A Proof of Loss is a sworn statement that usually must be furnished by the insured to an insurer before any loss under a policy may be paid.

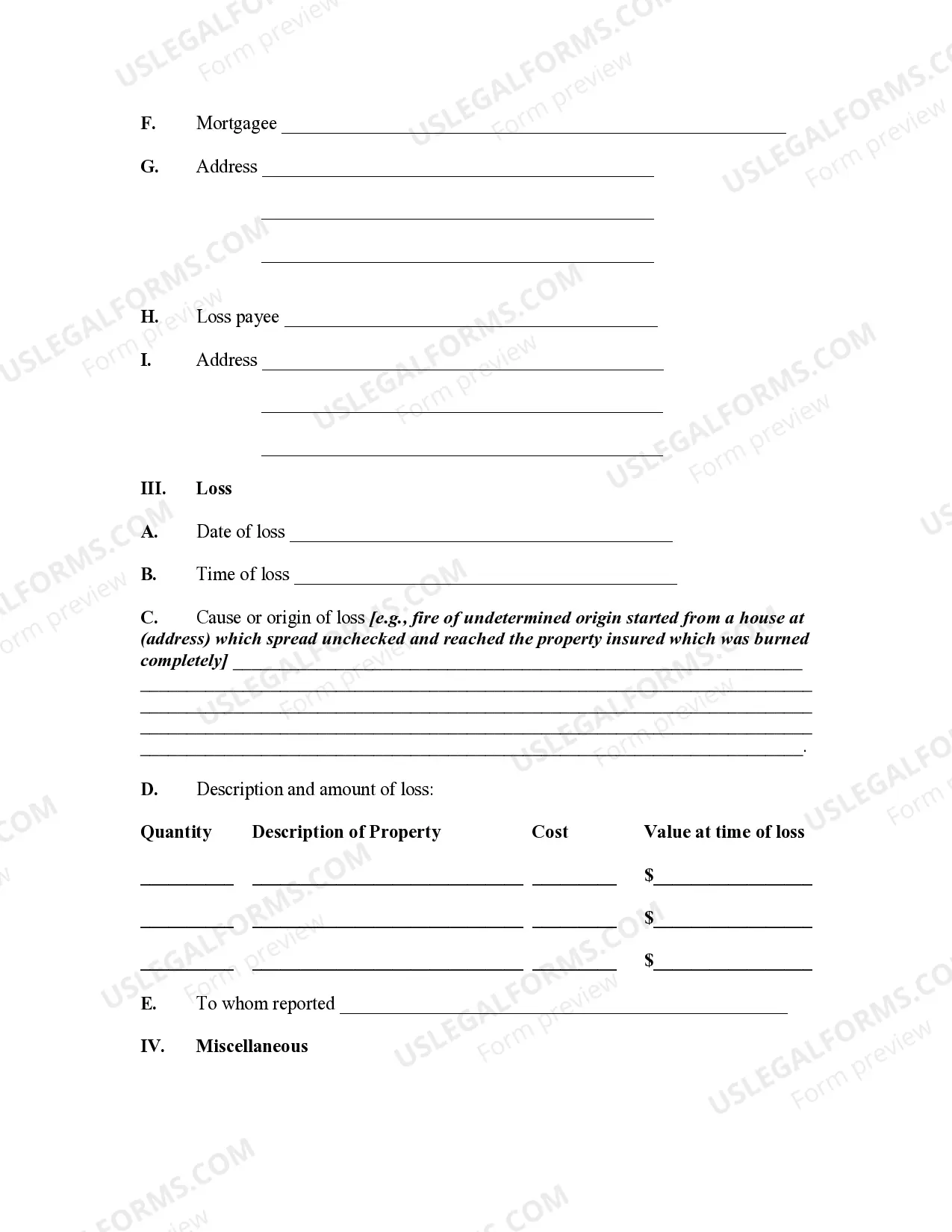

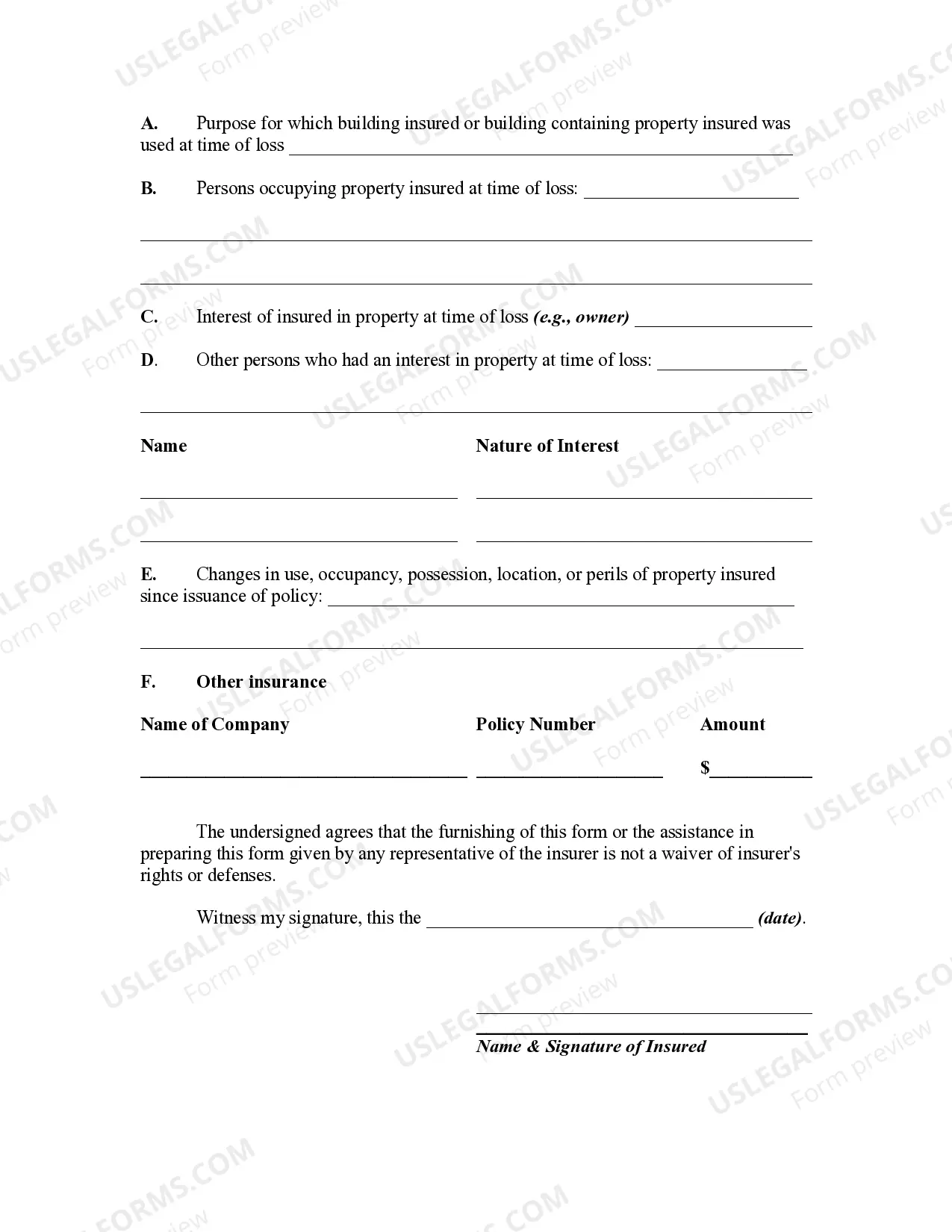

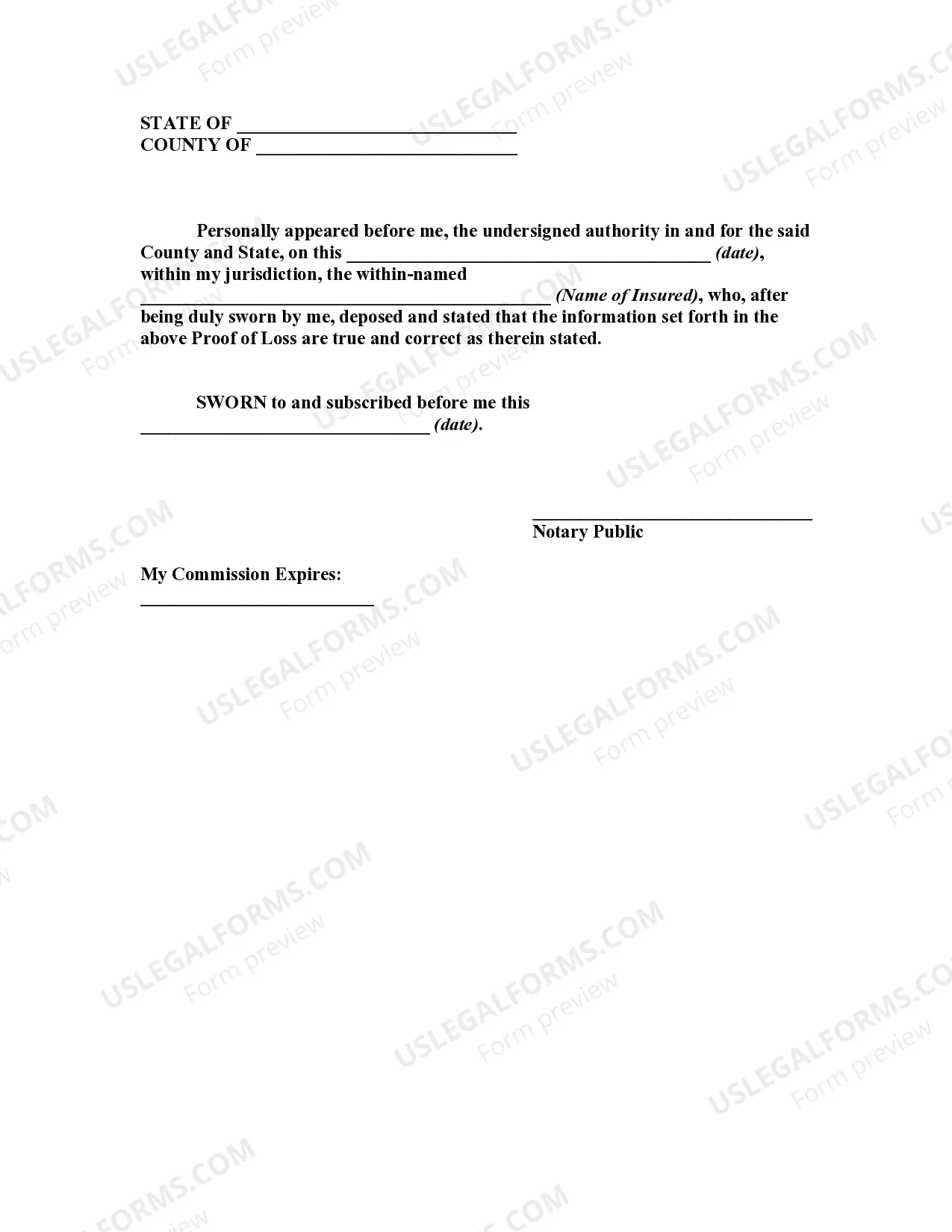

Title: Understanding Texas Proof of Loss for Fire Insurance Claims: Types and Detailed Explanation Introduction: When filing a fire insurance claim in Texas, it is vital to familiarize yourself with the Texas Proof of Loss, a crucial component of the claims process. This comprehensive guide will provide you with an in-depth understanding of what a Texas Proof of Loss for Fire Insurance Claim entails, including its purpose, requirements, and different types. 1. What is a Texas Proof of Loss for Fire Insurance Claim? A Texas Proof of Loss is a formal document required by insurance companies to assess and expedite fire insurance claims. It serves as an official statement outlining the details of the loss, damages, and the estimated value of the claim. Insurance companies typically request a Proof of Loss to substantiate the claimed amount, ensuring accuracy, fairness, and preventing fraudulent claims. 