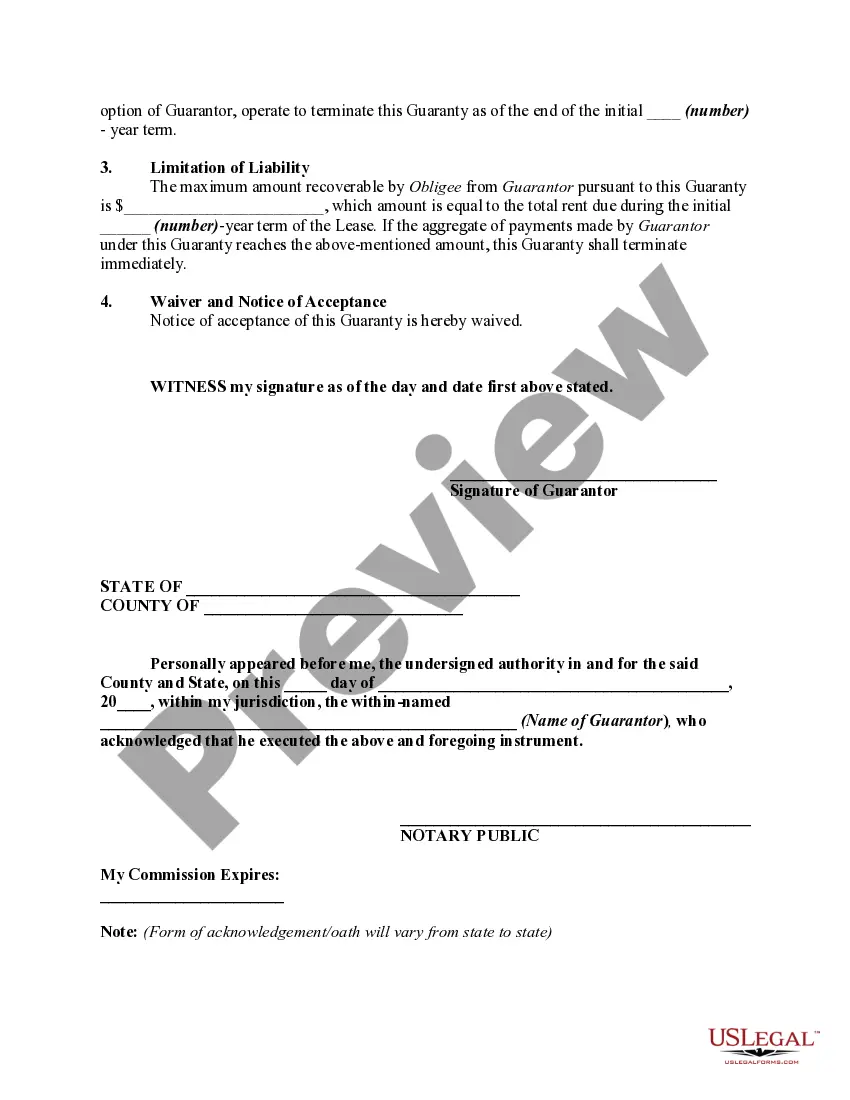

A guaranty is an agreement by one person (the guarantor) to perform an obligation in the event of default by the debtor or obligor. A guaranty acts as a type of collateral for an obligation of another person (the debtor or obligor). A guaranty agreement is a type of contract. Questions regarding such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law.

The Texas Guaranty of Payment of Rent under Lease Agreement is a legal document that provides protection to landlords by ensuring that rent payments are guaranteed even if the tenant fails to fulfill their financial obligations. This agreement is commonly used in commercial leasing situations, where landlords want an additional layer of security to secure consistent rental income. Under this agreement, a third party, usually an individual or a corporate entity, known as the guarantor, pledges to make the rent payment if the tenant defaults. The guarantor's responsibility is to honor the financial obligations of the tenant as outlined in the lease agreement. This agreement serves as a safeguard for landlords against potential financial loss caused by non-payment of rent. There are several types of Texas Guaranty of Payment of Rent under Lease Agreements available, each with variations based on the type of guarantor and specific terms and conditions. Some common types include: 1. Individual Guarantor: This type of agreement involves an individual, often a family member or business partner, who takes on the responsibility of ensuring timely rent payments in case the tenant fails to do so. 2. Corporate Guarantor: In this arrangement, a business entity, such as a parent company or a subsidiary, guarantees the payment of rent on behalf of the tenant. This type of guarantor provides additional security as the financial resources of the corporation back the guarantee. 3. Limited Guaranty: This type of agreement limits the guarantor's responsibility to a specific amount or a predetermined period. For example, the guarantor may pledge to cover rent payments for the first six months of the lease term only. 4. Full Guaranty: A full guaranty holds the guarantor responsible for the entire duration of the lease term and for the full amount of rent owed by the tenant, including any potential damages or fees. It's important to note that the terms and conditions of a Texas Guaranty of Payment of Rent under Lease Agreement can be negotiated between the parties involved. The agreement typically outlines the responsibilities, liabilities, and any specific conditions agreed upon by the landlord, tenant, and guarantor. In summary, the Texas Guaranty of Payment of Rent under Lease Agreement is a legal tool that offers landlords an added layer of financial security, ensuring consistent rent payments. It comes in different types and can involve individual or corporate guarantors, with variations in terms and conditions based on the specific needs and agreements of the parties involved.The Texas Guaranty of Payment of Rent under Lease Agreement is a legal document that provides protection to landlords by ensuring that rent payments are guaranteed even if the tenant fails to fulfill their financial obligations. This agreement is commonly used in commercial leasing situations, where landlords want an additional layer of security to secure consistent rental income. Under this agreement, a third party, usually an individual or a corporate entity, known as the guarantor, pledges to make the rent payment if the tenant defaults. The guarantor's responsibility is to honor the financial obligations of the tenant as outlined in the lease agreement. This agreement serves as a safeguard for landlords against potential financial loss caused by non-payment of rent. There are several types of Texas Guaranty of Payment of Rent under Lease Agreements available, each with variations based on the type of guarantor and specific terms and conditions. Some common types include: 1. Individual Guarantor: This type of agreement involves an individual, often a family member or business partner, who takes on the responsibility of ensuring timely rent payments in case the tenant fails to do so. 2. Corporate Guarantor: In this arrangement, a business entity, such as a parent company or a subsidiary, guarantees the payment of rent on behalf of the tenant. This type of guarantor provides additional security as the financial resources of the corporation back the guarantee. 3. Limited Guaranty: This type of agreement limits the guarantor's responsibility to a specific amount or a predetermined period. For example, the guarantor may pledge to cover rent payments for the first six months of the lease term only. 4. Full Guaranty: A full guaranty holds the guarantor responsible for the entire duration of the lease term and for the full amount of rent owed by the tenant, including any potential damages or fees. It's important to note that the terms and conditions of a Texas Guaranty of Payment of Rent under Lease Agreement can be negotiated between the parties involved. The agreement typically outlines the responsibilities, liabilities, and any specific conditions agreed upon by the landlord, tenant, and guarantor. In summary, the Texas Guaranty of Payment of Rent under Lease Agreement is a legal tool that offers landlords an added layer of financial security, ensuring consistent rent payments. It comes in different types and can involve individual or corporate guarantors, with variations in terms and conditions based on the specific needs and agreements of the parties involved.