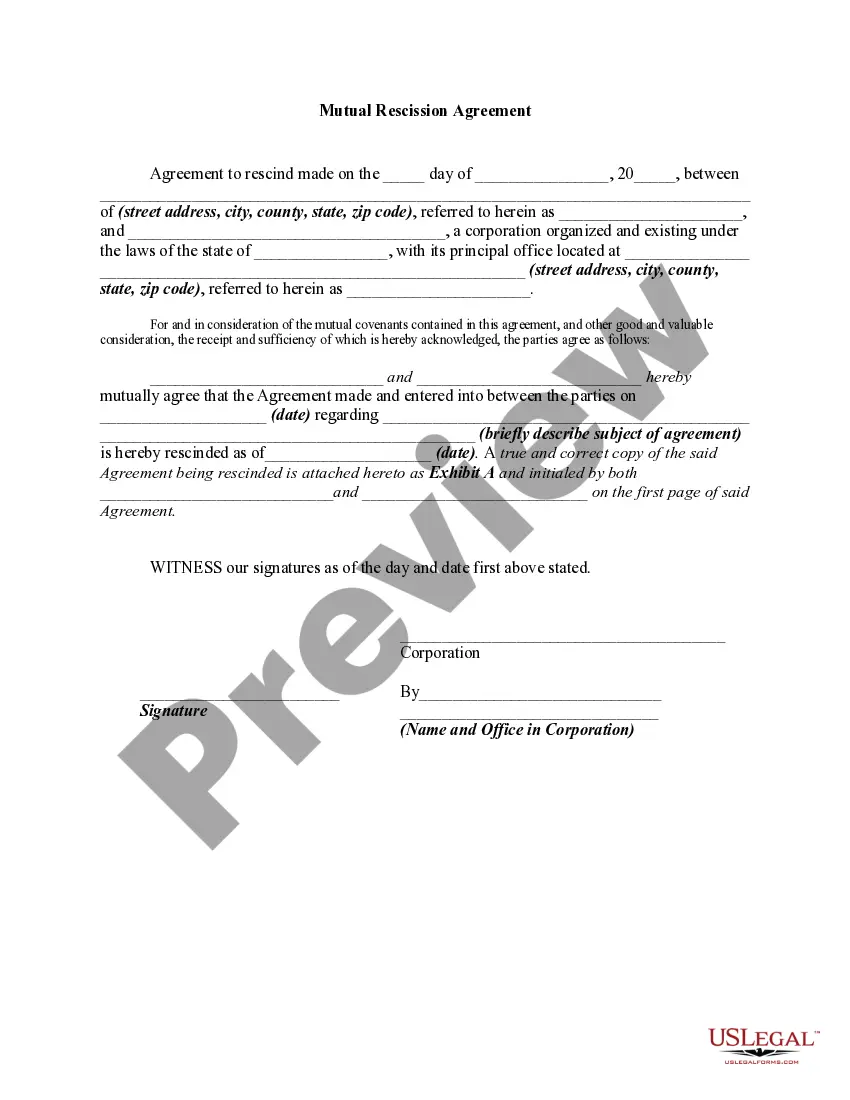

A rescission of a contract generally places the parties in the position they would have been had the contract never been entered into by the parties. For example, money is returned to a buyer and a buyer returns merchandise to the seller. In this form, the parties mutually agree to rescind an earlier agreement between the parties.

A Texas Mutual Rescission Agreement refers to a legal document that is utilized to terminate or cancel an existing agreement or contract between two or more parties. This agreement allows the parties involved to mutually agree to terminate their contractual obligations and walk away from the agreement without any further liabilities or legal consequences. It essentially nullifies the original contract, putting an end to any rights or responsibilities previously established. There are several types of Texas Mutual Rescission Agreements that can be used based on specific circumstances and the nature of the original contract. Some of these types include: 1. Business Contract Rescission Agreement: This type of agreement is commonly used to terminate a business agreement, such as a partnership agreement, joint venture agreement, or a supply contract. 2. Real Estate Rescission Agreement: Often utilized in the real estate industry, this agreement is used to cancel a property purchase contract, lease agreement, or any other real estate-related contractual arrangement. 3. Employment Rescission Agreement: This agreement is used when parties mutually agree to terminate an employment contract, typically outlining the terms and conditions of the termination, such as severance pay, confidentiality clauses, and non-compete agreements. 4. Loan Rescission Agreement: Applied in financial situations, this type of agreement aims to terminate a loan agreement or a financing arrangement between lenders and borrowers. 5. Insurance Rescission Agreement: This agreement is used in insurance contracts when both the insured and the insurer agree to cancel or terminate the insurance policy. When drafting a Texas Mutual Rescission Agreement, it is important to include crucial details such as the names and contact information of the parties involved, a clear description of the original agreement being canceled, the effective date of the rescission, and a statement acknowledging that all obligations, rights, and liabilities under the original agreement will cease to exist after the effective date. It is worth mentioning that a Texas Mutual Rescission Agreement should always be reviewed by legal professionals to ensure compliance with state laws and to protect the interests of all parties involved.A Texas Mutual Rescission Agreement refers to a legal document that is utilized to terminate or cancel an existing agreement or contract between two or more parties. This agreement allows the parties involved to mutually agree to terminate their contractual obligations and walk away from the agreement without any further liabilities or legal consequences. It essentially nullifies the original contract, putting an end to any rights or responsibilities previously established. There are several types of Texas Mutual Rescission Agreements that can be used based on specific circumstances and the nature of the original contract. Some of these types include: 1. Business Contract Rescission Agreement: This type of agreement is commonly used to terminate a business agreement, such as a partnership agreement, joint venture agreement, or a supply contract. 2. Real Estate Rescission Agreement: Often utilized in the real estate industry, this agreement is used to cancel a property purchase contract, lease agreement, or any other real estate-related contractual arrangement. 3. Employment Rescission Agreement: This agreement is used when parties mutually agree to terminate an employment contract, typically outlining the terms and conditions of the termination, such as severance pay, confidentiality clauses, and non-compete agreements. 4. Loan Rescission Agreement: Applied in financial situations, this type of agreement aims to terminate a loan agreement or a financing arrangement between lenders and borrowers. 5. Insurance Rescission Agreement: This agreement is used in insurance contracts when both the insured and the insurer agree to cancel or terminate the insurance policy. When drafting a Texas Mutual Rescission Agreement, it is important to include crucial details such as the names and contact information of the parties involved, a clear description of the original agreement being canceled, the effective date of the rescission, and a statement acknowledging that all obligations, rights, and liabilities under the original agreement will cease to exist after the effective date. It is worth mentioning that a Texas Mutual Rescission Agreement should always be reviewed by legal professionals to ensure compliance with state laws and to protect the interests of all parties involved.