The Texas Cash Disbursements Journal is an essential financial record used by businesses in Texas to track and document all outgoing cash payments made during a specific period. It serves as a detailed register of all disbursements, providing a comprehensive summary of expenses incurred by a company. This accounting document is crucial for accurately recording financial transactions, maintaining financial transparency, and ensuring compliance with state regulations. It enables businesses to keep track of their cash flow and manage their expenses efficiently. The Texas Cash Disbursements Journal typically includes various relevant details for each transaction. These details may consist of the date, check number (if applicable), payee's name, purpose of payment, and the amount disbursed. The purpose of payment might include various expense categories such as rent, utilities, supplier payments, employee salaries, office supplies, maintenance costs, etc. Companies may also choose to categorize their disbursements further by creating separate journals, such as the Texas Payroll Disbursements Journal and Texas Accounts Payable Disbursements Journal. The Texas Payroll Disbursements Journal specifically focuses on documenting payments related to employee salaries, wages, benefits, and payroll taxes. It assists businesses in ensuring accurate payroll processing, calculating tax obligations, and maintaining thorough records of all compensation-related transactions. On the other hand, the Texas Accounts Payable Disbursements Journal primarily focuses on recording disbursements made to suppliers, vendors, and service providers. This journal tracks expenses related to inventory purchases, raw materials, utilities, contract services, and other business-related obligations. By maintaining separate journals for different types of disbursements, businesses can streamline their accounting processes, enhance accuracy, and organize financial information in a more structured manner. Overall, the Texas Cash Disbursements Journal, along with its respective payroll and accounts payable counterparts, plays a vital role in Texas businesses' financial management. It facilitates diligent record-keeping, expense tracking, and compliance with state regulations, ultimately contributing to a transparent and efficient financial system.

Texas Cash Disbursements Journal

Description

How to fill out Texas Cash Disbursements Journal?

US Legal Forms - one of many largest libraries of authorized varieties in the USA - offers a wide range of authorized document web templates it is possible to obtain or print. While using website, you may get a large number of varieties for company and individual purposes, categorized by categories, states, or keywords.You can find the most up-to-date versions of varieties just like the Texas Cash Disbursements Journal within minutes.

If you already have a membership, log in and obtain Texas Cash Disbursements Journal from the US Legal Forms library. The Down load key will appear on each and every type you look at. You have access to all previously downloaded varieties from the My Forms tab of your respective account.

If you wish to use US Legal Forms initially, listed here are easy instructions to get you started out:

