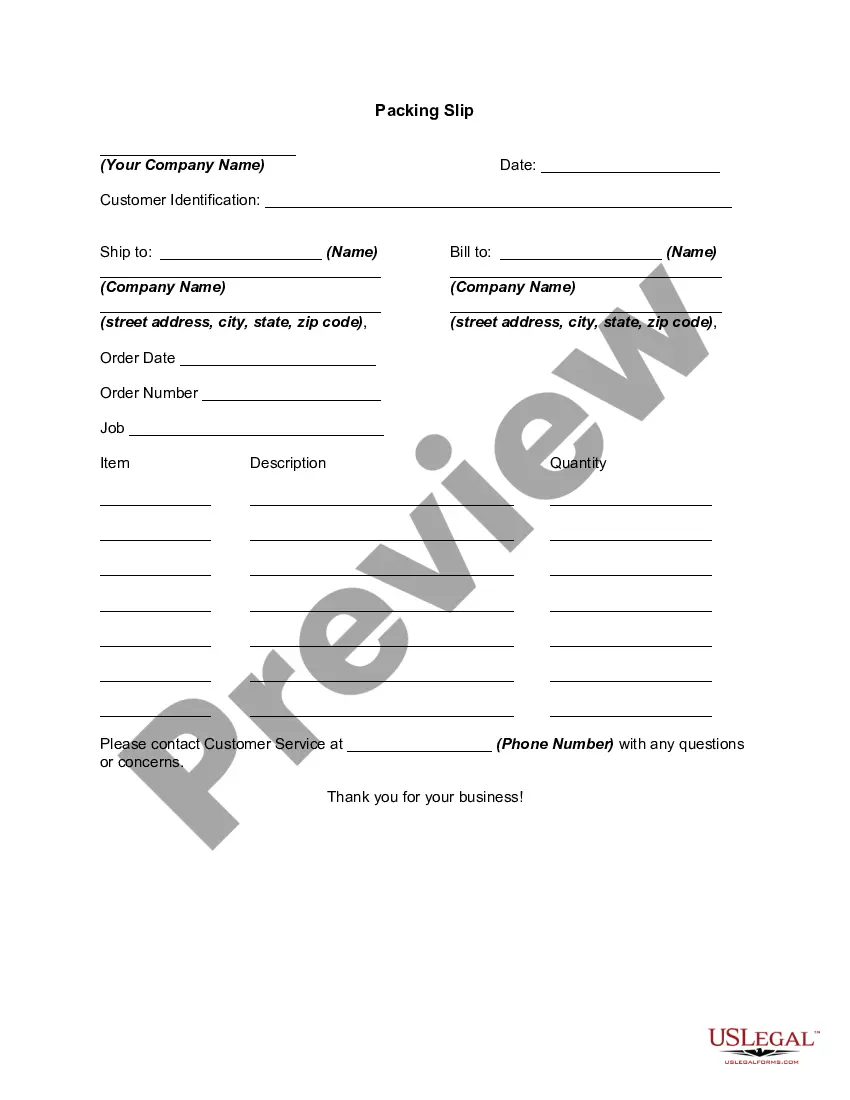

A Texas Letter to Confirm Accounts Receivable is a formal document utilized by businesses in Texas to verify the outstanding balances owed to them by customers or clients. This letter serves as a means of confirming the accuracy of accounts receivable and ensures that the billing information matches the records maintained by the business. Keywords: Texas, Letter to Confirm, Accounts Receivable, outstanding balances, customers, clients, formal document, billing information, records. Different types of Texas Letters to Confirm Accounts Receivable include: 1. Initial Confirmation Letter: This type of letter is commonly sent when a business first establishes a relationship with a new customer or client. It serves as a formal request to validate the billing information provided by the customer and confirms the details of the accounts receivable. 2. Periodic Confirmation Letter: These letters are sent at regular intervals, such as monthly or quarterly, to ensure the accounts receivable records remain accurate. They help identify any discrepancies, such as unpaid invoices or incorrect payment amounts, and allow businesses to rectify the issues promptly. 3. Audit Confirmation Letter: In situations where an external audit is performed, businesses may send an Audit Confirmation Letter to confirm the accuracy of their accounts receivable. This type of letter provides independent auditors with the necessary documentation to verify the balances owed by customers. 4. Account Confirmation Letter: When a customer requests an account confirmation, businesses can send them a letter detailing the outstanding balances and other relevant billing information. This type of letter aims to provide transparency and reassurance to the customer regarding their accounts receivable. 5. Financial Statement Confirmation Letter: This letter is typically included in a business's financial statements and is sent to customers to confirm the accounts receivable balance disclosed in the statements. It serves to establish credibility and transparency between the business and its stakeholders. In summary, a Texas Letter to Confirm Accounts Receivable is a formal document used in Texas to verify outstanding balances owed by customers or clients. The different types of such letters include Initial Confirmation, Periodic Confirmation, Audit Confirmation, Account Confirmation, and Financial Statement Confirmation Letters. These letters are essential for maintaining accurate records and establishing trust in business relationships.

