The Texas Consumer Loan Application — Personal Loan Agreement is a legal document that outlines the terms and conditions of a personal loan obtained by a consumer in the state of Texas. This agreement ensures that both the lender and the borrower are well-informed of their rights and responsibilities throughout the loan process. Keywords: Texas, consumer loan, personal loan, agreement, terms and conditions, legal document, lender, borrower, rights, responsibilities. Different types of Texas Consumer Loan Application — Personal Loan Agreements may include: 1. Secured Personal Loan Agreement: This type of loan agreement requires the borrower to provide collateral, such as a car or property, to secure the loan. The lender holds the right to repossess the collateral if the borrower fails to repay the loan. 2. Unsecured Personal Loan Agreement: Unlike secured loans, unsecured personal loans do not require collateral. The lender relies solely on the borrower's creditworthiness and reputation to determine loan approval. 3. Fixed Interest Rate Personal Loan Agreement: In a fixed-rate loan agreement, the interest rate remains constant throughout the loan term. This provides the borrower with predictable monthly payments, as the interest rate does not fluctuate with market changes. 4. Variable Interest Rate Personal Loan Agreement: A variable-rate loan agreement allows the interest rate to fluctuate during the loan term based on prevailing market conditions. This may lead to varying monthly payments for the borrower. 5. Payday Loan Agreement: Payday loans are short-term loans intended to provide temporary financial assistance. The loan amount is typically repaid in full on the borrower's next payday, along with any fees or interest. 6. Installment Loan Agreement: An installment loan agreement allows borrowers to repay the loan amount, interest, and fees in fixed monthly installments over a predetermined period. Terms can vary depending on the lender and the borrower's creditworthiness. 7. Line of Credit Agreement: A line of credit agreement provides borrowers with access to funds up to a predetermined maximum limit. Borrowers can withdraw money as needed and repay it according to the terms and conditions outlined in the agreement. When applying for a Texas Consumer Loan, it is crucial for borrowers to carefully review and understand the specific terms, conditions, and repayment obligations outlined in the loan agreement. Consulting with a legal or financial professional can help ensure full comprehension and protection of both parties' rights.

Texas Consumer Loan Application - Personal Loan Agreement

Description

How to fill out Texas Consumer Loan Application - Personal Loan Agreement?

It is possible to spend time on the web searching for the legal papers web template that meets the federal and state requirements you want. US Legal Forms gives a huge number of legal kinds that are analyzed by experts. You can easily acquire or printing the Texas Consumer Loan Application - Personal Loan Agreement from the service.

If you have a US Legal Forms profile, you are able to log in and click the Download option. Afterward, you are able to complete, edit, printing, or sign the Texas Consumer Loan Application - Personal Loan Agreement. Every legal papers web template you acquire is yours forever. To obtain an additional backup associated with a bought kind, proceed to the My Forms tab and click the corresponding option.

Should you use the US Legal Forms internet site the very first time, stick to the basic recommendations beneath:

- Initial, be sure that you have selected the right papers web template for that area/town of your choice. Read the kind outline to ensure you have picked out the appropriate kind. If offered, use the Review option to search throughout the papers web template also.

- If you wish to discover an additional edition of the kind, use the Search area to obtain the web template that suits you and requirements.

- Upon having discovered the web template you desire, simply click Purchase now to carry on.

- Choose the costs plan you desire, type in your credentials, and sign up for an account on US Legal Forms.

- Comprehensive the financial transaction. You can use your Visa or Mastercard or PayPal profile to cover the legal kind.

- Choose the formatting of the papers and acquire it to the product.

- Make modifications to the papers if necessary. It is possible to complete, edit and sign and printing Texas Consumer Loan Application - Personal Loan Agreement.

Download and printing a huge number of papers web templates making use of the US Legal Forms site, which offers the greatest selection of legal kinds. Use expert and state-certain web templates to take on your organization or person requires.

