Title: Texas Sample Letter for Reinstatement of Corporation with Detailed Guidelines Introduction: Reinstating a corporation in Texas requires a well-crafted reinstatement letter to the Secretary of State. This article provides a comprehensive guide on how to write a Texas Sample Letter for the Reinstatement of a Corporation, which is essential for reinstating dissolved corporations. Read on to understand the process and discover different types of reinstatement letters in Texas. I. General Format of a Texas Sample Letter for Reinstatement of Corporation: 1. Sender's Information: a. Corporation Name and Legal Address b. Registered Agent's Name and Address 2. Date: (Current Date) 3. Secretary of State: Office of the Secretary of State [Mailing Address] 4. Re: Application for Reinstatement of Corporation II. Key Elements to Include: 1. Explanation for Dissolution: Clearly state the reason for the corporation's dissolution (e.g., non-payment of annual franchise taxes, failure to file reports, etc.) and acknowledge fault if applicable. 2. Compliance Actions: Outline the necessary steps taken to rectify the default issues since the dissolution, including paying all outstanding fees, penalties, and interest. Specify the date of payment or include payment receipts. 3. Request for Reinstatement: Clearly express your desire to reinstate the corporation and emphasize the importance of resuming business operations. 4. Supporting Documents: Include copies of all relevant documentation, such as proof of payment, good standing certificates, and any other required supporting materials. 5. Contact Information: Provide up-to-date contact details for the corporation, including mailing address, phone number, and email for communication purposes. 6. Sign and Notarize: The letter should be signed by an authorized officer of the corporation and notarized to ensure authenticity. III. Types of Texas Sample Letters for Reinstatement of Corporation: 1. Texas Sample Letter for Reinstatement of Corporation — For Franchise Tax Default: This type of letter is used when a corporation's dissolution was due to non-payment of franchise taxes. It focuses on clearing all outstanding tax issues and rectifying the corporation's status. 2. Texas Sample Letter for Reinstatement of Corporation — For Failure to File Reports: If a corporation has been dissolved due to failure to file required reports, this letter addresses the need for filing all overdue reports and meeting the state's reporting requirements. 3. Texas Sample Letter for Reinstatement of Corporation — For Administrative Dissolution Errors: If a corporation was administratively dissolved due to an error or oversight by the Secretary of State's office, this letter highlights the mistake and urges speedy reinstatement. Conclusion: Writing a detailed and well-structured Texas Sample Letter for Reinstatement of Corporation is crucial to successfully reinstate a dissolved corporation in Texas. By following the general format and customizing the letter to address specific circumstances, any corporation can seek reinstatement and resume its operations promptly.

