The Texas Transfer of Property under the Uniform Transfers to Minors Act (TMA) is a legal provision that allows individuals to transfer assets or property to minors without the need for a formal trust. The TMA is aimed at simplifying the process of gifting or bequeathing property to minors by providing a statutory framework that ensures the assets are managed for the minor's benefit until they reach a specified age. Under the Texas TMA, there are different types of property transfers that can be made, including: 1. Real Estate: Real property, such as land or buildings, can be transferred to a minor under the TMA. The property will be held in a custodial account until the minor reaches the age of majority, which is typically 18 or 21, depending on the state. 2. Financial Assets: Various financial assets such as stocks, bonds, mutual funds, or even cash can be transferred to a minor through the TMA. These assets are typically managed by a custodian appointed by the transferor until the minor becomes of legal age. 3. Intellectual Property: The TMA can also be used to transfer intellectual property rights, such as copyrights, trademarks, or patents, to a minor. The custodian appointed under the TMA manages and protects these assets until the minor reaches the age of majority. 4. Personal Property: Tangible personal property, such as vehicles, jewelry, art collections, or other valuable possessions, can also be transferred through the TMA. The custodian holds and manages these assets until the minor becomes an adult. The Texas TMA ensures that the transferred property is protected and used for the minor's well-being until they are old enough to manage it themselves. The custodian appointed under the act has a fiduciary duty to act in the best interest of the minor, making decisions regarding investments, maintenance, or sale, if necessary. It is important to note that each state may have slight variations in the implementation of the TMA, including the defined age of majority and specific rules for custodial management. Therefore, individuals interested in utilizing the Texas Transfer of Property under the TMA should consult with a legal professional to ensure compliance with state-specific laws and guidelines. Overall, the Texas Transfer of Property under the Uniform Transfers to Minors Act provides a valuable mechanism for individuals to transfer assets to minors, enabling the long-term financial security and prosperity of the younger generation.

