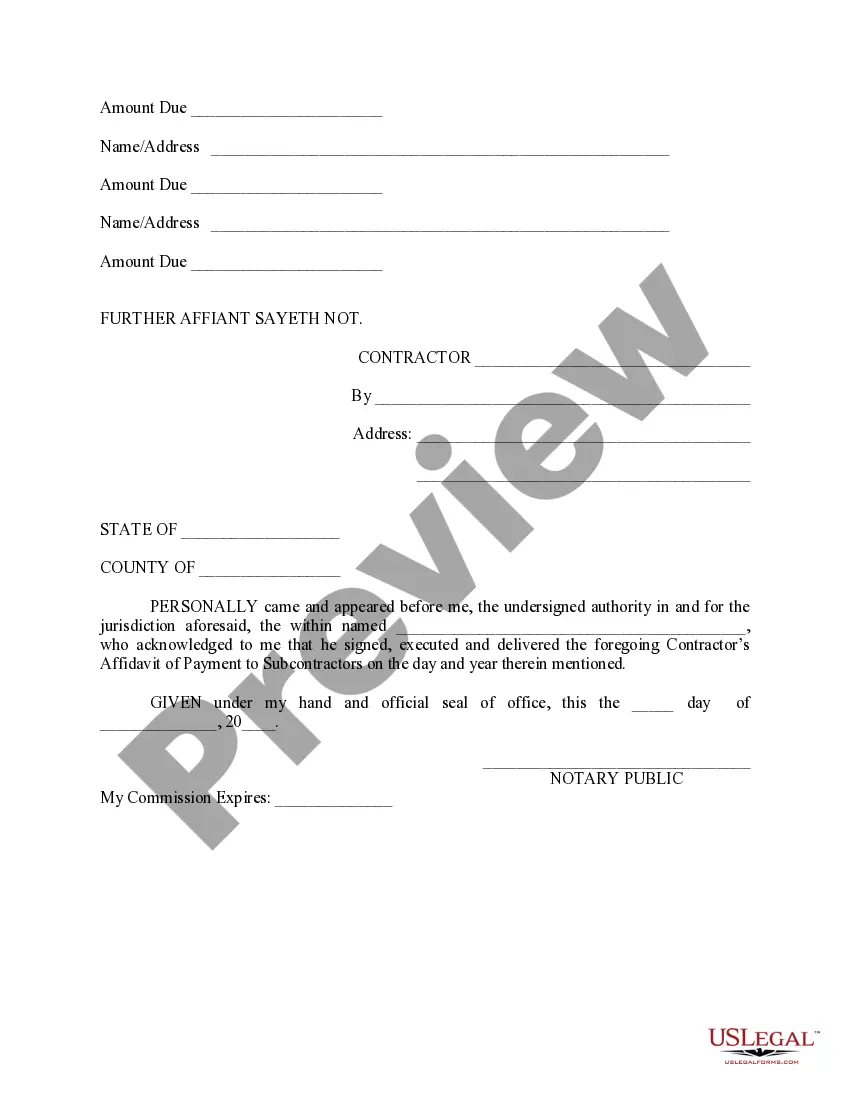

The Texas Contractor's Affidavit of Payment to Subs is a legal document used in the state of Texas to certify that a general contractor has made payments to their subcontractors and suppliers for work or materials provided on a construction project. This affidavit is typically required in order for the general contractor to obtain final payment and release of any liens on the property. The affidavit must be sworn under oath and usually must be notarized. It contains detailed information about the project, including the name and address of the property, the name of the general contractor, and the names and addresses of all subcontractors and suppliers involved. In the affidavit, the general contractor declares that they have paid all subcontractors and suppliers in full for their work or materials, and that there are no outstanding balances or claims against the project. The affidavit also typically includes a statement affirming that the general contractor has complied with all applicable laws, including paying all required taxes and providing necessary insurance coverage. There are different types of Texas Contractor's Affidavit of Payment to Subs that may be used depending on the specific requirements of the project. Some common variations include: 1. Original Contractor's Affidavit: This is the standard form used in most construction projects. It requires the general contractor to list all subcontractors and suppliers, along with the amount and date of payment for each. 2. Subcontractor's Affidavit: This form is used when a subcontractor needs to provide an affidavit of payment directly to the general contractor. It includes similar information as the original contractor's affidavit, but from the perspective of the subcontractor. 3. Partial Payment Affidavit: This form is used when the general contractor has made partial payments to subcontractors and suppliers throughout the course of the project. It requires the general contractor to list all previous payments made, along with any remaining balances. It is important for general contractors to thoroughly understand and comply with the requirements of the Texas Contractor's Affidavit of Payment to Subs to avoid potential legal disputes or delays in receiving final payment. Consultation with a legal professional or construction attorney is advisable to ensure accurate completion of the affidavit and compliance with relevant laws and regulations.

Texas Contractor's Affidavit of Payment to Subs

Description

How to fill out Texas Contractor's Affidavit Of Payment To Subs?

Are you in a position that you need documents for both business or personal purposes almost all the time.

There is a multitude of legal document templates available online, but finding reliable versions is not easy.

US Legal Forms offers thousands of form templates, such as the Texas Contractor's Affidavit of Payment to Subs, that are designed to comply with federal and state regulations.

Select a convenient document format and download your copy.

