Title: Understanding Texas Charge Account Terms and Conditions: A Comprehensive Guide Introduction: Texas Charge Account Terms and Conditions provide a set of guidelines and obligations that regulate credit-based transactions in Texas. These terms outline the rights and responsibilities of both the creditor and the account holder. This article aims to delve into the details of Texas Charge Account Terms and Conditions, presenting an overview of its importance, key elements, and potential variations. 1. Terms and Conditions Explained: Texas Charge Account Terms and Conditions are legal agreements governing credit lines between the consumer (account holder) and the creditor (usually a financial institution or retailer). It provides the framework for the account's operation, usage, interest rates, payment terms, fees, and penalties, ensuring a transparent and fair relationship between the parties involved. 2. Key Elements of Texas Charge Account Terms and Conditions: — Credit Limit: Specifies the maximum amount the account holder can borrow. — Annual Percentage Rate (APR): A variable or fixed interest rate charged on outstanding balances. — Minimum Payment: The minimum amount due each billing cycle. — Late Payment Fee: The penalty imposed for missed or delayed payments. — Grace Period: The duration within which an account holder can make payments without incurring interest charges. — Billing Cycle: The timeframe during which transactions are recorded, and statements are generated. Over limitit Fee: A penalty imposed when the account balance exceeds the credit limit. — Fraud Protection: Information on liability limits for unauthorized transactions. 3. Types of Texas Charge Account Terms and Conditions: While specific terms and conditions may vary between financial institutions and retailers, some common variations include: — Personal Credit Card Account Terms and Conditions — Business Credit Card Account Terms and Conditions — Retail Store Credit Account Terms and Conditions — Online Store Credit Account Terms and Conditions — Installment Loan Account Terms and Conditions 4. Importance of Understanding Texas Charge Account Terms and Conditions: Comprehending the terms and conditions of a charge account is vital for consumers to avoid any potential pitfalls or misunderstandings. By reviewing and understanding these terms, account holders can make informed financial decisions, avoid unnecessary fees, maximize benefits, and effectively manage their credit. Knowledge of the terms and conditions also enables customers to assert their rights and seek appropriate remedies in case of any discrepancies. Conclusion: Texas Charge Account Terms and Conditions provide the foundation for a mutually beneficial relationship between creditors and account holders. Familiarizing oneself with these terms helps consumers make informed decisions and avoid potential challenges. Understanding the key elements and variations of these terms is crucial for achieving financial responsibility and utilizing the charge account to its fullest potential.

