Title: Texas Sample Letter for Payment of Corporate Income and Franchise Taxes and Annual Report Filing Fees: A Comprehensive Guide Introduction: Understanding the process of paying corporate income and franchise taxes, as well as annual report filing fees, is crucial for businesses operating in Texas. Complying with these requirements ensures legal compliance and avoids penalties. This article provides a detailed description of Texas sample letters to facilitate the payment of corporate income and franchise taxes, along with annual report filing fees. Types of Texas Sample Letters for Payment of Corporate Income and Franchise Taxes and Annual Report Filing Fees: 1. Sample Letter for Corporate Income Tax Payment: When it comes to corporate income tax payment in Texas, businesses can use a sample letter to accompany their payment. This letter generally includes essential details such as business name, taxpayer identification number, tax year, payment amount, and a request for receipt confirmation. By providing clear and concise information, this letter helps streamline the payment process. 2. Sample Letter for Franchise Tax Payment: Texas franchise tax is imposed on businesses that have chosen specific legal structures or engage in specific activities. A sample letter for franchise tax payment can be used by these businesses to accompany their payment. It typically contains similar details to the corporate income tax payment letter, including accurate identification of the business and the specific tax year. 3. Sample Letter for Annual Report Filing Fee Payment: In addition to taxes, Texas-based businesses are required to file an annual report with the Secretary of State. This report provides crucial updates about the company's leadership, registered agent, and business activities. Along with the annual report, businesses need to submit the filing fee. A sample letter for annual report filing fee payment assists in submitting the fee along with the report and ensures that all necessary information is appropriately communicated. Key Considerations when Preparing a Texas Sample Letter: 1. Accuracy and Completeness: Ensure that all relevant details, such as business name, taxpayer identification number, tax year, and payment amount, are accurately included in the letter. Any errors or omissions can lead to delays or complications in the payment process. 2. Clarity and Conciseness: Keep the letter concise and to the point, clearly communicating the purpose and intent of the correspondence. Avoid unnecessary information that might confuse the recipient. 3. Formal Tone: Maintain a professional and formal tone throughout the letter, adhering to the established business communication standards. This helps establish credibility and ensures the letter is taken seriously. Conclusion: To comply with Texas tax and reporting requirements, utilizing a well-crafted sample letter for payment of corporate income and franchise taxes, along with annual report filing fees, is instrumental for businesses. By following the guidelines provided above and tailoring the sample letter to their specific needs, businesses can ensure prompt and accurate payment, minimizing the risk of penalties and avoiding potential issues with tax authorities.

Texas Sample Letter for Payment of Corporate Income and Franchise Taxes and Annual Report Filing Fees

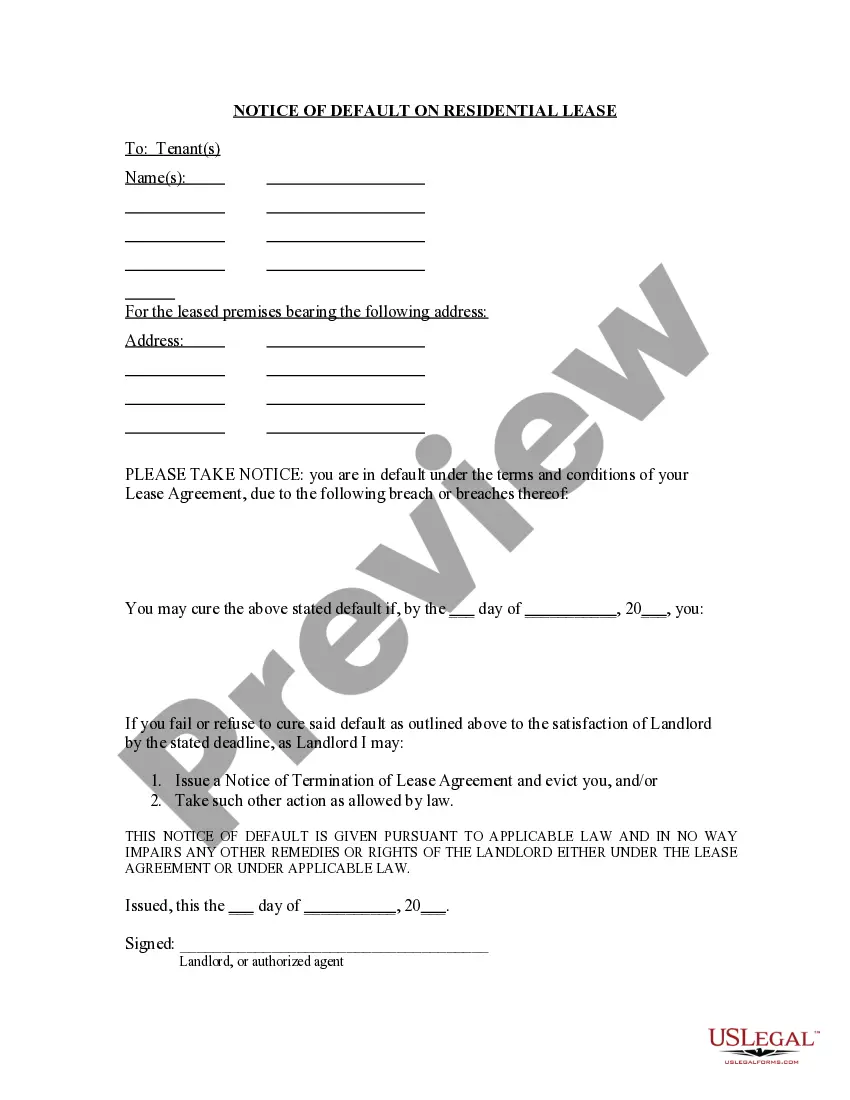

Description

How to fill out Texas Sample Letter For Payment Of Corporate Income And Franchise Taxes And Annual Report Filing Fees?

It is possible to devote several hours on-line attempting to find the legal papers format that fits the state and federal needs you require. US Legal Forms provides 1000s of legal varieties which are evaluated by specialists. You can easily download or print the Texas Sample Letter for Payment of Corporate Income and Franchise Taxes and Annual Report Filing Fees from your assistance.

If you currently have a US Legal Forms accounts, it is possible to log in and click the Down load key. Next, it is possible to total, modify, print, or indicator the Texas Sample Letter for Payment of Corporate Income and Franchise Taxes and Annual Report Filing Fees. Each legal papers format you purchase is the one you have forever. To have an additional backup of any purchased develop, visit the My Forms tab and click the corresponding key.

Should you use the US Legal Forms internet site the very first time, stick to the simple guidelines listed below:

- Very first, make certain you have chosen the right papers format for that region/metropolis of your liking. Look at the develop information to ensure you have picked the appropriate develop. If readily available, take advantage of the Preview key to appear from the papers format at the same time.

- If you would like get an additional variation in the develop, take advantage of the Lookup discipline to get the format that meets your requirements and needs.

- Upon having found the format you would like, just click Buy now to carry on.

- Choose the costs program you would like, key in your credentials, and register for a merchant account on US Legal Forms.

- Complete the purchase. You can use your bank card or PayPal accounts to purchase the legal develop.

- Choose the formatting in the papers and download it in your system.

- Make changes in your papers if possible. It is possible to total, modify and indicator and print Texas Sample Letter for Payment of Corporate Income and Franchise Taxes and Annual Report Filing Fees.

Down load and print 1000s of papers templates while using US Legal Forms site, which offers the most important collection of legal varieties. Use skilled and state-distinct templates to tackle your small business or personal requirements.