Title: A Comprehensive Guide to Texas Sample Letters for Corporate Annual Reports Introduction: Annual reports play a vital role in summarizing a company's performance, financial health, and future prospects. For businesses operating in Texas, it is crucial to adhere to the state's specific guidelines and regulations when preparing a corporate annual report. To simplify this process, Texas provides various types of sample letters that assist corporations in efficiently compiling their reports. In this article, we will explore the different types of Texas sample letters for corporate annual reports and provide a detailed description of each. 1. Texas Sample Letter for Corporate Financial Statements: This type of sample letter focuses on providing an overview of the company's financial performance throughout the year. It includes information about balance sheets, income statements, cash flow statements, and various ratios. The letter is designed to help corporations present their financial data in a clear and concise manner, following the specific formatting and content requirements set by the state of Texas. 2. Texas Sample Letter for Corporate Governance: Corporate governance is a critical aspect of any business operation. The Texas sample letter for corporate governance assists companies in describing their governance structure, including the roles of directors, the composition of the board, and their various committees. It emphasizes transparency, ethical practices, and compliance with state laws and regulations. 3. Texas Sample Letter for Corporate Highlights: This type of sample letter focuses on capturing the company's major achievements, milestones, and strategic initiatives undertaken throughout the year. It provides an opportunity for corporations to showcase their growth, new product launches, market expansions, awards, and other significant accomplishments. The Texas sample letter for corporate highlights helps to effectively communicate the company's progress and success. 4. Texas Sample Letter for Corporate Social Responsibility (CSR): Corporate social responsibility has become increasingly crucial for companies in Texas. This sample letter emphasizes a corporation's commitment to sustainable and responsible business practices, community involvement, philanthropic activities, and environmental stewardship. It allows businesses to showcase their CSR initiatives, partnerships, and ongoing efforts to make a positive impact on society. 5. Texas Sample Letter for Risk Management: Risk management is a key aspect of corporate governance in the modern business landscape. This sample letter assists companies in describing their risk management practices, strategies, and policies. It emphasizes the identification, assessment, and mitigation of potential risks that could impact the company's operations, reputation, or financial stability. Conclusion: Texas provides a range of sample letters tailored to different sections of a corporate annual report. These samples help corporations in Texas adhere to the state's regulations while presenting their financial performance, governance structure, accomplishments, social responsibility, and risk management effectively. By utilizing these Texas sample letters, businesses can ensure their annual reports comply with the required standards and provide clear, transparent, and comprehensive information to stakeholders.