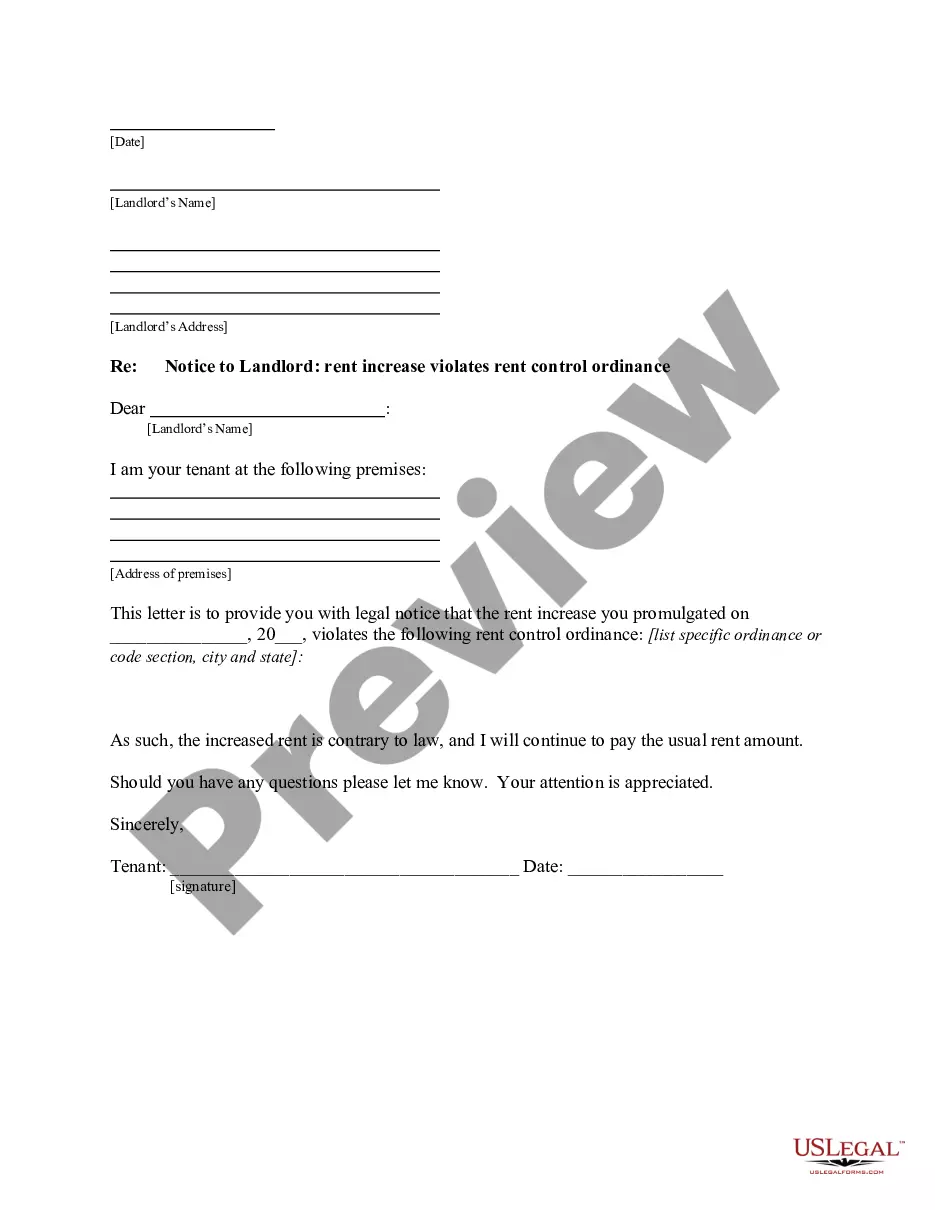

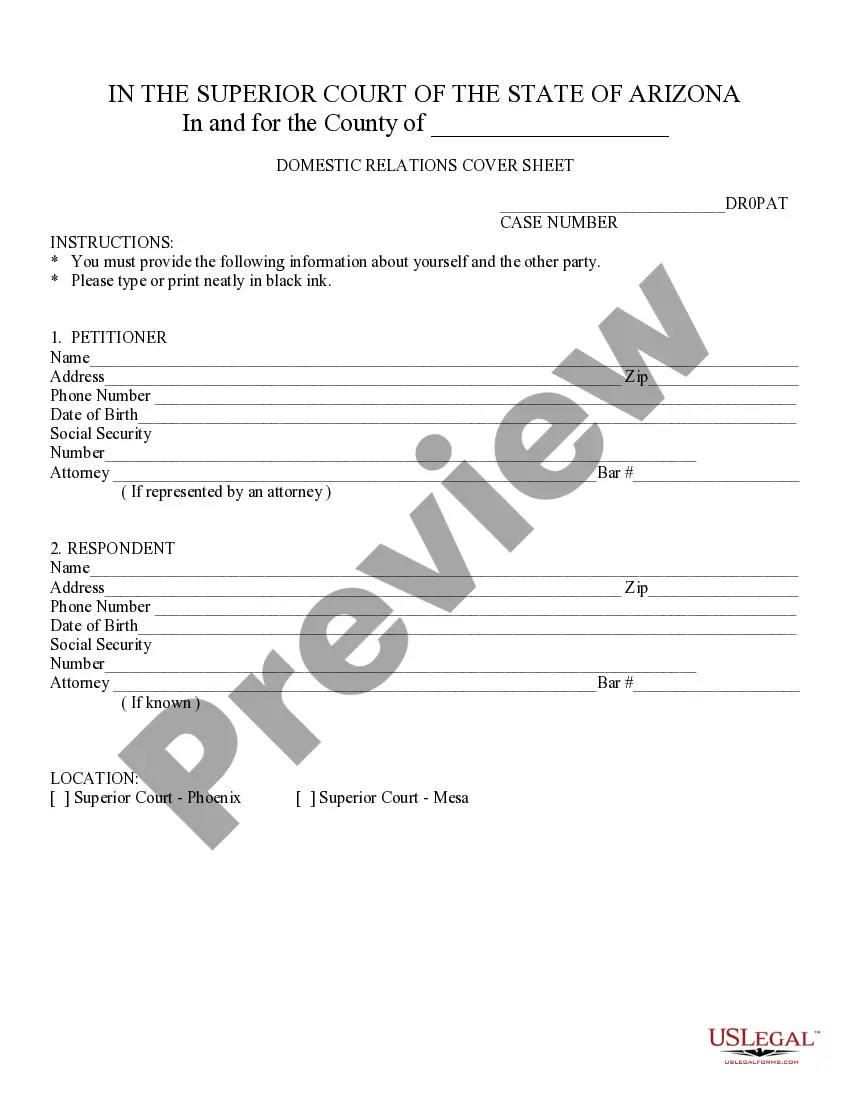

- Ensure you have picked the best type to your town/area. Select the Preview key to analyze the form`s information. Browse the type information to actually have selected the proper type.

- If the type doesn`t fit your demands, make use of the Research industry at the top of the monitor to obtain the one which does.

- In case you are satisfied with the shape, verify your choice by visiting the Get now key. Then, choose the pricing strategy you prefer and give your accreditations to register for the account.

- Process the deal. Use your credit card or PayPal account to complete the deal.

- Choose the formatting and obtain the shape on your own gadget.

- Make modifications. Complete, revise and print and indicator the downloaded Texas Cash Disbursements Journal.

Every single design you put into your money does not have an expiry day and is the one you have forever. So, if you wish to obtain or print another backup, just check out the My Forms portion and click about the type you require.

Obtain access to the Texas Cash Disbursements Journal with US Legal Forms, the most extensive library of authorized document web templates. Use a large number of skilled and status-distinct web templates that meet up with your small business or individual requirements and demands.

Form popularity

FAQ

A cash disbursements journal is summarized at the end of the period, usually a month. The total cash outflow is then posted to the general ledger, along with the total cash inflow (which can be derived from the cash receipts journal).

A cash disbursements journal is summarized at the end of the period, usually a month. The total cash outflow is then posted to the general ledger, along with the total cash inflow (which can be derived from the cash receipts journal).

The cash disbursements journal (or cash payments journal) is an accounting form used to record all cash outflows. Some examples of outflows are accounts payable, materials payable, and operating expenses, as well as all cash purchases and disbursements to a petty cash fund.

