Texas agreement to partners to incorporate partnership is a legal contract that outlines the terms and conditions for establishing a partnership within the state of Texas. This agreement incorporates various important details, including the responsibilities, rights, and obligations of the partners involved in the partnership. A Texas agreement to partners to incorporate partnership typically includes essential information such as the names and addresses of the partners involved, the name and purpose of the partnership, as well as the duration or expiration date of the partnership. It also outlines the specific contributions, capital investments, or assets that each partner will bring into the partnership. Furthermore, the agreement may detail the division of profits and losses among the partners, specifying the percentage or proportion in which they will be distributed. This provision ensures fairness and transparency in the partnership's financial matters. In addition, the Texas agreement to partners to incorporate partnership may include clauses related to the decision-making process within the partnership. It may outline the procedures for voting, the number of votes required for various actions, and any specific limitations or restrictions placed upon the partners. It is important to note that there are different types of Texas agreements to partners to incorporate partnership, each tailored to specific partnership structures. Some common types include general partnerships, limited partnerships, and limited liability partnerships. General partnerships are the simplest form of partnership, where all partners have equal rights and responsibilities in managing the business. Each partner is personally liable for any debts or obligations of the partnership. Limited partnerships introduce a distinction between general partners and limited partners. General partners have management authority and personal liability, while limited partners are passive investors with limited liability. Limited liability partnerships (Laps) offer partners limited liability protection, meaning their personal assets are not at risk if the partnership faces financial difficulties. Laps are often preferred by professionals such as lawyers, accountants, or architects. In summary, a Texas agreement to partners to incorporate partnership is a comprehensive and legally binding contract that covers all necessary aspects of forming a partnership in Texas. It clarifies the roles, responsibilities, and financial arrangements among the partners, ensuring a smooth functioning of the partnership. Different types of agreements cater to the varying needs and preferences of partners, such as general partnerships, limited partnerships, and limited liability partnerships.

Texas Agreement to Partners to Incorporate Partnership

Description

How to fill out Texas Agreement To Partners To Incorporate Partnership?

Discovering the right authorized record design could be a have difficulties. Naturally, there are plenty of themes accessible on the Internet, but how would you discover the authorized type you will need? Use the US Legal Forms site. The services offers 1000s of themes, including the Texas Agreement to Partners to Incorporate Partnership, that you can use for company and private needs. All the varieties are checked by experts and meet up with state and federal specifications.

In case you are previously registered, log in to your accounts and click on the Download key to find the Texas Agreement to Partners to Incorporate Partnership. Utilize your accounts to appear through the authorized varieties you may have acquired formerly. Check out the My Forms tab of the accounts and acquire one more copy from the record you will need.

In case you are a fresh end user of US Legal Forms, listed below are basic directions for you to adhere to:

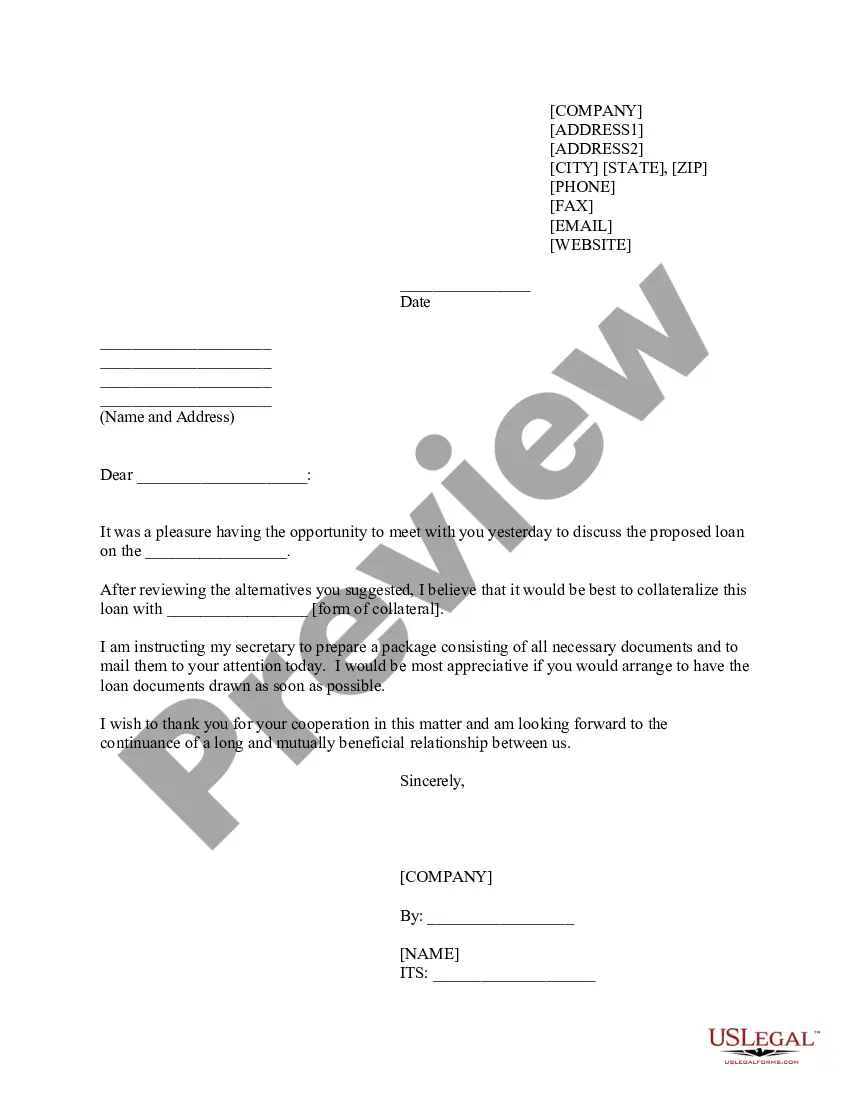

- Initially, make sure you have selected the correct type for the area/area. You are able to look through the shape making use of the Preview key and look at the shape outline to guarantee this is the right one for you.

- If the type is not going to meet up with your preferences, utilize the Seach field to obtain the correct type.

- Once you are certain the shape is suitable, select the Buy now key to find the type.

- Choose the rates strategy you desire and type in the necessary details. Make your accounts and purchase the order making use of your PayPal accounts or Visa or Mastercard.

- Pick the document formatting and acquire the authorized record design to your system.

- Total, edit and printing and signal the attained Texas Agreement to Partners to Incorporate Partnership.

US Legal Forms will be the biggest catalogue of authorized varieties that you can find numerous record themes. Use the service to acquire skillfully-produced papers that adhere to status specifications.