Texas Uniform Transfers To Minors Act

Description utma texas

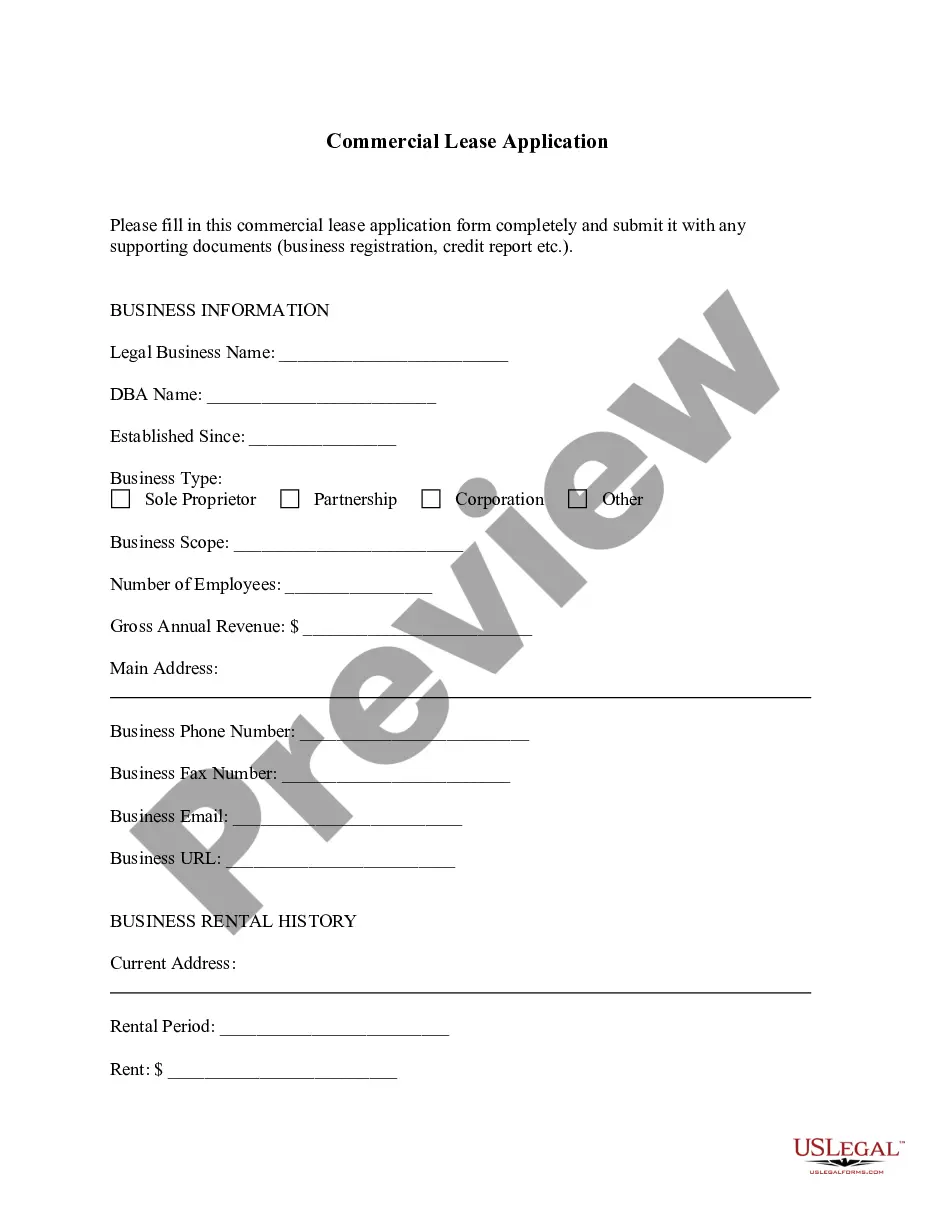

How to fill out Texas Transfer Of Property Under The Uniform Transfers To Minors Act?

