The Texas Restricted Endowment to Religious Institution is a program that focuses on the funding and support provided to religious institutions located in the state of Texas. This initiative ensures the continuity of religious organizations by enabling them to establish and maintain endowment funds that have specific limitations and conditions. One type of Texas Restricted Endowment to Religious Institution is the "General Support Endowment." These endowments are intended to provide sustained financial assistance for the general operation and maintenance of a religious institution. This includes funding for salaries, building upkeep, utilities, and other essential expenses. Through the General Support Endowment, religious institutions can achieve stability and continue their service to the community. Another category is the "Scholarship Endowment." This type of endowment is designed to support educational endeavors within a religious institution. Scholarships are offered to members or affiliates of the religious organization who wish to pursue higher education, theological studies, or other related fields. The Scholarship Endowment intends to promote the growth and development of individuals interested in contributing to their religious institution in a meaningful way. Furthermore, the Texas Restricted Endowment to Religious Institution also includes the "Outreach and Community Development Endowment." These endowments aim to enable religious institutions to actively engage with their local communities and serve as a resource for social welfare programs, community development initiatives, and outreach activities. Funding from this type of endowment can be used for organizing community events, offering support to low-income individuals, or providing services in areas such as healthcare, education, and disaster relief. It should be noted that the Texas Restricted Endowment to Religious Institution follows specific guidelines and regulations to ensure fairness, transparency, and accountability. These guidelines ensure that the endowment funds are used according to their intended purposes and that adequate reporting mechanisms are established. By establishing different types of endowments, the Texas Restricted Endowment to Religious Institution program enables religious institutions to meet their specific financial needs while positively impacting the community. This initiative not only supports the preservation and growth of religious organizations but also promotes their involvement in community development and the betterment of Texas as a whole.

Texas Restricted Endowment to Religious Institution

Description

How to fill out Texas Restricted Endowment To Religious Institution?

Are you in a situation where you need documents for either business or personal reasons almost all the time.

There are numerous legal document templates available online, but finding ones you can rely on is challenging.

US Legal Forms provides thousands of template options, such as the Texas Restricted Endowment to Religious Institution, that are designed to comply with federal and state regulations.

Once you find the proper document, click on Purchase now.

Select the payment plan you need, fill in the required details to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Texas Restricted Endowment to Religious Institution template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- 1. Find the document you need and ensure it’s for the correct city/county.

