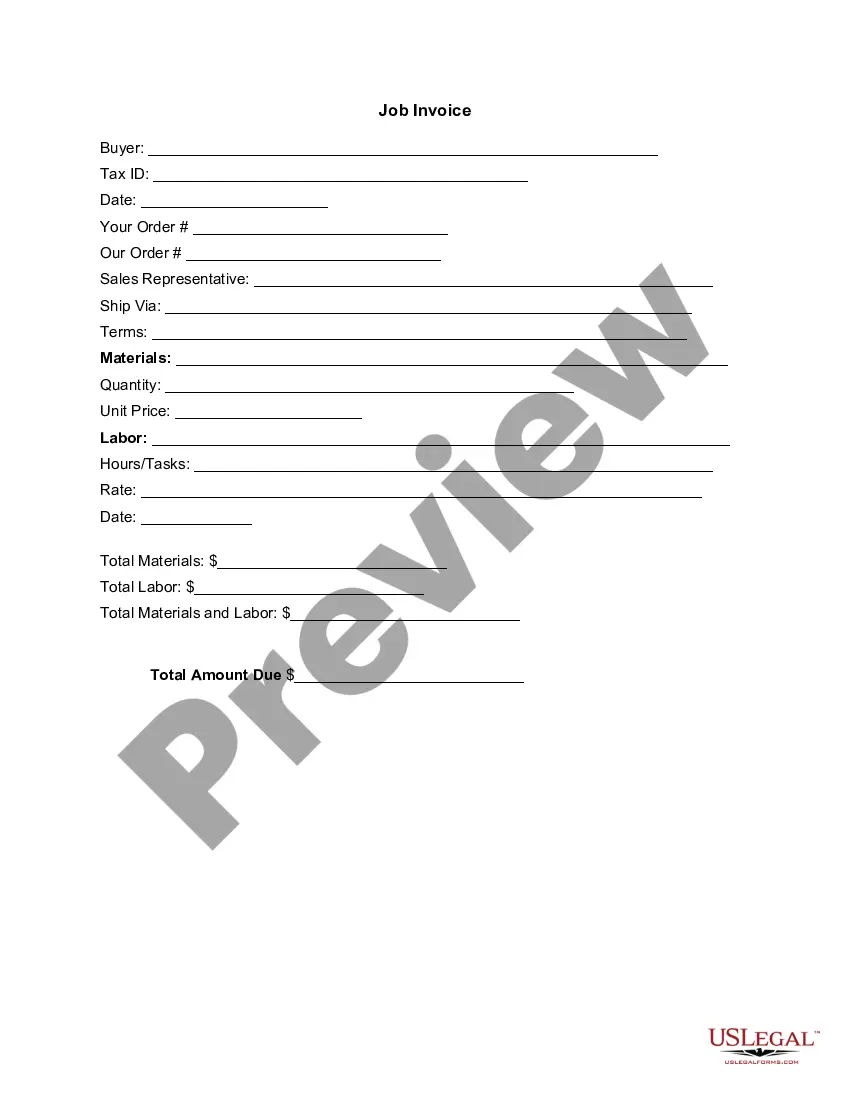

Texas Invoice Template for CEO

Description

How to fill out Invoice Template For CEO?

Finding the appropriate authentic document format can be challenging.

Certainly, there are numerous templates accessible online, but how can you obtain the authentic type you need.

Utilize the US Legal Forms website. The service offers thousands of templates, such as the Texas Invoice Template for CEO, which you can employ for commercial and personal purposes. All templates are reviewed by experts and comply with federal and state regulations.

US Legal Forms is the largest repository of legal templates where you can find numerous document formats. Use the service to download professionally crafted paperwork that adhere to state requirements.

- If you are currently registered, Log In to your account and click on the Obtain button to access the Texas Invoice Template for CEO.

- Use your account to search through the legal templates you may have previously purchased.

- Visit the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the correct form for your city/region.

