A Texas Non-Disclosure Agreement (NDA) for merger or acquisition is a legal document that safeguards sensitive information exchanged between two parties involved in a potential merger or acquisition transaction. This agreement ensures that any confidential or proprietary information shared during the negotiation process remains confidential and cannot be disclosed to any third party without explicit consent. The Texas Non-Disclosure Agreement for Merger or Acquisition typically includes the following key elements: 1. Parties Involved: Clearly identifies the parties involved in the agreement, including the disclosing party (often the seller) and the receiving party (often the buyer). 2. Definition of Confidential Information: Provides a comprehensive definition of what constitutes confidential information in the context of the merger or acquisition, such as financial data, strategic plans, customer lists, trade secrets, and any other proprietary information. 3. Purpose and Scope: Outlines the purpose behind the agreement and defines the parameters within which confidential information may be used solely for evaluating the potential merger or acquisition. 4. Non-Disclosure Obligations: Specifies the obligations of the receiving party to maintain the confidentiality of the disclosed information. This includes restrictions on disclosing, copying, distributing, or using the information for any purpose other than evaluating the transaction. 5. Exclusions: Lists certain exclusions that do not fall under the confidential information category, ensuring that information already in the public domain, obtained from a third party, or independently developed by the receiving party is not considered confidential. 6. Non-Competition and Non-Solicitation: May include provisions preventing the receiving party from engaging in any competitive activities or soliciting employees or customers during the negotiation process or for a specified period following the termination of discussions. 7. Term and Termination: Specifies the duration of the agreement and conditions for termination, such as a mutual agreement or upon the completion or termination of the merger or acquisition negotiations. It's worth noting that there may be variations or specialized versions of the Texas Non-Disclosure Agreement for Merger or Acquisition, depending on the specific requirements of the parties involved or the industry in which they operate. For example, certain industries, like technology or healthcare, may have additional clauses addressing data security, intellectual property rights, or regulatory compliance. Overall, the primary objective of a Texas Non-Disclosure Agreement for Merger or Acquisition is to maintain confidentiality throughout the negotiation process, protecting the disclosing party's sensitive information and encouraging open communication between the parties involved.

Texas Non-Disclosure Agreement for Merger or Acquisition

Description

How to fill out Texas Non-Disclosure Agreement For Merger Or Acquisition?

You may invest time on the web looking for the authorized papers format that fits the state and federal demands you want. US Legal Forms provides 1000s of authorized varieties which are examined by pros. It is simple to obtain or produce the Texas Non-Disclosure Agreement for Merger or Acquisition from the support.

If you have a US Legal Forms bank account, it is possible to log in and click the Download key. Afterward, it is possible to comprehensive, edit, produce, or sign the Texas Non-Disclosure Agreement for Merger or Acquisition. Every single authorized papers format you acquire is yours permanently. To obtain another copy of the acquired form, visit the My Forms tab and click the corresponding key.

If you work with the US Legal Forms internet site initially, follow the straightforward guidelines under:

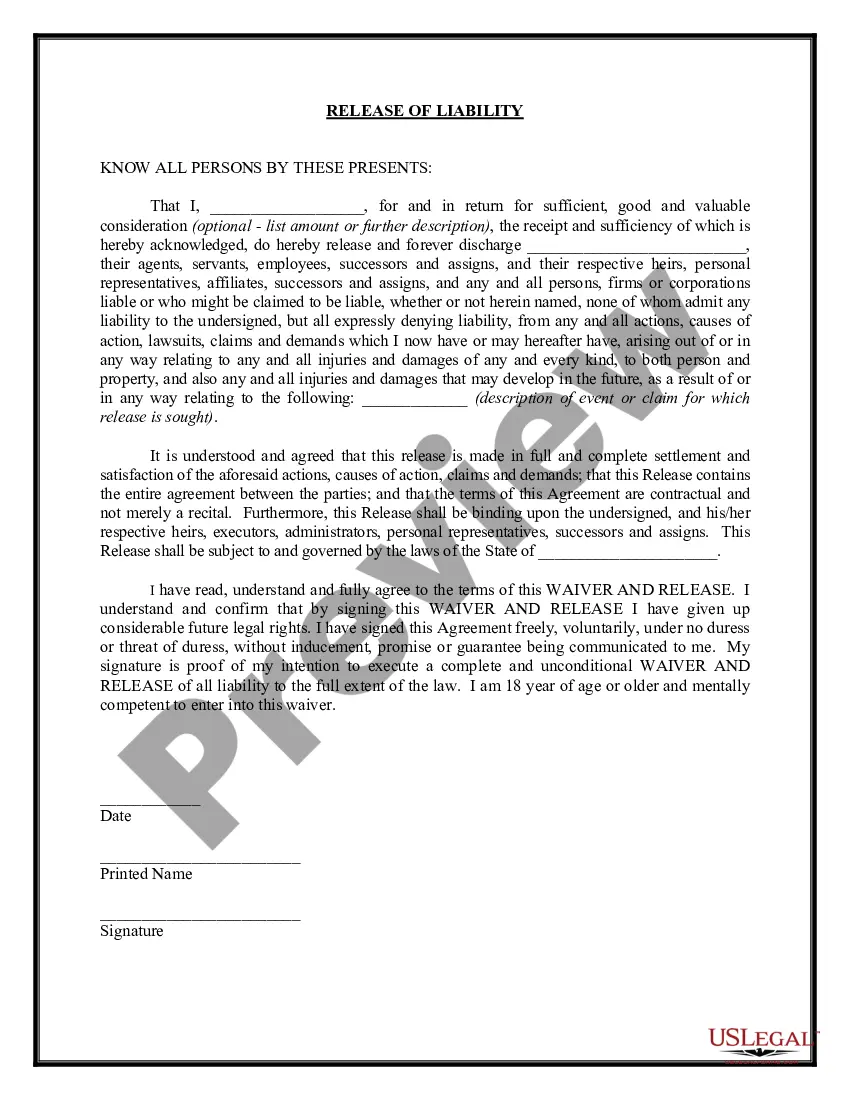

- Very first, be sure that you have chosen the best papers format for that county/metropolis that you pick. Read the form information to ensure you have chosen the right form. If accessible, utilize the Review key to appear throughout the papers format as well.

- If you want to discover another variation of your form, utilize the Lookup area to get the format that fits your needs and demands.

- When you have discovered the format you would like, simply click Acquire now to continue.

- Select the pricing program you would like, type in your references, and sign up for a merchant account on US Legal Forms.

- Total the deal. You may use your Visa or Mastercard or PayPal bank account to fund the authorized form.

- Select the file format of your papers and obtain it for your product.

- Make changes for your papers if possible. You may comprehensive, edit and sign and produce Texas Non-Disclosure Agreement for Merger or Acquisition.

Download and produce 1000s of papers templates using the US Legal Forms site, which provides the greatest collection of authorized varieties. Use specialist and state-specific templates to tackle your small business or person requirements.