Texas General Form of Receipt

Description

How to fill out General Form Of Receipt?

You might dedicate numerous hours online trying to discover the valid document format that aligns with the state and federal requirements you need.

US Legal Forms offers a vast array of valid forms that are verified by experts.

You can easily access or generate the Texas General Form of Receipt from our service.

If you wish to find another version of your form, take advantage of the Search field to discover the format that meets your needs and requirements. Once you have found the format you want, click Purchase now to proceed. Select the pricing plan you need, enter your information, and register for your account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal form. Choose the format of your document and download it to your device. Make alterations to the document if possible. You may complete, edit, sign, and print the Texas General Form of Receipt. Obtain and print numerous document templates using the US Legal Forms site, which provides the largest variety of valid forms. Use professional and state-specific templates to address your business or personal requirements.

- If you already possess a US Legal Forms account, you can Log In and click the Acquire button.

- After that, you can complete, modify, print, or sign the Texas General Form of Receipt.

- Each legal document format you download is yours permanently.

- To obtain another copy of any downloaded form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, ensure you have selected the correct document format for the state/city of your choice. Read the form description to verify you have chosen the right one.

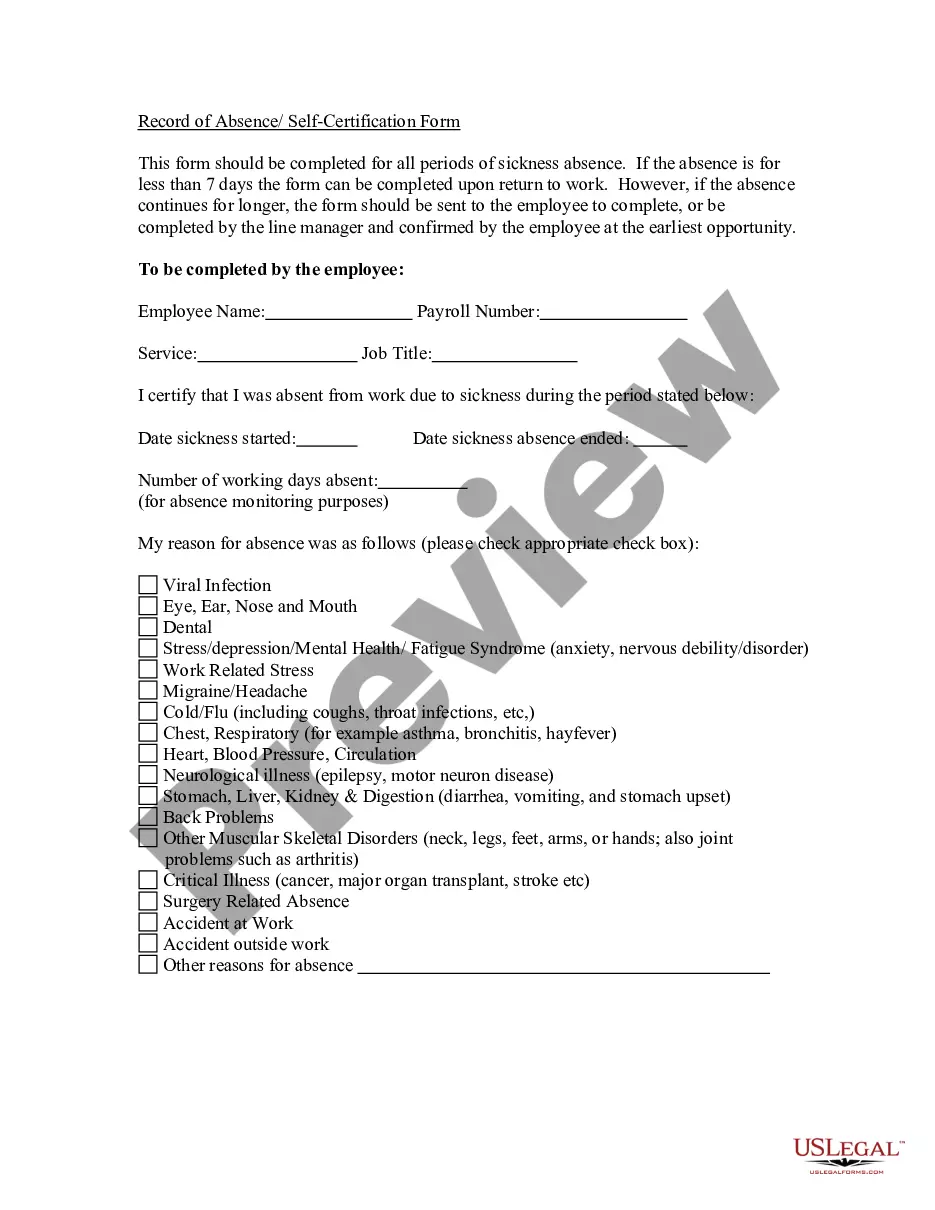

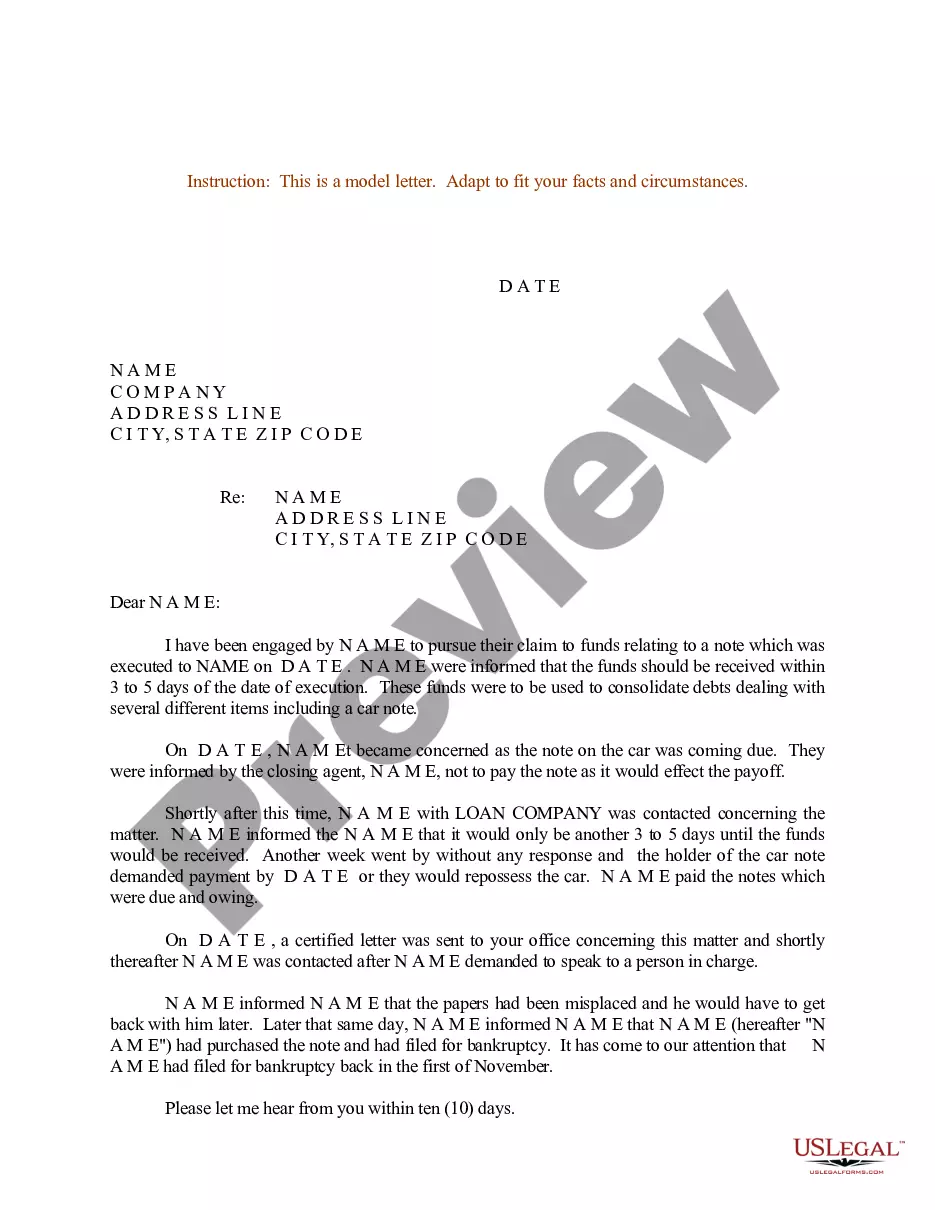

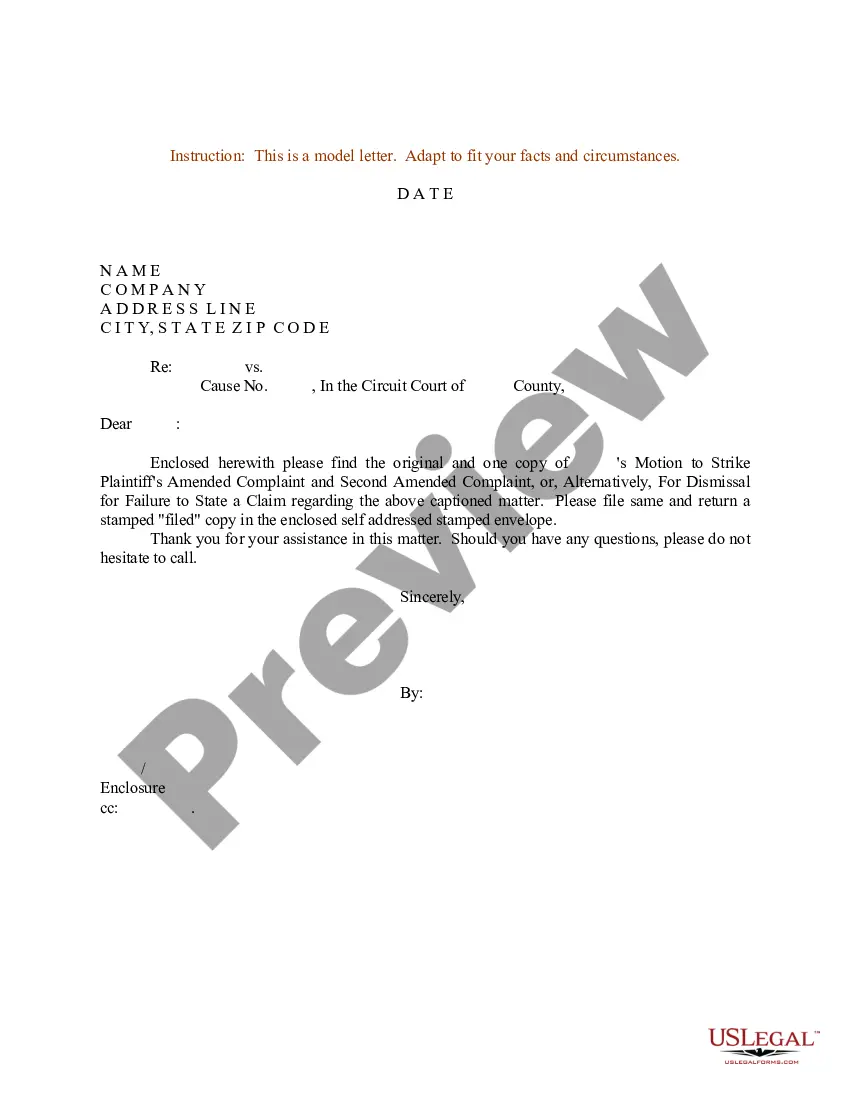

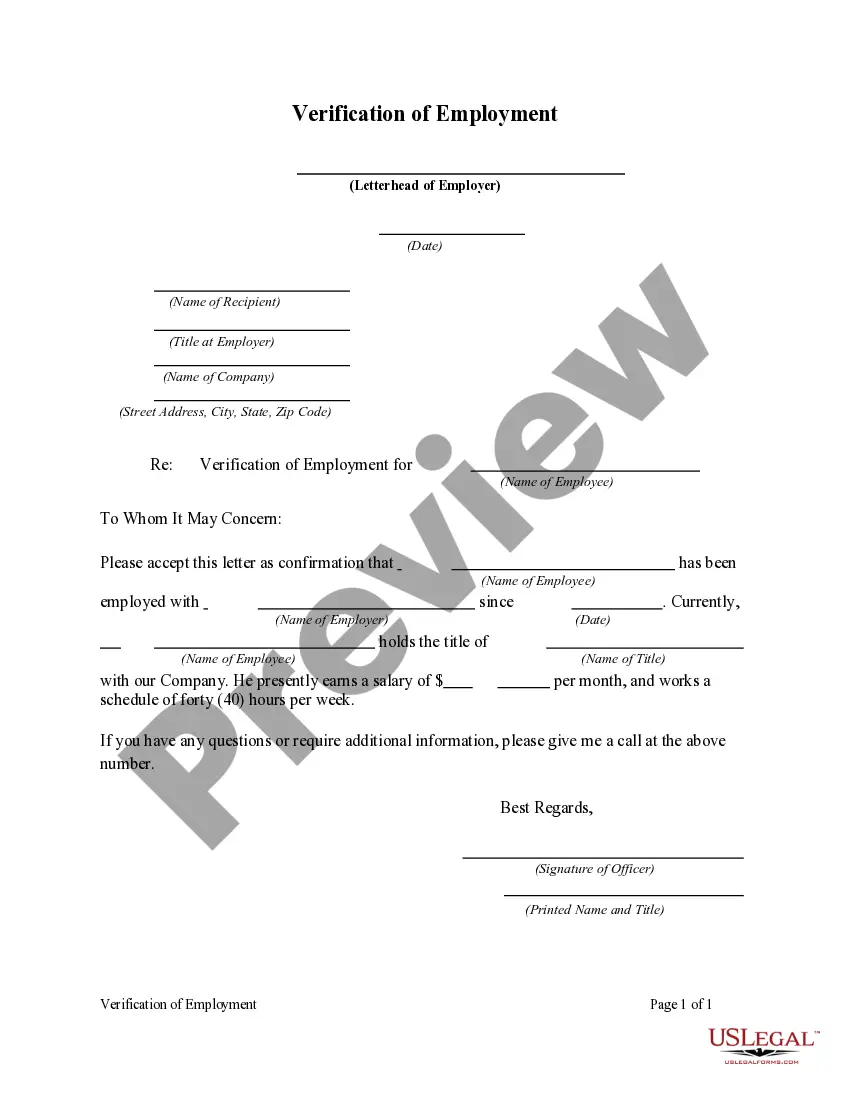

- If available, utilize the Preview button to view the document format as well.

Form popularity

FAQ

An official receipt form, like the Texas General Form of Receipt, is a crucial document that confirms the receipt of payment for goods or services. This form details important information, such as the date, amount, and purpose of the transaction. Using an official receipt helps ensure transparency in financial dealings, making it easier for both parties to track exchanges. With platforms like USLegalForms, you can easily create and manage your official receipts.

Texas form 05 102 is commonly known as the Texas General Form of Receipt. This document serves as an official acknowledgment of the receipt of funds or property. By utilizing this form, individuals and businesses can clearly document transactions, providing proof of payment or transfer. It is essential for maintaining accurate records and protecting against future disputes.

