A Texas Invoice Template for Translator is a pre-designed document specifically tailored for translators working within the jurisdiction of Texas, United States. It serves as a professional and legal instrument to ensure accurate and prompt payment for translation services rendered by translators operating in Texas. This invoice template incorporates key elements required for a comprehensive and well-structured invoice, facilitating seamless financial transactions between translators and their clients. The Texas Invoice Template for Translator typically includes the following essential components: 1. Header: The template starts with a header section that includes the translator's contact information, such as name, address, phone number, and email address. Additionally, the translator may include their business logo or a professional image in this section. 2. Invoice Number and Date: Each invoice generated by the translator is assigned a unique invoice number and accompanied by the invoice date, enabling easy identification and record-keeping. 3. Client Information: This section captures the client's details, including their name or company name, address, and contact information. It is crucial to have accurate client information to facilitate communication and payment processing. 4. Services Provided: The invoice template features a detailed description of the services provided by the translator. It may include specifications such as language pairs, word count, hourly rate, project duration, and any additional charges or discounts agreed upon. 5. Breakdown of Charges: The Texas Invoice Template for Translator provides a breakdown of charges to ensure transparency and clarity. This section may include the cost per word, hourly rate if applicable, and any other cost components related to the translation service. 6. Total Amount Due: The total amount due is prominently displayed, summing up all the charges and providing a clear figure that the client needs to pay. 7. Payment Terms: The template outlines the payment terms agreed upon between the translator and the client, specifying the due date and accepted payment methods. It may also include information about late payment penalties or early payment discounts if such terms have been established. 8. Tax Information: If applicable, the Texas Invoice Template for Translator may include information about any applicable taxes, such as state sales tax or local tax regulations. It is important to consult relevant tax authorities or professionals for accurate tax reporting. Different types of Texas Invoice Templates for Translators may include variations in design, format, or additional sections tailored to specific translation specialties or preferences. Common variations may include invoicing templates for legal translators, medical translators, technical translators, or general translators. These template variations often feature predefined sections or terminology relevant to their respective fields, catering to specific industry requirements. In conclusion, a Texas Invoice Template for Translator is a customized document that streamlines the invoicing process for translators working in Texas. It ensures professionalism, accuracy, and compliance with local guidelines while simplifying payment processing and record-keeping for both the translator and the client.

Texas Invoice Template for Translator

Description

How to fill out Texas Invoice Template For Translator?

If you want to total, download, or print out lawful document themes, use US Legal Forms, the biggest collection of lawful varieties, that can be found on-line. Take advantage of the site`s basic and convenient lookup to obtain the papers you need. A variety of themes for enterprise and specific reasons are categorized by types and suggests, or keywords. Use US Legal Forms to obtain the Texas Invoice Template for Translator with a few mouse clicks.

In case you are already a US Legal Forms client, log in for your bank account and click the Acquire button to get the Texas Invoice Template for Translator. You may also access varieties you previously acquired within the My Forms tab of your bank account.

If you use US Legal Forms for the first time, follow the instructions listed below:

