Title: Understanding the Texas Contract of Sale of Commercial Property with No Broker Involved Keywords: Texas Contract of Sale, Commercial Property, No Broker Involved, Types Introduction: When it comes to selling commercial property in Texas without involving a broker, it is essential to understand the intricacies of the Texas Contract of Sale. This legally binding document outlines the terms and conditions agreed upon by the buyer and seller, ensuring a smooth transaction. In this article, we will explore the key elements of the contract and discuss any possible variations or types that may exist. Key Elements of the Texas Contract of Sale of Commercial Property with No Broker Involved: 1. Legal Identification: The contract commences by accurately identifying the parties involved, including the buyer and seller, along with their corresponding contact details. 2. Property Description: A comprehensive description of the commercial property being sold must be provided, including its legal address, dimensions, and any existing structures or improvements on the premises. 3. Purchase Price and Payment Terms: The agreed-upon purchase price must be clearly stated, along with the payment terms, including the amount due at the time of signing, any down payment, and the schedule for future payments. This section may also include information on contingencies related to financing. 4. Closing and Possession: The contract should outline the expected closing date, the location where it will take place, and the conditions for possession of the property by the buyer. It may also include provisions for the proration of expenses between the buyer and seller, such as property taxes, utilities, and insurance. 5. Representations and Warranties: The contract may include representations and warranties by the seller regarding the property's condition, any pending legal matters, environmental issues, or limitations on the property's use. These provisions protect the buyer's interests by ensuring disclosure of vital information. 6. Title and Survey: The contract may require the seller to provide a title commitment, title insurance, and an updated survey of the property, demonstrating clear ownership and boundaries. 7. Due Diligence and Inspections: The buyer typically has a specific timeframe to conduct inspections, obtain reports, and perform due diligence on the property. Any provisions related to the buyer's rights to terminate the contract based on the findings should be outlined in detail. Types of Texas Contracts of Sale of Commercial Property with No Broker Involved: While there may not be distinct "types" of contracts specific to commercial property sales without broker involvement, variations can arise depending on the unique requirements of each transaction. Some contracts may pertain to: 1. All Cash Transactions: Contracts where the buyer intends to pay the entire purchase price in cash, eliminating the need for financing provisions. 2. Seller Financing: Contracts where the seller agrees to finance part or all of the purchase price, with specific terms and conditions indicated in the contract. 3. Contingency-Based Contracts: Contracts that include contingencies related to obtaining necessary permits, zoning approvals, or other regulatory authorizations before closing the sale. Conclusion: The Texas Contract of Sale of Commercial Property with No Broker Involved is a crucial legal document that ensures transparency and accountability between the buyer and seller. By understanding its key elements and any potential variations, both parties can adhere to the agreement and facilitate a successful commercial property transaction in Texas.

Texas Contract of Sale of Commercial Property with No Broker Involved

Description

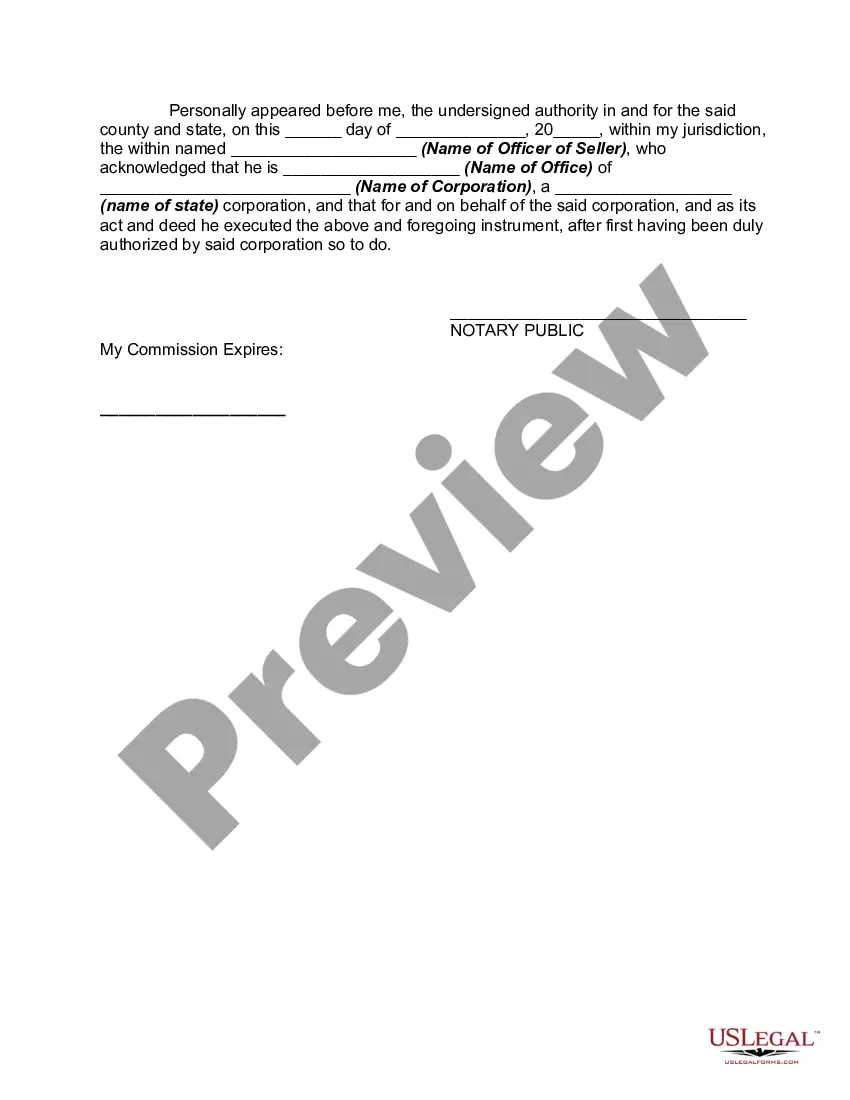

How to fill out Texas Contract Of Sale Of Commercial Property With No Broker Involved?

You are able to spend several hours on the web looking for the legitimate file web template that suits the federal and state needs you need. US Legal Forms offers thousands of legitimate forms that are evaluated by specialists. You can actually acquire or printing the Texas Contract of Sale of Commercial Property with No Broker Involved from your services.

If you already possess a US Legal Forms account, you can log in and click the Down load switch. Afterward, you can full, edit, printing, or indicator the Texas Contract of Sale of Commercial Property with No Broker Involved. Each legitimate file web template you acquire is your own property for a long time. To obtain yet another version of the obtained form, visit the My Forms tab and click the corresponding switch.

If you work with the US Legal Forms internet site the very first time, stick to the straightforward guidelines listed below:

- Initial, be sure that you have chosen the right file web template for that county/metropolis that you pick. Read the form explanation to make sure you have picked the appropriate form. If offered, take advantage of the Preview switch to search with the file web template as well.

- If you want to get yet another version of your form, take advantage of the Search discipline to discover the web template that fits your needs and needs.

- Upon having found the web template you would like, click Get now to continue.

- Select the pricing prepare you would like, type in your accreditations, and register for a free account on US Legal Forms.

- Full the financial transaction. You can use your credit card or PayPal account to purchase the legitimate form.

- Select the file format of your file and acquire it for your product.

- Make modifications for your file if necessary. You are able to full, edit and indicator and printing Texas Contract of Sale of Commercial Property with No Broker Involved.

Down load and printing thousands of file templates using the US Legal Forms Internet site, that offers the biggest collection of legitimate forms. Use skilled and condition-particular templates to take on your organization or person requirements.