A limited review of financial statements is an audit restricted to an examination either for a limited period or of a limited part of the records. A review does not contemplate obtaining an understanding of the entity's internal control; assessing fraud risk; tests of accounting records by obtaining sufficient appropriate audit evidence through inspection, observation, confirmation, or the examination of source documents (for example, cancelled checks or bank images); and other procedures ordinarily performed in an audit. Accordingly, a review does not provide assurance that we will become aware of all significant matters that would be disclosed in an audit. Therefore, a review provides only limited assurance that there are no material modifications that should be made to the financial statements in order for the statements to be in conformity with generally accepted accounting principles.

The definition of nonattest services is very inclusive. It includes, for example, preparation of the client's depreciation schedule and preparation of journal entries even if management has approved the journal entries. I have confirmed these examples directly with the AICPA ethics division. The definition of nonattest services includes preparation of tax returns.

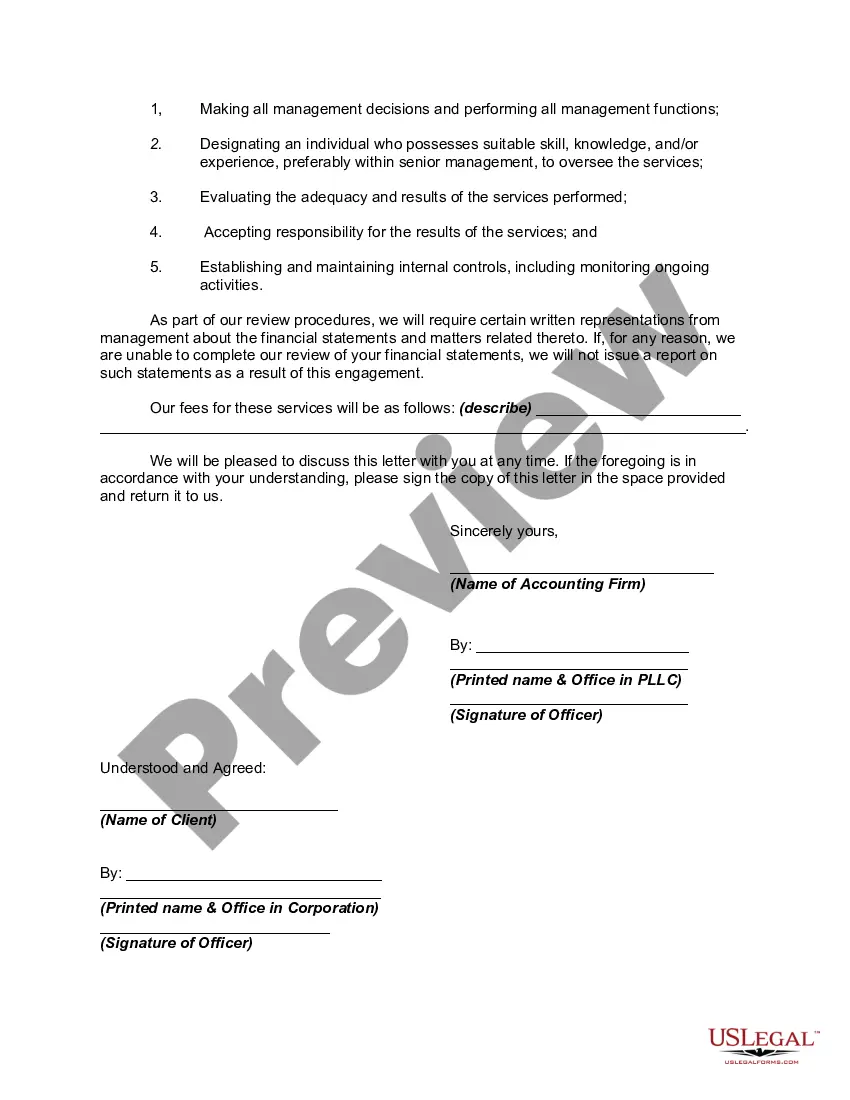

Texas Engagement Letter for Review of Financial Statements by Accounting Firm An engagement letter is a legally binding agreement between an accounting firm and their client, outlining the terms and conditions of the review engagement to be performed on the financial statements. In Texas, specific engagement letters are used for the review of financial statements, ensuring clarity, communication, and proper understanding of the engagement scope and responsibilities. The Texas Engagement Letter for Review of Financial Statements by an Accounting Firm effectively outlines the objectives, responsibilities, and limitations of the review engagement process. It ensures that both the accounting firm and the client are aware of the purpose and scope of the review engagement, providing a clear path for all parties involved. The primary purpose of the engagement letter for the review of financial statements is to establish a mutual understanding of the accounting firm's responsibilities and the client's expectations. This letter helps facilitate effective communication and sets the ground rules for the review engagement, ensuring that both parties are on the same page throughout the process. The Texas Engagement Letter for Review of Financial Statements by an Accounting Firm typically includes the following key components: 1. Introduction: The engagement letter begins with a formal introduction, including the names of the accounting firm, the client, and their respective roles. 2. Objective of the Engagement: This section clearly states the primary objective of the review engagement, typically focusing on providing limited assurance that the financial statements are presented in accordance with the applicable financial reporting framework. 3. Scope of Work: The engagement letter describes the specific scope of the review engagement, including the procedures to be performed, the timeframe for completion, and any additional requirements agreed upon by both parties. 4. Responsibilities of the Accounting Firm: This section outlines the responsibilities of the accounting firm in conducting the review engagement. These responsibilities may include obtaining an understanding of the client's business, performing necessary procedures, and preparing the review report. 5. Responsibilities of the Client: The engagement letter also specifies the client's responsibilities, such as providing accurate and complete financial records and ensuring compliance with applicable laws and regulations. 6. Limitations: This section highlights the limitations of the review engagement, emphasizing that the review does not provide the same level of assurance as an audit. It clarifies that the accounting firm will not express an opinion on the financial statements. 