Texas Venture Capital Finder's Fee Agreement is a legal document that outlines the terms and conditions of an agreement between a venture capital firm and a finder, defining the compensation allowed for the finder's assistance in identifying potential investment opportunities. In the world of venture capital, finding promising investment prospects can be a challenging and time-consuming task. This is where finders come into play, acting as intermediaries who connect venture capital firms with entrepreneurs seeking funding. The Texas Venture Capital Finder's Fee Agreement serves as a blueprint regulating the relationship between the finder and the firm, ensuring both parties understand their rights and obligations. The agreement typically covers various essential aspects such as compensation, confidentiality, exclusivity, and representations and warranties. It is crucial for both parties to fully comprehend these terms before entering into the agreement. This aids in fostering a clear and transparent working relationship, minimizing the potential for disputes. Compensation details are a central component of the Texas Venture Capital Finder's Fee Agreement. They typically involve a finder's fee, which is a predetermined percentage of the amount invested in any company referred by the finder. This fee structure serves as an incentive for the finder to diligently source and assess prospective investment opportunities. Confidentiality clauses are another critical aspect of the agreement. Since finders often have access to sensitive information regarding investment targets, ensuring the protection of this information is crucial. The agreement establishes guidelines for the handling, use, and disclosure of confidential data, safeguarding the interests of both parties. Exclusivity provisions may also be present in the agreement. These terms stipulate that the finder will exclusively work with the venture capital firm, eliminating conflicts of interest that could arise from simultaneously engaging multiple firms. This ensures a focused and dedicated effort in identifying potential investments. Moreover, representations and warranties clause may be included in the agreement, serving as a guarantee from the finder that all information provided is accurate and truthful. This helps the venture capital firm make informed investment decisions based on reliable data. Multiple types of Texas Venture Capital Finder's Fee Agreement can exist, varying based on the specific terms negotiated between the parties involved. Some alternative types include: 1. Percentage-based agreement: This type of agreement outlines a fixed percentage of the investment amount that will be paid to the finder as a fee. 2. Time-based agreement: In this variation, the finder is compensated based on the time and effort invested in sourcing and evaluating potential investment opportunities. 3. Results-based agreement: This type of agreement ties the finder's compensation to the successful completion of investment transactions sourced by the finder. The fee is only paid if an investment actually occurs. 4. Retainer agreement: This variation may involve an upfront payment or a regular retainer fee to the finder, providing a consistent income stream for their services. Texas Venture Capital Finder's Fee Agreement is a critical legal instrument that governs the relationship between venture capital firms and their finders. By clarifying compensation, confidentiality, exclusivity, and representations and warranties, this agreement ensures a smooth and mutually beneficial partnership in the dynamic world of venture capital.

Texas Venture Capital Finder's Fee Agreement

Description

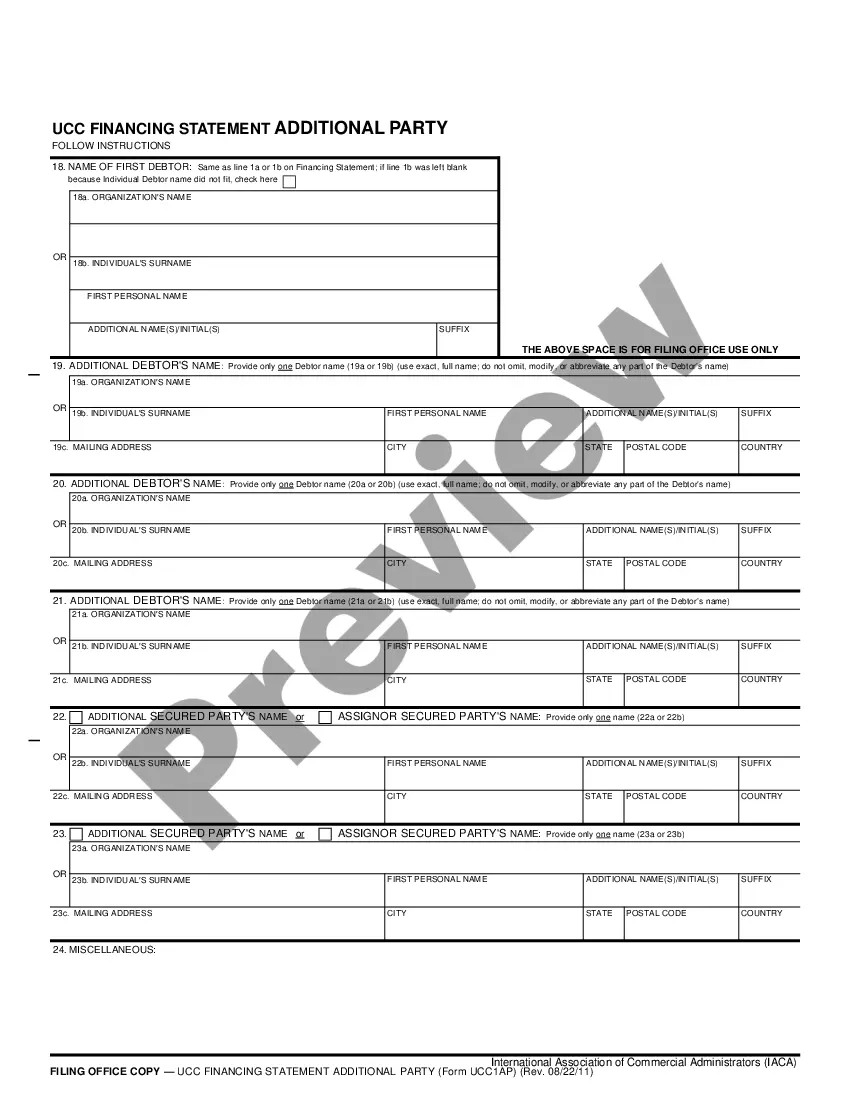

How to fill out Texas Venture Capital Finder's Fee Agreement?

You may commit time on the web searching for the legal document template that suits the federal and state demands you will need. US Legal Forms provides a large number of legal varieties which are examined by professionals. You can actually download or printing the Texas Venture Capital Finder's Fee Agreement from the support.

If you have a US Legal Forms profile, you may log in and then click the Down load switch. Next, you may full, edit, printing, or indicator the Texas Venture Capital Finder's Fee Agreement. Each and every legal document template you buy is yours permanently. To acquire another copy of any purchased type, proceed to the My Forms tab and then click the corresponding switch.

Should you use the US Legal Forms web site the very first time, follow the basic instructions listed below:

- Very first, make sure that you have chosen the proper document template for the county/town of your choice. Read the type explanation to ensure you have chosen the correct type. If offered, utilize the Review switch to look through the document template too.

- In order to get another model of your type, utilize the Search discipline to discover the template that meets your requirements and demands.

- Once you have discovered the template you need, click on Buy now to continue.

- Choose the prices strategy you need, type in your references, and sign up for a free account on US Legal Forms.

- Complete the purchase. You may use your Visa or Mastercard or PayPal profile to fund the legal type.

- Choose the format of your document and download it to your gadget.

- Make changes to your document if necessary. You may full, edit and indicator and printing Texas Venture Capital Finder's Fee Agreement.

Down load and printing a large number of document templates using the US Legal Forms Internet site, which provides the largest variety of legal varieties. Use professional and status-specific templates to handle your small business or person requires.