For example, cash disbursed to pay bills is credited to the Cash account (which goes down in value) and is debited to the account from which the bill or loan is paid, such as Accounts Payable.

Key Takeaways. A cash disbursement journal is a record of a company's internal accounts that itemizes all financial expenditures made with cash or cash equivalents. A cash disbursement journal is done before payments are posted to the general ledger and is used in creating a general ledger.

A cash disbursement journal is a method of recording all cash flows for your business. Many entrepreneurs start out their small business spending and receiving cash payments. Unlike credit card payments, there is not an automatic system recording each transaction.

Create a Cash Disbursements Journal reportFrom the QuickBooks Reports menu, select Custom Reports then click Transaction Detail.Enter the appropriate date range.In the Columns box, check off the following columns:Click the Total by drop-down and select an appropriate criteria like Payee, Account or Month.More items...

A cash disbursement journal is done before payments are posted to the general ledger and is used in creating a general ledger. The information included in a cash disbursement journal is the disbursement amount, the check number, the transaction type, the payee, and any other pertinent information.

In accounting terms, a disbursement, also called a cash disbursement or cash payment, refers to a wide range of payment types made in a specific period, including interest payments on loans and operating expenses. It can refer to cash payments, electronic fund transfers, checks and other forms of payment.

An entry for a disbursement includes the date, the payee name, the amount debited or credited, the payment method, and the purpose of the payment. The overall cash balance of the business is then adjusted to account for the disbursement.