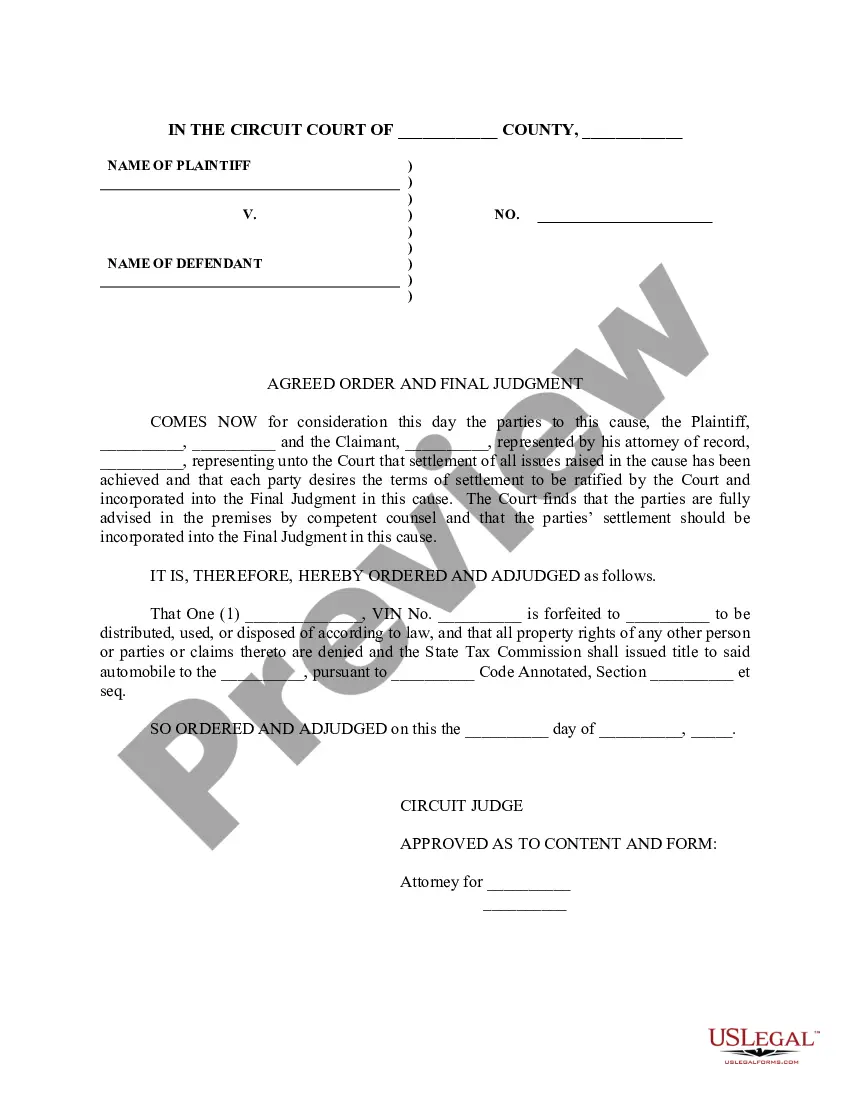

Discovering the right legitimate document design might be a have difficulties. Naturally, there are tons of templates accessible on the Internet, but how can you find the legitimate kind you will need? Make use of the US Legal Forms site. The support offers a large number of templates, like the Texas Transfer of Property under the Uniform Transfers to Minors Act, which can be used for enterprise and private demands. All the varieties are checked by experts and fulfill federal and state needs.

If you are previously registered, log in to the bank account and click on the Download button to get the Texas Transfer of Property under the Uniform Transfers to Minors Act. Make use of your bank account to check through the legitimate varieties you have bought previously. Proceed to the My Forms tab of the bank account and obtain another copy of the document you will need.

If you are a fresh customer of US Legal Forms, allow me to share easy guidelines that you can adhere to:

- Initial, ensure you have selected the appropriate kind for your area/county. You can look over the form utilizing the Review button and look at the form description to ensure this is basically the best for you.

- If the kind is not going to fulfill your preferences, take advantage of the Seach discipline to find the correct kind.

- Once you are certain that the form is acceptable, click on the Purchase now button to get the kind.

- Choose the pricing program you want and enter in the required info. Design your bank account and buy the transaction utilizing your PayPal bank account or charge card.

- Pick the document file format and obtain the legitimate document design to the device.

- Complete, modify and print out and signal the received Texas Transfer of Property under the Uniform Transfers to Minors Act.

US Legal Forms may be the most significant library of legitimate varieties where you can discover different document templates. Make use of the company to obtain skillfully-produced files that adhere to status needs.

Form popularity

FAQ

Can You Withdraw Money From an UTMA Account? It's possible to withdraw money from an UTMA account. However, there's one essential rule you've got to bear in mind ? all withdrawals from a custodial account must be for the direct benefit of the beneficiary.

Because money placed in an UGMA/UTMA account is owned by the child, earnings are generally taxed at the child's?usually lower?tax rate, rather than the parent's rate. For some families, this savings can be significant. Up to $1,050 in earnings tax-free. The next $1,050 is taxable at the child's tax rate.

Transferring a UTMA account to a child is simple. You can do so with most financial or investment institutions. You can also consult a tax or business lawyer to help you set up the legal structure, although most financial institutions can do this for you.

The UTMA allows the donor to name a custodian, who has the fiduciary duty to manage and invest the property on behalf of the minor until that minor becomes of legal age. The property belongs to the minor from the time the property is gifted.

Cons Of Uniform Gift to Minors Act & Uniform Transfers to Minors Act Account No tax advantages for contributions. UGMA and UTMA plans offer no tax advantages for ?contributions?. ... No oversight for the use of funds. ... Limited tax advantages on income.