Failing to file the Texas franchise tax can lead to penalties, including monetary fines and loss of good standing for your business entity. In some cases, your business could even face involuntary dissolution. To avoid these consequences, it’s essential to stay on top of your filing obligations. Utilize our comprehensive resources at uslegalforms to help prevent these situations.

Franchise tax in Texas is typically triggered when a business exceeds a certain amount of revenue, which changes periodically. Additionally, entities that operate in Texas or are registered to conduct business must remain compliant with the tax law to stay in good standing. If you find your business approaching these thresholds, consider reaching out to uslegalforms for expert advice on managing your tax responsibilities.

Any business entity operating in Texas, such as corporations and LLCs, that meets certain revenue thresholds must file a Texas franchise tax report. This helps maintain transparency in business operations and ensures compliance with state tax regulations. Filing the report protects your business from potential penalties. Use our resources at uslegalforms for more assistance on how to navigate this requirement.

Texas form 05 164 is a document used for specific tax reporting in the state. This form relates primarily to franchise tax and is essential for businesses to declare their revenues accurately. Filing this form helps in ensuring that your business meets the financial reporting standards set by Texas law. You can find more details and resources through platforms like uslegalforms.

The Texas form 05 167 must be filed by entities that are required to report certain transactions and actions in Texas. This includes corporations and limited liability companies that need to document their financial activities accurately. Filing this form ensures that the entity maintains compliance with Texas regulations. If you're unsure, it's wise to consult with uslegalforms for specific guidance.

Yes, you can file an amended Texas franchise tax return online. The Texas Comptroller's website provides the necessary forms and instructions for this process. Utilize the Texas General Form of Receipt to ensure your amended return is recorded correctly, which helps you avoid complications.

You can request a copy of your Texas sales tax exemption certificate directly from the Texas Comptroller's office. If you have misplaced your original certificate, online resources can guide you to the appropriate forms. Having the Texas General Form of Receipt during this process can help simplify your request.

Yes, Texas form 05 102 can be filed electronically. This form, related to franchise tax, allows for fast and secure submission through the Texas Comptroller's online portal. By using the Texas General Form of Receipt, you’ll receive confirmation of your filing instantly, making the process easier and more efficient.