7. Reporting and Communication: The engagement letter sets out the reporting requirements, including the form and content of the review report. It also establishes the lines of communication between the accounting firm and the client throughout the engagement. Different types of Texas Engagement Letters for the Review of Financial Statements by an Accounting Firm may exist based on variables such as the industry, entity size, or the nature of the financial statements being reviewed. However, the core components mentioned above generally remain consistent. In conclusion, the Texas Engagement Letter for Review of Financial Statements by an Accounting Firm serves as a crucial document that ensures effective communication, clear understanding of engagement objectives, and delineation of responsibilities between the accounting firm and the client. It provides a solid foundation for the review engagement process, promoting transparency, accuracy, and professionalism in the financial reporting and auditing practices in the state of Texas.Texas Engagement Letter for Review of Financial Statements by Accounting Firm An engagement letter is a legally binding agreement between an accounting firm and their client, outlining the terms and conditions of the review engagement to be performed on the financial statements. In Texas, specific engagement letters are used for the review of financial statements, ensuring clarity, communication, and proper understanding of the engagement scope and responsibilities. The Texas Engagement Letter for Review of Financial Statements by an Accounting Firm effectively outlines the objectives, responsibilities, and limitations of the review engagement process. It ensures that both the accounting firm and the client are aware of the purpose and scope of the review engagement, providing a clear path for all parties involved. The primary purpose of the engagement letter for the review of financial statements is to establish a mutual understanding of the accounting firm's responsibilities and the client's expectations. This letter helps facilitate effective communication and sets the ground rules for the review engagement, ensuring that both parties are on the same page throughout the process. The Texas Engagement Letter for Review of Financial Statements by an Accounting Firm typically includes the following key components: 1. Introduction: The engagement letter begins with a formal introduction, including the names of the accounting firm, the client, and their respective roles. 2. Objective of the Engagement: This section clearly states the primary objective of the review engagement, typically focusing on providing limited assurance that the financial statements are presented in accordance with the applicable financial reporting framework. 3. Scope of Work: The engagement letter describes the specific scope of the review engagement, including the procedures to be performed, the timeframe for completion, and any additional requirements agreed upon by both parties. 4. Responsibilities of the Accounting Firm: This section outlines the responsibilities of the accounting firm in conducting the review engagement. These responsibilities may include obtaining an understanding of the client's business, performing necessary procedures, and preparing the review report. 5. Responsibilities of the Client: The engagement letter also specifies the client's responsibilities, such as providing accurate and complete financial records and ensuring compliance with applicable laws and regulations. 6. Limitations: This section highlights the limitations of the review engagement, emphasizing that the review does not provide the same level of assurance as an audit. It clarifies that the accounting firm will not express an opinion on the financial statements. 7. Reporting and Communication: The engagement letter sets out the reporting requirements, including the form and content of the review report. It also establishes the lines of communication between the accounting firm and the client throughout the engagement. Different types of Texas Engagement Letters for the Review of Financial Statements by an Accounting Firm may exist based on variables such as the industry, entity size, or the nature of the financial statements being reviewed. However, the core components mentioned above generally remain consistent. In conclusion, the Texas Engagement Letter for Review of Financial Statements by an Accounting Firm serves as a crucial document that ensures effective communication, clear understanding of engagement objectives, and delineation of responsibilities between the accounting firm and the client. It provides a solid foundation for the review engagement process, promoting transparency, accuracy, and professionalism in the financial reporting and auditing practices in the state of Texas.