The Texas Option to Purchase Stock — Long Form is a legal agreement that outlines the terms and conditions for an individual or entity to acquire stock in a company based in Texas. This option grants the holder the right, but not the obligation, to purchase a specified number of shares at a predetermined price within a designated time frame. The Long Form option provides a comprehensive and detailed framework for the transaction, ensuring all parties involved are clear about their rights and responsibilities. It includes various clauses and provisions to protect both the buyer and the seller, as well as to address potential contingencies. Some different types of Texas Option to Purchase Stock — Long Form include: 1. Standard Texas Option to Purchase Stock — Long Form: This is the most commonly used type of long form agreement that covers the essential terms and conditions for purchasing stock in a Texas-based company. It outlines the purchase price, the number of shares, expiration date of the option, and any specific conditions that need to be met before exercising the option. 2. Texas Option to Purchase Preferred Stock — Long Form: In certain situations, companies may issue different classes of stock, such as common stock and preferred stock. This type of long form agreement specifies the purchase of preferred stock rather than common stock. Preferred stockholders usually have certain rights and privileges not available to common stockholders, such as priority in receiving dividends or liquidation proceeds. 3. Texas Option to Purchase Restricted Stock — Long Form: Restricted stock refers to shares that are subject to certain limitations or restrictions, typically related to vesting periods or transferability. This type of long form agreement is used when an option holder wishes to acquire restricted stock in a Texas-based company. It outlines the restrictions and conditions associated with the stock and any limitations on transferability. 4. Texas Option to Purchase Stock — Long Form with Financing Provision: In some cases, the option holder may require financing to exercise their option and purchase the stock. This type of long form option agreement includes provisions related to financing, such as obligations, terms, repayment conditions, and interest rates. It allows the option holder to secure the necessary funds to acquire the stock. Overall, the Texas Option to Purchase Stock — Long Form is a versatile legal agreement that can be tailored to accommodate different types of stock transactions. Whether acquiring common stock, preferred stock, or restricted stock, this agreement provides a comprehensive framework to protect the interests of all parties involved.