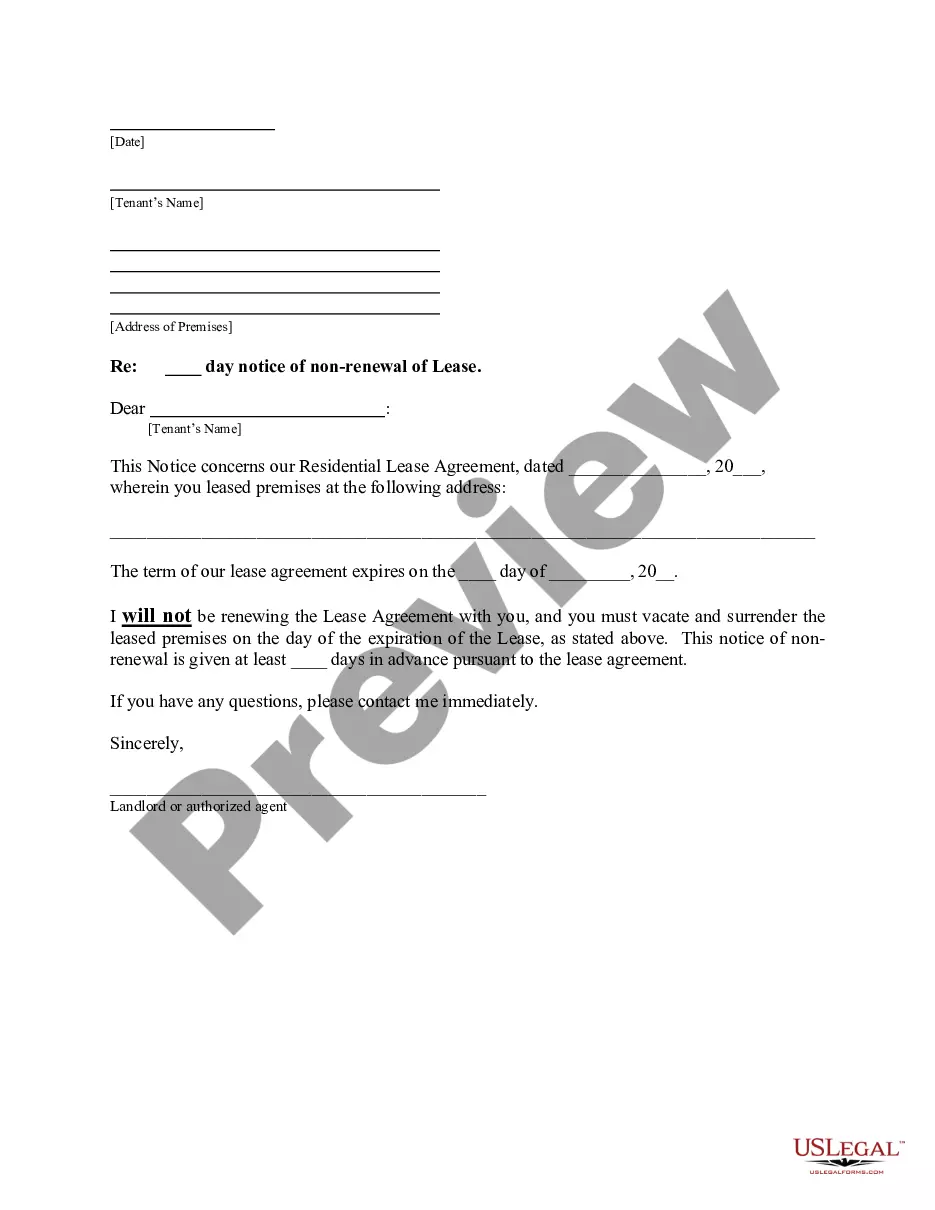

- Step 1. Make sure you have chosen the form to the appropriate area/country.

- Step 2. Utilize the Review choice to examine the form`s content material. Never neglect to read through the information.

- Step 3. In case you are unsatisfied with the type, make use of the Search field on top of the screen to discover other types of your lawful type design.

- Step 4. Upon having discovered the form you need, click on the Purchase now button. Choose the costs program you favor and add your credentials to register for an bank account.

- Step 5. Method the purchase. You should use your charge card or PayPal bank account to complete the purchase.

- Step 6. Pick the formatting of your lawful type and download it on your gadget.

- Step 7. Complete, edit and print out or signal the Texas Invoice Template for Translator.

Each lawful document design you acquire is your own eternally. You may have acces to every type you acquired in your acccount. Select the My Forms section and select a type to print out or download once more.

Be competitive and download, and print out the Texas Invoice Template for Translator with US Legal Forms. There are many specialist and state-particular varieties you can use for your enterprise or specific demands.

Form popularity

FAQ

Microsoft Word provides templates for invoice sheets that you customize to suit your business needs. Office features more than 100 online invoice templates that copy to a Word document. The Word command ribbon plus the Table Tools ribbon help update the style, color, alignment and other layout elements.

Translator hourly rates in the United States in 2021 range from $30 range from $70 per hour depending on language combination, volume, turnaround, and subject matter.

There are a variety of free, premade invoice templates for Microsoft Word you can find online and download to your computer. FreshBooks offers a range of invoice templates available in Word, Excel and PDF format that are customized to different industries.

How to Create a Translation InvoiceDownload a free interpreter invoice template.Add your business name and contact information.Include your translation business media and logo.Insert client's name and business information.Create and input a unique invoice number.Add the invoice issue date and payment due date.More items...

How to Create an Invoice in WordOpen a New Blank Document.Create an Invoice Header.Add the Invoice Date.Include a Unique Invoice Number.Include Your Client's Contact Details.Create an Itemized List of Services.Display the Total Amount Due.Add the Deadline for Payment.More items...?

How to Design an InvoiceDesign the Invoice Structure. Take time before diving into invoice design to plan out the structure of your invoice template.Include Your Brand and Style.Make the Information Readable.Leave Room for Descriptions.Make Deadlines and Payment Totals Stand Out.Clearly State Payment Terms.

How to Create Your Own Invoice Template Using WordOpen Microsoft Word.Click on File and select New.Enter Invoice into the search field, and Word will bring up all available invoice templates.If you're using Office Online, there is a series of templates on the homepage.Choose the template you want to use.More items...?

Translator hourly rates in the United States in 2021 range from $30 range from $70 per hour depending on language combination, volume, turnaround, and subject matter.

What is the average cost to translate a legal document in 2022? Legal translation costs are calculated on the total word-count, not the number of pages; however, nationally, the average legal document translation cost is around $0.14 to $0.18 per word for court document translations.

To create an invoice for free, build your own invoice using Microsoft Word, Microsoft Excel or Google Docs. You can use a premade invoice template offered by the program you choose, or you can create your own invoice from scratch.