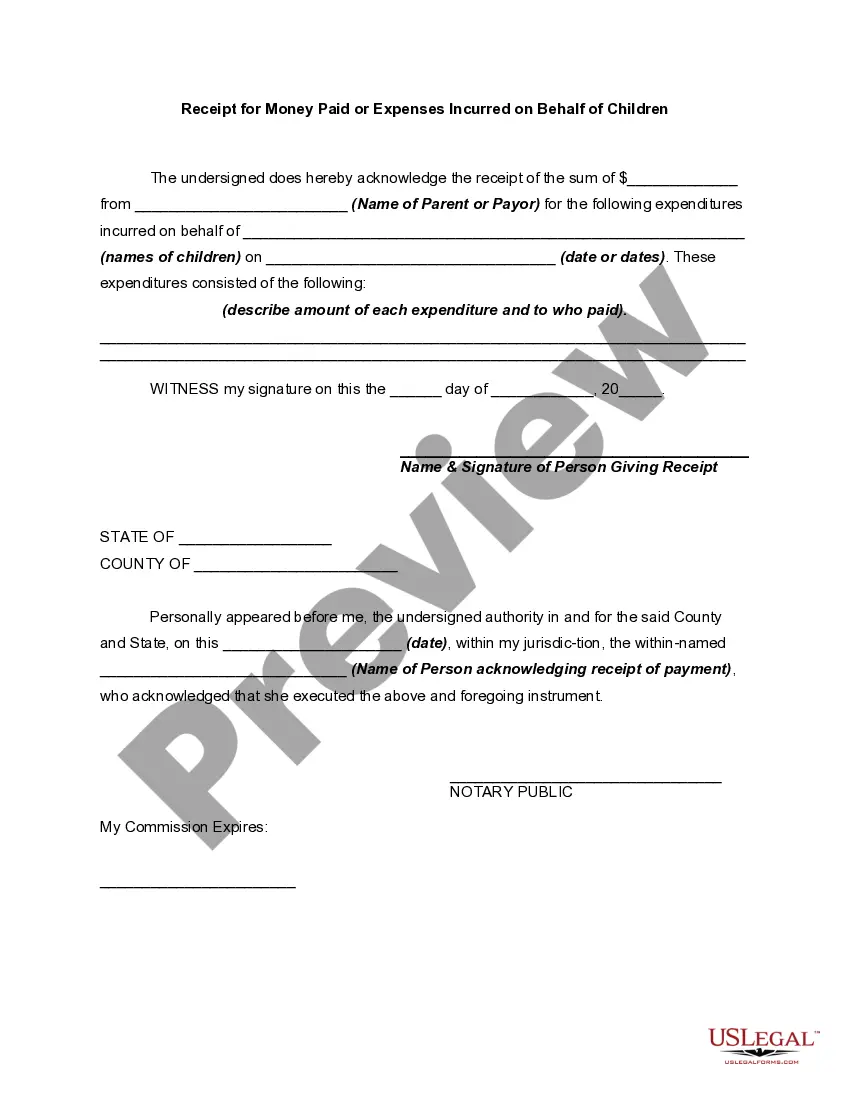

A receipt is a written acknowledgment by the recipient of payment for goods, payment of a debt or receiving property from another. An acknowledgment receipt is a recipient's confirmation that the items were received by the recipient.