Texas Option to Purchase Stock - Long Form

Description

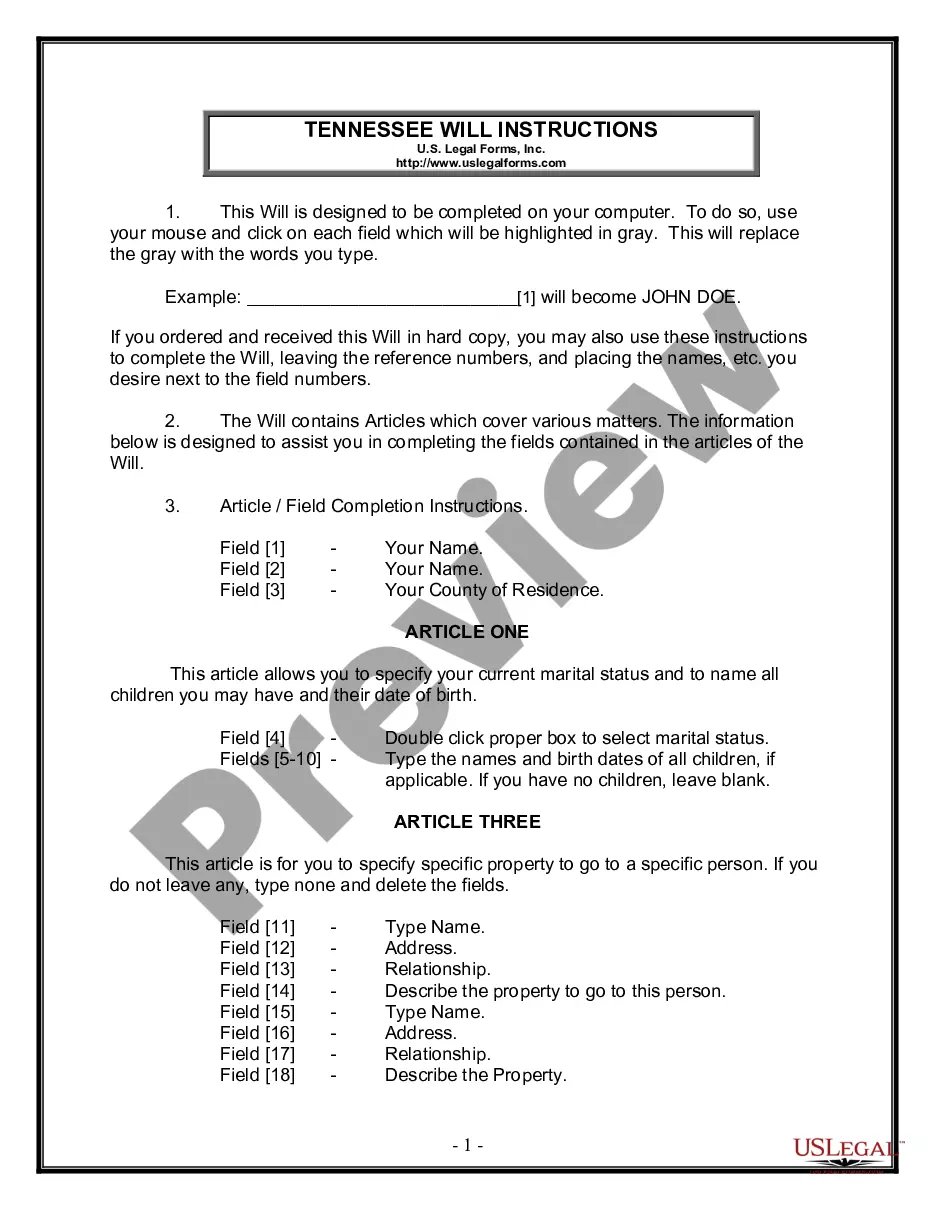

How to fill out Texas Option To Purchase Stock - Long Form?

US Legal Forms - one of the most extensive collections of legal documents in the United States - offers a wide range of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent versions of forms such as the Texas Option to Purchase Stock - Long Form in just minutes.

If you hold a membership, Log In and download the Texas Option to Purchase Stock - Long Form from your US Legal Forms library. The Download button will be available on every form you view.

If you are content with the form, affirm your choice by tapping the Get now button. Then, select your preferred payment plan and provide your details to create an account.

Complete the purchase. Use your credit card or PayPal account to finalize the transaction. Choose the format and download the form onto your device.

Make alterations. Fill in, revise, print, and sign the downloaded Texas Option to Purchase Stock - Long Form.

Each template you add to your account does not have an expiration date and is yours indefinitely. Thus, to download or print another copy, simply return to the My documents section and click on the needed form.

Access the Texas Option to Purchase Stock - Long Form with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- Access all previously acquired forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, let me provide you with simple steps to get started.

- Ensure you have selected the correct form for your area/county.

- Click the Preview button to review the form's content.

- Check the form overview to confirm you have chosen the right form.

- If the form does not satisfy your needs, utilize the Search bar at the top of the page to find one that does.

Form popularity

FAQ

Long call option: A long call option is, simply, your standard call option in which the buyer has the right, but not the obligation, to buy a stock at a strike price in the future. The advantage of a long call is that it allows you to plan ahead to purchase a stock at a cheaper price.

A longor a long positionrefers to the purchase of an asset with the expectation it will increase in valuea bullish attitude. A long position in options contracts indicates the holder owns the underlying asset. A long position is the opposite of a short position.

A long call gives you the right to buy the underlying stock at strike price A. Calls may be used as an alternative to buying stock outright. You can profit if the stock rises, without taking on all of the downside risk that would result from owning the stock.

You can implement a long call strategy by buying a call option with a strike price of 10,750 at a premium of Rs 40. If the Nifty goes above 10,790, you will make a net profit on exercising the option. In case the Nifty stays at or falls below 10,750, you will make a maximum loss of the premium paid.

Long-term options are less liquid than front-month options. Therefore, it is only viable to use them for longer term investing instead of short-term active trading. When deciding whether to use long-term options or to simply buy the stock, one should consider whether the stock is a dividend-paying stock.

Investors maintain long security positions in the expectation that the stock will rise in value in the future. The opposite of a long position is a short position. A "short" position is generally the sale of a stock you do not own. Investors who sell short believe the price of the stock will decrease in value.

7 Tips for Trading Options Like a Long-term InvestorFind a great story. Make believe you are actually investing.Use long-term LEAPS.Buy deep-in-the-money options.Choose LEAPS that are liquid.Use stop losses.Manage your position.Set target prices for the stock and the LEAPS.

A long call is simply a call option that is betting that the underlying stock is going to increase in value prior to its expiration date.

How to trade options in four stepsOpen an options trading account. Before you can start trading options, you'll have to prove you know what you're doing.Pick which options to buy or sell.Predict the option strike price.Determine the option time frame.

If a stock has LEAPS, then more than four expiration months will be available. LEAPS have expiration dates that are a year away or longer, typically up to three years. The expiry date is on the third Friday of the expiry month.