Texas Owner Financing Contract for Home: A Comprehensive Guide In the vast real estate landscape of Texas, owner financing has emerged as a favorable alternative to traditional mortgages. Many homebuyers who may not be eligible for bank loans or simply desire more flexibility in their home purchasing process prefer this method. The Texas Owner Financing Contract for Home caters to such buyers, allowing them to secure a property through direct negotiations and establish a financing agreement directly with the property owner. Owner financing contracts, also known as seller carry-back agreements or real estate contracts, essentially involve the property owner acting as the lender, providing the buyer with a loan to purchase the property. This arrangement typically circumvents the need for bank financing, resulting in a streamlined and more accessible home buying process. Important Keywords: 1. Texas Owner Financing: Refers to the practice of homebuyers in Texas securing funding directly from property owners, bypassing traditional lending institutions. 2. Owner Financing Contract: A legal agreement between the property owner and the buyer outlining the terms and conditions of the loan used to purchase the property. 3. Home Buying Process: The step-by-step journey of acquiring a residential property, starting from property search to closing the deal. 4. Property Owner: The person or entity who possesses legal title to the property and acts as the lender in the owner financing arrangement. 5. Seller Carry-back Agreement: Another term commonly used to describe owner financing contracts. 6. Real Estate Contract: A legally binding document outlining the terms of a property sale, including financing arrangements. 7. Bank Loan: A loan obtained from a traditional lending institution such as a bank or mortgage company. 8. Streamlined: Indicates a simplified and efficient process compared to traditional home financing methods. Types of Texas Owner Financing Contracts for Home: 1. All-Inclusive Deed of Trust (AID): This type of contract transfers ownership to the buyer subject to an existing mortgage held by the seller. The buyer makes payments to the seller, who in turn pays the original mortgage. 2. Contract for Deed (Land Contract): In this arrangement, the seller retains the property title until the buyer completes the agreed-upon payment schedule. Once all payments are made, the title is transferred to the buyer. 3. Purchase Money Mortgage: The seller provides a mortgage loan to the buyer, securing it with the property being sold. The buyer makes regular payments to the seller as agreed upon in the contract. 4. Lease-Purchase Agreement: This contract combines a lease agreement with an option to purchase the property in the future. The buyer typically pays a higher rent, some of which may go towards the future purchase. These various types of owner financing contracts give both buyers and sellers flexibility in tailoring the terms to their specific needs and circumstances. By offering Texas homebuyers an alternative to traditional bank financing, the Texas Owner Financing Contract for Home opens doors to homeownership that might otherwise remain closed. With various contract options and the ability to negotiate terms directly with the property owner, prospective buyers are granted increased accessibility and opportunities within the Texas real estate market.

Owner Finance Contract

Description

How to fill out Texas Owner Financing Contract For Home?

Finding the right lawful document format can be quite a battle. Needless to say, there are a variety of web templates accessible on the Internet, but how will you obtain the lawful type you need? Utilize the US Legal Forms website. The assistance provides a huge number of web templates, such as the Texas Owner Financing Contract for Home, that can be used for enterprise and private requires. Every one of the varieties are checked out by pros and fulfill federal and state needs.

Should you be presently listed, log in to the accounts and then click the Download key to obtain the Texas Owner Financing Contract for Home. Use your accounts to appear throughout the lawful varieties you might have ordered formerly. Proceed to the My Forms tab of your own accounts and get yet another backup of the document you need.

Should you be a whole new user of US Legal Forms, here are easy instructions that you should stick to:

- Initial, be sure you have chosen the correct type to your metropolis/region. You can look over the shape utilizing the Preview key and look at the shape information to make certain this is basically the best for you.

- In the event the type does not fulfill your requirements, use the Seach industry to find the appropriate type.

- When you are certain the shape would work, click on the Purchase now key to obtain the type.

- Select the pricing program you want and enter the necessary information and facts. Design your accounts and purchase an order using your PayPal accounts or bank card.

- Choose the file file format and down load the lawful document format to the gadget.

- Full, change and print out and signal the attained Texas Owner Financing Contract for Home.

US Legal Forms is the largest local library of lawful varieties in which you can find various document web templates. Utilize the company to down load appropriately-made files that stick to status needs.

Form popularity

FAQ

In Texas, the responsibility for paying property taxes typically falls on the buyer when utilizing owner financing. However, this can be negotiated between the parties involved, and it should be clearly stated in the Texas Owner Financing Contract for Home. Ensuring clarity on tax responsibilities helps avoid future disputes, making it an essential aspect of the agreement.

Owner financing can be a good idea in Texas for both sellers and buyers. It provides an alternative route for buyers who may not qualify for traditional loans, thereby expanding the potential buyer pool. Additionally, sellers can potentially earn higher interest rates and sell their homes more quickly. The key is to ensure all terms are clearly defined in the Texas Owner Financing Contract for Home to protect your interests.

