Title: Texas Open a Bank Account — Corporate Resolutions Forms: A Comprehensive Guide Introduction: In order to open a bank account for your corporate entity in Texas, it is essential to comply with the required legal procedures and provide necessary documentation. One crucial aspect of this process is submitting properly executed Corporate Resolutions Forms. This article provides a detailed description of what Texas Open a Bank Account — Corporate Resolutions Forms entail, their significance, and various types commonly encountered. Keywords: Texas, open a bank account, corporate resolutions forms, legal procedures, documentation, properly executed, significance, types. 1. Understanding Corporate Resolutions Forms for Opening a Bank Account in Texas: Corporate Resolutions Forms are legally binding documents that authorize a designated representative(s) to open a bank account on behalf of a corporate entity registered in Texas. These forms outline crucial details and decisions made by the corporation's directors or shareholders pertaining to the bank account setup. 2. Importance and Significance of Corporate Resolutions Forms: Completing Corporate Resolutions Forms is vital to establish accountability, manage financial transactions, and ensure compliance with Texas banking regulations and corporate governance practices. It proves the legitimacy of the bank account's setup and provides the necessary information to protect the interests of the corporation and its stakeholders. 3. Common Types of Texas Open a Bank Account — Corporate Resolutions Forms: a. Shareholder Resolution: This type of resolution is typically used when a corporation's shareholders authorize the opening of a bank account, outlining the approved signatories and their powers to manage the account's funds. b. Board of Directors Resolution: This form is employed when the corporation's board of directors approves the initiation of a bank account, specifying details such as the authorized account signatories, withdrawal limits, and any other relevant instructions. c. LLC Member Resolution: In the case of a limited liability company (LLC), members adopt this resolution to authorize the opening of a bank account, providing similar details as a shareholder or board of directors resolution. d. Partnership Resolution: For partnerships, this resolution document is used to officially authorize the opening of a bank account, usually outlining the managing partner(s), signatories, and any specific instructions related to the account's operation. e. Sole Proprietorship Resolution: Although not strictly required, a sole proprietor may use a resolution form to demonstrate their intention to open a bank account and outline their responsibilities and powers in managing the account's transactional operations. Conclusion: When planning to open a bank account for a corporate entity in Texas, it is imperative to understand and complete the necessary Corporate Resolutions Forms. By adhering to the relevant legal procedures and providing the proper documentation, corporations can establish their banking operations securely and transparently. The various types of resolutions forms mentioned above cater to different business structures and ensure that the opening of a bank account aligns with the specific requirements of each entity type.

Texas Open a Bank Account - Corporate Resolutions Forms

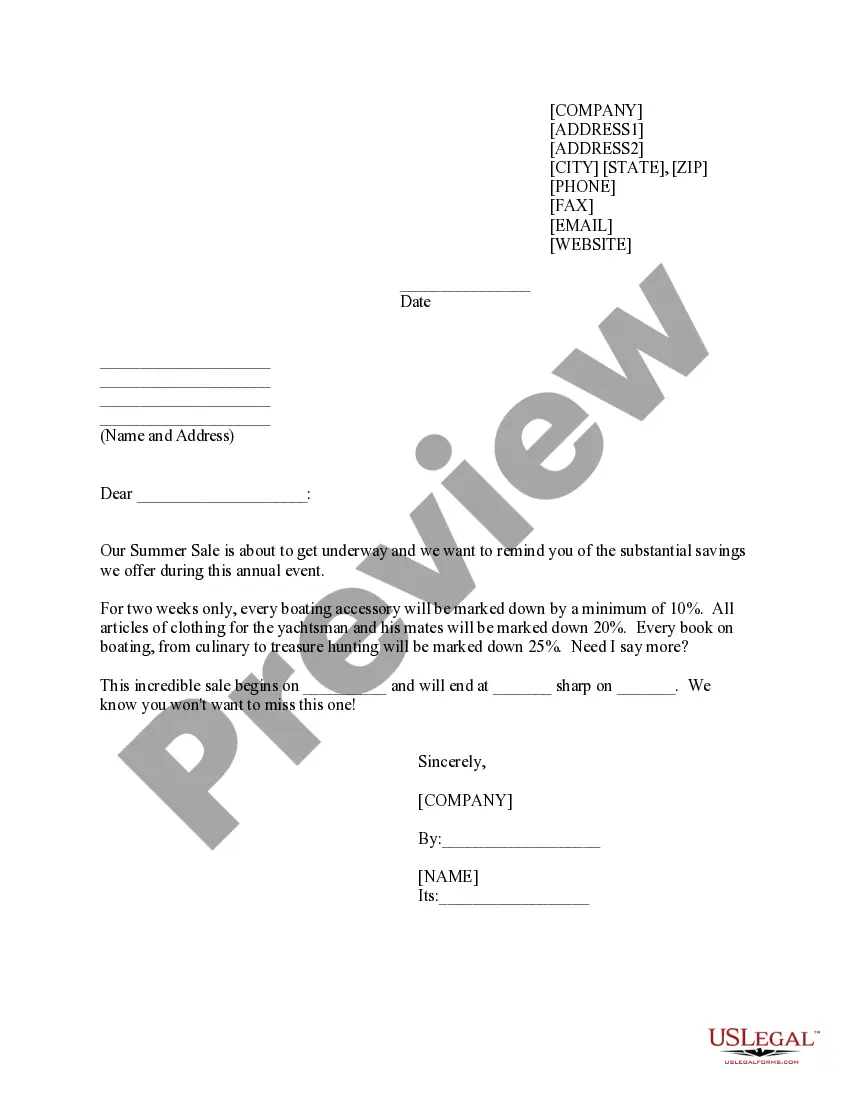

Description

How to fill out Texas Open A Bank Account - Corporate Resolutions Forms?

If you have to comprehensive, obtain, or printing lawful document layouts, use US Legal Forms, the greatest variety of lawful kinds, which can be found online. Use the site`s simple and handy search to obtain the papers you want. A variety of layouts for organization and specific purposes are sorted by types and claims, or search phrases. Use US Legal Forms to obtain the Texas Open a Bank Account - Corporate Resolutions Forms within a number of click throughs.

In case you are currently a US Legal Forms consumer, log in to your profile and then click the Download option to have the Texas Open a Bank Account - Corporate Resolutions Forms. Also you can entry kinds you formerly acquired within the My Forms tab of your own profile.

If you are using US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Ensure you have selected the shape for your right town/region.

- Step 2. Use the Preview solution to look over the form`s information. Never forget to see the description.

- Step 3. In case you are unsatisfied with all the form, make use of the Look for industry on top of the monitor to discover other versions of your lawful form web template.

- Step 4. When you have located the shape you want, click the Get now option. Opt for the rates program you favor and include your accreditations to sign up for an profile.

- Step 5. Procedure the deal. You may use your charge card or PayPal profile to complete the deal.

- Step 6. Find the format of your lawful form and obtain it in your system.

- Step 7. Total, edit and printing or indication the Texas Open a Bank Account - Corporate Resolutions Forms.

Every single lawful document web template you buy is yours eternally. You have acces to every single form you acquired in your acccount. Go through the My Forms portion and select a form to printing or obtain yet again.

Contend and obtain, and printing the Texas Open a Bank Account - Corporate Resolutions Forms with US Legal Forms. There are many professional and condition-particular kinds you can utilize for the organization or specific requires.