A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. A guaranty of the payment of a debt is different from a guaranty of the collection of the debt. A guaranty of payment is absolute while a guaranty of collection is conditional.

Texas Guaranty of Collection of Promissory Note

Description

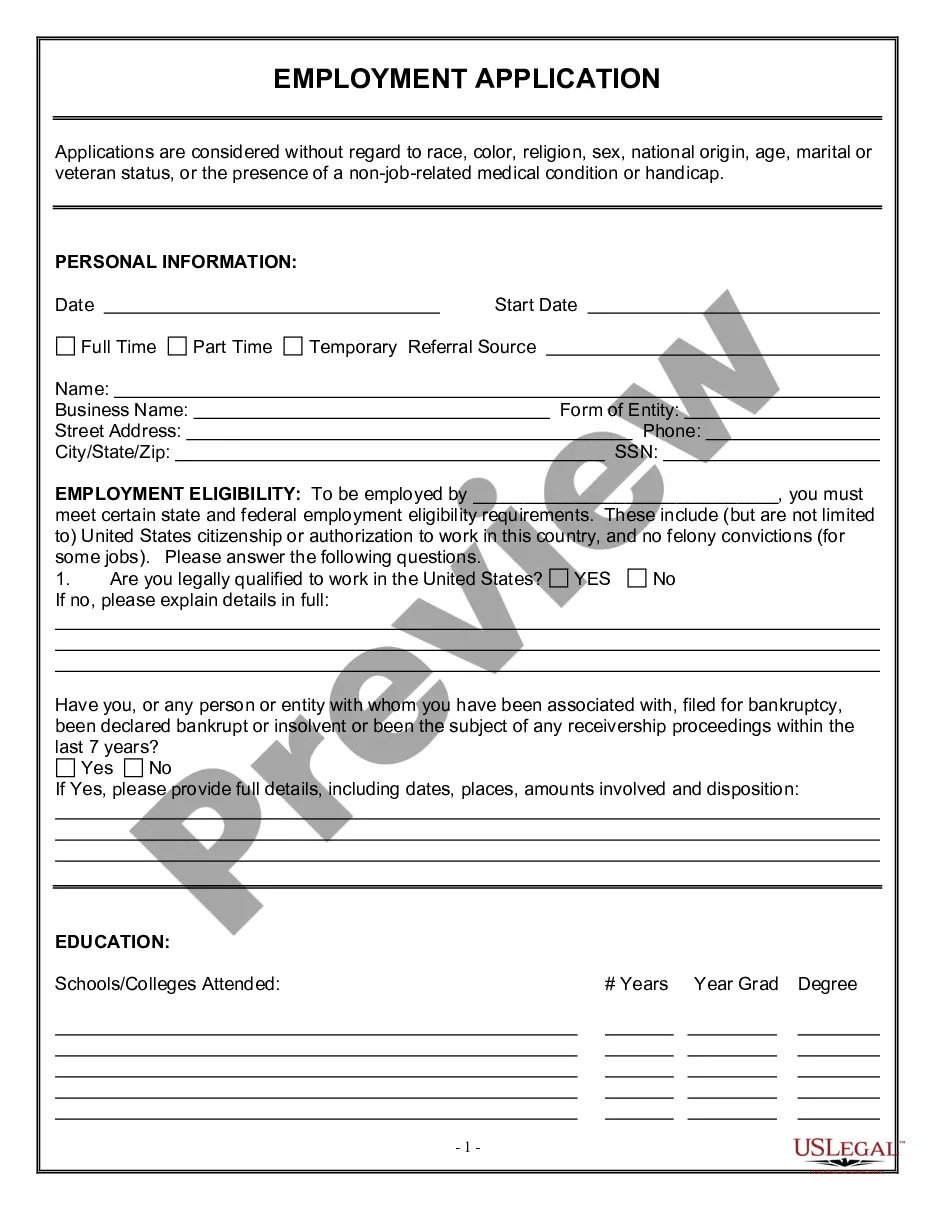

How to fill out Guaranty Of Collection Of Promissory Note?