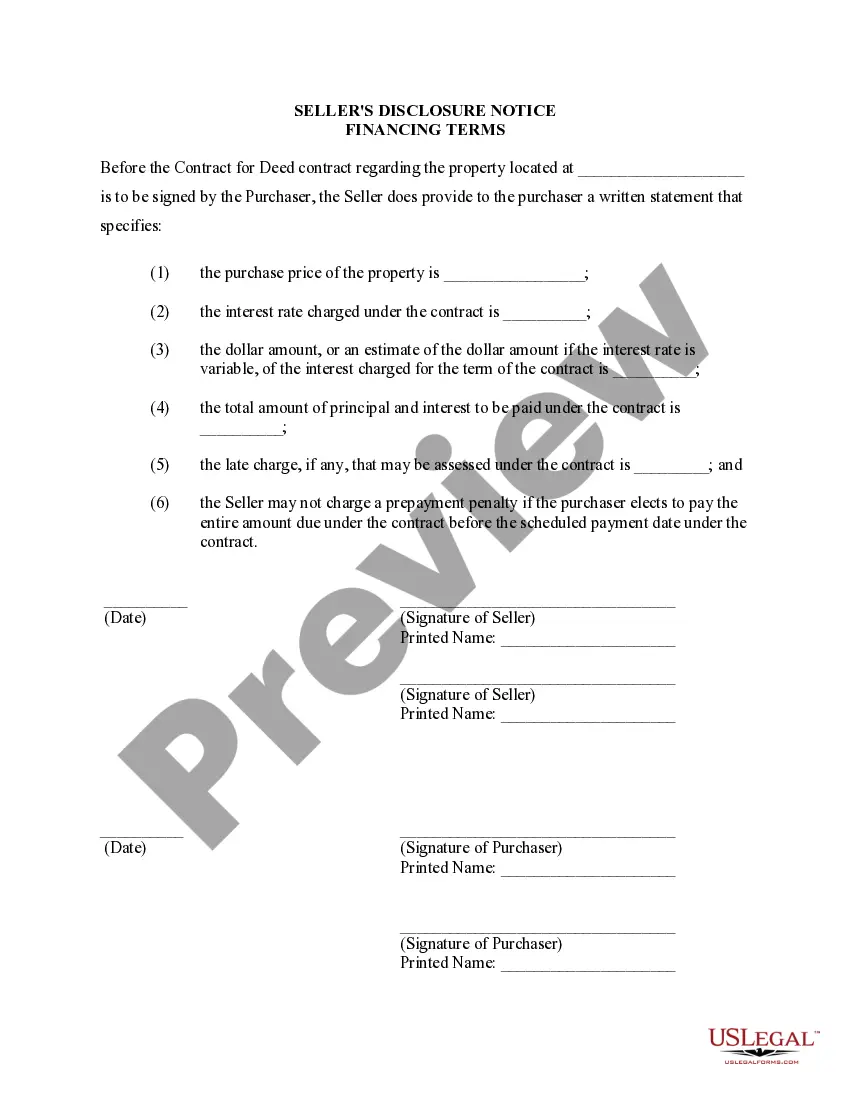

To owner finance a house in Texas, start by agreeing on terms with the buyer, such as down payment and monthly payments. Next, create a legally binding Texas Owner Financing Contract for Home that outlines all terms, responsibilities, and conditions. You should also consider consulting legal or financial professionals to ensure compliance with local laws and regulations. This step safeguards both you and your buyer throughout the financing process.

Yes, you can owner finance your home in Texas. This financing method allows sellers to offer buyers a more flexible payment method outside of traditional mortgage financing. However, it is essential to comply with Texas laws and regulations governing owner financing. Creating a comprehensive Texas Owner Financing Contract for Home can help protect both parties involved in the transaction.

In Texas, the typical owner financing terms include a down payment, interest rate, and repayment period. Generally, buyers make monthly payments to the seller over a specified duration, which can vary but often lasts from five to 30 years. It is common for sellers to require a significant down payment, sometimes 10% to 20%, to secure the agreement. Understanding these terms is crucial when drafting a Texas Owner Financing Contract for Home.

Yes, owner financing is allowed in Texas and is a beneficial option for many buyers and sellers. This arrangement provides flexibility when traditional financing options may not be available or suitable. However, certain legal requirements must be met to ensure compliance. US Legal Forms provides templates and guidelines to help you navigate the legal landscape of owner financing contracts in Texas.

One downside of a Texas Owner Financing Contract for Home is the possibility of a higher interest rate compared to traditional mortgage loans. This can lead to larger monthly payments over time. Additionally, sellers may not report the transaction to credit bureaus, potentially affecting buyers' credit scores. It's crucial to weigh these factors, and US Legal Forms can assist you with necessary documents and clarity on your rights.

Good terms for seller financing in a Texas Owner Financing Contract for Home should include a reasonable down payment, competitive interest rate, and manageable monthly payments. Sellers often benefit from clear repayment schedules and stipulations on late payments. Ensuring both parties understand the ramifications of these terms fosters a positive and transparent relationship. Using platforms like USLegalForms can help both sellers and buyers draft contracts that reflect beneficial terms.

The average length of seller financing in a Texas Owner Financing Contract for Home typically ranges from five to 30 years. Many sellers prefer shorter terms, around five to ten years, yet some buyers benefit from longer contracts. This flexibility allows both parties to negotiate terms that align with their financial goals. Understanding payment structures and timelines can greatly enhance the buyer's experience.

Standard terms for a Texas Owner Financing Contract for Home generally encompass a down payment and an interest rate, similar to traditional financing. Additionally, these contracts often specify payment schedules, late fees, and consequences for default. It is crucial for both buyers and sellers to communicate openly about their expectations, as custom terms can often lead to successful transactions. Always consider seeking guidance to help structure these terms effectively.