Texas Sample Letter for Reinstatement of Corporation

Description

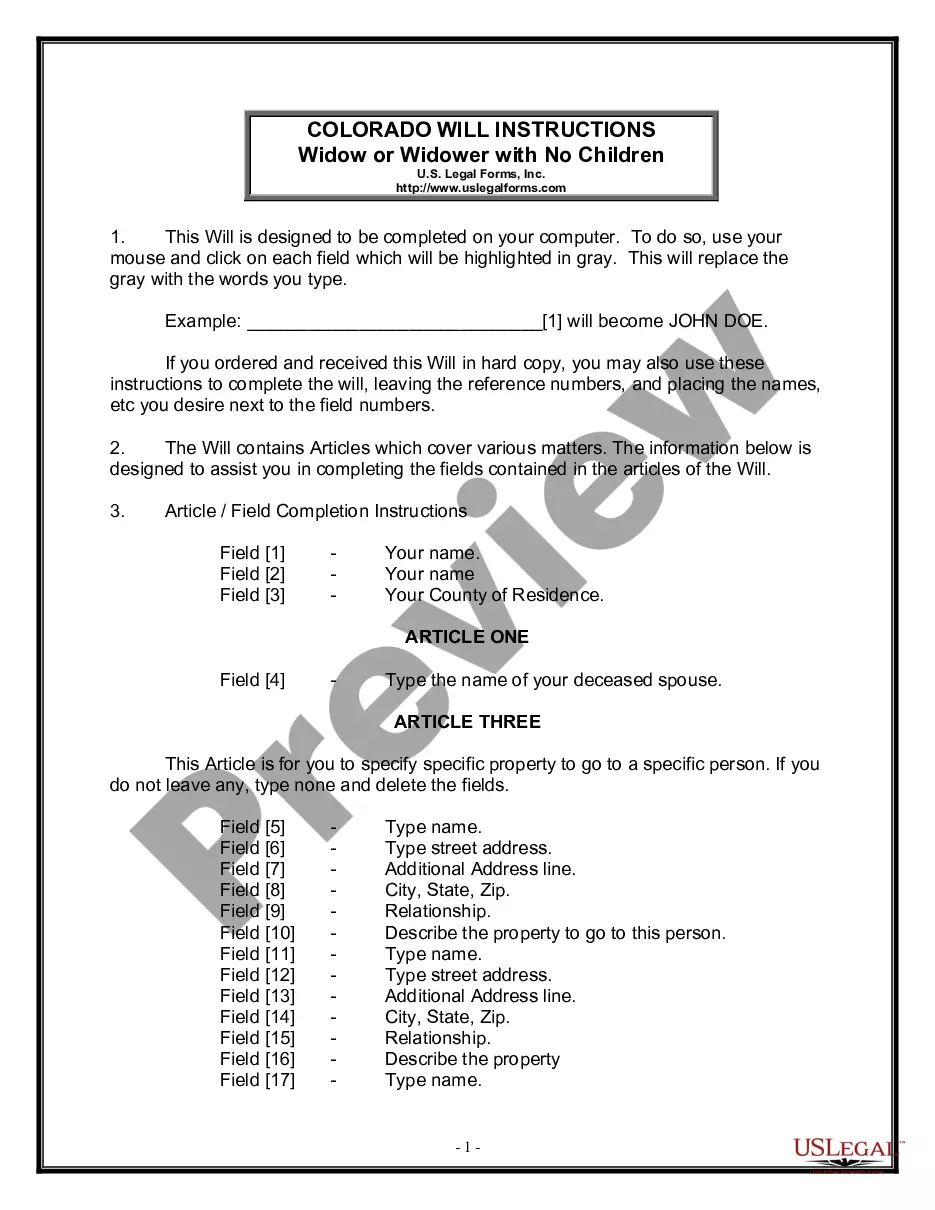

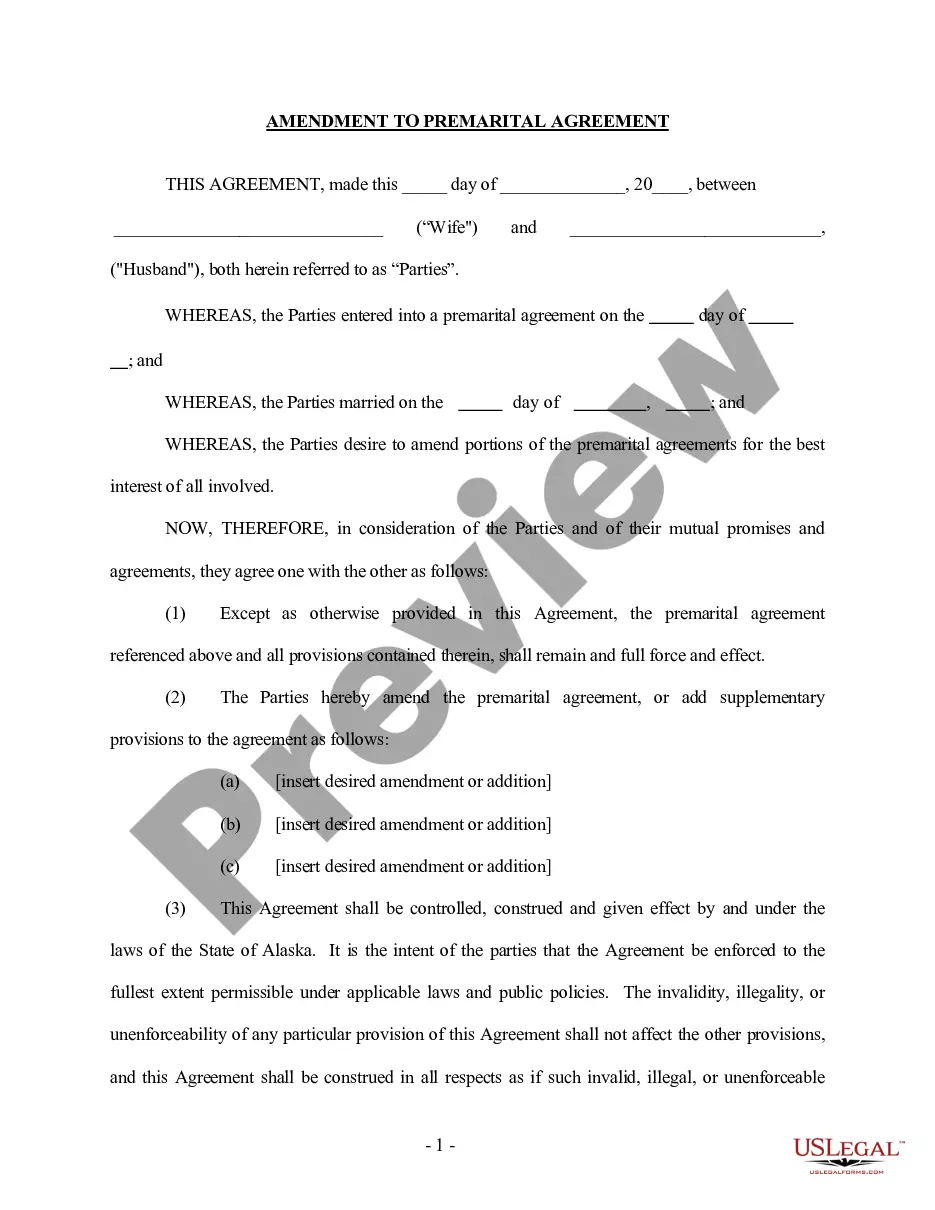

How to fill out Texas Sample Letter For Reinstatement Of Corporation?

Have you been inside a situation where you require papers for either enterprise or personal reasons almost every day? There are plenty of authorized document themes accessible on the Internet, but locating ones you can rely on is not effortless. US Legal Forms offers thousands of kind themes, much like the Texas Sample Letter for Reinstatement of Corporation, that are written to satisfy federal and state requirements.

Should you be currently knowledgeable about US Legal Forms site and possess an account, just log in. Following that, you are able to download the Texas Sample Letter for Reinstatement of Corporation web template.

Unless you have an profile and would like to start using US Legal Forms, abide by these steps:

- Get the kind you require and ensure it is to the proper metropolis/area.

- Use the Preview switch to review the form.

- Read the description to actually have chosen the correct kind.

- In the event the kind is not what you`re searching for, use the Research field to get the kind that fits your needs and requirements.

- Whenever you get the proper kind, click on Buy now.

- Select the rates plan you want, complete the required information and facts to make your account, and pay for the transaction using your PayPal or Visa or Mastercard.

- Pick a handy file file format and download your version.

Locate all of the document themes you might have purchased in the My Forms menu. You may get a further version of Texas Sample Letter for Reinstatement of Corporation at any time, if needed. Just click the essential kind to download or printing the document web template.

Use US Legal Forms, probably the most substantial collection of authorized types, in order to save some time and prevent mistakes. The service offers expertly made authorized document themes that you can use for a range of reasons. Make an account on US Legal Forms and initiate producing your daily life easier.