Texas Sample Letter for Corporate Annual Report

Description

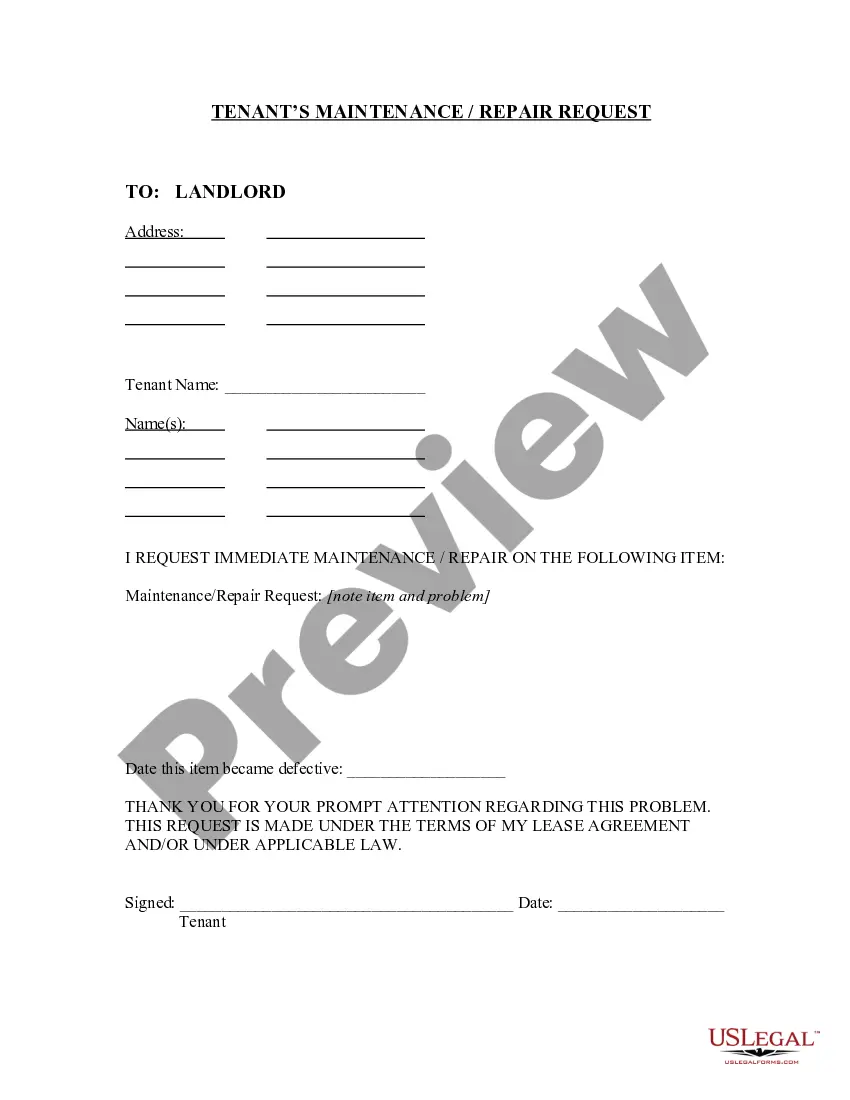

How to fill out Texas Sample Letter For Corporate Annual Report?

Discovering the right legal file web template can be a have difficulties. Naturally, there are plenty of layouts available on the net, but how would you find the legal type you need? Make use of the US Legal Forms site. The services delivers 1000s of layouts, like the Texas Sample Letter for Corporate Annual Report, which can be used for company and personal requirements. Every one of the types are inspected by professionals and meet up with federal and state specifications.

When you are currently registered, log in for your account and then click the Down load button to get the Texas Sample Letter for Corporate Annual Report. Make use of your account to look from the legal types you might have acquired earlier. Check out the My Forms tab of your own account and get yet another version from the file you need.

When you are a brand new customer of US Legal Forms, here are basic recommendations for you to stick to:

- Very first, make sure you have selected the appropriate type for your personal town/county. You can look through the shape making use of the Review button and study the shape explanation to make sure it will be the best for you.

- In case the type will not meet up with your requirements, use the Seach industry to obtain the right type.

- When you are sure that the shape is proper, click on the Buy now button to get the type.

- Opt for the pricing program you need and type in the required information and facts. Build your account and buy your order with your PayPal account or Visa or Mastercard.

- Choose the document format and acquire the legal file web template for your product.

- Comprehensive, edit and print and sign the obtained Texas Sample Letter for Corporate Annual Report.

US Legal Forms is definitely the greatest library of legal types in which you can see numerous file layouts. Make use of the company to acquire professionally-made documents that stick to condition specifications.

Form popularity

FAQ

Texas Corporation Annual Report Requirements: Due: Annually by May 15 in the year following your first filing in Texas. For example, if your organization was incorporated in April of 2022, then your report would be due . Reports may be filed as early as January 1.

Each taxable entity formed in Texas or doing business in Texas must file and pay franchise tax.

Unlike many states, Texas does not require LLCs to file an annual report or biennial report with the Secretary of State or pay an annual fee. Instead of paying these LLC maintenance costs, Texas LLCs must make annual franchise tax reports with the Office of the Comptroller.

A Texas annual report is included when a company files their taxes with the Texas Comptroller of Public Accounts. For example, Texas limited liability companies and corporations must include a Public Information Report when submitting their franchise taxes to the state.

Most states require an annual report, also called a periodic report, statement of information, or annual registration. However, there are exceptions. For example, Arizona doesn't require an LLC annual report, and if you formed your company in Indiana, you only need to send the report every two years.

In the state of Texas, there is no annual report. Instead, there is a Texas Franchise Tax. This is levied annually by the Texas Comptroller on all taxable entities that do business in Texas. It is calculated in a few different ways and paid on May 15 each year.