Form popularity

FAQ

Consumer installment loans, including car loans, student loans, and home mortgage loans, are examples of consumer loans. Other examples of consumer loans include certain revolving credit products, such as consumer credit cards and personal lines of credit.

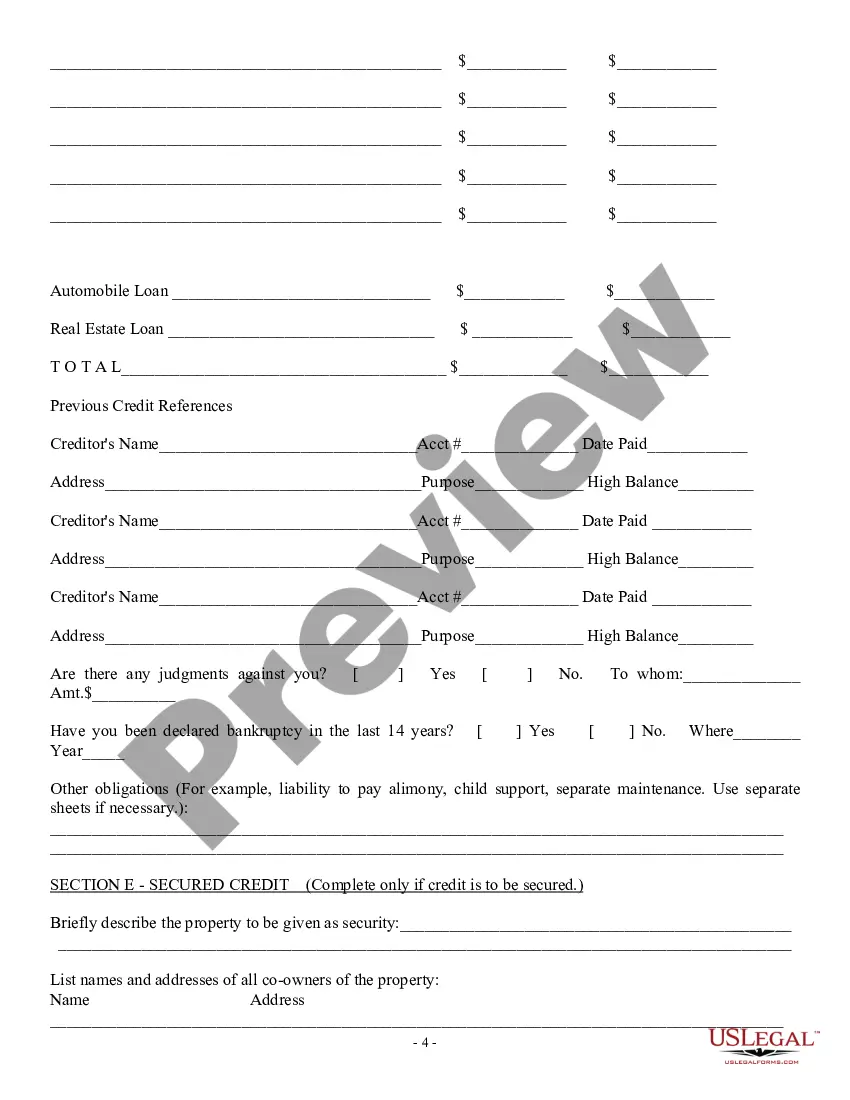

An agreement, promise, or commitment to loan more than $50,000 MUST BE IN WRITING AND SIGNED BY THE LENDER OR IT WILL BE UNENFORCEABLE. The written loan agreement will be the ONLY source of rights and obligations for agreements to lend more than $50,000.

The biggest difference between a consumer loan and a personal loan is that consumer loans can include revolving credit. Personal loans are nonrevolving financial lending products that provide borrowers with a lump sum of money and payment schedule for repaying the loan.

