Title: Comprehensive Guide to Texas Letter to Creditors Notifying them of Identity Theft Introduction: In the unfortunate event of identity theft, it is crucial to inform your creditors promptly to mitigate any potential financial damage to your reputation and credit history. This article provides a detailed description of Texas Letter to Creditors notifying them of identity theft, ensuring that your message is clear, concise, and legally compliant. We will also address specific types of identity theft letters within the Texas jurisdiction. Key Terms: Texas, Letter to Creditors, Identity Theft, notifying, types I. Understanding the Texas Letter to Creditors Notifying them of Identity Theft: 1. Purpose: The purpose of the Texas Letter to Creditors is to inform and request the immediate freezing of your accounts and the initiation of an investigation into fraudulent activity resulting from identity theft. 2. Legal Compliance: The letter should adhere to the legal framework set forth under the Fair Credit Reporting Act (FCRA), specifically § 32.035 in Texas, which pertains to identity theft. II. Components of a Texas Letter to Creditors Notifying them of Identity Theft: 1. Professional Format and Tone: Compose the letter professionally, adopting a polite and serious tone. Use a formal letter format with your contact information, the creditor's details, and a date. 2. Salutation and Introduction: Address the letter directly to the creditor and introduce yourself as the victim of identity theft. State the purpose of the letter clearly, emphasizing that it pertains to fraudulent activity on your account. 3. Account Information: Provide the relevant account details associated with the fraudulent activity, including account numbers, dates of unauthorized transactions, and any other supporting evidence to establish the existence of identity theft. 4. Explanation of Identity Theft: Briefly explain the circumstances of the identity theft incident, such as stolen personal information, phishing scams, or any other relevant details. 5. Request for Account Freeze and Investigation: Clearly demand an immediate freeze on all affected accounts and an investigation into the fraudulent activity by the creditor to rectify the situation. State your expectations from the creditor as per the FCRA guidelines. 6. Supporting Documentation: Enclose copies of any supporting documents, such as police reports, identity theft affidavits, or related conformational correspondence, to validate your claims. 7. Contact Information: Provide your contact information, including a valid phone number and email address, ensuring the creditor can easily reach you for any further inquiries or communications. 8. Appreciation and Closing: Convey appreciation for the creditor's prompt attention to the matter, and sign off with a formal closing such as "Sincerely" or "Regards," followed by your full name and signature. III. Types of Texas Letter to Creditors Notifying them of Identity Theft: 1. Initial Notification Letter: This letter is the first communication to creditors, informing them of the identity theft incident and requesting immediate action to secure affected accounts. 2. Follow-up Investigation Request Letter: In case the creditor does not respond promptly or fails to take necessary actions, this letter ensures their attention and issuance of an investigation into the identity theft. Conclusion: Adhering to the guidelines outlined in this comprehensive guide will help you draft an effective Texas Letter to Creditors notifying them of identity theft. Remember, timely notification is crucial in minimizing the potential financial impact resulting from identity theft incidents in the state of Texas.

