The Texas Conveyance of Deed to Lender in Lieu of Foreclosure is a legal process through which a property owner in Texas transfers ownership of their property to the lender in order to avoid a foreclosure. This voluntary transfer of the property title is done by the borrower (also known as the granter) in exchange for the lender (also known as the grantee) agreeing not to proceed with the foreclosure process. In Texas, there are various types of Conveyance of Deed to Lender in Lieu of Foreclosure that can be executed, depending on the specific circumstances of the borrower and the lender. These may include: 1. Traditional Deed in Lieu of Foreclosure: This is the standard form of conveyance where the property owner voluntarily transfers the deed to the lender, absolving themselves of further mortgage obligations. 2. Conditional Deed in Lieu of Foreclosure: This type of conveyance involves certain conditions that must be met by the borrower to complete the transfer. These conditions can include the forgiveness of certain debts, payment of outstanding fees, or other specific terms agreed upon by the parties. 3. Deficiency Waiver Deed in Lieu of Foreclosure: In this scenario, the lender agrees to waive any deficiency balance owed by the borrower after the conveyance of the property. This means that the borrower will not be held responsible for the difference between the outstanding loan balance and the sale price or fair market value of the property. 4. Partial Release Deed in Lieu of Foreclosure: This type of conveyance allows the borrower to transfer ownership of a portion of the property to the lender, typically in exchange for a release of the mortgage lien on the remaining portion of the property. It can be a practical option when a borrower only wants to relinquish a specific part of the property to satisfy their debt. 5. Junior Lien holder Agreement: When a property has multiple liens, a junior lien holder (such as a second mortgage lender) can participate in the conveyance process with the primary lender. This involves negotiations between both lenders to determine how the ownership transfer will affect their respective interests. It is important to note that specific legal requirements and procedures may vary depending on the terms of the mortgage agreement and applicable Texas state laws. Seeking professional legal advice from a qualified real estate attorney is highly recommended navigating the complexities of the Conveyance of Deed to Lender in Lieu of Foreclosure process in Texas.

Texas Conveyance of Deed to Lender in Lieu of Foreclosure

Description

How to fill out Texas Conveyance Of Deed To Lender In Lieu Of Foreclosure?

Are you currently in a position where you will need papers for both business or personal uses just about every working day? There are tons of lawful record web templates available on the net, but getting types you can trust isn`t effortless. US Legal Forms offers thousands of form web templates, just like the Texas Conveyance of Deed to Lender in Lieu of Foreclosure, that happen to be composed in order to meet federal and state needs.

Should you be already familiar with US Legal Forms internet site and get a free account, simply log in. Following that, you can obtain the Texas Conveyance of Deed to Lender in Lieu of Foreclosure format.

If you do not offer an bank account and wish to begin to use US Legal Forms, follow these steps:

- Get the form you will need and make sure it is for your appropriate metropolis/county.

