The Fair Credit Reporting Act regulates the use of information on a consumer's personal and financial condition. The most typical transaction which this Act would cover would be where a person applies for a personal loan or other consumer credit. Consumer credit is credit for personal, family, or household use, and not for business or commercial transactions. The purpose of the Act is to insure that consumer information obtained and used is done in such a way as to insure its confidentiality, accuracy, relevancy and proper utilization. Credit reporting bureaus are not permitted to disclose information to persons not having a legitimate use for this information. It is a federal crime to obtain or to furnish a credit report for an improper purpose.

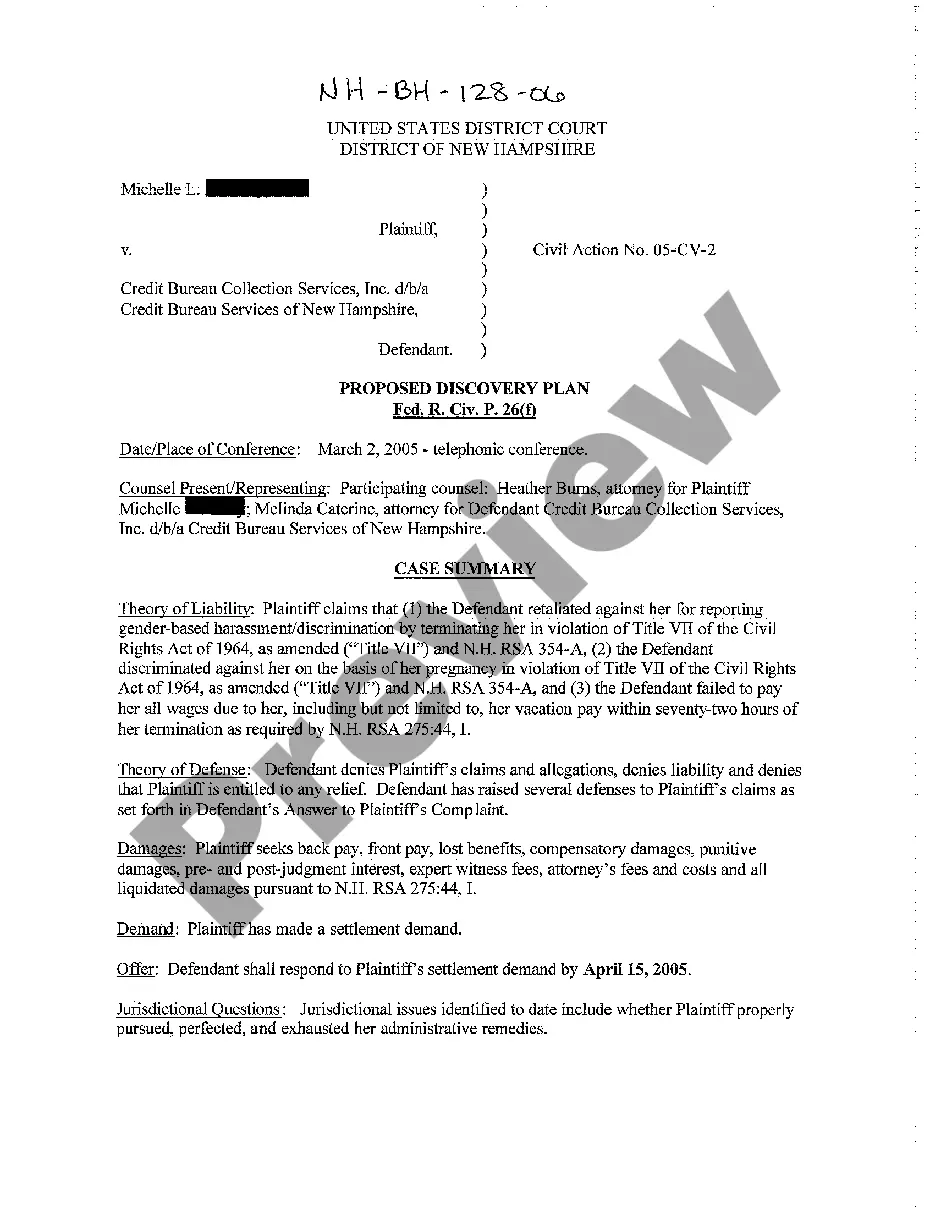

Texas Complaint by Consumer against Wrongful User of Credit Information

Description

How to fill out Complaint By Consumer Against Wrongful User Of Credit Information?