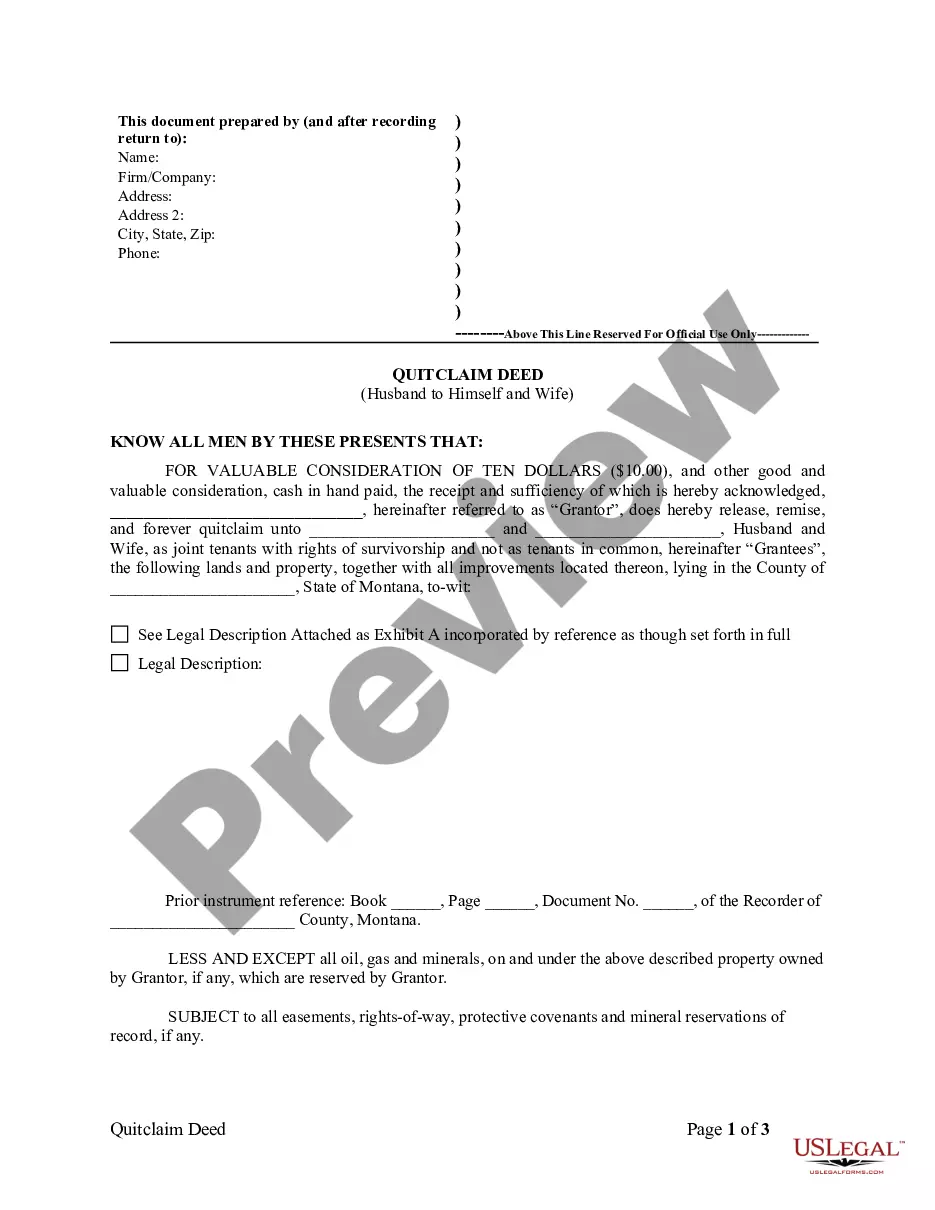

- 2. Use the Preview button to view the form.

- 3. Review the description to confirm you have selected the correct document.

- 4. If the form is not what you are looking for, use the Search box to find the document that meets your needs.

Form popularity

FAQ

The two types of endowment are restricted and unrestricted endowments. A restricted endowment, like the Texas Restricted Endowment to Religious Institution, mandates that funds be used for designated purposes. In contrast, an unrestricted endowment allows the institution greater flexibility in using the funds as needed. This diversity in endowments enables religious institutions to secure funding for specific outreach initiatives while also maintaining operational flexibility.

The primary difference between restricted and unrestricted assets lies in their use. Restricted assets, such as those in a Texas Restricted Endowment to Religious Institution, must be used for specific purposes set by the donor, while unrestricted assets can be utilized for general operational costs and needs. Understanding this distinction allows institutions to allocate their resources effectively. Institutions must carefully manage both types to ensure sustainability and compliance.

Restricted endowment refers to funds that have limitations placed on their use, as specified by the donor. When we talk about a Texas Restricted Endowment to Religious Institution, it highlights the commitment to using the funds strictly for designated activities, such as scholarships, outreach programs, or capital projects. This ensures the donor's intent is honored while providing steady support to the institution. Proper management of these funds can significantly boost long-term financial health.

A restricted endowment is a fund that ensures that the principal amount remains intact while the generated income is used for specific purposes defined by the donor. In the context of a Texas Restricted Endowment to Religious Institution, these specific purposes often align with religious missions or community support initiatives. This type of endowment provides financial sustainability for projects vital to the institution's mission. Understanding these restrictions is crucial for effective financial planning.

To record an endowment fund, start by establishing its purpose and the terms of the donation. Next, you will need to open a dedicated account for the fund to ensure proper tracking. Remember, for a Texas Restricted Endowment to Religious Institution, documentation must align with both state regulations and your institution's requirements. Lastly, maintain clear records and periodic reports to ensure transparency and compliance.

An endowment generally refers to funds that are invested to generate income for a specific purpose, like supporting a Texas Restricted Endowment to Religious Institution. In contrast, a foundation is usually a type of nonprofit organization that manages grants and donations for broader charitable activities. Understanding these differences is vital for effective financial planning and compliance. If you seek more detailed information on these concepts, US Legal Forms offers valuable resources to guide you.

The ability to withdraw from your endowment ties directly to the rules set by the Texas Restricted Endowment to Religious Institution you are part of. Most endowments focus on long-term funding, which might limit withdrawal options. If withdrawals are permitted, conditions often apply that could affect the amount and timing. For clarity and guidance, accessing tools and templates on the US Legal Forms platform can be incredibly useful.

Withdrawing from your Texas Restricted Endowment to Religious Institution can depend on the specific terms of your policy. Generally, these endowment policies are structured to provide financial support over time, rather than immediate access to funds. Therefore, it is essential to review your policy's details or consult with a financial advisor who specializes in endowments. Resources like US Legal Forms can help you understand your options and the withdrawal process.

The four types of endowments include permanent, term, quasi, and operating endowments. Each serves distinct purposes, catering to various organizational needs, from long-term capital growth to immediate operational funding. Understanding these categories can help your organization build a well-structured Texas restricted endowment to religious institution.

A prominent example of an endowment is the Harvard University endowment, which supports its academic programs, student aid, and faculty. Endowments can also be established within religious institutions to fund specific initiatives, like scholarships or community outreach. Such an endowment can serve as a vital resource for a Texas restricted endowment to religious institution.

More info

The legislature finds that certain existing state investment rules are not necessary to preserve the status quo and are unduly burdensome to individual citizens the investment decisions should not have to be made in full light of all information and may be subject to a variety of constraints on individual citizens, including, but not limited to those outlined by state law or by applicable state statutes, such as those found in the Uniform Prudent Management Institutional Funds Amendment Act of 2015 the legislatures finds that the funds currently available are sufficient to satisfy state needs and should be used for institutional operations the legislature finds the funds can be managed by non-profits other than the institution and be a vehicle to support non-profit causes without significantly impacting non-profit status and ability of the institution to provide financial support to state governmental services state investment rules do not require the investment of endowment funds in