Form popularity

FAQ

Unless the entity is a nonprofit corporation or cooperative association, the filing fee for reinstatement following a voluntary termination is $15, and the filing fee for reinstatement following an involuntary termination or revocation is $75.

In order to reinstate an entity, the Texas Secretary of State requires evidence that the entity has met certain franchise tax requirements. To provide this evidence, the Comptroller's office issues a Tax Clearance Letter, Form 05-377.

Tax Code § 171.252 which provides, ?[i]f the corporate privileges of a corporation are forfeited under this subchapter?the corporation shall be denied the right to sue or defend in a court of this state.? So far, the motion seems relatively straight forward.

File application for reinstatement with the SOS (Form 801). Filing fee $75. Application for reinstatement must be submitted and signed by an officer, director, or shareholder at the time of forfeiture. No time limit within which to file reinstatement.

The Comptroller is required by law to forfeit a company's right to transact business in Texas if the company has not filed a franchise tax report or paid a franchise tax required under Chapter 171.

How Much Will It Cost To Reinstate? LLC ? The filing fee for reinstating an administratively dissolved LLC in Texas is $75. Expedited service requires an additional $25. Corporation ? An administratively dissolved corporation in Texas has to pay $75 in order to be reinstated.

An entity forfeited under the Tax Code can reinstate at any time (so long as the entity would otherwise continue to exist) by (1) filing the required franchise tax report, (2) paying all franchise taxes, penalties, and interest, and (3) filing an application for reinstatement (Form 801 Word 178kb, PDF 87kb), ...

The form may be mailed to P.O. Box 13697, Austin, Texas 78711-3697; faxed to (512) 463-5709; or delivered to the James Earl Rudder Office Building, 1019 Brazos, Austin, Texas 78701. If a document is transmitted by fax, credit card information must accompany the transmission (Form 807).