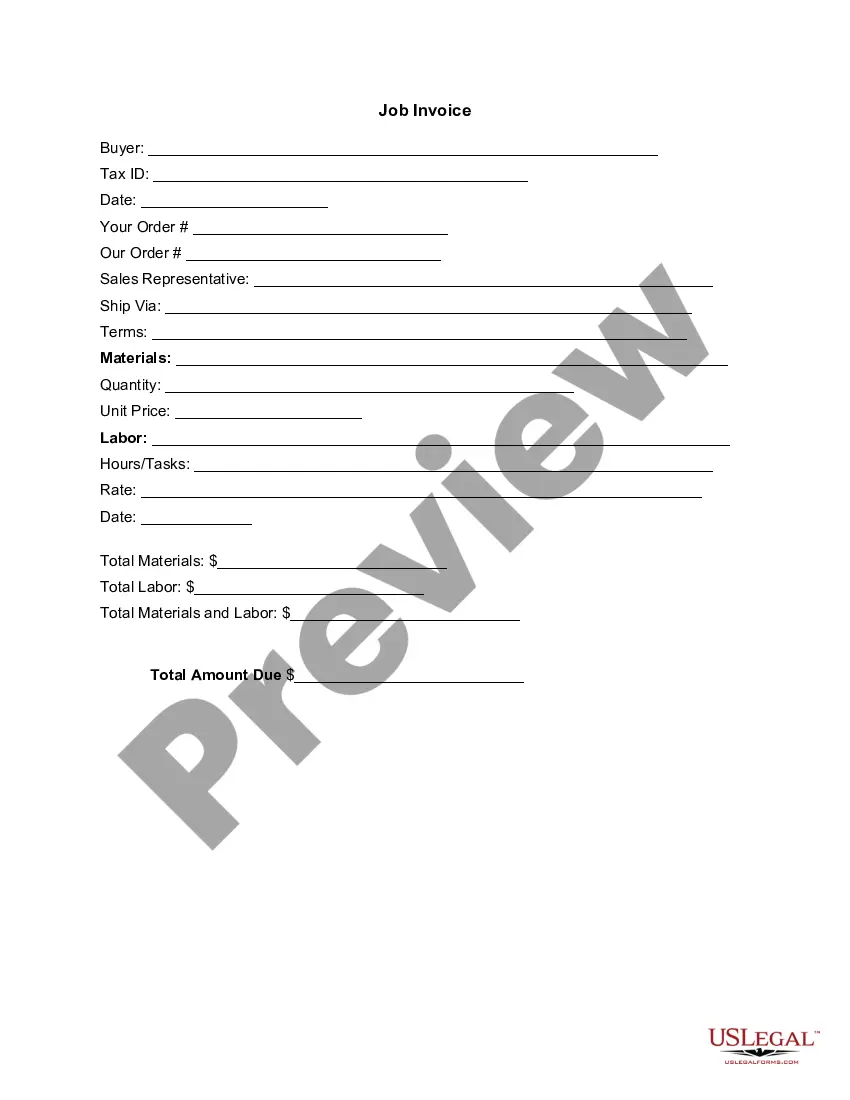

- You can review the document using the Preview button and read the form description to confirm it's suitable for your needs.

- If the form does not meet your requirements, utilize the Search field to find the correct form.

- Once you confirm that the document is correct, click on the Get now button to obtain the form.

- Choose the pricing plan you want and enter the necessary information.

- Create your account and purchase your order using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

- Complete, modify, print, and sign the acquired Texas Invoice Template for CEO.

Form popularity

FAQ

Both Word and Excel offer invoice templates that can suit your Texas Invoice Template for CEO needs. While Word focuses on design and layout, Excel specializes in managing numbers and calculations. You can choose either platform based on whether you prefer a visually appealing invoice or one that integrates calculations seamlessly. Consider using USLegalForms to access professionally designed templates that meet your business requirements.

Yes, Microsoft Word includes several invoice templates. You can easily access these templates by searching for 'invoice' within the application. For a Texas Invoice Template for CEO, these templates can be customized to fit your business's unique branding and needs. This flexibility allows you to create professional-grade invoices without starting from scratch.

Choosing between Word and Excel for your Texas Invoice Template for CEO depends on your specific needs. Word allows for more creative layouts and formatting, making it suitable for formal invoices. On the other hand, Excel provides powerful functions for calculations, which can help streamline the invoice process. Evaluate what features you need before making your decision.

To create an LLC invoice, you should include your LLC name, address, and tax identification number. Then, list the services or products provided, including the total amount due and payment terms. A Texas Invoice Template for CEO can simplify this process, providing a clear framework for your invoicing needs.

Invoices are typically required by law for formal transactions between businesses and customers. They provide a record that can be used in case of disputes or audits. Using a Texas Invoice Template for CEO allows you to create compliant invoices effortlessly and ensures your business operates within legal boundaries.

Yes, invoices are often required by law to ensure proper documentation of business transactions. This legal necessity underscores the need to have clear records for accounting and tax purposes. A Texas Invoice Template for CEO can assist you in fulfilling this requirement while maintaining an organized approach.

In the USA, it is generally a legal requirement to provide an invoice for sales transactions, especially for businesses. This requirement may vary by state and type of business. Adopting a Texas Invoice Template for CEO helps ensure compliance with local laws while simplifying your invoicing process.

The best format for an invoice includes clear sections for the seller's and buyer's information, a detailed list of products or services, the total amount due, and payment terms. A well-structured invoice ensures clarity and professionalism. Using a Texas Invoice Template for CEO can guide you in maintaining this format easily.

Invoices are often considered mandatory for business transactions, especially when a sale occurs. They provide essential documentation for financial records and tax purposes. By using a Texas Invoice Template for CEO, you can ensure you meet all necessary requirements while keeping your invoicing efficient.

Yes, companies are generally required to provide invoices when selling products or services. Invoices serve as a crucial record for both the buyer and seller. They outline the transaction details and ensure transparency in business dealings. Utilizing a Texas Invoice Template for CEO can streamline this process effectively.