Texas Letter to Creditors notifying them of Identity Theft

Description

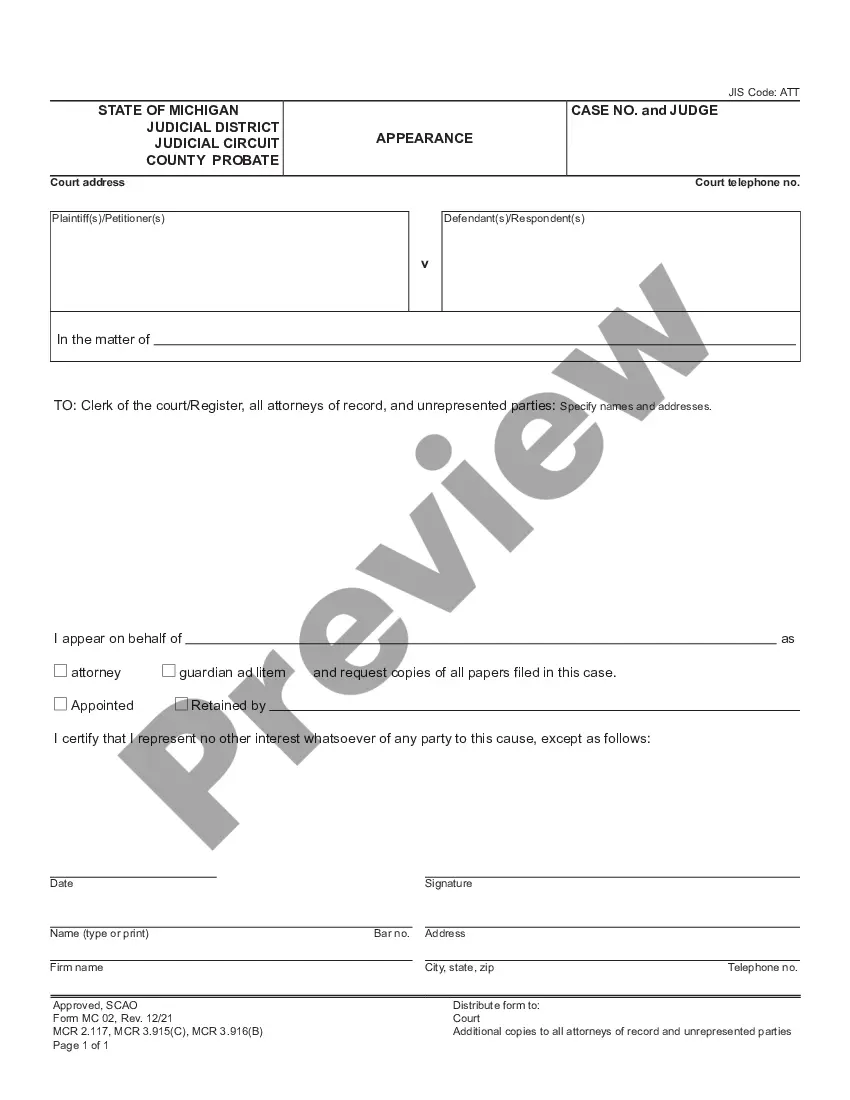

How to fill out Texas Letter To Creditors Notifying Them Of Identity Theft?

Finding the right legal file web template can be quite a struggle. Needless to say, there are plenty of layouts accessible on the Internet, but how do you get the legal type you require? Use the US Legal Forms web site. The support delivers thousands of layouts, such as the Texas Letter to Creditors notifying them of Identity Theft, that you can use for organization and personal needs. Every one of the varieties are inspected by professionals and meet up with federal and state demands.

Should you be currently registered, log in in your profile and then click the Download key to get the Texas Letter to Creditors notifying them of Identity Theft. Use your profile to search with the legal varieties you might have purchased in the past. Check out the My Forms tab of the profile and have an additional backup from the file you require.

Should you be a new consumer of US Legal Forms, allow me to share straightforward guidelines that you should follow:

- Very first, ensure you have chosen the proper type to your city/state. You may look over the form using the Preview key and study the form information to make sure it is the best for you.

- If the type will not meet up with your needs, utilize the Seach discipline to discover the correct type.

- Once you are certain the form is suitable, select the Buy now key to get the type.

- Select the rates program you would like and enter in the needed information and facts. Create your profile and pay money for the transaction using your PayPal profile or credit card.

- Select the submit file format and obtain the legal file web template in your device.

- Comprehensive, edit and print and indicator the obtained Texas Letter to Creditors notifying them of Identity Theft.

US Legal Forms will be the most significant catalogue of legal varieties where you can find numerous file layouts. Use the company to obtain appropriately-created documents that follow express demands.

