Texas Assignment of Rents by Lessor is a legal document that grants the lessor the right to collect and receive rental payments from a property owned by the lessee. In simpler terms, it allows the lessor to gain control over the rental income generated by leased property. This assignment plays a crucial role in commercial real estate transactions, providing security to the lessor in case of default by the lessee. With the Texas Assignment of Rents by Lessor, the lessor can have peace of mind knowing that they have a means to recover their investment and continue to receive income even if the lessee fails to meet their payment obligations. By having an Assignment of Rents provision in the lease agreement, the lessor is granted a security interest in the rental income, essentially making them the beneficiary of any rental payments made by tenants. This type of assignment is especially common in commercial leases where the property generates substantial income. By having the right to collect rents, the lessor can ensure a consistent cash flow, making it easier to cover mortgage payments, property maintenance costs, and other associated expenses. There are a few different types of Texas Assignment of Rents by Lessor that can be utilized depending on the specific situation and the agreement between the lessor and lessee: 1. Absolute Assignment of Rents: This type grants the lessor complete control and ownership of all rents generated from the leased property. The lessor has the right to immediately collect and use the rental income as they see fit. 2. Conditional Assignment of Rents: In this scenario, the lessor has the right to collect the rental income only if certain conditions are met. This can involve the lessee defaulting on rent payments or breaching certain lease terms. Until the conditions are fulfilled, the lessee retains the right to collect rents. 3. Assignment of Rents as Additional Security: With this type of assignment, the rental income acts as an additional security for the lessor. It helps protect the value of the property in case of default by the lessee. In the event of default, the lessor gains the right to collect rents to help offset any losses incurred. In conclusion, Texas Assignment of Rents by Lessor is a crucial legal provision in commercial real estate leases, giving the lessor control over rental income. It ensures the lessor continues to receive income even if the lessee fails to fulfill their payment obligations. Different types of assignments exist, including absolute assignments, conditional assignments, and assignments as additional security, each with its own set of conditions and implications.

Texas Assignment of Rents by Lessor

Description

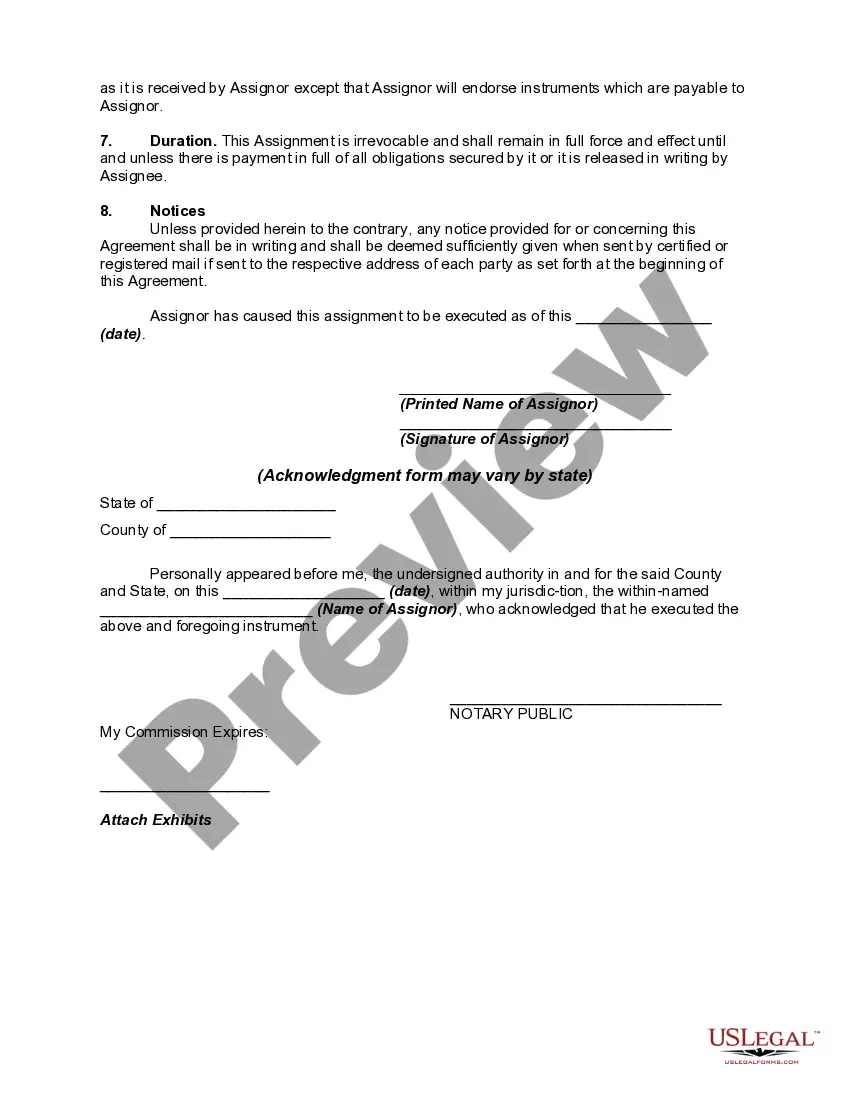

How to fill out Texas Assignment Of Rents By Lessor?

Choosing the right legitimate file template could be a have a problem. Obviously, there are a lot of themes available on the net, but how can you find the legitimate kind you want? Make use of the US Legal Forms web site. The support gives a large number of themes, for example the Texas Assignment of Rents by Lessor, that you can use for organization and personal needs. Every one of the varieties are inspected by experts and satisfy state and federal specifications.

When you are previously registered, log in to the bank account and click on the Download option to have the Texas Assignment of Rents by Lessor. Make use of your bank account to appear with the legitimate varieties you might have bought formerly. Proceed to the My Forms tab of your own bank account and obtain an additional copy from the file you want.

When you are a brand new customer of US Legal Forms, allow me to share easy recommendations that you should adhere to:

- First, make sure you have selected the right kind to your city/area. You can look through the form using the Preview option and look at the form information to guarantee it will be the right one for you.

- If the kind fails to satisfy your needs, use the Seach field to get the correct kind.

- Once you are certain that the form is acceptable, go through the Acquire now option to have the kind.

- Opt for the prices prepare you would like and type in the essential details. Design your bank account and pay money for an order utilizing your PayPal bank account or Visa or Mastercard.

- Pick the file file format and obtain the legitimate file template to the device.

- Complete, revise and produce and indication the obtained Texas Assignment of Rents by Lessor.

US Legal Forms may be the biggest collection of legitimate varieties in which you can discover different file themes. Make use of the service to obtain expertly-created paperwork that adhere to status specifications.