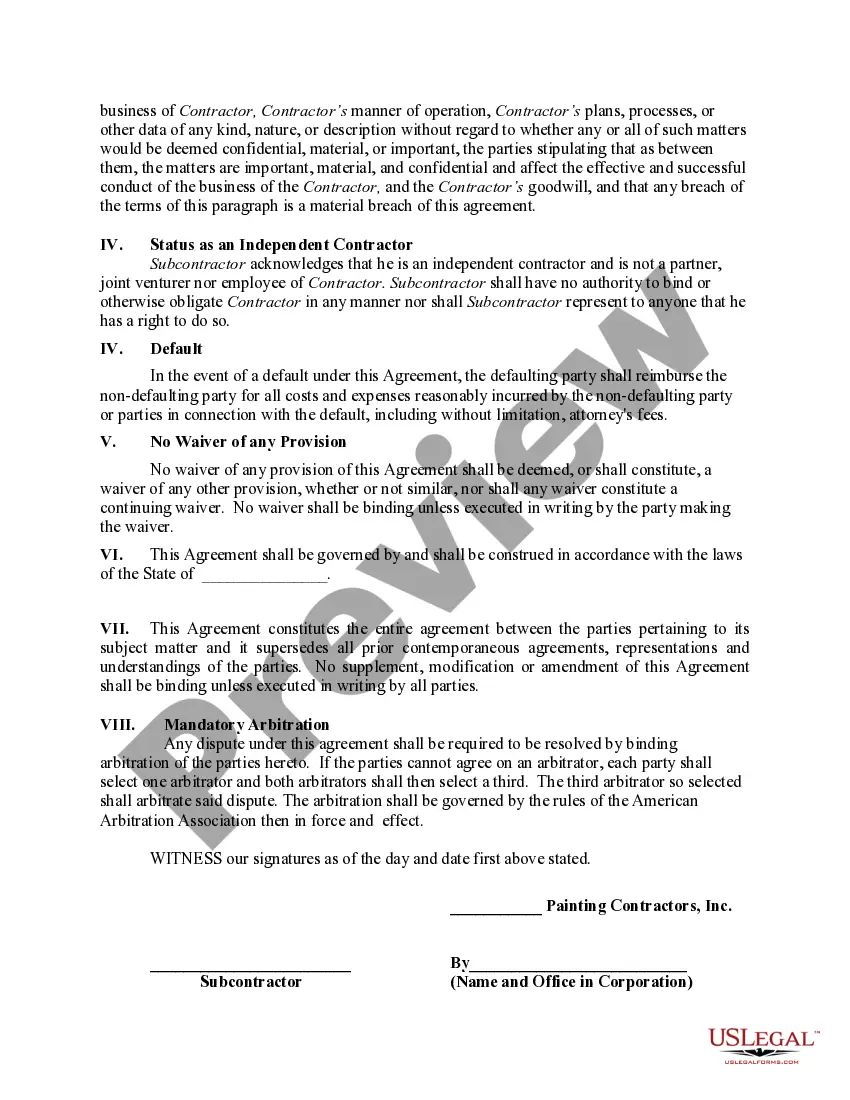

Title: Understanding the Texas Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor Introduction: The Texas Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor is an essential legal document that clarifies the limitations and expectations for self-employed individuals or subcontractors in the painting industry. By entering into this agreement, the contractor ensures that their workers refrain from bidding on or accepting painting projects directly from potential clients, which could potentially harm the interests of the general contractor. Keywords: Texas Agreement, Self-Employed Independent Contractor, Subcontractor, Bid Against, Painting General Contractor. Types of Texas Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor: 1. Standard Texas Agreement: This is the most common type of agreement used among self-employed contractors and subcontractors in the painting industry. It outlines the general terms and conditions, including the restriction on bidding against the painting general contractor and accepting projects that might conflict with existing client relationships. 2. Subcontractor Agreements: These types of agreements pertain specifically to subcontractors who work under a painting general contractor. The agreement clarifies the restrictions on subcontractors bidding or accepting projects that directly compete with the primary contractor's business interests. 3. Individual Contractor Agreements: This agreement pertains to self-employed individual contractors who work independently in the painting industry. It establishes a contractual obligation not to bid against a specific painting general contractor. This type of agreement ensures that independent contractors do not undermine the general contractor's business. 4. Confidentiality and Non-Disclosure Agreement: This type of agreement often accompanies the Texas Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor. It ensures that the independent contractor or subcontractor maintains the confidentiality of client lists, trade secrets, and other proprietary information related to the general contractor's business. Conclusion: The Texas Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor plays a crucial role in maintaining a healthy working relationship and protecting the professional interests of both parties involved. By mutually agreeing to these terms and conditions, the contractor can efficiently manage potential conflicts and ensure the long-term success of their business partnerships. Keywords: Texas Agreement, Self-Employed Independent Contractor, Subcontractor, Bid Against, Painting General Contractor.

