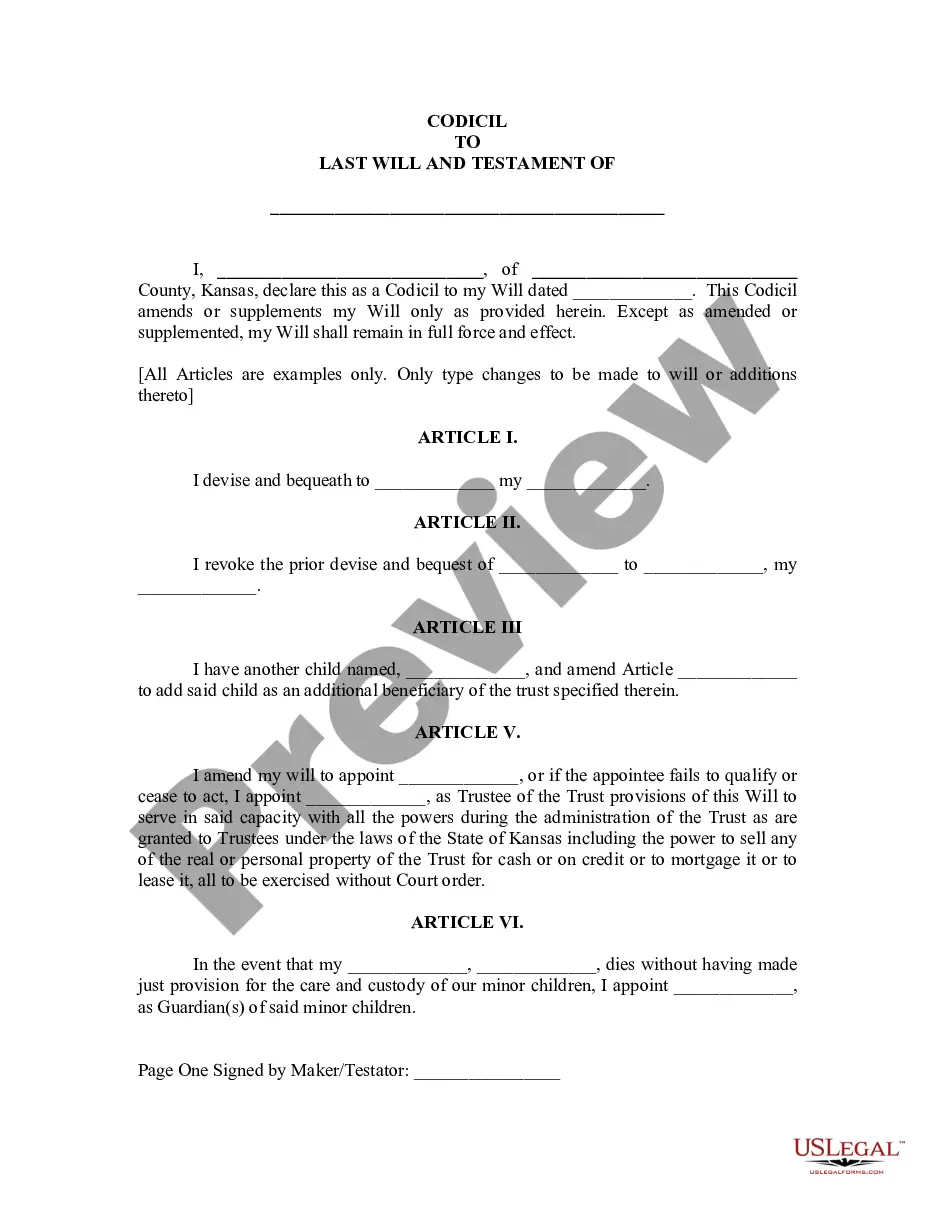

A Legacy is a gift of property or money under the terms of the will of a person who has died. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: Texas Assignment of Legacy in Order to Pay Indebtedness — A Comprehensive Overview Introduction: The Texas Assignment of Legacy in Order to Pay Indebtedness is a legal mechanism allowing a debtor to satisfy an outstanding debt by transferring their inheritance rights or legacies to their creditor(s). This legal concept plays a crucial role in managing debt obligations and ensuring fair treatment of creditors in the state of Texas. This article will delve into the details of this assignment, its legal implications, and potential types of assignments commonly seen in Texas. Keywords: Texas Assignment of Legacy, Indebtedness, Inheritance rights, Legacies, Legal mechanism, Debt obligations, Creditors, Texas law I. Understanding Texas Assignment of Legacy: 1. Definition and Purpose: The Texas Assignment of Legacy in Order to Pay Indebtedness refers to the voluntary transfer of an individual's rights to inherit property or bequests from a deceased individual (legacy) to their creditors. It allows debtors to use their potential inheritance as compensation for unpaid debts. 2. Legal Basis: This instrument is primarily governed by the Texas Estates Code, specifically under Chapter 361, which outlines the requirements and procedures for executing an Assignment of Legacy. 3. Executor's Role: The executor or administrator of the deceased person's estate typically plays a crucial role in facilitating the assignment process and ensuring that the assignment adheres to applicable legal requirements. 4. Validity and Limitations: Assignments are subject to legal validity and must comply with specific criteria, including being made in writing (typically referred to as a deed of assignment) and properly executed in the presence of witnesses. II. Types of Texas Assignment of Legacy in Order to Pay Indebtedness: 1. Absolute Assignment: An absolute assignment involves the complete transfer of inheritance rights or legacies to creditors, ensuring that the debtor's entire potential inheritance is used to satisfy the debt. This assignment type provides certainty to creditors regarding the settlement of the outstanding debts. 2. Conditional Assignment: In a conditional assignment, the transfer of inheritance rights is contingent upon certain conditions. These conditions could dictate the amount or percentage of the legacy being assigned to creditors, allowing debtors to retain a portion of their inheritance. Commonly, such conditions are mutually agreed upon and are aimed at striking a balance between the debtor's interests and the creditor's rights. 3. Partial Assignment: In cases where the debtor's indebtedness exceeds the value of their potential inheritance, a partial assignment is utilized. This type enables the debtor to assign a fraction of their legacy or bequest, allowing creditors to recoup a portion of their debts while ensuring the debtor still retains some inheritance rights. Conclusion: The Texas Assignment of Legacy in Order to Pay Indebtedness serves as a vital legal tool for debtors and creditors alike, balancing the need for debt resolution while considering the debtor's right to inheritance. It is important to consult with legal professionals well-versed in Texas law to ensure compliance and proper execution of this assignment, ensuring a fair and lawful resolution to outstanding debts. Keywords: Texas Assignment of Legacy, Indebtedness, Inheritance rights, Legacies, Legal mechanism, Debt obligations, Creditors, Texas law