Access all the document templates you have purchased in the My documents list. You can download another copy of the Texas Contractor's Affidavit of Payment to Subs anytime if needed. Just follow the necessary form to download or print the document template.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Texas Contractor's Affidavit of Payment to Subs template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the document you need and ensure it is for your correct city/state.

- Utilize the Preview feature to review the form.

- Check the details to confirm you have selected the right form.

- If the form is not what you're looking for, use the Search field to find the form that fits your needs and requirements.

- Once you locate the correct form, click on Buy now.

Form popularity

FAQ

A general rule of contributory negligence is that a main contractor is not liable for the negligence of its independent subcontractor. There are some exceptions to this rule, including: The main contractor had actual knowledge that the sub-contractor's work had been done in a foreseeably dangerous way and condoned it.

Right to withhold payments The Texas Prompt Payment Act does allow the withholding of payments on public works projects in particular circumstances. The entity, vendors (prime contractors), and subs may withhold payments if there is a bona fide dispute about the goods delivered or services performed.

When Can Contractors Withhold Payment From Subcontractors? The main contractor is able to withhold payment if the work or goods supplied by a subcontractor are deemed unsuitable. Evidence of this should always be provided along with the option to rectify any shortcomings.

The Texas Government Code Chapter 2251 Prompt Payment Act stipulates that payment is due for goods or services 30 days from the date goods/services are received/completed, or a correct invoice is received, whichever is later.

Thus, if a general contractor's subcontract currently requires its subcontractors to indemnify it from any and all claims or disputes arising from general contractor's sole negligence, it will not be enforceable.

Under the Texas Prompt Payment Act, once a general contractor receives payment from an owner, the general contractor has seven (7) days to pay each of its subcontractors the portion of the payment attributable to the subcontractors' work performed under its contract with the contractor.

Under the Texas Prompt Payment Act, once a general contractor receives payment from an owner, the general contractor has seven (7) days to pay each of its subcontractors the portion of the payment attributable to the subcontractors' work performed under its contract with the contractor.

Generally, under Texas law, an entity that employs an independent contractor does not maintain a duty to ensure that the subcontractor performs its work safely.

No. It depends on the facts, but in this case the general contractor did not retain enough control to be liable. A recent Texas Supreme Court case provides a good example of how Texas courts evaluate general contractor liability to subcontractors and its' employees for on-the-job personal injuries.

AIA Document G70621221994 requires the contractor to list any indebtedness or known claims in connection with the construction contract that have not been paid or otherwise satisfied.

Interesting Questions

More info

Forms.