US Legal Forms - among the greatest libraries of legal forms in the United States - gives a variety of legal document layouts it is possible to download or printing. Making use of the website, you can get thousands of forms for enterprise and individual purposes, sorted by types, states, or keywords.You can get the newest models of forms like the Texas Complaint by Consumer against Wrongful User of Credit Information within minutes.

If you already have a subscription, log in and download Texas Complaint by Consumer against Wrongful User of Credit Information through the US Legal Forms catalogue. The Obtain option can look on every single form you see. You have access to all earlier delivered electronically forms inside the My Forms tab of the bank account.

In order to use US Legal Forms for the first time, listed here are basic directions to help you get started:

- Be sure you have selected the correct form to your town/county. Click the Review option to examine the form`s information. Read the form outline to ensure that you have chosen the right form.

- When the form does not fit your requirements, make use of the Research field near the top of the display screen to find the the one that does.

- Should you be pleased with the form, validate your decision by simply clicking the Get now option. Then, pick the prices prepare you prefer and offer your qualifications to register for an bank account.

- Approach the deal. Make use of bank card or PayPal bank account to complete the deal.

- Pick the formatting and download the form on your own system.

- Make modifications. Fill up, edit and printing and sign the delivered electronically Texas Complaint by Consumer against Wrongful User of Credit Information.

Every template you included in your money lacks an expiration date which is your own for a long time. So, if you wish to download or printing yet another duplicate, just visit the My Forms section and click on about the form you require.

Obtain access to the Texas Complaint by Consumer against Wrongful User of Credit Information with US Legal Forms, by far the most substantial catalogue of legal document layouts. Use thousands of expert and state-specific layouts that meet your company or individual requires and requirements.

Form popularity

FAQ

The FTC must complete the investigation, including the report of investigation, within 180 calendar days of the date your complaint was filed.

Credit Protection Laws: The Consumer Credit Protection Act The Truth in Lending Act ensures that creditors provide complete and honest information. The Fair Credit Reporting Act regulates credit reports. The Equal Credit Opportunity Act prevents creditors from discriminating against individuals.

The FTC's Bureau of Consumer Protection stops unfair, deceptive or fraudulent practices in the marketplace. BCP conducts investigations, sues companies and people that violate the law, develops rules to ensure a vibrant marketplace, and educates consumers and businesses about their rights and responsibilities.

Before filing a DTPA lawsuit, a consumer must first give written notice to the alleged violator, advising the violator of the consumer's specific complaint and the amount of actual damages and expenses, including attorney fees, if any, reasonably incurred by the consumer in asserting the claim.

Telling the Federal Trade Commission helps us stop ripoffs, scams, and fraudsters. Your complaints matter here. To file a complaint, just go to ftc.gov/complaint, and answer the questions. Or call That's all there is to it.

The FTC sues scammers and works to shut them down. When you report a scam to the FTC, investigators use your information to build cases against scammers. Other law enforcement agencies can see the reports, too, and use them to further their own investigations.

The FTC's Bureau of Consumer Protection stops unfair, deceptive and fraudulent business practices by collecting reports from consumers and conducting investigations, suing companies and people that break the law, developing rules to maintain a fair marketplace, and educating consumers and businesses about their rights ...

The FTC's Bureau of Consumer Protection stops unfair, deceptive and fraudulent business practices by collecting reports from consumers and conducting investigations, suing companies and people that break the law, developing rules to maintain a fair marketplace, and educating consumers and businesses about their rights ...