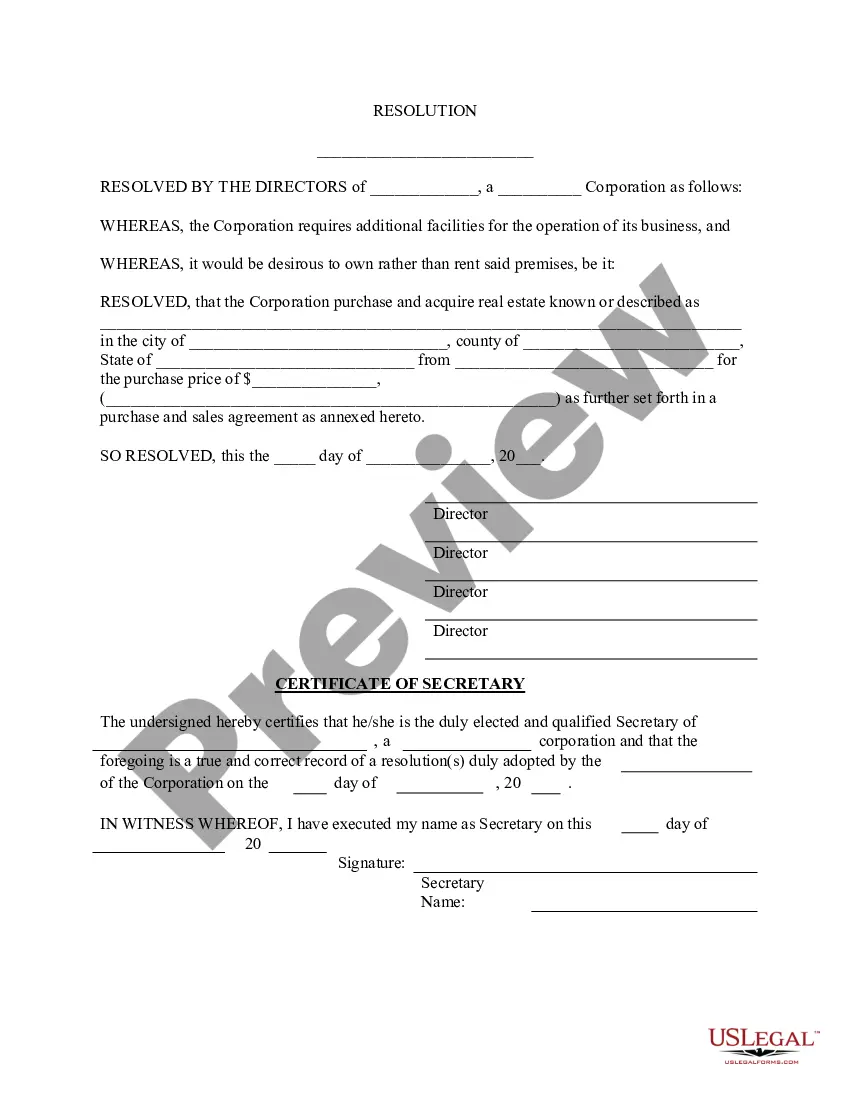

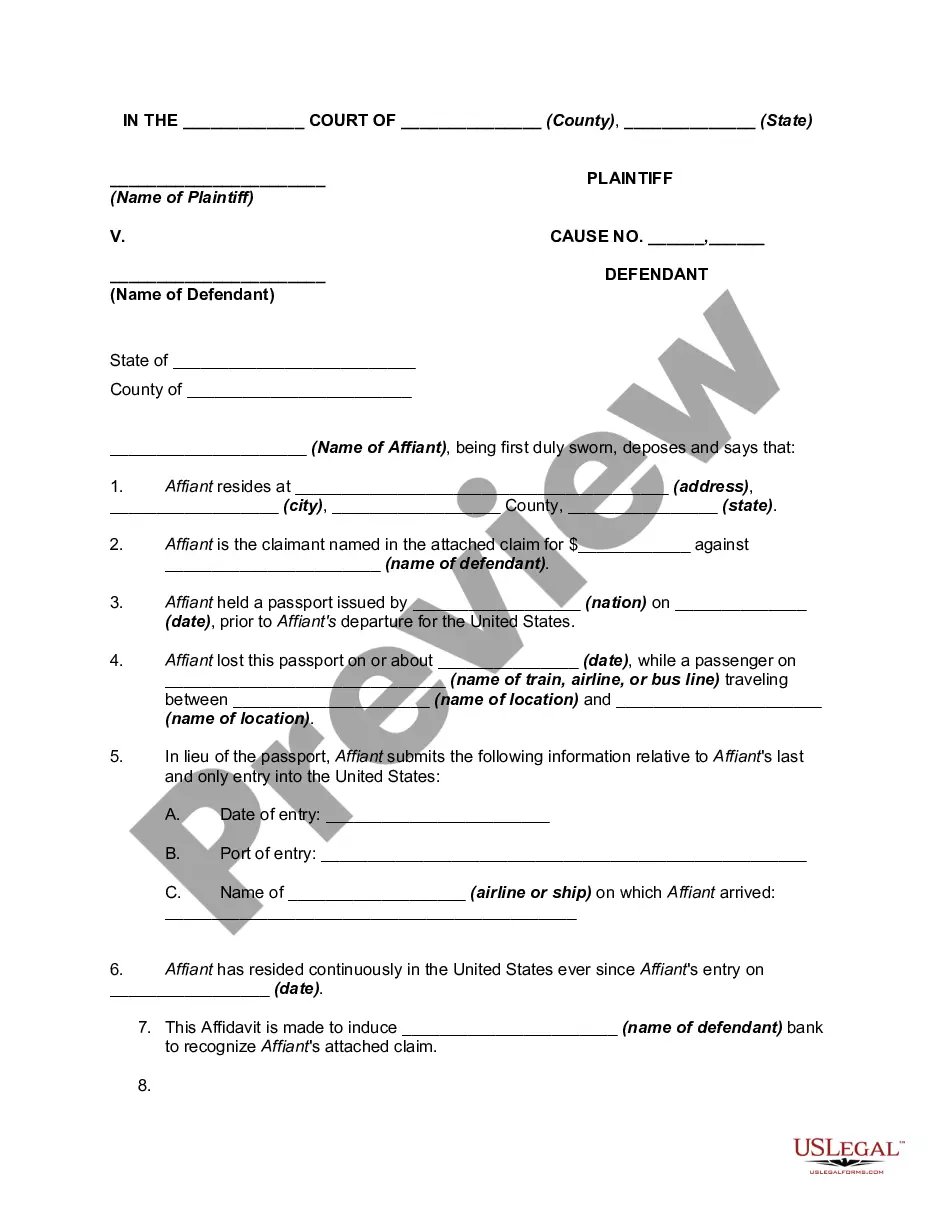

- Take advantage of the Review switch to analyze the form.

- Read the explanation to ensure that you have chosen the correct form.

- In case the form isn`t what you`re searching for, take advantage of the Research field to get the form that fits your needs and needs.

- When you discover the appropriate form, click Acquire now.

- Choose the costs prepare you desire, submit the required information to create your money, and buy an order utilizing your PayPal or Visa or Mastercard.

- Select a practical data file format and obtain your duplicate.

Discover all of the record web templates you may have purchased in the My Forms menus. You can aquire a further duplicate of Texas Conveyance of Deed to Lender in Lieu of Foreclosure any time, if possible. Just click the essential form to obtain or printing the record format.

Use US Legal Forms, probably the most comprehensive assortment of lawful kinds, to save efforts and steer clear of errors. The services offers professionally made lawful record web templates that you can use for a selection of uses. Produce a free account on US Legal Forms and start making your daily life a little easier.

Form popularity

FAQ

The short sale is often preferable to a foreclosure, but it is not a resolution to all a homeowner's financial woes. Aside from potential tax liability and credit implications, if the homeowner is expected to pay the difference between the sale price and the mortgage, that can compound the financial difficulty.

