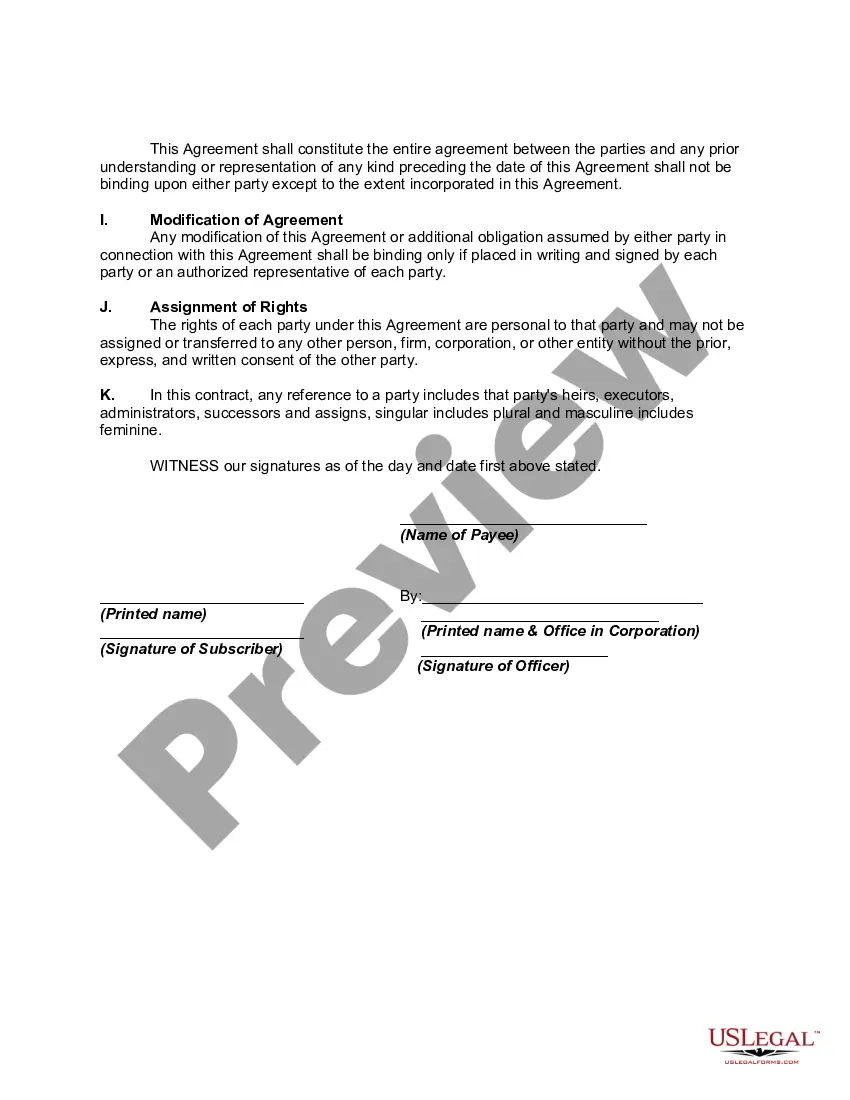

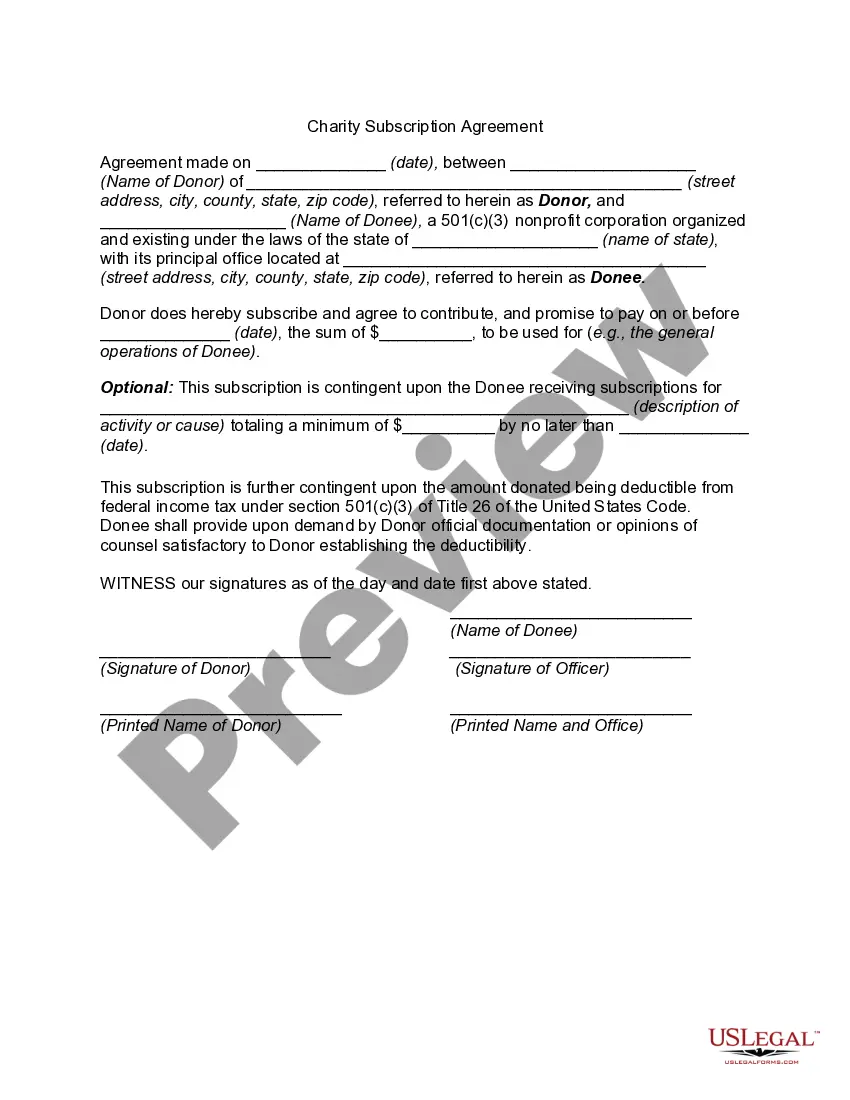

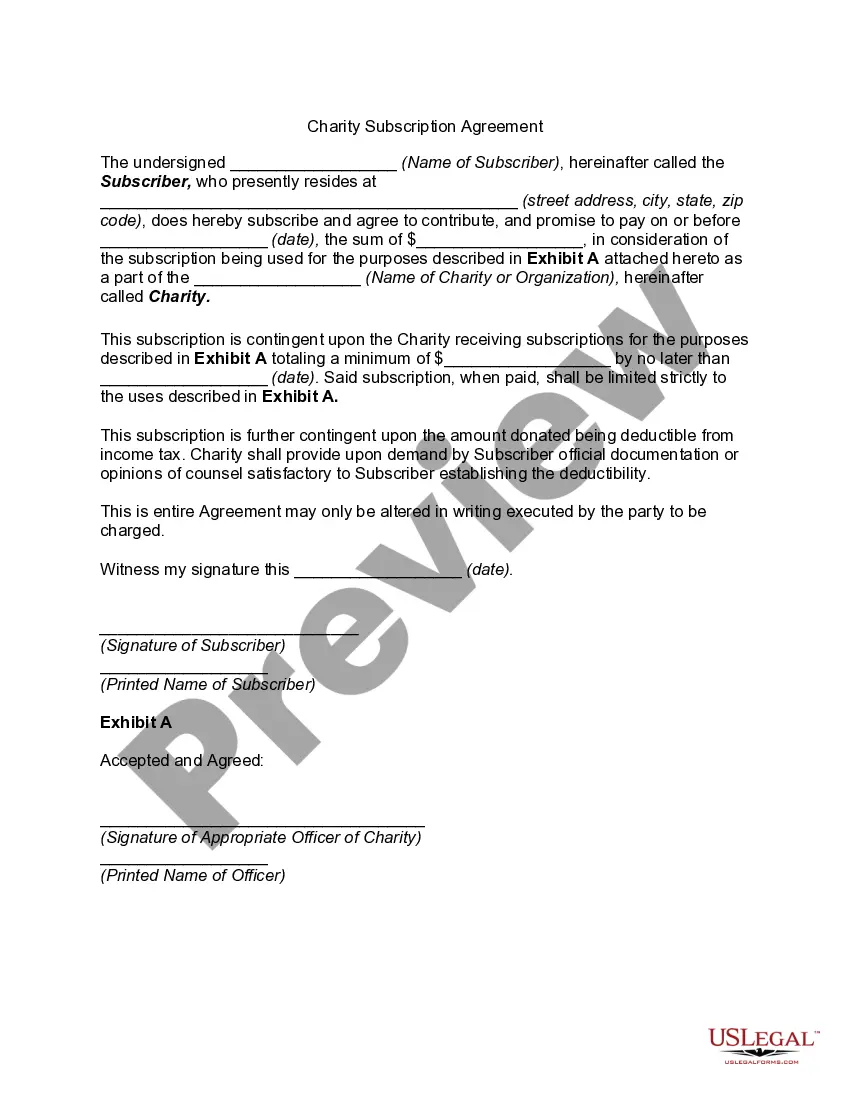

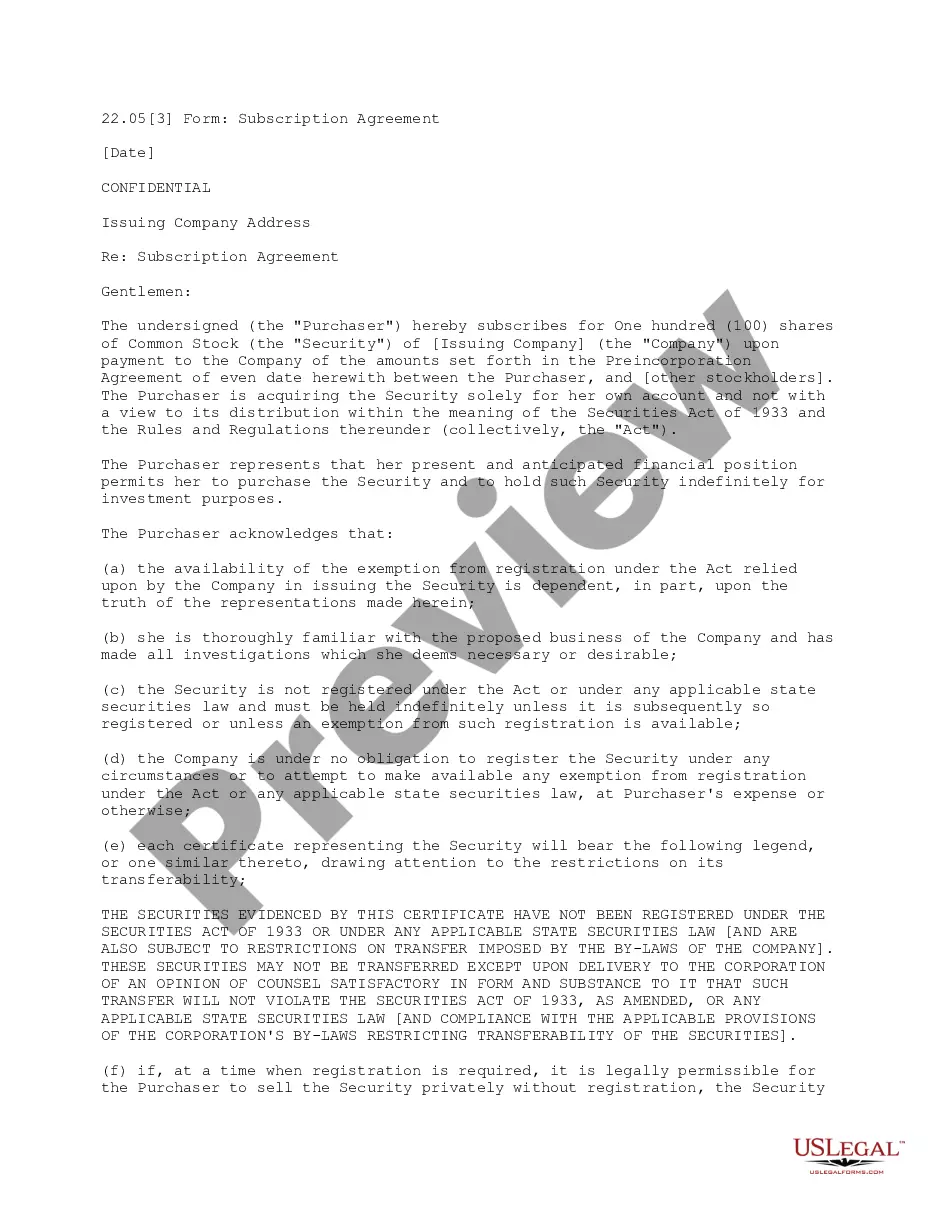

A subscription is a purchase made by a signed order. A subscription offer should state with certainty the name of the payee, the amount and date of the subscription, any limitations placed on the use of the property contributed, and a clear description of the consideration. To ensure enforceability a subscription should also include a clear recitation of consideration.

