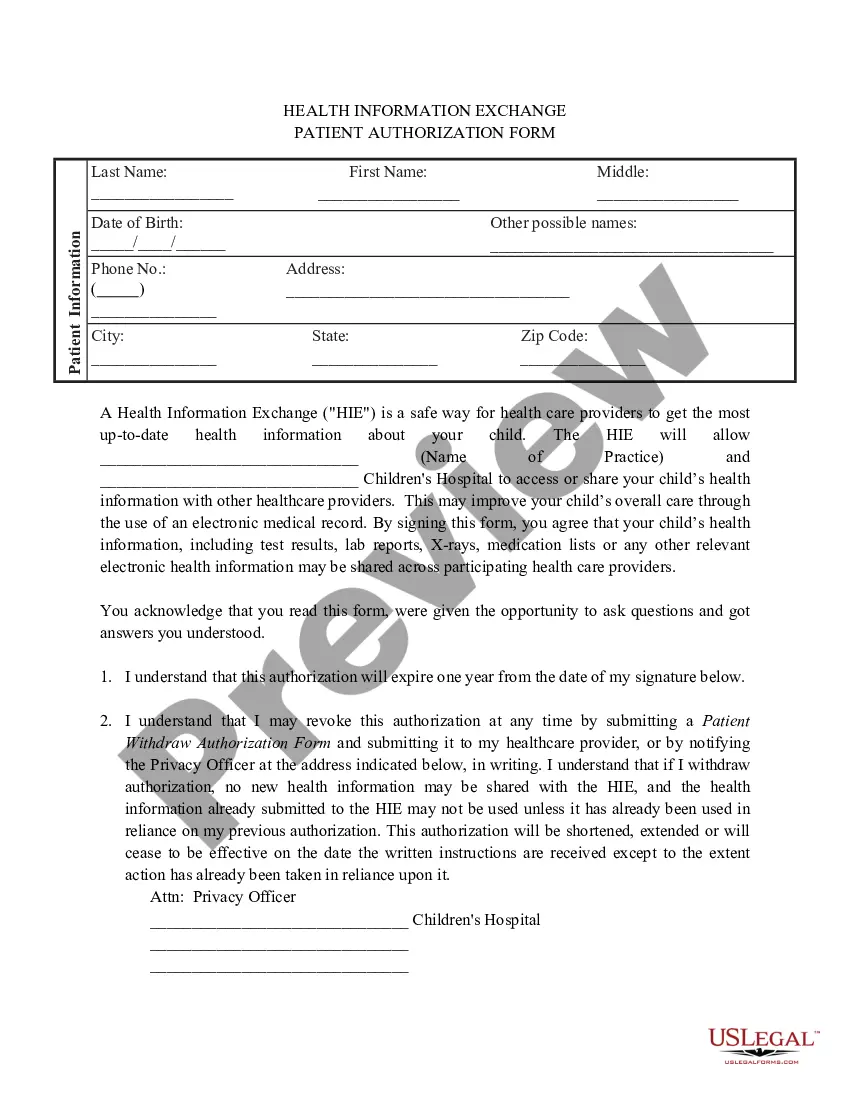

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A Texas Contract to Sell Commercial Property with Commercial Building — Seller Financing Secured by Mortgage and Security Agreement is a legal document that outlines the terms and conditions for the sale of a commercial property in Texas. This type of agreement is commonly used when the seller is providing financing to the buyer for the purchase of the property, and the financing is secured by a mortgage and security agreement. The key components of this contract include the identification of the parties involved, a description of the commercial property being sold, the purchase price and payment terms, and the terms and conditions for the seller financing. The agreement will also outline the rights and responsibilities of both the buyer and seller, as well as any additional provisions or contingencies that may apply to the transaction. There can be variations of the Texas Contract to Sell Commercial Property with Commercial Building — Seller Financing Secured by Mortgage and Security Agreement, depending on the specific circumstances of the sale. It is important to consult with a legal professional to ensure that the contract is tailored to meet the specific needs and requirements of the parties involved. Some additional types of Texas Contract to Sell Commercial Property with Commercial Building — Seller Financing Secured by Mortgage and Security Agreement may include: 1. Texas Contract to Sell Commercial Property with Commercial Building — Seller Financing Secured by Mortgage and Security Agreement for a construction project: This type of agreement may be used when the buyer intends to use the commercial property for construction purposes and requires financing from the seller during the construction phase. 2. Texas Contract to Sell Commercial Property with Commercial Building — Seller Financing Secured by Mortgage and Security Agreement with lease-back option: In this scenario, the seller also offers a lease-back option to the buyer, allowing them to lease the commercial property back to the seller for a specified period of time after the sale. This can provide additional income to the buyer while still benefitting from seller financing. 3. Texas Contract to Sell Commercial Property with Commercial Building — Seller Financing Secured by Mortgage and Security Agreement for a distressed property: This type of agreement may be used when the commercial property is in distress or in need of significant repairs. The seller may offer financing with more flexible terms to attract buyers who are willing to invest in the property's rehabilitation or redevelopment. Overall, the Texas Contract to Sell Commercial Property with Commercial Building — Seller Financing Secured by Mortgage and Security Agreement is a comprehensive legal document that facilitates the sale of commercial property with seller financing in Texas. It helps protect the interests of both the buyer and seller and ensures that all relevant terms and conditions are clearly defined and agreed upon.A Texas Contract to Sell Commercial Property with Commercial Building — Seller Financing Secured by Mortgage and Security Agreement is a legal document that outlines the terms and conditions for the sale of a commercial property in Texas. This type of agreement is commonly used when the seller is providing financing to the buyer for the purchase of the property, and the financing is secured by a mortgage and security agreement. The key components of this contract include the identification of the parties involved, a description of the commercial property being sold, the purchase price and payment terms, and the terms and conditions for the seller financing. The agreement will also outline the rights and responsibilities of both the buyer and seller, as well as any additional provisions or contingencies that may apply to the transaction. There can be variations of the Texas Contract to Sell Commercial Property with Commercial Building — Seller Financing Secured by Mortgage and Security Agreement, depending on the specific circumstances of the sale. It is important to consult with a legal professional to ensure that the contract is tailored to meet the specific needs and requirements of the parties involved. Some additional types of Texas Contract to Sell Commercial Property with Commercial Building — Seller Financing Secured by Mortgage and Security Agreement may include: 1. Texas Contract to Sell Commercial Property with Commercial Building — Seller Financing Secured by Mortgage and Security Agreement for a construction project: This type of agreement may be used when the buyer intends to use the commercial property for construction purposes and requires financing from the seller during the construction phase. 2. Texas Contract to Sell Commercial Property with Commercial Building — Seller Financing Secured by Mortgage and Security Agreement with lease-back option: In this scenario, the seller also offers a lease-back option to the buyer, allowing them to lease the commercial property back to the seller for a specified period of time after the sale. This can provide additional income to the buyer while still benefitting from seller financing. 3. Texas Contract to Sell Commercial Property with Commercial Building — Seller Financing Secured by Mortgage and Security Agreement for a distressed property: This type of agreement may be used when the commercial property is in distress or in need of significant repairs. The seller may offer financing with more flexible terms to attract buyers who are willing to invest in the property's rehabilitation or redevelopment. Overall, the Texas Contract to Sell Commercial Property with Commercial Building — Seller Financing Secured by Mortgage and Security Agreement is a comprehensive legal document that facilitates the sale of commercial property with seller financing in Texas. It helps protect the interests of both the buyer and seller and ensures that all relevant terms and conditions are clearly defined and agreed upon.