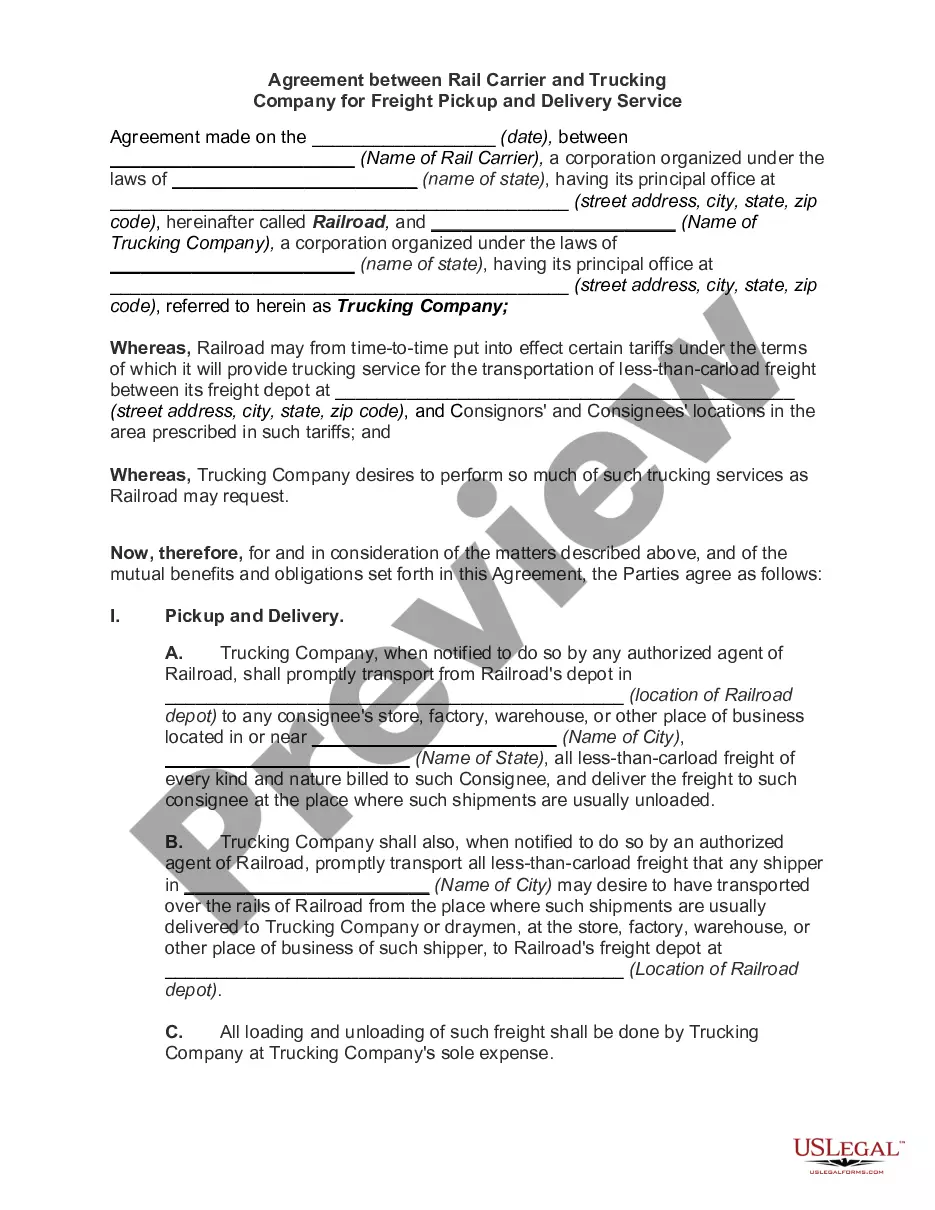

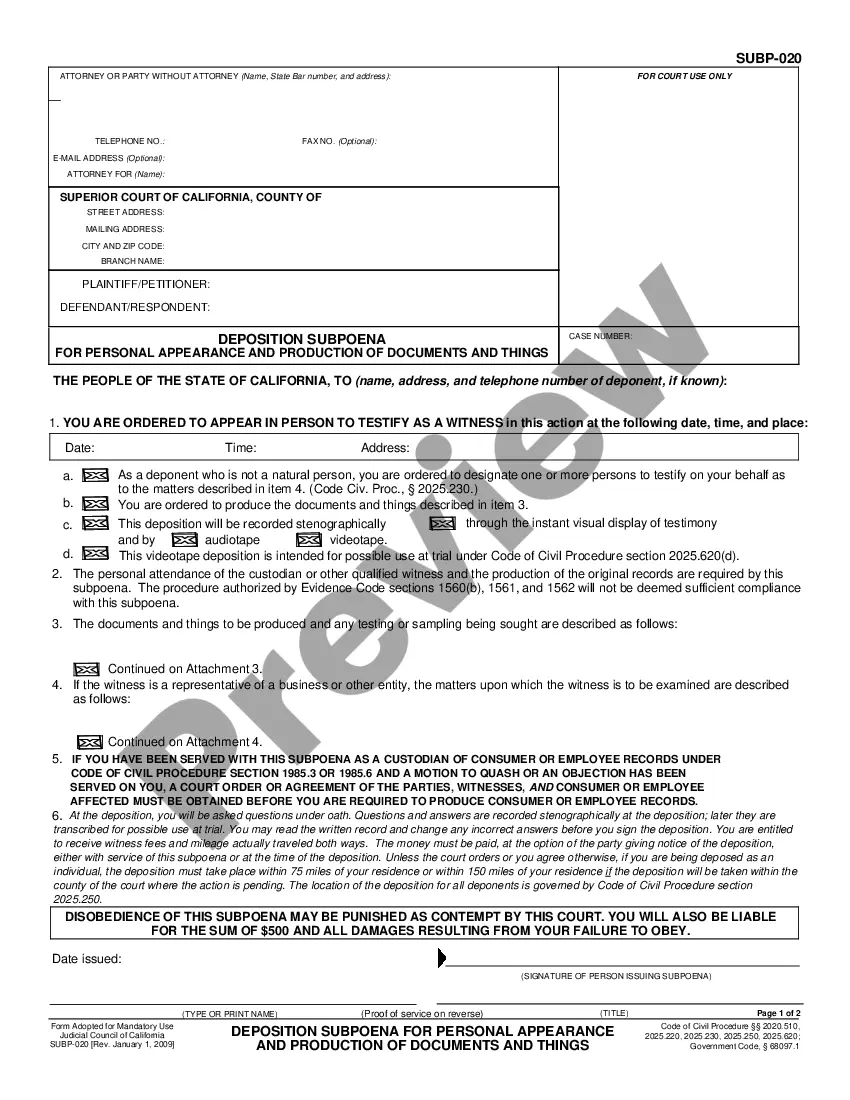

A Texas Consultant Agreement with Sharing of Software Revenues is a legally binding contract entered into between a software consultant and a client in the state of Texas. This agreement outlines the specific terms and conditions under which the consultant provides their services and receives a portion of the software revenues generated as a result of their work. The primary objective of this agreement is to ensure that both parties involved have a clear understanding of their rights, responsibilities, and the revenue-sharing arrangement. By defining these terms, the agreement aims to protect the interests of the consultant and the client, fostering a mutually beneficial professional relationship. Key elements included in a Texas Consultant Agreement with Sharing of Software Revenues are as follows: 1. Parties and Effective Date: This section identifies the consultant and client, along with their contact information and the date the agreement becomes effective. 2. Scope of Work: This portion outlines in detail the specific services to be provided by the consultant. It delineates the tasks, milestones, and deliverables to be achieved throughout the engagement. 3. Compensation and Revenue Sharing: The agreement specifies how the consultant is to be compensated for their services and the distribution of software revenues. It may include details such as base compensation, percentage of revenues, payment terms, and frequency. 4. Intellectual Property Rights: This section clarifies ownership and usage rights of the software developed during the engagement. It ensures that the client retains the rights to the software, while the consultant may have limited usage rights for portfolio purposes. 5. Confidentiality: Confidentiality clauses protect sensitive information shared between the parties during the engagement. It establishes the consultant's obligation to maintain confidentiality and protects the client's proprietary information. 6. Termination: The agreement defines the conditions under which either party may terminate the agreement, including breach of contract, non-performance, or completion of services. Types of Texas Consultant Agreement with Sharing of Software Revenues: 1. Fixed Revenue Share Agreement: In this type of agreement, the consultant receives a predetermined percentage of the software revenues generated, regardless of the overall revenue amount. 2. Sliding Scale Revenue Share Agreement: This agreement involves a variable percentage of revenue sharing, depending on the total software revenue achieved. As the revenue increases, the consultant receives a higher percentage of the generated revenues. 