Form popularity

FAQ

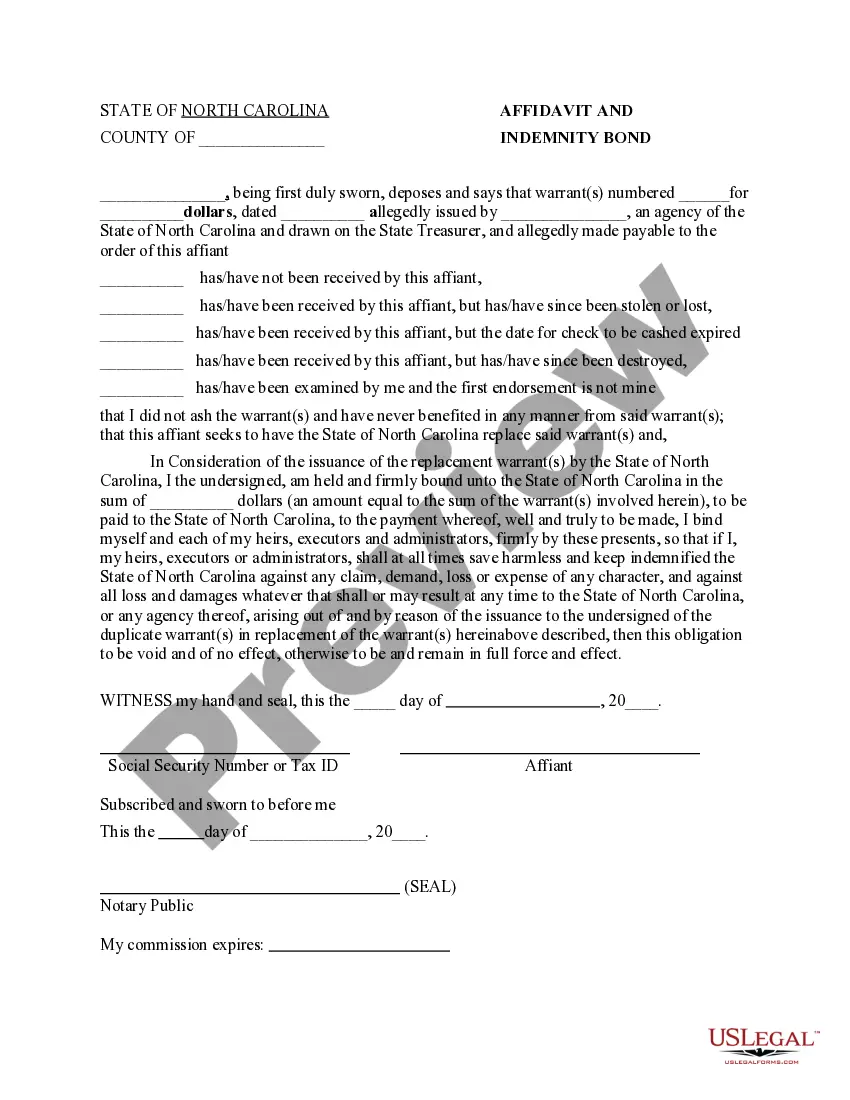

I am a victim of identity theft, and I did not make [this/these] charge(s). I request that you remove the fraudulent charge(s) and any related finance charge and other charges from my account, send me an updated and accurate statement, and close the account (if applicable).

I am a victim of identity theft, and I did not make [this/these] charge(s). I request that you remove the fraudulent charge(s) and any related finance charge and other charges from my account, send me an updated and accurate statement, and close the account (if applicable).

Texas Penal Code §32.51 is the section that provides for ID Theft as a crime in Texas. It states that ?A person commits an offense if the person, with the intent to harm or defraud another, obtains, possesses, transfers, or uses an item of identifying information of another person without the other person's consent??

I am a victim of identity theft, and did not make the charge(s). I am requesting that the item(s) be blocked to correct my credit report. Enclosed are copies of (describe any enclosed documents) supporting my position. Please investigate this (these) matter(s) and block the disputed item(s) as soon as possible.

Identity theft happens when someone takes your name and personal information (like your social security number) and uses it without your permission to do things like open new accounts, use your existing accounts, or obtain medical services.

The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.