Texas Letter to Confirm Accounts Receivable

Description

How to fill out Letter To Confirm Accounts Receivable?

Selecting the finest authentic document template can be a challenge. Certainly, there are numerous templates accessible online, but how can you discover the genuine type you require.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Texas Letter to Confirm Accounts Receivable, that you can utilize for both business and personal needs. All forms are reviewed by experts and meet state and federal standards.

If you are already registered, Log In to your account and click on the Download button to locate the Texas Letter to Confirm Accounts Receivable. Use your account to search among the legal forms you have previously purchased. Proceed to the My documents tab of your account and download another copy of the document you require.

Complete, modify, print, and sign the received Texas Letter to Confirm Accounts Receivable. US Legal Forms is the largest repository of legal forms where you can find various document templates. Utilize the service to download professionally crafted documents that comply with state regulations.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have chosen the correct form for the city/state. You can review the form using the Review button and read the form description to ensure it is appropriate for you.

- If the form does not meet your requirements, use the Search field to find the correct form.

- Once you are confident that the form is suitable, click the Get now button to acquire the form.

- Select the pricing plan you prefer and enter the necessary information. Create your account and pay for the order via your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

Form popularity

FAQ

To write a cover letter for an accounts receivable position, focus on your experience with financial records, customer service, and payment collections. Start by introducing yourself and highlighting relevant qualifications, like familiarity with a Texas Letter to Confirm Accounts Receivable. Clearly outline your skills, such as attention to detail and problem-solving capabilities. Finally, express your enthusiasm for the position and your desire to contribute to the company’s success.

An example of an accounts receivable cover letter would be a brief letter that accompanies an invoice or payment reminder. It should clearly state the purpose, mention the outstanding amount, and politely request confirmation or payment by a specific date. A Texas Letter to Confirm Accounts Receivable can enhance this communication by targeting confirmation of received amounts. Crafting these letters effectively ensures clarity and encourages timely responses from customers.

An example of a cover letter for accounts receivable is a letter you send alongside your invoice. This cover letter should summarize the details, such as the total amount due and due date, while also expressing gratitude for the customer's business. A Texas Letter to Confirm Accounts Receivable might be included in this package to encourage prompt balance verification. This approach personalizes your communication and enhances customer relationships.

An example of an accounts receivable letter could be a formal letter requesting payment for overdue invoices. In the case of a Texas Letter to Confirm Accounts Receivable, the letter would state the exact amount due, along with the invoice numbers and dates. This clear communication allows for swift resolution of any discrepancies and motivates customers to settle their debts promptly. You can find templates online that standardize this process.

The process of confirming accounts receivable balances involves sending a Texas Letter to Confirm Accounts Receivable to customers to verify the amounts owed. This letter requests confirmation of the outstanding balances on the customers' accounts. Once customers respond, businesses can match the replies with their records to ensure accuracy. Implementing this process helps maintain financial integrity and foster better relationships with clients.

The phone number for check verification with the Texas Comptroller is typically found on their official website. They have dedicated hotlines for various services, including accounts receivable inquiries. When you call, be sure to mention your interest in the Texas Letter to Confirm Accounts Receivable if it pertains to your query to ensure you receive the best assistance.

To speak with a representative at the Texas Comptroller's office, you can call their main office number during business hours. Alternatively, you can use their online contact form for inquiries if you're unable to connect by phone. When discussing your concerns, consider using the Texas Letter to Confirm Accounts Receivable to clarify any questions related to your accounts.

A sales tax audit in Texas may occur due to various reasons, including discrepancies in reported income and sales taxes. Additionally, certain red flags such as high exemption claims or inconsistencies in the Texas Letter to Confirm Accounts Receivable can attract attention. Staying organized and transparent in your reporting can help minimize the risk of an audit.

You can reach the Texas Comptroller during regular business hours, typically from 8 a.m. to 5 p.m., Monday through Friday. It is often best to call early in the week, as Mondays and Tuesdays tend to be less busy. When you contact them, consider mentioning the Texas Letter to Confirm Accounts Receivable for any specific queries regarding your tax accounts. This can help streamline your discussion.

You can contact the Texas Comptroller's tax policy office by visiting their official website or calling their helpline. They provide comprehensive resources and can answer specific inquiries regarding your tax concerns. Engaging with this office can also assist you in obtaining necessary documents, such as a Texas Letter to Confirm Accounts Receivable.