A Texas Stock Purchase Agreement is a legal document that outlines the sale of stocks or shares between two sellers and one investor, with the transfer of title occurring simultaneously with the execution of the agreement. This agreement serves as a binding contract between the parties involved, ensuring a smooth and legal transaction. It contains important provisions related to the terms, conditions, and rights associated with the sale of stock. This detailed description will provide an overview of the key elements present in such an agreement using relevant keywords. Key Elements of a Texas Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement: 1. Parties: The agreement identifies the two sellers and one investor involved in the transaction. It includes their legal names, addresses, and other relevant contact information. 2. Stock Description: The agreement provides a detailed description of the stocks or shares being sold. This includes the number of shares, class of stock, and any specific rights or restrictions associated with them. 3. Purchase Price: The agreement outlines the agreed-upon purchase price for the stocks. This includes the total amount to be paid, the currency in which it will be paid, and any installment or payment schedules. 4. Payment Terms: This section specifies the payment terms, such as the mode of payment (cash, check, wire transfer), the deadline for payment, and any possible adjustments based on the completion of due diligence or other agreed-upon conditions. 5. Representations and Warranties: Both sellers and the investor make certain representations and warranties regarding their authority to enter into the agreement, the accuracy of disclosed information, and any existing legal obligations related to the stocks being sold. 6. Conditions Precedent: The agreement may include conditions that must be met before the completion of the transaction. These could include obtaining necessary regulatory approvals, third-party consents, or the satisfactory completion of due diligence. 7. Closing and Transfer of Title: This essential section outlines the process of closing the transaction and the simultaneous transfer of title. It typically includes details such as the date, time, and location of closing, and the necessary documentation for the transfer of stocks. 8. Indemnification: The agreement may include indemnification clauses to protect the parties from potential losses or damages arising from breaches of warranties, misrepresentation, or non-compliance with legal requirements. 9. Governing Law and Jurisdiction: The agreement specifies that the laws of the state of Texas govern the interpretation and enforcement of the agreement. It also designates the jurisdiction and venue for resolving any disputes that may arise. Types of Texas Stock Purchase Agreements between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement: 1. Simple Stock Purchase Agreement: This type of agreement involves the straightforward sale of stocks without any complex provisions or specific conditions. 2. Conditional Stock Purchase Agreement: In this agreement, the completion of the transaction is subject to certain conditions precedent, such as the approval of certain regulatory bodies or the satisfaction of specific financial or legal requirements. 3. Staged Payment Stock Purchase Agreement: This type of agreement involves a purchase price that is paid in multiple installments over a specified period. Each payment may be tied to the achievement of certain milestones or performance targets. In conclusion, a Texas Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement is a legal document that facilitates the sale of stocks. It safeguards the rights and interests of all parties involved and binds them to the terms and conditions outlined in the agreement. Various types of such agreements exist, each tailored to specific circumstances or requirements.

Texas Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement

Description

How to fill out Texas Stock Purchase Agreement Between Two Sellers And One Investor With Transfer Of Title Concurrent With Execution Of Agreement?

If you have to complete, down load, or print out lawful papers layouts, use US Legal Forms, the largest collection of lawful forms, which can be found on the web. Take advantage of the site`s simple and easy convenient search to obtain the papers you need. Numerous layouts for company and person purposes are categorized by types and says, or key phrases. Use US Legal Forms to obtain the Texas Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement in a number of clicks.

When you are presently a US Legal Forms buyer, log in for your bank account and then click the Obtain button to get the Texas Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement. You may also accessibility forms you in the past acquired inside the My Forms tab of your respective bank account.

