Title: Texas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation: A Comprehensive Guide Keywords: Texas agreement, physician, self-employed, independent contractor, professional corporation, types Introduction: The Texas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation outlines the legal relationship and responsibilities between a physician operating as a self-employed independent contractor and a professional corporation within the state of Texas. This agreement aims to establish clear and mutually beneficial terms, ensuring compliance with applicable laws and regulations governing the healthcare industry. Types of Texas Agreements Between Physician as Self-Employed Independent Contractor and Professional Corporation: 1. General Texas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation: This is a standard agreement tailored for physicians who will be providing their services as independent contractors to a professional corporation in Texas. It encompasses essential provisions such as scope of work, compensation, termination, liability, and non-compete clauses. 2. Multi-Physician Professional Corporation Agreement: This type of agreement is designed specifically for professional corporations consisting of multiple physicians. It addresses additional considerations such as profit-sharing arrangements, governance structure, decision-making authority, and the distribution of assets. 3. Specialist Physician Agreement: In some cases, professional corporations may enter into agreements with specialist physicians in specific medical fields. This specialized agreement outlines specific terms unique to the field of specialization, covering aspects such as treatment protocols, referral arrangements, medical equipment, and technology requirements. Key Elements of a Texas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation: 1. Identification and Recitals: The agreement will include the names and contact details of both parties, clearly defining their roles and intentions in the document's recitals section. 2. Scope of Work: This section outlines the services the physician will provide, including any specializations or limitations. It also specifies the location and schedule for service delivery. 3. Compensation and Billing: This section covers the remuneration arrangement between the physician and the professional corporation, including the basis for calculation, payment frequency, and any bonus or incentive structure. 4. Non-Compete and Non-Solicitation: To protect the interests of the professional corporation, clauses restricting the physician's competitive activities during and after the agreement term may be included, along with provisions regarding patient and staff solicitation. 5. Confidentiality and Intellectual Property: This part ensures the confidentiality of patient records, trade secrets, and proprietary information. It also specifies the ownership and usage rights of any intellectual property developed during the collaboration. 6. Termination and Dispute Resolution: The agreement will define the conditions and procedures for terminating the contract. It may also outline the dispute resolution mechanism, such as arbitration or mediation. Conclusion: The Texas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation caters to the unique needs of physicians operating within professional corporations, setting a clear framework for their collaboration. By understanding the various types of agreements available and considering relevant keywords, physicians and professional corporations can ensure a legally compliant and mutually beneficial working relationship in Texas.

Texas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation

Description

How to fill out Texas Agreement Between Physician As Self-Employed Independent Contractor And Professional Corporation?

Are you currently in a situation in which you will need files for sometimes enterprise or person reasons almost every working day? There are plenty of authorized record web templates available on the Internet, but getting kinds you can depend on is not easy. US Legal Forms provides a huge number of type web templates, like the Texas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation, which can be composed in order to meet state and federal specifications.

Should you be already familiar with US Legal Forms website and have a free account, basically log in. Next, you may obtain the Texas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation web template.

If you do not provide an profile and need to start using US Legal Forms, follow these steps:

- Find the type you want and make sure it is for that proper town/county.

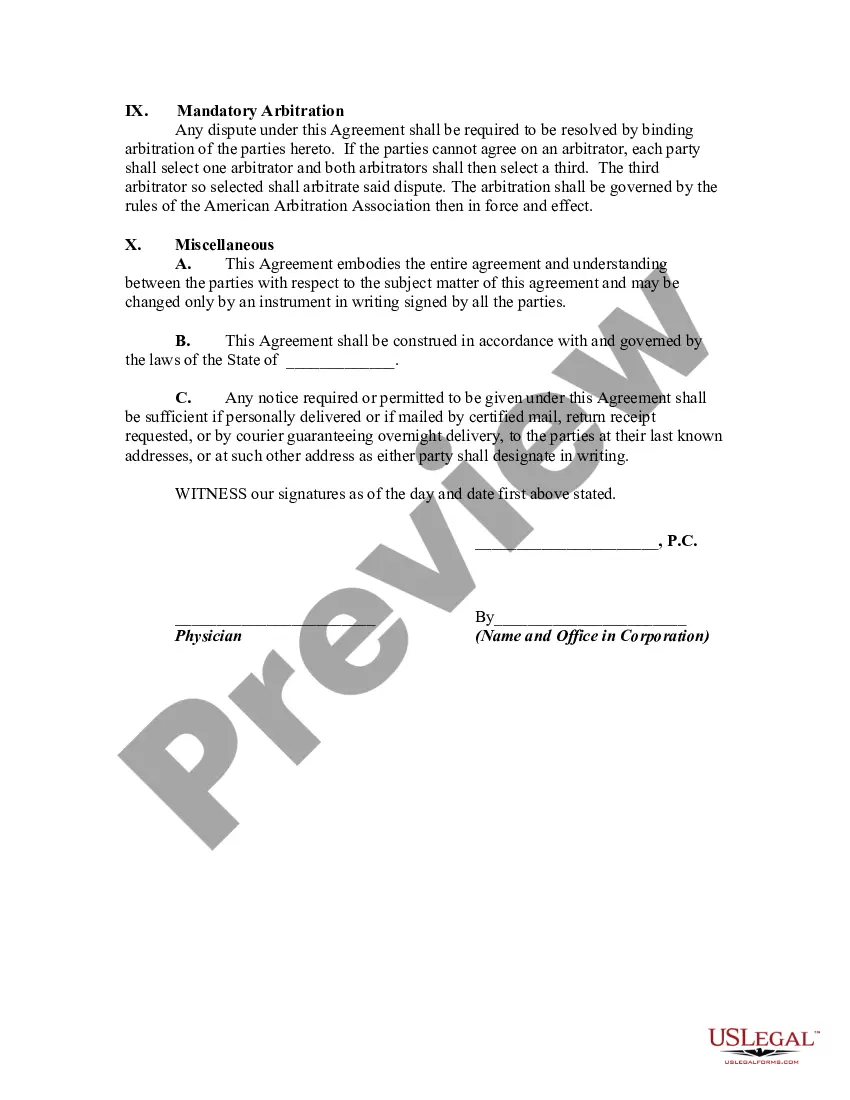

- Take advantage of the Review button to review the form.

- See the information to ensure that you have chosen the appropriate type.

- When the type is not what you`re searching for, use the Research industry to obtain the type that suits you and specifications.

- Whenever you get the proper type, simply click Get now.

- Opt for the pricing strategy you want, fill in the required info to create your money, and buy the order with your PayPal or credit card.

- Decide on a handy paper formatting and obtain your version.

Locate all of the record web templates you might have purchased in the My Forms menu. You can get a extra version of Texas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation at any time, if required. Just click on the necessary type to obtain or produce the record web template.

Use US Legal Forms, probably the most substantial variety of authorized kinds, to save lots of some time and stay away from blunders. The service provides skillfully manufactured authorized record web templates which can be used for an array of reasons. Generate a free account on US Legal Forms and start generating your daily life easier.