2. Key Components of a Texas Proof of Loss: — Policyholder Information: Provide your name, contact details, policy number, and any other relevant personal information. — Loss Description: Include the date, location, cause, and circumstances of the fire incident, along with a thorough account of the damages suffered. — Itemized List of Damaged Property: Enumerate all damaged or destroyed items, including their description, quantity, age, model number, purchase price, and either actual cash value (ACV) or replacement cost value (REV). — Supporting Documentation: Collect and attach any supporting evidence such as photos, videos, receipts, appraisals, and repair/replacement estimates to validate your claims. — Estimation of Loss: Provide a detailed calculation of the total amount claimed, including deductibles, depreciation, and applicable limits as per the terms of your insurance policy. 3. Types of Texas Proof of Loss: — Initial Proof of Loss: This is the first submission provided by the policyholder, usually within a specific timeframe after the incident. It outlines the initial estimate of the claimed loss and acts as a preliminary document to initiate the claims process. — Supplemented Proof of Loss: If additional damages are discovered or the initial estimate requires adjustment, policyholders can submit a supplemented Proof of Loss, expanding on the initial claim. This allows for a more accurate calculation of the final reimbursement amount. — Sworn Proof of Loss: In certain cases, the insurance company may require policyholders to submit a sworn Proof of Loss. This type of proof requires policyholders to provide a notarized statement attesting to the accuracy and truthfulness of the submitted information. Conclusion: Understanding the importance of a Texas Proof of Loss for Fire Insurance Claims is crucial for policyholders to initiate and expedite the claims process accurately. By fulfilling the necessary requirements and providing detailed documentation, you can maximize your chances of receiving a fair and timely settlement. Familiarize yourself with the different types of Texas Proof of Loss, ensuring you meet the specific requirements set by your insurance provider.