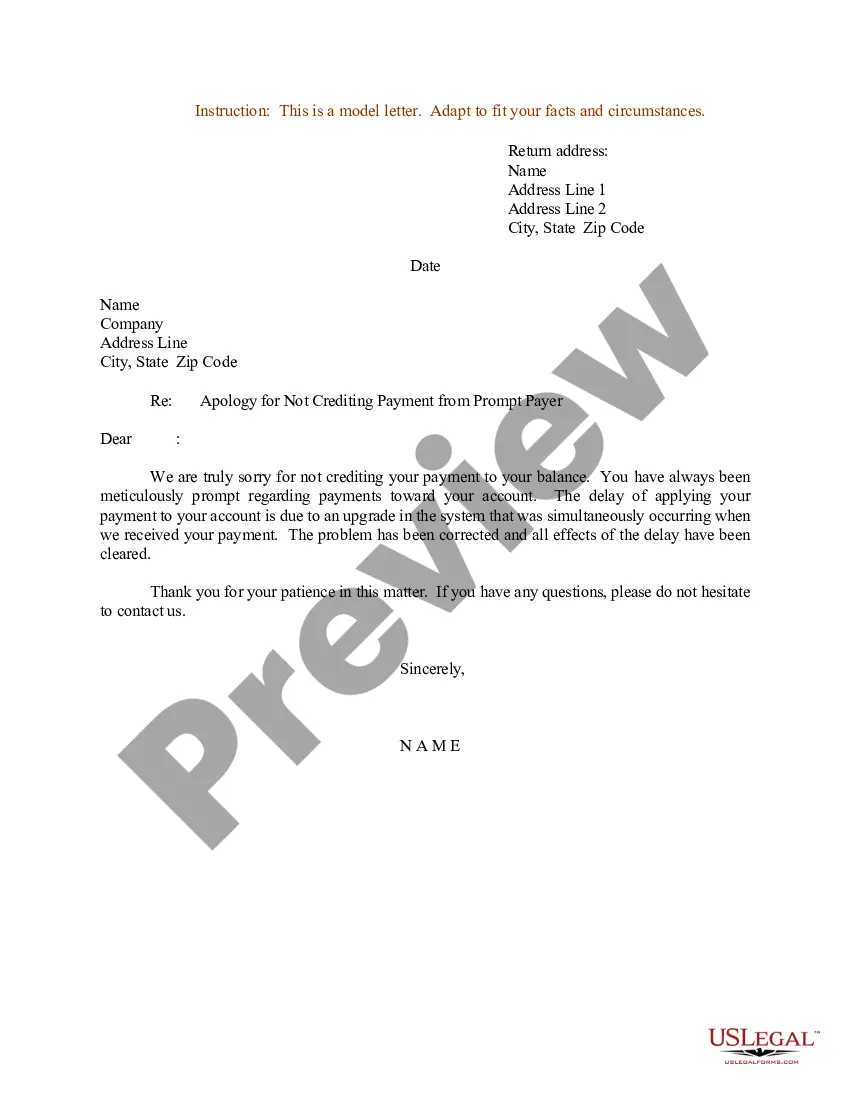

If you need to compile, acquire, or print legitimate document templates, utilize US Legal Forms, the most significant assortment of legal forms available online.

Leverage the site's straightforward and user-friendly search feature to find the documents you need.

Various templates for business and personal purposes are categorized by classifications and suggestions, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Select the pricing plan you prefer and provide your details to register for an account.

Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to obtain the Texas Guaranty of Collection of Promissory Note in just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and click the Acquire button to locate the Texas Guaranty of Collection of Promissory Note.

- You can also access forms you previously saved from the My documents tab in your account.

- If this is your first experience with US Legal Forms, refer to the guidelines below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's content. Be sure to check the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other types of the legal form template.

Form popularity

FAQ

In Texas, the statute of limitations on a promissory note is typically four years. This means that a lender has four years from the due date of the payment to take legal action to collect the debt based on the terms outlined in the Texas Guaranty of Collection of Promissory Note. Understanding these timeframes is crucial for both lenders and borrowers to protect their rights.

A promissory note can be considered invalid in Texas if it lacks essential elements like a signature, specific repayment terms, or if it involves illegal actions. Furthermore, if the note is deemed unconscionable or if there is evidence of fraud, it could nullify the agreement. Following the guidelines of the Texas Guaranty of Collection of Promissory Note helps to establish a valid document.

Yes, a written contract is legally binding in Texas as long as it meets the general requirements for contracts, such as mutual consent and a lawful purpose. This includes promissory notes, which are fundamental under the Texas Guaranty of Collection of Promissory Note. As a proactive measure, having clear terms in writing protects both parties and aids in enforcement if issues arise.

A promissory note is considered unsecured when it lacks collateral, relying solely on the borrower’s promise to repay. This can pose a greater risk for lenders, but it also offers borrowers more flexibility. Using the Texas Guaranty of Collection of Promissory Note allows lenders to mitigate risk through clear legal protections without requiring collateral upfront. Understanding both sides’ responsibilities is crucial.

The primary borrower on a promissory note is liable for repayment, as they have agreed to the terms outlined in the document. However, if a guarantor is involved, they also share responsibility. The Texas Guaranty of Collection of Promissory Note provides additional assurance for lenders, ensuring they have recourse if the borrower fails to meet their obligations. Awareness of liability is key when entering an agreement.

In Texas, recording a promissory note is generally not mandatory, but it can serve to protect the lender’s interests. By recording, the lender establishes a public record of their claim against the property. The Texas Guaranty of Collection of Promissory Note emphasizes the importance of clarity in agreements, making it easier for both parties to manage the relationship. It’s wise to consult with legal professionals for specific situations.

Notes can indeed be secured debt if they are backed by collateral. This means that if the borrower defaults, the lender has a claim on the collateral. The Texas Guaranty of Collection of Promissory Note reinforces this concept, ensuring that both lenders and borrowers recognize the security structure in place. Clear documentation is essential to avoid any misunderstandings.

A promissory note is generally not classified as a security, as it is primarily a debt instrument. Securities are often subject to different regulations and requirements. However, when it comes to the Texas Guaranty of Collection of Promissory Note, being aware of this classification helps you understand your rights and obligations. For any specific cases, consulting legal expertise is advisable.

To guarantee a promissory note, you may require a guarantor to assume the responsibility for repayment. This adds a layer of security in cases where the primary borrower cannot meet their obligations. Additionally, by implementing the Texas Guaranty of Collection of Promissory Note, you can ensure that there are clear terms outlining accountability. This way, both parties understand the agreement and its implications.

Filling out a promissory demand note involves writing the names of the borrower and lender, specifying the amount borrowed, and outlining repayment terms on demand. It’s essential to keep the language clear and direct to avoid confusion. The Texas Guaranty of Collection of Promissory Note ensures that these demands are enforceable.