Title: Texas Assignment of Legacy in Order to Pay Indebtedness — A Comprehensive Overview Introduction: The Texas Assignment of Legacy in Order to Pay Indebtedness is a legal mechanism allowing a debtor to satisfy an outstanding debt by transferring their inheritance rights or legacies to their creditor(s). This legal concept plays a crucial role in managing debt obligations and ensuring fair treatment of creditors in the state of Texas. This article will delve into the details of this assignment, its legal implications, and potential types of assignments commonly seen in Texas. Keywords: Texas Assignment of Legacy, Indebtedness, Inheritance rights, Legacies, Legal mechanism, Debt obligations, Creditors, Texas law I. Understanding Texas Assignment of Legacy: 1. Definition and Purpose: The Texas Assignment of Legacy in Order to Pay Indebtedness refers to the voluntary transfer of an individual's rights to inherit property or bequests from a deceased individual (legacy) to their creditors. It allows debtors to use their potential inheritance as compensation for unpaid debts. 2. Legal Basis: This instrument is primarily governed by the Texas Estates Code, specifically under Chapter 361, which outlines the requirements and procedures for executing an Assignment of Legacy. 3. Executor's Role: The executor or administrator of the deceased person's estate typically plays a crucial role in facilitating the assignment process and ensuring that the assignment adheres to applicable legal requirements. 4. Validity and Limitations: Assignments are subject to legal validity and must comply with specific criteria, including being made in writing (typically referred to as a deed of assignment) and properly executed in the presence of witnesses. II. Types of Texas Assignment of Legacy in Order to Pay Indebtedness: 1. Absolute Assignment: An absolute assignment involves the complete transfer of inheritance rights or legacies to creditors, ensuring that the debtor's entire potential inheritance is used to satisfy the debt. This assignment type provides certainty to creditors regarding the settlement of the outstanding debts. 2. Conditional Assignment: In a conditional assignment, the transfer of inheritance rights is contingent upon certain conditions. These conditions could dictate the amount or percentage of the legacy being assigned to creditors, allowing debtors to retain a portion of their inheritance. Commonly, such conditions are mutually agreed upon and are aimed at striking a balance between the debtor's interests and the creditor's rights. 3. Partial Assignment: In cases where the debtor's indebtedness exceeds the value of their potential inheritance, a partial assignment is utilized. This type enables the debtor to assign a fraction of their legacy or bequest, allowing creditors to recoup a portion of their debts while ensuring the debtor still retains some inheritance rights. Conclusion: The Texas Assignment of Legacy in Order to Pay Indebtedness serves as a vital legal tool for debtors and creditors alike, balancing the need for debt resolution while considering the debtor's right to inheritance. It is important to consult with legal professionals well-versed in Texas law to ensure compliance and proper execution of this assignment, ensuring a fair and lawful resolution to outstanding debts. Keywords: Texas Assignment of Legacy, Indebtedness, Inheritance rights, Legacies, Legal mechanism, Debt obligations, Creditors, Texas law