Texas Purchase Real Estate - Resolution Form - Corporate Resolutions

Description

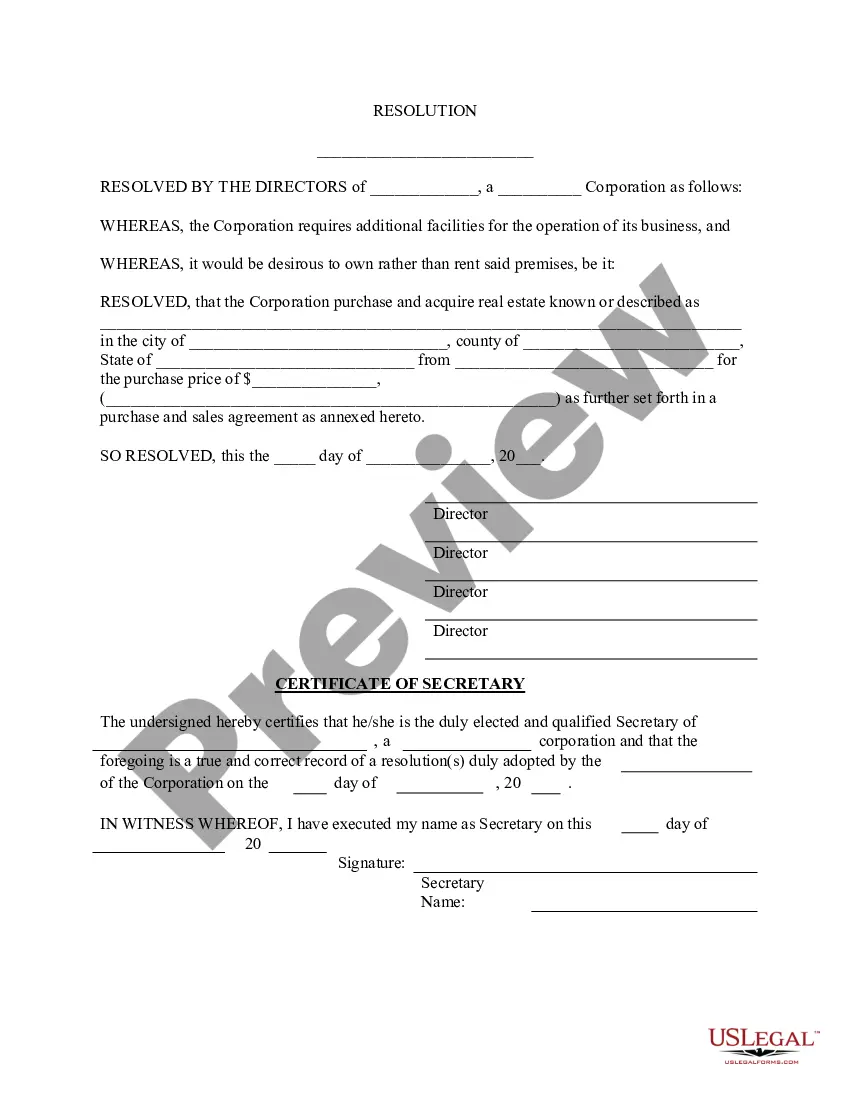

How to fill out Purchase Real Estate - Resolution Form - Corporate Resolutions?

If you intend to finalize, retrieve, or produce legal document templates, utilize US Legal Forms, the premier collection of legal forms accessible online.

Make the most of the site’s convenient and user-friendly search to locate the documents you require.

Various templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Step 4. Once you have identified the form you want, click the Get now button. Choose your preferred pricing plan and enter your details to register for an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to find the Texas Purchase Real Estate - Resolution Form - Corporate Resolutions in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to obtain the Texas Purchase Real Estate - Resolution Form - Corporate Resolutions.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your correct city/state.

- Step 2. Use the Review option to examine the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

A corporate resolution helps the corporation to remain independent from its owners by ensuring that the decisions made by the board and the corporate executives do not create a conflict of interest with the owners.

A corporate resolution form is used when a corporation wants to document major decisions made during the year. It is especially important when decisions made by a corporation's directors or shareholders are in written form.

A corporate resolution is a legal document written by a board of directors that describes and declares major corporate decisions. This document may explain who is legally allowed to sign contracts, make assignments, sell real estate or determine other decisions related to business transactions.

Three forms of resolutions are available: ordinary resolution, special resolution, and unanimous resolution. There is no concept of special resolutions in Board meetings, and very few unanimous resolutions are also required. However, all three are covered in the case of general meetings.

A corporate resolution is a document that formally records the important binding decisions into which a company enters. These decisions are made by such stakeholders as the corporation's managers, directors, officers or owners.

Examples of Actions that Need Corporate ResolutionsApproval of new board members and officers.Acceptance of the corporate bylaws.Creation of a corporate bank account.Designating which board members and officers can access the bank account.Documentation of a shareholder decision.Approval of hiring or firing employees.More items...

An LLC corporate resolution is a record of a decision made through a vote by the board of directors or LLC members. Limited liability companies (LLCs) enjoy specific tax and legal benefits modeled after a corporate structure, although they are not corporations.

What to Include in a Corporate Resolution FormThe date of the resolution.The state in which the corporation is formed and under whose laws it is acting.Signatures of officers designated to sign corporate resolutionsusually the board chairperson or the corporate secretary.Title the document with its purpose.More items...?

A corporate resolution is a written document created by the board of directors of a company detailing a binding corporate action. A corporate resolution is the legal document that provides the rules and framework as to how the board can act under various circumstances.