A Transmutation Agreement is a marital contract that provides that the ownership of a particular piece of property will, from the date of the agreement forward, be changed. Spouses can transmute, partition, or exchange community property to separate property by agreement. According to some authority, separate property can be transmuted into community property by an agreement between the spouses, but there is also authority to the contrary.

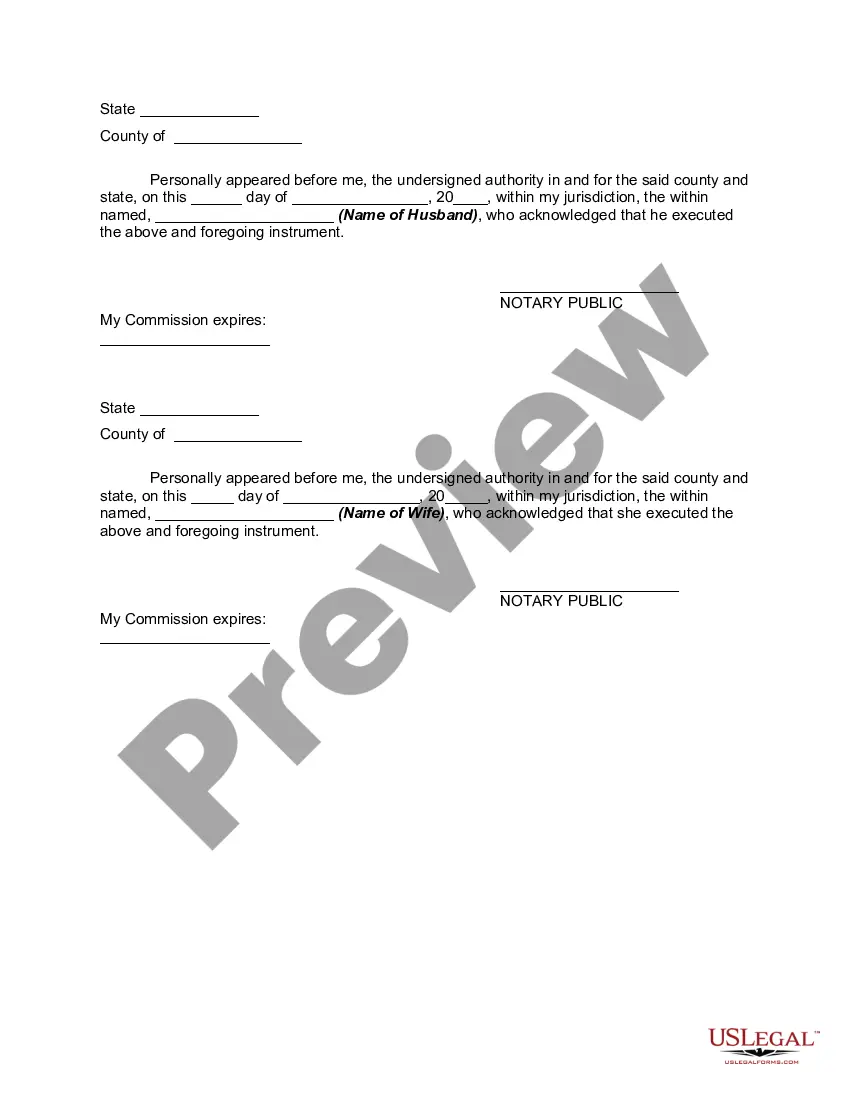

Texas Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property is a legal tool that allows spouses in the state of Texas to change the classification of their property from community property to separate property. This agreement grants couples the ability to redefine how their assets and debts are treated, providing them with the flexibility to protect their individual interests within their marital estate. Under Texas law, community property is generally defined as any property acquired during the course of the marriage, while separate property consists of assets acquired before the marriage, through inheritance or gifts, and certain personal injury settlements. By executing a Texas Transmutation or Postnuptial Agreement, couples can convert certain community property into separate property, altering its legal classification. This agreement enables spouses to redefine ownership and control over specific assets or debts, allowing for greater protection of individual interests. For instance, if one spouse brought a significant amount of personal assets into the marriage, they may want to legally designate these as separate property to ensure they remain solely under their control in the event of a divorce. There are different types of Texas Transmutation or Postnuptial Agreements to Convert Community Property into Separate Property, which include: 1. Partial Transmutation Agreement: This agreement converts a portion of the community property into separate property. Couples may choose this option to protect specific assets, such as a business or real estate, from becoming subject to division in a divorce. 2. Full Transmutation Agreement: In this agreement, spouses convert all of their community property into separate property. This option is suitable for couples seeking complete autonomy over their individual assets and debts within the marital estate. 3. Debt Repayment Transmutation Agreement: This type of agreement allows couples to convert community debt into separate debt, making one spouse solely responsible for its repayment. This can be beneficial if one spouse has incurred significant debt during the marriage, ensuring that the other spouse is not held liable for it in the event of a divorce. It's important to note that Texas Transmutation or Postnuptial Agreements must comply with certain legal requirements, such as being in writing, signed by both spouses, and disclosure of all assets and debts. It is strongly recommended consulting with a qualified family law attorney to ensure the agreement is properly drafted and executed to protect the interests of both spouses.Texas Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property is a legal tool that allows spouses in the state of Texas to change the classification of their property from community property to separate property. This agreement grants couples the ability to redefine how their assets and debts are treated, providing them with the flexibility to protect their individual interests within their marital estate. Under Texas law, community property is generally defined as any property acquired during the course of the marriage, while separate property consists of assets acquired before the marriage, through inheritance or gifts, and certain personal injury settlements. By executing a Texas Transmutation or Postnuptial Agreement, couples can convert certain community property into separate property, altering its legal classification. This agreement enables spouses to redefine ownership and control over specific assets or debts, allowing for greater protection of individual interests. For instance, if one spouse brought a significant amount of personal assets into the marriage, they may want to legally designate these as separate property to ensure they remain solely under their control in the event of a divorce. There are different types of Texas Transmutation or Postnuptial Agreements to Convert Community Property into Separate Property, which include: 1. Partial Transmutation Agreement: This agreement converts a portion of the community property into separate property. Couples may choose this option to protect specific assets, such as a business or real estate, from becoming subject to division in a divorce. 2. Full Transmutation Agreement: In this agreement, spouses convert all of their community property into separate property. This option is suitable for couples seeking complete autonomy over their individual assets and debts within the marital estate. 3. Debt Repayment Transmutation Agreement: This type of agreement allows couples to convert community debt into separate debt, making one spouse solely responsible for its repayment. This can be beneficial if one spouse has incurred significant debt during the marriage, ensuring that the other spouse is not held liable for it in the event of a divorce. It's important to note that Texas Transmutation or Postnuptial Agreements must comply with certain legal requirements, such as being in writing, signed by both spouses, and disclosure of all assets and debts. It is strongly recommended consulting with a qualified family law attorney to ensure the agreement is properly drafted and executed to protect the interests of both spouses.