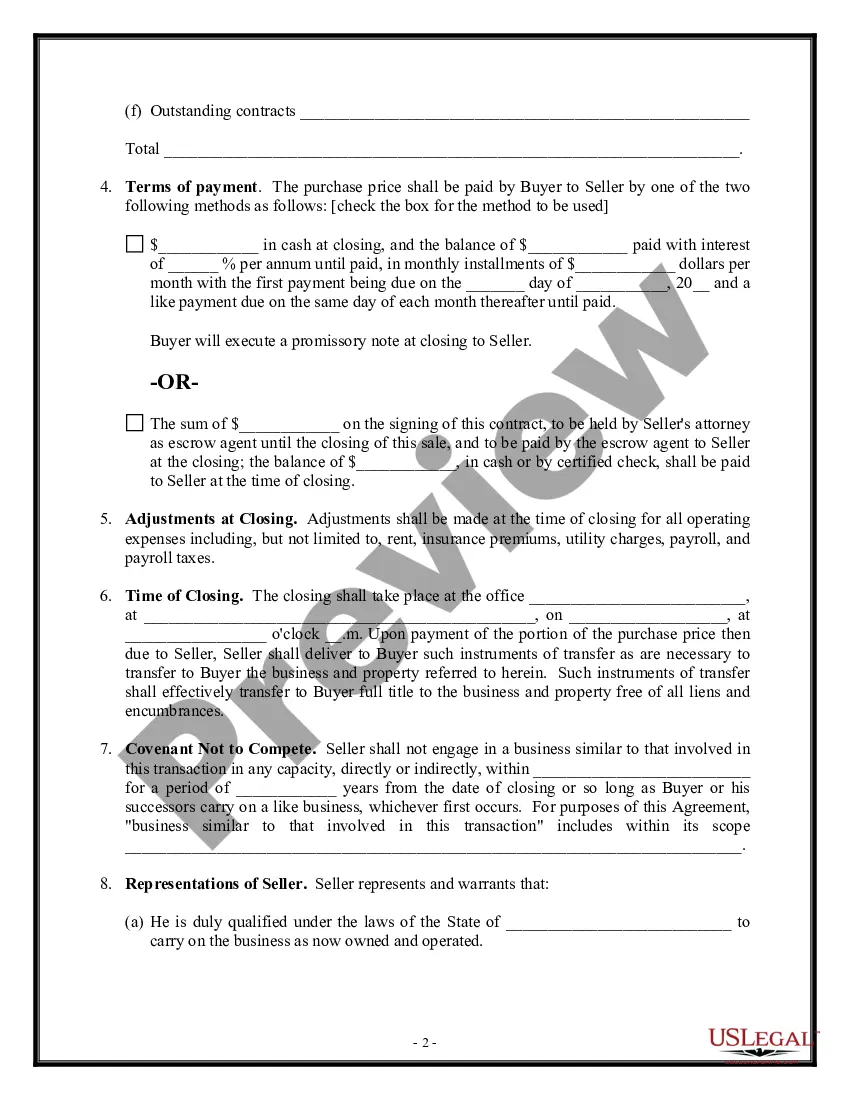

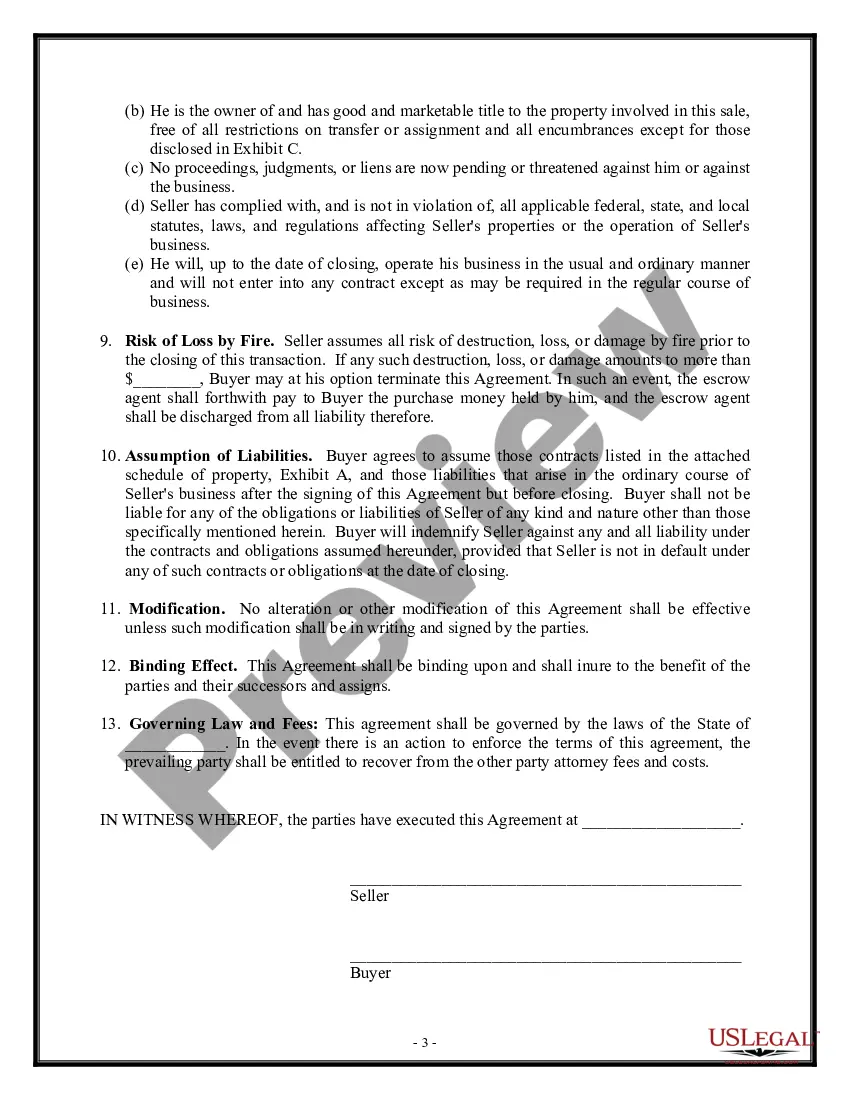

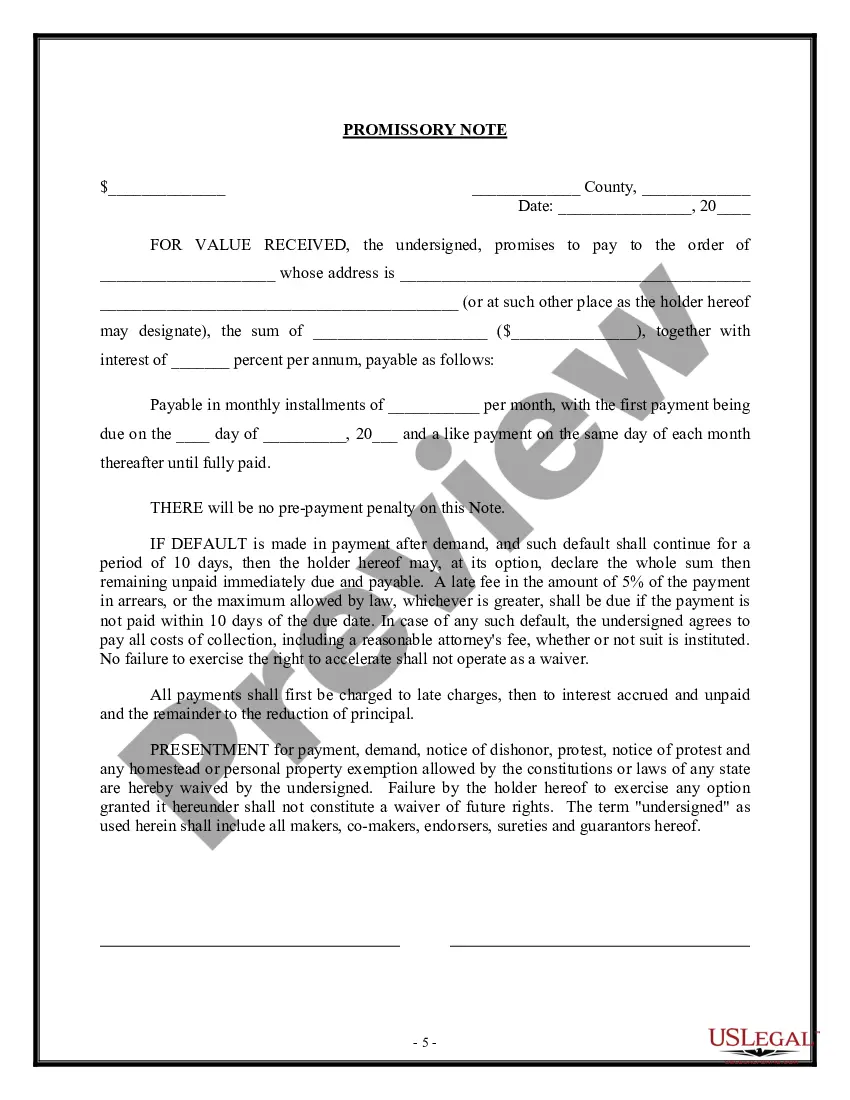

The Texas Agreement for Sale of Business — SolProprietorshiphi— - Asset Purchase is a legal document that outlines the terms and conditions for the sale of a sole proprietorship business in Texas. This agreement is specifically designed for transactions where the buyer is interested in acquiring the assets of the business rather than the entire business itself. The agreement includes various key elements to protect both the buyer and the seller during the asset purchase process. These elements usually include: 1. Parties Involved: The agreement identifies the buyer and seller, stating their legal names, addresses, and contact information. It is essential to include accurate details to avoid any confusion or disputes later on. 2. Business Assets: The agreement lists all the specific assets that are being sold as part of the transaction. This can include tangible assets like equipment, inventory, furniture, and fixtures, as well as intangible assets like intellectual property, licenses, permits, contracts, and customer lists. 3. Purchase Price and Payment Terms: The agreement clearly states the purchase price for the assets being sold and outlines the agreed-upon payment terms. This can include information about down payments, installments, or lump-sum payments. 4. Representations and Warranties: Both parties provide assurances about the accuracy and completeness of the information they have provided. Seller representations may include affirming that they are the rightful owner of the assets being sold or that there are no outstanding liens or encumbrances on the assets. Buyer representations may state that they have the necessary funds to complete the transaction. 