Unless a particular jurisdiction grants a breeder a common law breeder's lien or has a statute providing for such a lien, a breeder should specifically contract for such a lien for the breeder's service fee. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

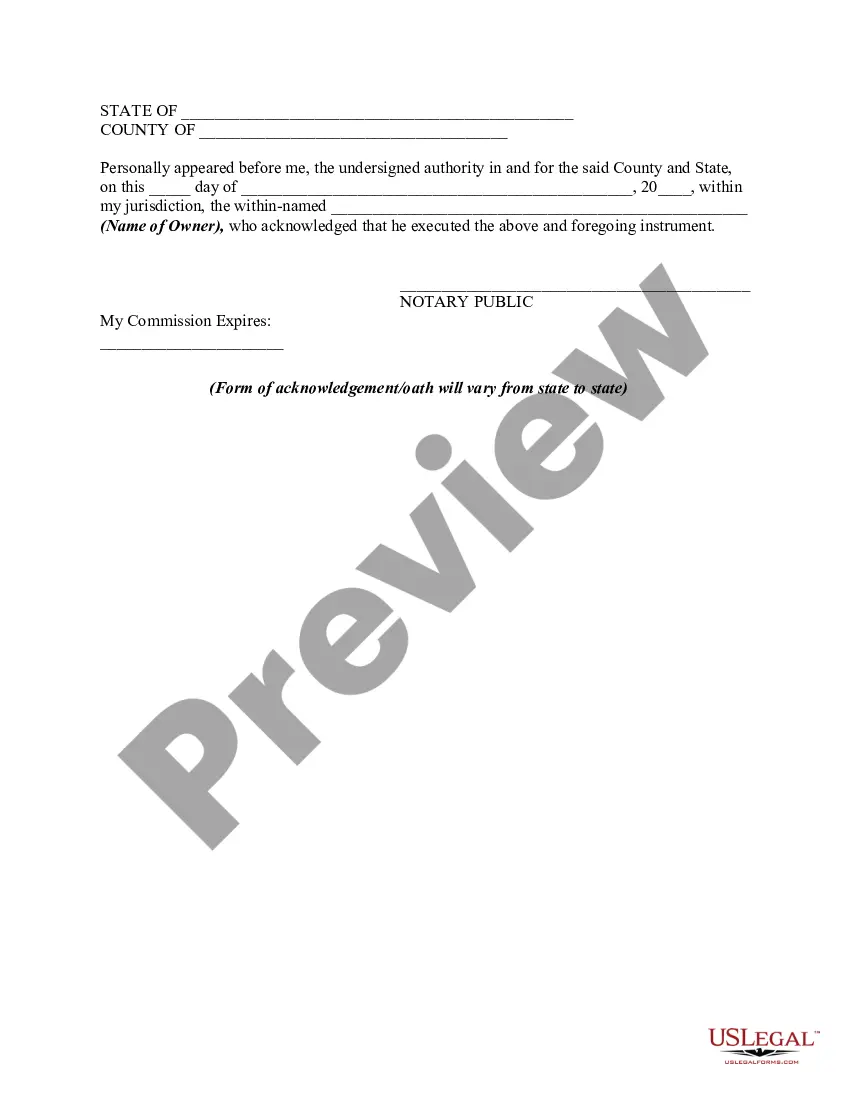

A Texas Notice of Breeder's Lien is a legal document that establishes and protects the rights of breeders in relation to their animals. This lien provides breeders with security and safeguards their interests in cases where there are unpaid fees or other contractual obligations relating to the breeding services provided. There are primarily two types of Texas Notices of Breeder's Lien: the Livestock Lien and the Non-Livestock Lien. 1. Livestock Lien: A Livestock Lien is applicable when a breeder provides breeding services for livestock animals such as cattle, horses, goats, or sheep. In such cases, the Texas Notice of Breeder's Lien ensures that breeders have a legal claim or hold over the livestock until any outstanding fees or expenses are duly paid by the owner of the animals. This type of lien is governed by the Texas Property Code, specifically Chapter 70. 2. Non-Livestock Lien: A Non-Livestock Lien applies to breeders who provide services for animals other than livestock, such as dogs, cats, or other companion animals. Similar to the Livestock Lien, the Texas Notice of Breeder's Lien enables breeders to assert their rights over the animals until any unpaid fees or contractual obligations are resolved. Non-Livestock Liens fall under the Texas Business and Commerce Code, especially Chapters 70 and 9. To initiate the process of establishing a Texas Notice of Breeder's Lien, breeders must comply with specific legal requirements. These requirements may include providing written notice of claim to the owner, providing accurate and detailed information about the animals involved, and filing the lien with the appropriate local county or district clerk's office. It is crucial for breeders to ensure that their Texas Notice of Breeder's Lien is properly filed and recorded. This ensures that the lien is legally enforceable and protects the breeder's rights in cases where the owner fails to honor their financial obligations. In conclusion, a Texas Notice of Breeder's Lien is a vital legal instrument that safeguards the rights of breeders in the state. Whether it is a Livestock Lien or a Non-Livestock Lien, breeders can utilize this lien to assert their claim over the animals in question until any outstanding fees or contractual obligations are duly fulfilled. Compliance with legal requirements and proper filing is essential to maximize the effectiveness of the Texas Notice of Breeder's Lien.A Texas Notice of Breeder's Lien is a legal document that establishes and protects the rights of breeders in relation to their animals. This lien provides breeders with security and safeguards their interests in cases where there are unpaid fees or other contractual obligations relating to the breeding services provided. There are primarily two types of Texas Notices of Breeder's Lien: the Livestock Lien and the Non-Livestock Lien. 1. Livestock Lien: A Livestock Lien is applicable when a breeder provides breeding services for livestock animals such as cattle, horses, goats, or sheep. In such cases, the Texas Notice of Breeder's Lien ensures that breeders have a legal claim or hold over the livestock until any outstanding fees or expenses are duly paid by the owner of the animals. This type of lien is governed by the Texas Property Code, specifically Chapter 70. 2. Non-Livestock Lien: A Non-Livestock Lien applies to breeders who provide services for animals other than livestock, such as dogs, cats, or other companion animals. Similar to the Livestock Lien, the Texas Notice of Breeder's Lien enables breeders to assert their rights over the animals until any unpaid fees or contractual obligations are resolved. Non-Livestock Liens fall under the Texas Business and Commerce Code, especially Chapters 70 and 9. To initiate the process of establishing a Texas Notice of Breeder's Lien, breeders must comply with specific legal requirements. These requirements may include providing written notice of claim to the owner, providing accurate and detailed information about the animals involved, and filing the lien with the appropriate local county or district clerk's office. It is crucial for breeders to ensure that their Texas Notice of Breeder's Lien is properly filed and recorded. This ensures that the lien is legally enforceable and protects the breeder's rights in cases where the owner fails to honor their financial obligations. In conclusion, a Texas Notice of Breeder's Lien is a vital legal instrument that safeguards the rights of breeders in the state. Whether it is a Livestock Lien or a Non-Livestock Lien, breeders can utilize this lien to assert their claim over the animals in question until any outstanding fees or contractual obligations are duly fulfilled. Compliance with legal requirements and proper filing is essential to maximize the effectiveness of the Texas Notice of Breeder's Lien.