Texas Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor

Description

How to fill out Texas Agreement By Self-Employed Independent Contractor Or Subcontractor Not To Bid Against Painting General Contractor?

US Legal Forms - one of the most extensive collections of official documents in the United States - offers a range of official document templates that you can download or print. By using the website, you can discover thousands of documents for business and personal purposes, categorized by types, states, or keywords.

You can obtain the latest documents such as the Texas Agreement by Self-Employed Independent Contractor or Subcontractor Not to Compete Against Painting General Contractor in just seconds.

If you already have an account, Log In and download the Texas Agreement by Self-Employed Independent Contractor or Subcontractor Not to Compete Against Painting General Contractor from the US Legal Forms library. The Download button will be visible on each form you view. You can access all previously saved documents in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the document to your device. Edit. Fill out, modify, print, and sign the downloaded Texas Agreement by Self-Employed Independent Contractor or Subcontractor Not to Compete Against Painting General Contractor. Each template you purchase has no expiration date and belongs to you permanently. So, if you wish to download or print another copy, simply head to the My documents section and click on the document you need. Access the Texas Agreement by Self-Employed Independent Contractor or Subcontractor Not to Compete Against Painting General Contractor with US Legal Forms, the most thorough repository of official document templates. Utilize thousands of specialized and state-specific templates that cater to your business or personal requirements.

- Ensure you have selected the correct form for your locality.

- Click the Review button to examine the document's content.

- Refer to the form description to confirm that you have chosen the right document.

- If the document does not suit your requirements, utilize the Search feature at the top of the screen to find one that does.

- If you are satisfied with the document, confirm your choice by clicking the Buy now button.

- Then, select your preferred payment plan and provide your details to register for an account.

Form popularity

FAQ

To write a simple contract agreement, start with a description of the parties involved and the services to be provided. Follow with payment terms, duration, and any specific conditions like non-competition clauses, such as seen in the Texas Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor. Keeping the language simple promotes clarity and mutual understanding.

The independent contractor agreement in Texas is a legal document that outlines the terms between a contractor and the hiring party. This agreement typically includes responsibilities, payment terms, and specific clauses to prevent competition, like those in the Texas Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor, ensuring that all parties understand their roles.

To write an independent contractor agreement, include details such as project scope, payment structure, timelines, and any confidentiality obligations. Reference the Texas Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor to adapt relevant legal requirements. Keeping this document clear and detailed will benefit both parties.

In Texas, general contractors do not need a state license, but specific local governments may require permits or registrations. It is crucial to check local regulations to ensure compliance. Additionally, a Texas Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor can help define responsibilities regarding permit acquisition.

In Texas, a 1099 employee, who is classified as an independent contractor, can work as many hours as they wish, as there are no restrictions on the number of hours they can log. However, it is essential to ensure that the terms of their engagement are well-defined, possibly including guidelines similar to those in the Texas Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor.

The best contract for contractors is one that clearly defines all terms, including project scope, payment, and rights. It should also address any specific needs relevant to the industry, such as the Texas Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor, which includes clauses that protect both parties from bidding against each other.

To write a contract for a contractor, you should start by outlining the scope of work, payment terms, and timelines. It is vital to include clauses that address confidentiality and non-compete aspects, such as those found in the Texas Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor. Clear definitions of terms and responsibilities help prevent misunderstandings.

Yes, non-compete agreements can be enforceable against independent contractors in Texas, provided they meet certain criteria. These agreements should protect legitimate business interests and must be reasonable in scope. The Texas Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor may include such clauses to guard the general contractor's market against competition.

In Texas, an independent contractor is typically someone who has the freedom to determine how and when to complete their work. This person usually operates under a contract that outlines their responsibilities, which may include the Texas Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor, ensuring clarity between all parties.

An independent contractor often includes a freelance graphic designer who provides services to various businesses without being tied to one employer. In the context of the Texas Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor, this arrangement allows them to work on multiple projects while maintaining control over their own schedule.

Interesting Questions

More info

The purpose of the ICR can be a time-consuming task; however, a review provides a valuable insight on who in the company is an authority on specific products and services. These decisions are made by the individuals who have been the source of knowledge that they use in creating their products and services. The individual's knowledge, experience and the quality of their product and service knowledge are the most important determinants of the decision-makers decision in this case. These decisions are made within the company as well as across the organization. They can be driven by the product manager, sales manager or other key decision makers. If there is a conflict of interest in making these decisions, this can have far-reaching ramifications and a potential for negative impacts on the business.