5. Covenant Not to Compete: In some cases, the seller may agree not to compete with the buyer's business within a specific geographic area or for a certain period of time. This covenant aims to protect the buyer's interests and customer base after the sale. 6. Obligations and Conditions: The agreement may outline specific responsibilities that each party must fulfill before the transaction can be completed, such as obtaining necessary permits or consents, transferring contracts, or providing access to financial records for due diligence purposes. Different types of Texas Agreement for Sale of Business — SolProprietorshiphi— - Asset Purchase may exist based on the specifics of the transaction or the industry involved. For example, there might be separate templates for businesses in the retail sector, hospitality industry, or professional services sector. However, the key components mentioned above would generally be included in any variation of the agreement. It is important to note that while this content provides a general overview of what a Texas Agreement for Sale of Business — SolProprietorshiphi— - Asset Purchase entails, it is recommended to consult with a legal professional to ensure compliance with state laws and to address the specific needs and circumstances of each transaction.

Texas Agreement for Sale of Business - Sole Proprietorship - Asset Purchase

Description

How to fill out Texas Agreement For Sale Of Business - Sole Proprietorship - Asset Purchase?

You can invest hrs online looking for the lawful file format that meets the federal and state requirements you need. US Legal Forms supplies thousands of lawful varieties which are examined by experts. It is simple to down load or print out the Texas Agreement for Sale of Business - Sole Proprietorship - Asset Purchase from your support.

If you currently have a US Legal Forms accounts, you may log in and click on the Down load option. Next, you may complete, edit, print out, or signal the Texas Agreement for Sale of Business - Sole Proprietorship - Asset Purchase. Each lawful file format you acquire is yours forever. To have one more copy of any obtained form, check out the My Forms tab and click on the related option.

If you use the US Legal Forms website the first time, stick to the easy recommendations beneath:

- Very first, make certain you have selected the best file format for that region/city of your choice. See the form outline to ensure you have picked out the right form. If readily available, utilize the Preview option to look throughout the file format also.

- If you would like find one more version of your form, utilize the Search area to find the format that suits you and requirements.

- After you have discovered the format you need, click on Get now to continue.

- Select the rates strategy you need, type your accreditations, and sign up for an account on US Legal Forms.

- Complete the purchase. You can use your bank card or PayPal accounts to purchase the lawful form.

- Select the structure of your file and down load it to the system.

- Make adjustments to the file if needed. You can complete, edit and signal and print out Texas Agreement for Sale of Business - Sole Proprietorship - Asset Purchase.

Down load and print out thousands of file layouts making use of the US Legal Forms web site, which provides the largest variety of lawful varieties. Use professional and state-certain layouts to tackle your company or individual requires.