A Deed in Lieu does not clear second (or even third) mortgages, and therefore will not allow the lender to take clear title to the property. (These are sometimes referred to as junior liens.) And if the Deed in Lieu is accepted, the secondary lender may come after you for the deficiency.

Understanding Deed in Lieu of Foreclosure In this process, the mortgagor deeds the collateral property, which is typically the home, back to the lender serving as the mortgagee in exchange for the release of all obligations under the mortgage. Both sides must enter into the agreement voluntarily and in good faith.

Drawbacks Of A Deed In Lieu No guarantee of acceptance: Your lender isn't obligated to accept your deed in lieu of foreclosure. Your credit will still take a hit: While a deed in lieu arrangement won't harm your credit as drastically as a foreclosure, you can still expect your score to drop.

A "deed in lieu" is a transaction in which the homeowner voluntarily transfers title to the property to the bank in exchange for releasing the mortgage (or deed of trust) securing the loan. Unlike with a short sale, one benefit to a deed in lieu is that you don't have to take responsibility for selling your house.

Advantages to a borrower in offering a lieu deed include, first, the release of the borrower and all other persons who may owe payment or the performance of other obligations secured by the mortgage. However, such persons remain liable if they agree to do so contemporaneously with the lieu deed transaction.

Short sale vs foreclosure The lender accepts that it won't recover the full amount of its debt. But accepting the lesser sum is a better option than dealing with the red tape and costs involved with foreclosure and then having to unload the property in a separate transaction.