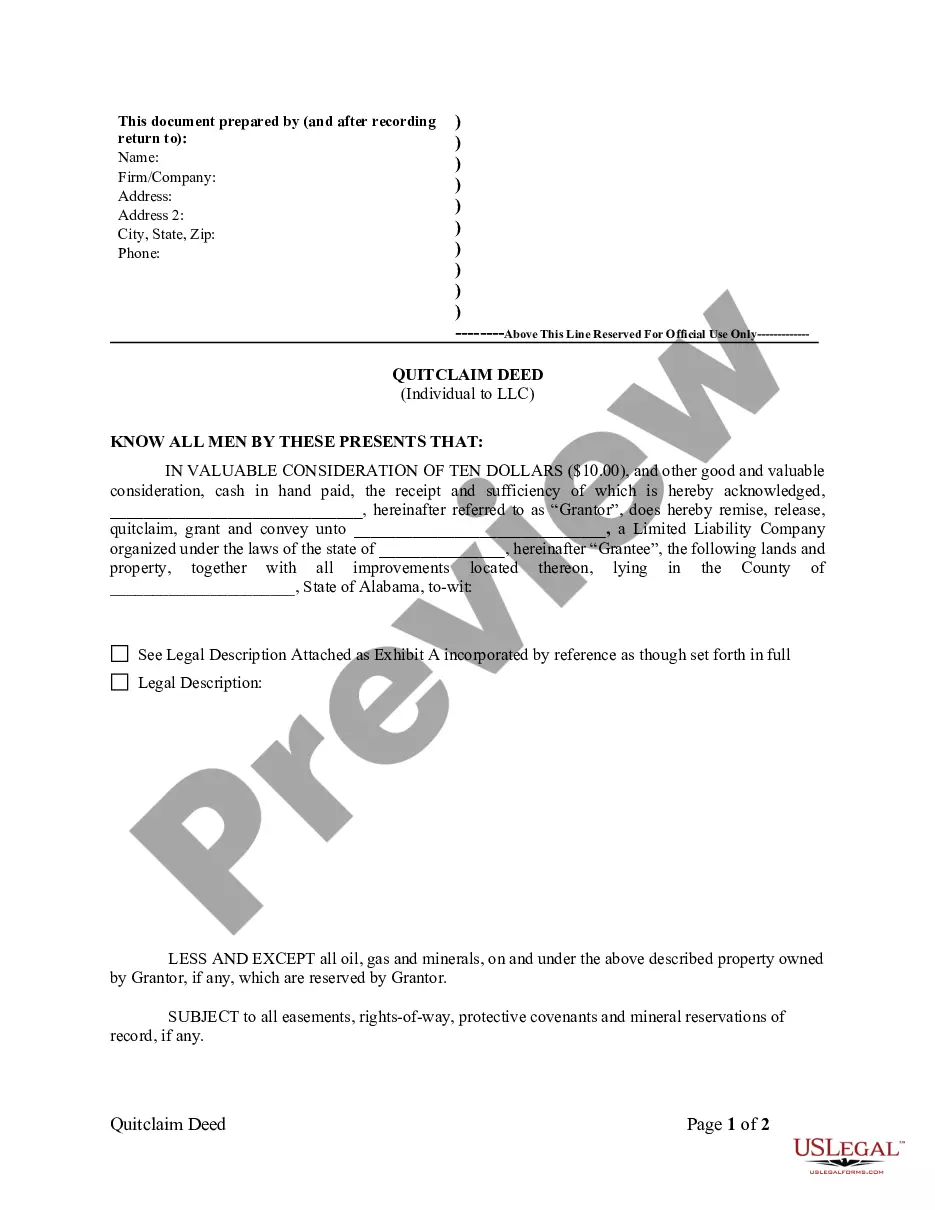

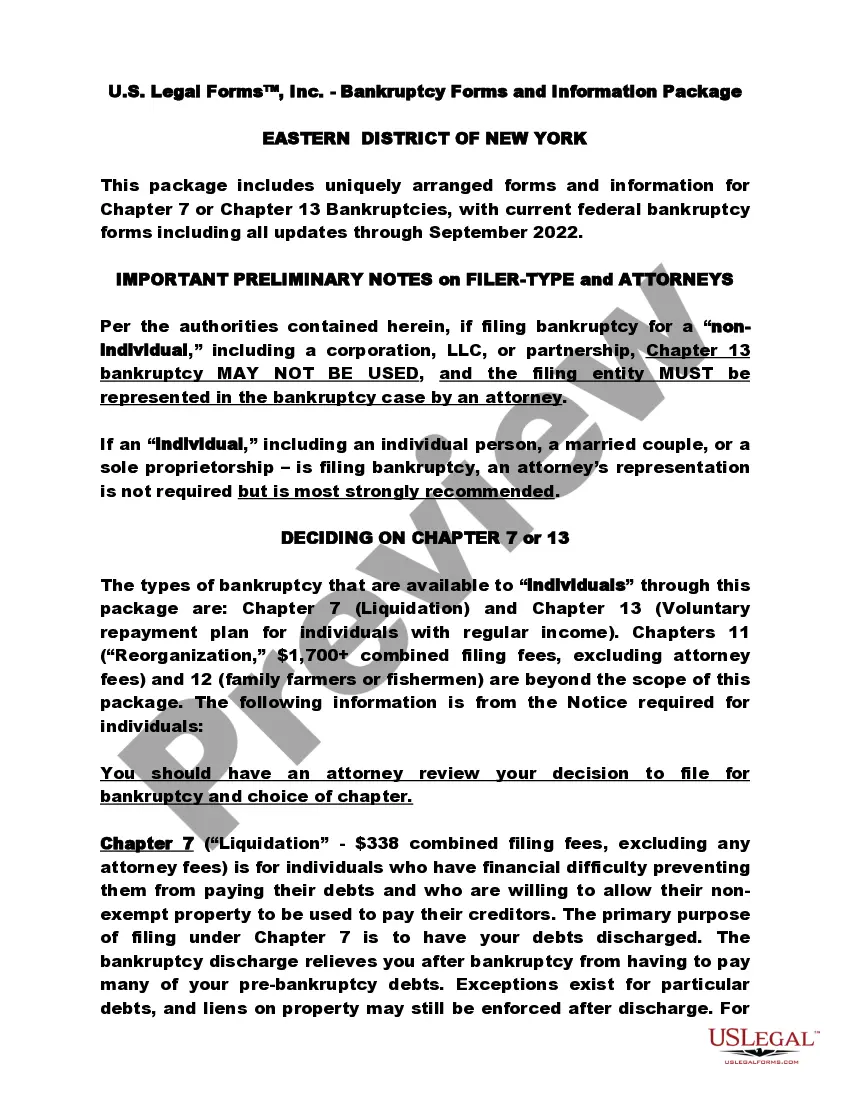

Texas Charge Account Terms and Conditions

Description

How to fill out Texas Charge Account Terms And Conditions?

Choosing the right authorized file template could be a struggle. Naturally, there are plenty of templates available online, but how can you get the authorized kind you need? Take advantage of the US Legal Forms web site. The support provides thousands of templates, such as the Texas Charge Account Terms and Conditions, which can be used for business and personal demands. Every one of the forms are inspected by pros and meet federal and state requirements.

When you are previously listed, log in to your accounts and then click the Download option to find the Texas Charge Account Terms and Conditions. Utilize your accounts to check from the authorized forms you might have acquired earlier. Go to the My Forms tab of your respective accounts and obtain another copy in the file you need.

When you are a fresh consumer of US Legal Forms, here are easy guidelines so that you can stick to:

- Initial, make certain you have chosen the appropriate kind for the town/county. You may check out the shape while using Preview option and browse the shape description to make sure it will be the right one for you.

- When the kind does not meet your expectations, take advantage of the Seach area to discover the right kind.

- Once you are positive that the shape is acceptable, go through the Get now option to find the kind.

- Select the costs prepare you need and enter in the necessary information. Make your accounts and pay money for the transaction with your PayPal accounts or charge card.

- Pick the file structure and down load the authorized file template to your device.

- Comprehensive, change and printing and indicator the acquired Texas Charge Account Terms and Conditions.

US Legal Forms is the largest collection of authorized forms for which you can find a variety of file templates. Take advantage of the company to down load appropriately-manufactured documents that stick to express requirements.