3. Time-Based Revenue Share Agreement: This type of agreement involves revenue sharing for a specified timeframe. The consultant receives a percentage of the software revenue during the contract period, typically until a specific milestone or goal is achieved. In conclusion, a Texas Consultant Agreement with Sharing of Software Revenues is a comprehensive legal document that outlines the terms, compensation, and revenue-sharing arrangement between a software consultant and a client. It provides a framework for a productive, transparent, and mutually beneficial business relationship while protecting the interests of both parties involved.

Texas Consultant Agreement with Sharing of Software Revenues

Description

How to fill out Texas Consultant Agreement With Sharing Of Software Revenues?

You are able to commit several hours on the web attempting to find the legal file web template that suits the state and federal requirements you require. US Legal Forms supplies thousands of legal forms which can be examined by professionals. It is simple to acquire or print out the Texas Consultant Agreement with Sharing of Software Revenues from the service.

If you have a US Legal Forms account, you may log in and then click the Download switch. After that, you may complete, change, print out, or indication the Texas Consultant Agreement with Sharing of Software Revenues. Each legal file web template you buy is your own property eternally. To get one more copy of the acquired form, proceed to the My Forms tab and then click the corresponding switch.

If you are using the US Legal Forms web site for the first time, follow the easy instructions below:

- Initially, ensure that you have selected the best file web template for the state/town of your choosing. Look at the form information to ensure you have picked the proper form. If readily available, take advantage of the Review switch to check throughout the file web template as well.

- In order to discover one more edition from the form, take advantage of the Look for industry to get the web template that suits you and requirements.

- When you have found the web template you would like, click Purchase now to carry on.

- Select the pricing plan you would like, type in your accreditations, and register for your account on US Legal Forms.

- Full the deal. You may use your bank card or PayPal account to fund the legal form.

- Select the structure from the file and acquire it in your gadget.

- Make changes in your file if possible. You are able to complete, change and indication and print out Texas Consultant Agreement with Sharing of Software Revenues.

Download and print out thousands of file web templates utilizing the US Legal Forms Internet site, which offers the biggest variety of legal forms. Use skilled and express-certain web templates to deal with your business or personal needs.