Texas Subscription Agreement with Nonprofit Corporation

Description

How to fill out Subscription Agreement With Nonprofit Corporation?

If you require to complete, obtain, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search to find the documents you need.

Various templates for business and personal purposes are organized by categories and suggestions, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose the payment plan you prefer and enter your information to register for an account.

Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the payment.

- Use US Legal Forms to find the Texas Subscription Agreement with Nonprofit Corporation in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Obtain button to access the Texas Subscription Agreement with Nonprofit Corporation.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Make sure you have selected the form for the correct area/country.

- Step 2. Utilize the Review option to check the contents of the form. Don’t forget to read the summary.

- Step 3. If you are unhappy with the form, use the Search field at the top of the screen to find alternative versions of your legal form template.

Form popularity

FAQ

The 33% rule refers to the requirement that no more than one-third of a nonprofit's board can be related by blood or marriage. This rule maintains diversity and independence among the board members. By adhering to this guideline, nonprofits strengthen their governance. When creating a Texas Subscription Agreement with Nonprofit Corporation, consider including a reference to this rule to promote sound practices.

Yes, most nonprofits in Texas are required to file an annual franchise tax report, although they may be exempt from paying the tax itself. This rule applies to organizations that generate a certain level of revenue. Keeping up with these obligations is essential for maintaining good standing. If you are working on a Texas Subscription Agreement with Nonprofit Corporation, be sure to highlight compliance with tax regulations.

The minimum number of board members for a 501(c)(3) organization is three. This ensures that there is adequate oversight and reduces potential conflicts of interest. Having a minimum number of members also enhances decision-making processes. When drafting your Texas Subscription Agreement with Nonprofit Corporation, be sure to address this requirement clearly.

The minimum number of board members for a 501(c)(3) in Texas is three. This ensures a basic level of governance while allowing for diverse perspectives. Each member plays a vital role in fulfilling the nonprofit's mission. When formalizing your governance structure in a Texas Subscription Agreement with Nonprofit Corporation, include details on board composition.

Board requirements for a 501(c)(3) include having a minimum of three directors, with at least a majority being independent. Directors should not be related and they should maintain accurate records of meetings and decisions. This structure promotes accountability and transparency. When creating a Texas Subscription Agreement with Nonprofit Corporation, consider outlining these board requirements clearly.

In Texas, a 501(c)(3) nonprofit organization must have at least three board members. These members should not be related by blood or marriage to ensure proper governance. This requirement supports the establishment of a diverse board, which is crucial for effective decision-making. If you are drafting a Texas Subscription Agreement with Nonprofit Corporation, ensure your board composition meets these legal requirements.

While Texas does not legally require nonprofits to have bylaws, they are essential for the effective functioning of any organization. Bylaws provide clarity on how the nonprofit will operate and help in resolving conflicts. When forming a Texas Subscription Agreement with Nonprofit Corporation, it's wise to include comprehensive bylaws to support good governance and compliance with legal standards.

Non-profit bylaws typically include provisions for the organization's name, purpose, membership structure, governance, and the roles of officers and directors. They should also outline the procedures for meetings, voting, and amendments to the bylaws. When establishing a Texas Subscription Agreement with Nonprofit Corporation, ensuring that these key elements are included will help create a solid foundation for your organization's operations.

Texas law does not strictly mandate that nonprofit organizations have bylaws; however, having them is crucial for effective governance. Bylaws outline the rules for operation, decision-making processes, and member rights within the organization. When forming a Texas Subscription Agreement with Nonprofit Corporation, including detailed bylaws can help avoid potential disputes and enhance organizational structure.

Section 22.351 of the Texas Business Organization Code outlines the requirements for the formation and operation of nonprofit corporations in Texas. This section addresses matters such as the powers and responsibilities of directors, as well as the fiduciary duties owed to the organization. Understanding this section is important when creating a Texas Subscription Agreement with Nonprofit Corporation, as it helps ensure compliance with state regulations.