Consumer loans are structured in one of two key ways: either as a fixed loan that is repaid over a set period of time or as a revolving credit account that you can use at your own discretion. Closed loans are structured with a fixed interest rate, monthly payment amount, and repayment term.

A consumer credit contract is a formal written agreement to borrow money, or pay something off over time, for personal use. You pay interest and fees for the use of the bank or finance company's money. One or more of your assets might secure the loan. Examples include: vehicle finance to buy a car, van, or boat.

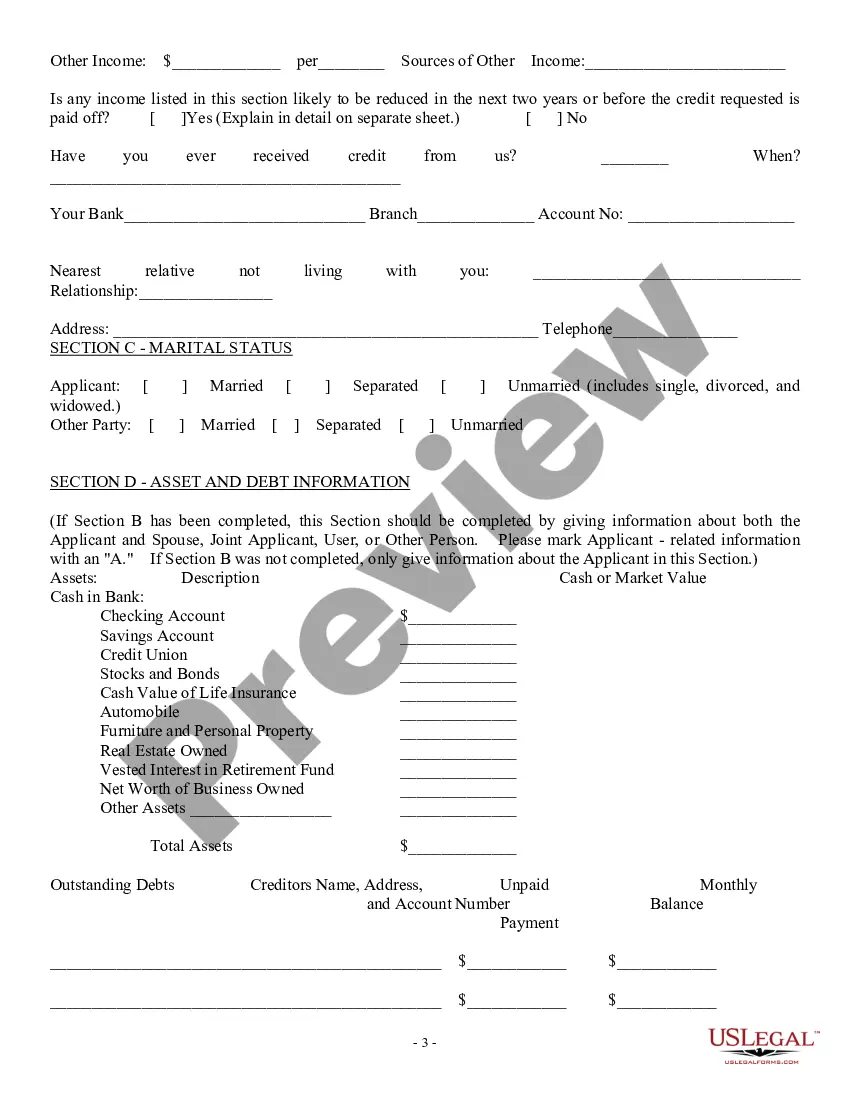

Lenders offer two types of consumer loans ? secured and unsecured ? that are based on the amount of risk both parties are willing to take.

Categorizing loan agreements by type of facility usually results in two primary categories: term loans, which are repaid in set installments over the term, or. revolving loans (or overdrafts) where up to a maximum amount can be withdrawn at any time, and interest is paid from month to month on the drawn amount.

