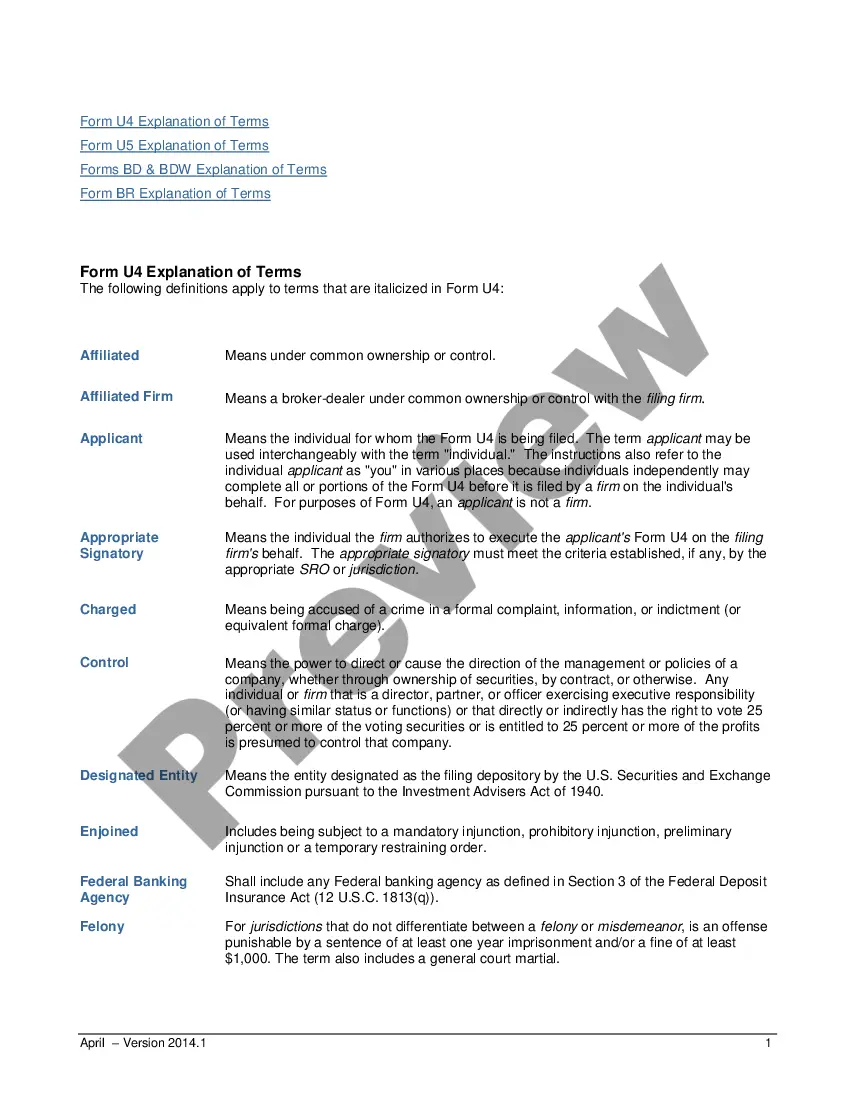

The Fair Credit Reporting Act provides that the consumer, in obtaining disclosure of information in the consumer's file from a consumer reporting agency personally, is permitted to be accompanied by one other person of the consumer's choosing, which person must provide reasonable identification. The act further provides that the consumer reporting agency may require the consumer to furnish a written statement granting permission to the consumer reporting agency to discuss the consumer's file in such person's presence.

Texas Consent to Discuss Consumer's File in Presence of Third Person

Description

How to fill out Consent To Discuss Consumer's File In Presence Of Third Person?

Are you inside a place the place you will need files for possibly business or person uses nearly every day? There are tons of legal record web templates accessible on the Internet, but locating kinds you can trust is not effortless. US Legal Forms provides thousands of type web templates, such as the Texas Consent to Discuss Consumer's File in Presence of Third Person, which can be written to fulfill state and federal requirements.

If you are presently knowledgeable about US Legal Forms web site and get a merchant account, merely log in. Following that, it is possible to download the Texas Consent to Discuss Consumer's File in Presence of Third Person template.

Should you not have an accounts and would like to begin using US Legal Forms, follow these steps:

- Discover the type you require and ensure it is for the correct city/area.

- Take advantage of the Review option to review the shape.

- Browse the description to ensure that you have chosen the right type.

- When the type is not what you are trying to find, utilize the Look for area to discover the type that fits your needs and requirements.

- When you find the correct type, simply click Acquire now.

- Select the pricing program you would like, fill in the necessary information to make your bank account, and pay for your order using your PayPal or charge card.

- Pick a practical document structure and download your duplicate.

Locate each of the record web templates you possess purchased in the My Forms menus. You can obtain a extra duplicate of Texas Consent to Discuss Consumer's File in Presence of Third Person any time, if needed. Just go through the needed type to download or print the record template.

Use US Legal Forms, by far the most extensive assortment of legal kinds, to save lots of some time and prevent faults. The assistance provides appropriately made legal record web templates that you can use for a range of uses. Generate a merchant account on US Legal Forms and initiate making your daily life a little easier.

Form popularity

FAQ

Business and Commerce Code, §3.506, authorizes the holder of a dishonored check, seeking collection of the face value of the check, to charge the drawer or endorser of the check a reasonable processing fee, not to exceed $30.

(a) A person who receives notice under Section 17.505 may tender an offer of settlement at any time during the period beginning on the date the notice is received and ending on the 60th day after that date.

Texas' Business and Commerce Code Section 20.05 limits consumer reporting agencies (background screening companies) from reporting criminal convictions older than seven years to employers.

The law grants consumers a set of rights over their data akin to those in other state privacy laws, including the rights to: (1) confirm whether a controller is processing their personal data and access that data; (2) correct inaccuracies in their personal data; (3) request deletion of their data (whether the personal ...

The full text can be found starting at section 17.41 of the Texas Business and Commerce Code. The primary purpose of the DTPA is to protect consumers against false, misleading, and deceptive business and insurance practices, unconscionable actions, and breaches of warranty.

(a) If the completeness or accuracy of information contained in a consumer's file is disputed by the consumer and the consumer notifies the consumer reporting agency of the dispute, the agency shall reinvestigate the disputed information free of charge and record the current status of the disputed information not later ...

This federal law is also known as the Fair Credit Reporting Act protects a consumer's information when collected by consumer reporting agencies. This act also extends to how a company must handle a consumer's financial information when providing information to consumer reporting agencies.