If you are using US Legal Forms the first time, refer to the instructions under:

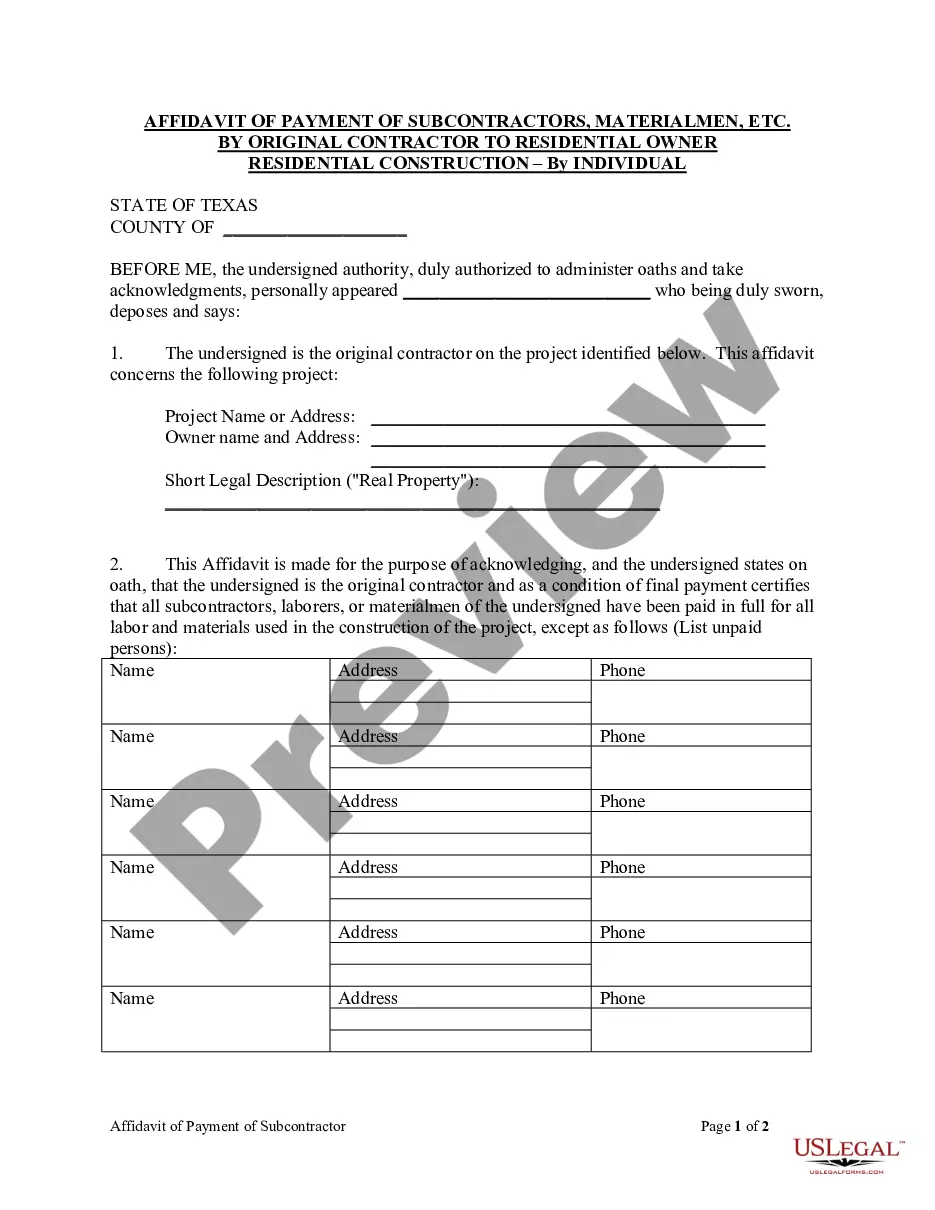

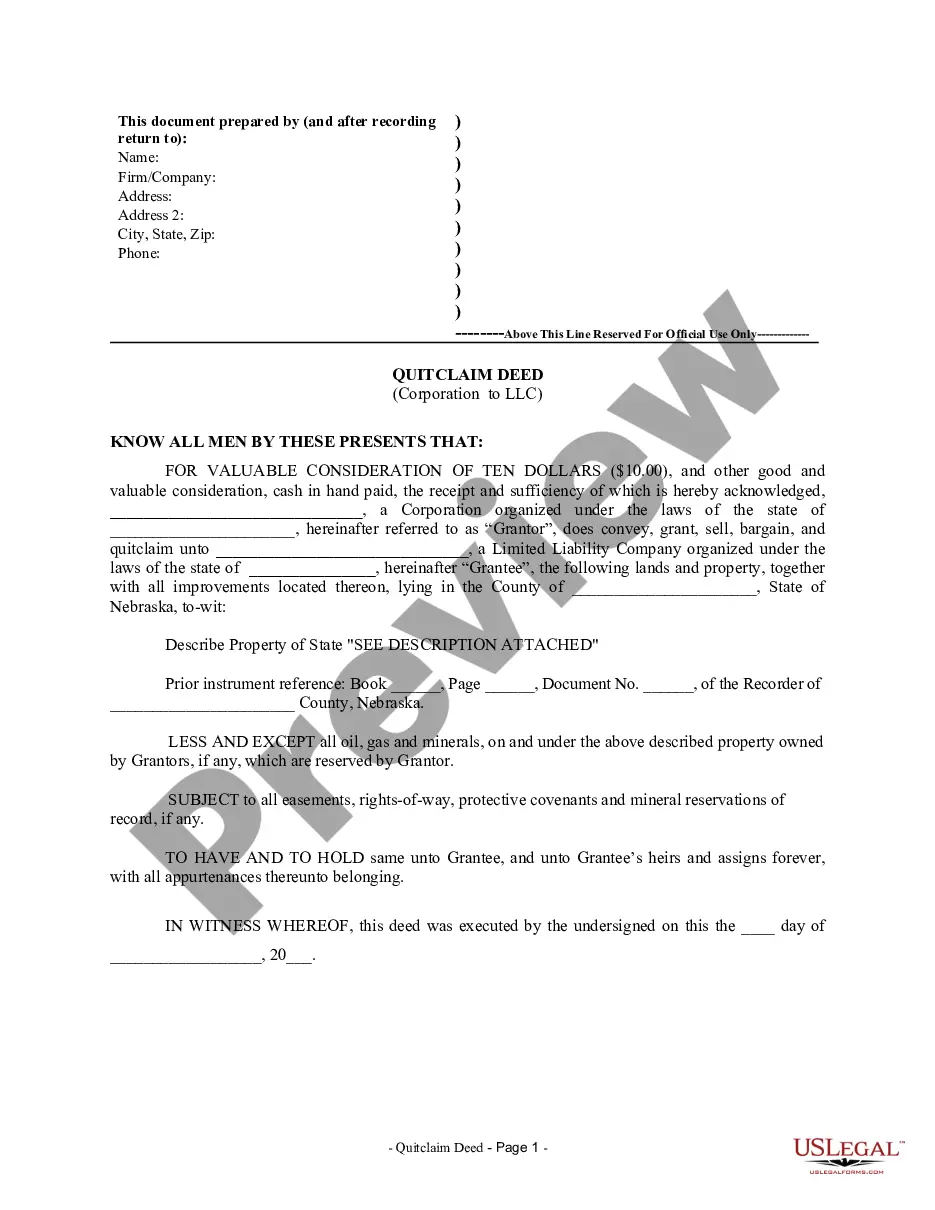

- Step 1. Be sure you have chosen the form to the proper metropolis/country.

- Step 2. Take advantage of the Preview choice to examine the form`s articles. Do not forget to learn the outline.

- Step 3. When you are unsatisfied together with the form, make use of the Look for discipline near the top of the monitor to locate other variations from the lawful form web template.

- Step 4. Upon having found the form you need, select the Acquire now button. Select the costs program you prefer and put your references to sign up for the bank account.

- Step 5. Process the purchase. You can use your credit card or PayPal bank account to accomplish the purchase.

- Step 6. Select the structure from the lawful form and down load it on your own gadget.

- Step 7. Comprehensive, revise and print out or indicator the Texas Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement.

Every lawful papers web template you acquire is yours eternally. You might have acces to each and every form you acquired with your acccount. Click on the My Forms section and decide on a form to print out or down load once more.

Compete and down load, and print out the Texas Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement with US Legal Forms. There are many skilled and express-particular forms you can utilize for your personal company or person needs.