region/area you have chosen.

- Check the form description to confirm you have selected the correct form.

Form popularity

FAQ

Setting up a consulting agreement starts with understanding the services you will provide and the needs of your client. Use a template like the Texas Consulting Agreement - with Former Shareholder to guide you through creating a solid foundation. Once you draft the agreement, review it with the client, make necessary adjustments, and ensure both parties sign to formalize the arrangement.

A consulting agreement is a formal document that outlines the terms of the relationship between a consultant and a client. It typically includes details such as services to be provided, payment terms, and confidentiality clauses. Using a comprehensive template like the Texas Consulting Agreement - with Former Shareholder helps ensure that all necessary components are addressed.

Writing a simple consulting agreement involves detailing the scope of work, payment terms, and duration of the contract. Leverage a structured template like the Texas Consulting Agreement - with Former Shareholder for clarity and completeness. Always include mutual obligations to protect both parties and ensure a fair, professional relationship.

Consultants can bill clients in several ways, including hourly rates, flat fees, or retainer agreements. It’s essential to clearly outline your billing structure in the Texas Consulting Agreement - with Former Shareholder to avoid misunderstandings. Many consultants find that transparent communication helps in securing timely payments and maintaining good client relationships.

To get a contract as a consultant, start by defining your services and target market. You can use a reliable template like the Texas Consulting Agreement - with Former Shareholder to ensure you cover all essential terms. Networking and online platforms can help you find potential clients, and don’t forget to showcase your expertise through a compelling portfolio.

In Texas, governmental entities can indemnify under certain circumstances, particularly in relation to the Texas Consulting Agreement - with Former Shareholder. This type of agreement may include provisions that allow for indemnification, ensuring protection for parties involved. It's essential to carefully draft these clauses to comply with state regulations. For personalized guidance, consider using the US Legal Forms platform to create a compliant agreement tailored to your specific needs.

To write a simple consulting contract, begin by clearly defining the consulting services to be provided. Include relevant details such as payment terms and duration of the agreement. Make sure to include confidentiality provisions to protect proprietary information. You may find it beneficial to use templates from uslegalforms to create a straightforward Texas Consulting Agreement - with Former Shareholder that meets your needs.

A consulting agreement should include the scope of work, payment details, timelines, and terms regarding confidentiality. It is crucial to specify the rights and responsibilities of each party to avoid misunderstandings. Additionally, ensure the agreement addresses termination conditions and any applicable dispute resolution clauses. For comprehensive templates, consider visiting uslegalforms for a Texas Consulting Agreement - with Former Shareholder.

To write up a shareholder agreement, first gather input from all shareholders to ensure everyone's perspective is considered. The agreement should specify ownership percentages, voting rights, and procedures for share transfers. Be sure to mention the roles of each shareholder and how disputes will be resolved. Utilizing resources like uslegalforms can simplify the process, especially when creating a Texas Consulting Agreement - with Former Shareholder.

Writing a simple contract agreement involves focusing on clear terms and conditions that both parties can understand. Start with identifying the parties involved, followed by a description of the services to be provided. Be sure to include payment terms, timelines, and any other essential details. For a structured approach, check out uslegalforms for templates that support a Texas Consulting Agreement - with Former Shareholder.