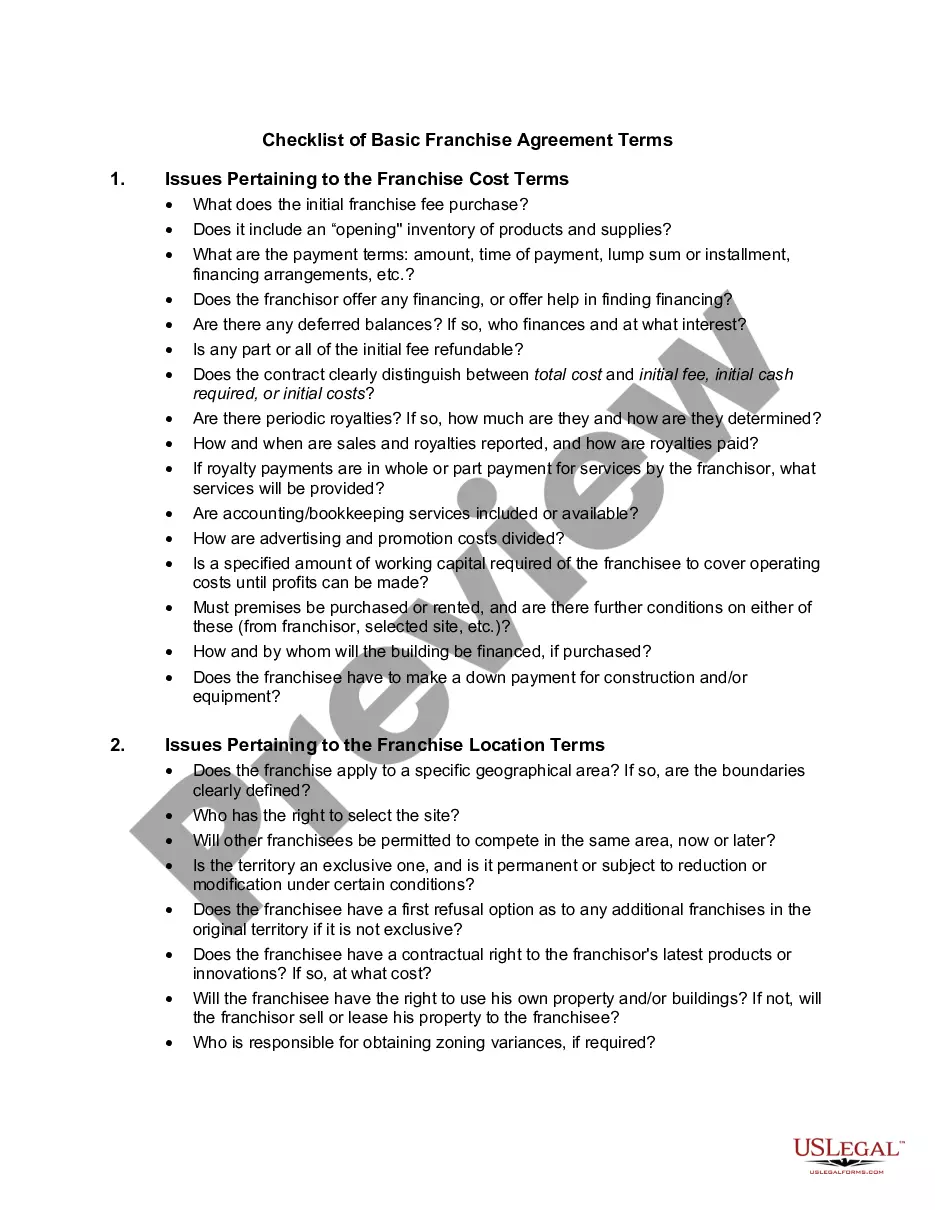

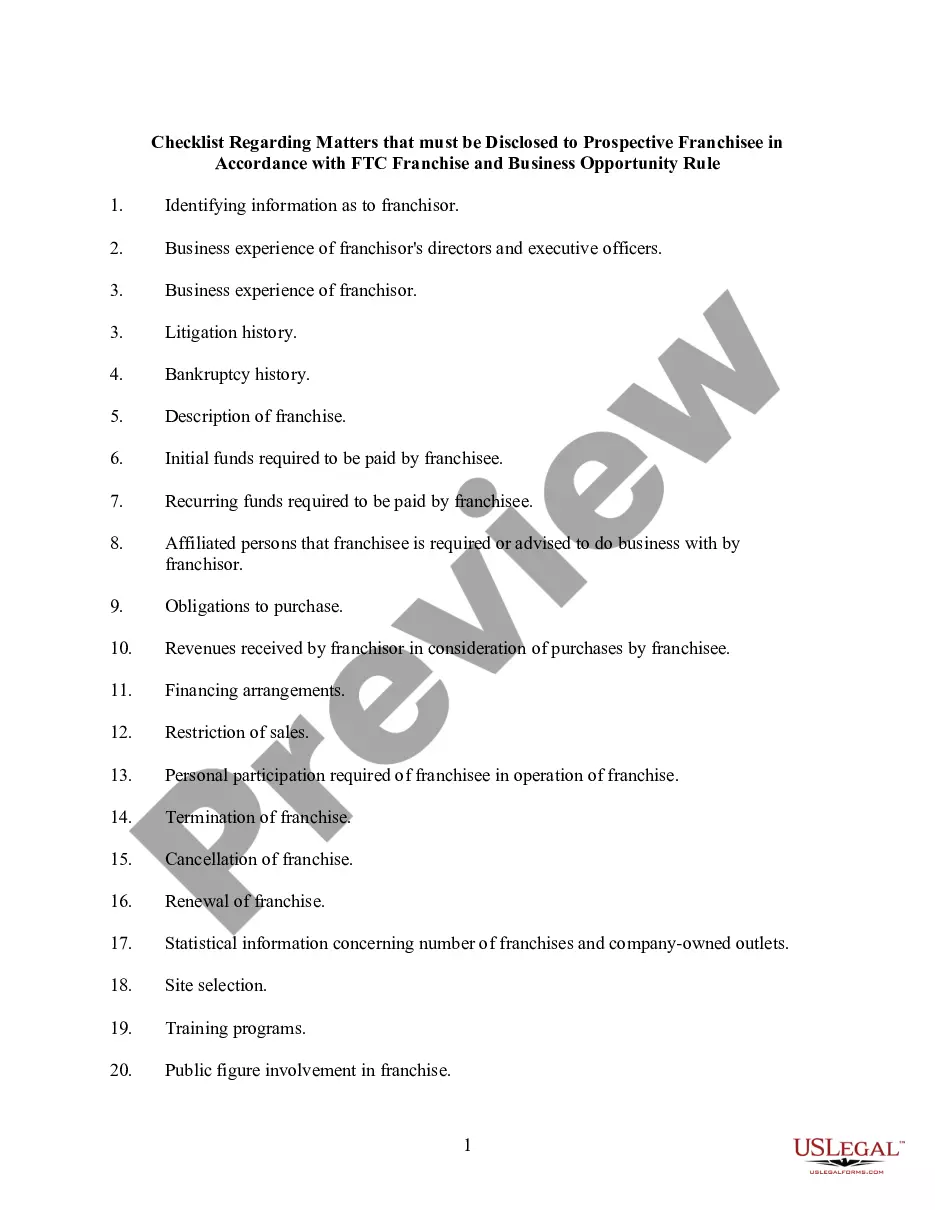

A franchise or business opportunity seller must give the prospective buyer a detailed disclosure document at least ten (10) business days before the buyer pays any money or legally commit himself to a purchase. The disclosure document includes:

" Names, addresses, and telephone numbers of at least 10 previous purchasers who live closest to the buyer;

" A fully audited financial statement of the seller;

" Background and experience of the business's key executives;

" Cost of starting and maintaining the business; and

" The responsibilities buyer and the seller will have to each other once the buyer has invested in the opportunity.

Franchise sellers also must tell a prospective buyer in writing the number and percentage of owners who have failed.