Title: Texas Receipt for Money Paid or Expenses Incurred on Behalf of Mayor's Children: A Comprehensive Guide Keywords: Texas, receipt for money paid, expenses incurred, mayor's children, types Introduction: A Texas Receipt for Money Paid or Expenses Incurred on Behalf of Mayor's Children is a document that serves as proof of financial transactions or expenditures made by a person for the benefit of another individual's children. This receipt is essential for record-keeping purposes and can be utilized in various legal or personal situations. In Texas, specific types of receipts may vary depending on the nature of the expenses incurred. Let's explore these dynamics further. 1. General Overview: The Texas Receipt for Money Paid or Expenses Incurred on Behalf of Mayor's Children is a legally recognized document acknowledging the payment or reimbursement of expenses associated with child-related responsibilities. This receipt highlights the financial involvement and commitment of the mayor towards the children's needs. 2. Common Types of Texas Receipts: a. Educational Expenses Receipt: Texas recognizes the significance of education for children and, as a result, provides a dedicated type of receipt for educational expenses. This may include payments for tuition fees, textbooks, school supplies, extracurricular activities, or any other academic-related costs incurred by the mayor on behalf of the children. b. Medical and Health Expenses Receipt: This type of receipt acknowledges payments made for medical, dental, or health-related bills on behalf of the mayor's children. It acts as proof of the mayor's financial support towards the children's well-being, covering expenses such as doctor consultations, prescription medications, surgeries, hospital stays, and more. c. Childcare Expenses Receipt: Childcare is crucial, especially for working parents, and Texas provides a specific type of receipt for these expenses. It includes documentation of payments made towards daycare centers, after-school programs, babysitting services, or camps, allowing the mayor to claim reimbursement or prove financial contributions. d. Extracurricular Activities Receipt: Children often engage in extracurricular activities, and Texas recognizes the benefits these activities bring. Receipts for expenses incurred in activities such as sports, music lessons, dance classes, scouting, or other hobbies serve as evidence of the mayor's direct involvement and support in nurturing their children's interests. 3. Essential Elements of a Texas Receipt: Regardless of the type of receipt, certain vital elements should be present: — Date of thtransactionio— - Payor's and recipient's details (name, address, contact information) — Description of the expenseincurredre— - Amount paid or reimbursed — Method of payment (e.g., cash, check, electronic transfer) — Signatures of both partiesmayoror and recipient) — Additional terms and conditions if applicable Conclusion: The Texas Receipt for Money Paid or Expenses Incurred on Behalf of Mayor's Children is a critical document that validates the financial role of the mayor in providing for the well-being and needs of the children. By understanding different types of receipts relating to education, healthcare, childcare, and extracurricular activities, one can ensure accurate record-keeping and fulfill legal obligations. Maintaining organized receipts will facilitate transparency and clarity in financial matters concerning the children's expenses.Title: Texas Receipt for Money Paid or Expenses Incurred on Behalf of Mayor's Children: A Comprehensive Guide Keywords: Texas, receipt for money paid, expenses incurred, mayor's children, types Introduction: A Texas Receipt for Money Paid or Expenses Incurred on Behalf of Mayor's Children is a document that serves as proof of financial transactions or expenditures made by a person for the benefit of another individual's children. This receipt is essential for record-keeping purposes and can be utilized in various legal or personal situations. In Texas, specific types of receipts may vary depending on the nature of the expenses incurred. Let's explore these dynamics further. 1. General Overview: The Texas Receipt for Money Paid or Expenses Incurred on Behalf of Mayor's Children is a legally recognized document acknowledging the payment or reimbursement of expenses associated with child-related responsibilities. This receipt highlights the financial involvement and commitment of the mayor towards the children's needs. 2. Common Types of Texas Receipts: a. Educational Expenses Receipt: Texas recognizes the significance of education for children and, as a result, provides a dedicated type of receipt for educational expenses. This may include payments for tuition fees, textbooks, school supplies, extracurricular activities, or any other academic-related costs incurred by the mayor on behalf of the children. b. Medical and Health Expenses Receipt: This type of receipt acknowledges payments made for medical, dental, or health-related bills on behalf of the mayor's children. It acts as proof of the mayor's financial support towards the children's well-being, covering expenses such as doctor consultations, prescription medications, surgeries, hospital stays, and more. c. Childcare Expenses Receipt: Childcare is crucial, especially for working parents, and Texas provides a specific type of receipt for these expenses. It includes documentation of payments made towards daycare centers, after-school programs, babysitting services, or camps, allowing the mayor to claim reimbursement or prove financial contributions. d. Extracurricular Activities Receipt: Children often engage in extracurricular activities, and Texas recognizes the benefits these activities bring. Receipts for expenses incurred in activities such as sports, music lessons, dance classes, scouting, or other hobbies serve as evidence of the mayor's direct involvement and support in nurturing their children's interests. 3. Essential Elements of a Texas Receipt: Regardless of the type of receipt, certain vital elements should be present: — Date of thtransactionio— - Payor's and recipient's details (name, address, contact information) — Description of the expenseincurredre— - Amount paid or reimbursed — Method of payment (e.g., cash, check, electronic transfer) — Signatures of both partiesmayoror and recipient) — Additional terms and conditions if applicable Conclusion: The Texas Receipt for Money Paid or Expenses Incurred on Behalf of Mayor's Children is a critical document that validates the financial role of the mayor in providing for the well-being and needs of the children. By understanding different types of receipts relating to education, healthcare, childcare, and extracurricular activities, one can ensure accurate record-keeping and fulfill legal obligations. Maintaining organized receipts will facilitate transparency and clarity in financial matters concerning the children's expenses.