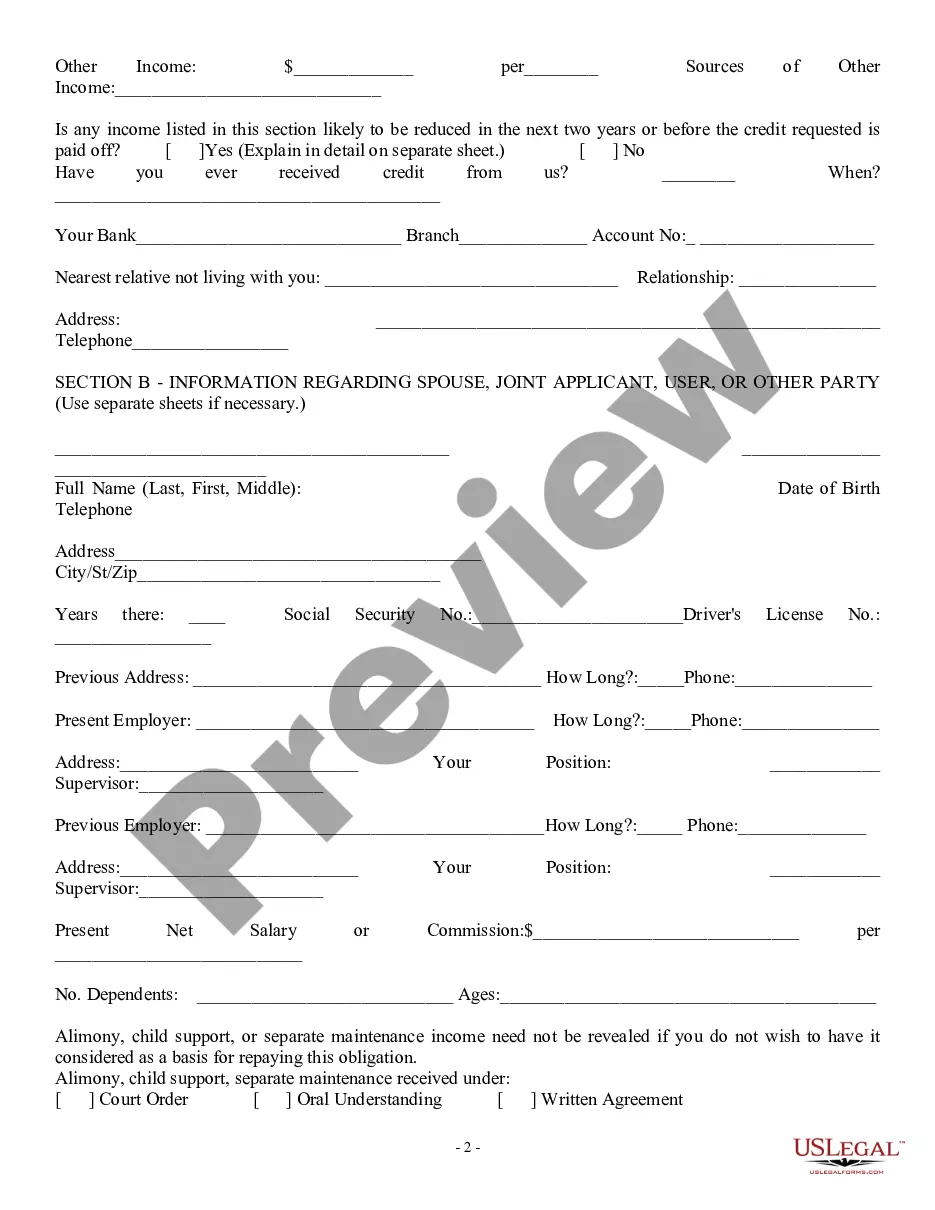

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan co-borrower or cosigner, if it's a joint personal loan. Loan amount and the method for disbursement (lump sum, installments, etc.) Date the loan was provided. Expected repayment date.